crypto

U.S. Treasury Department Targets 13 Russian Firms Allegedly Offering Crypto-Related Services To Avoid Sanctions

Published

1 month agoon

By

admin

The US Government has named entities and individuals allegedly responsible for providing crypto products and services that aided in the evasion of sanctions on Russia.

The U.S. Department of the Treasury’s Office of Foreign Assets Control (OFAC) says that it has “sanctioned thirteen entities and two individuals for operating in the financial services and technology sectors of the Russian Federation economy.”

According to the agency, many of the designated individuals and entities “facilitated transactions or offered other services that helped OFAC-designated entities evade sanctions.”

Among the designated entities include the Moscow-based fintech firm B-Crypto, which OFAC accuses of partnering with Rosbank to enable Russian exporters to make cross-border payments using crypto assets. Rosbank is a Russian commercial bank that is also under US sanctions.

Other designated entities are Moscow-based fintech firms Masterchain, Laitkhaus, and Atomaiz. Peer-to-peer crypto exchange Bitpapa and centralized digit asset exchange Crypto Explorer were also sanctioned.

Firms based outside Russia that were sanctioned include Eastern European companies such as the Cyprus-based Tokentrust Holdings and the Estonia-based Bitfingroup.

Blockchain technology firms Veb3 Integrator and Veb3 Tekhnologii as well as fintech firm TOEP which operates a crypto exchange were also placed on the list of entities supporting the evasion of sanctions by Russian firms and individuals. The two firms are based in Moscow.

The two sanctioned individuals are Igor Veniaminovich Kaigorodov, the majority shareholder of Veb3 Integrator and Veb3 Tekhnologii and Timur Evgenyevich Bukanov, the owner and director of TOEP.

While some of America’s economic and trade sanctions on Russia have existed for decades, some of the most severe ones were placed following Russia’s invasion of Ukraine in February of 2022.

Last year in May, it was reported that the world’s largest crypto exchange Binance was being investigated by US authorities over possible violation of sanctions on Russia.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any loses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney

Source link

You may like

Cardano Faces Make-Or-Break Price Level For Bullish Revival

A Premier Crypto Exchange Tailored for Seasoned Traders – Blockchain News, Opinion, TV and Jobs

Crypto Whale Withdraws $75.8 Million in USDC From Coinbase To Invest In Ethereum’s Biggest Presale – Blockchain News, Opinion, TV and Jobs

CFTC Chair Says ‘Another Cycle of Enforcement Actions’ Coming As Crypto Enters New Phase of Asset Appreciation

Spectral Labs Joins Hugging Face’s ESP Program to advance the Onchain x Open-Source AI Community – Blockchain News, Opinion, TV and Jobs

DOT Price (Polkadot) Reaches Key Juncture, Is This Bulls Trap or Correction?

coinbase

Crypto Whale Withdraws $75.8 Million in USDC From Coinbase To Invest In Ethereum’s Biggest Presale – Blockchain News, Opinion, TV and Jobs

Published

5 hours agoon

May 8, 2024By

admin

A crypto whale has withdrawn $75.8 million USDC from Coinbase institutional and invested a significant amount in Ethereum’s biggest presale, ETFSwap (ETFS).

An anonymous crypto whale reportedly withdrew a whopping $75.8 million in USDC from their Coinbase Institutional account on Friday night. This move follows the bull market widely predicted to happen in the coming weeks. An in-depth investigation into the event reveals that a large chunk of the money was used to acquire ETFSwap (ETFS) tokens in Ethereum’s biggest presale, making waves in the crypto community.

Crypto Whale Withdraws $75.8 Million In USDC From Coinbase Institutional

Whale Alert, an X (formerly Twitter) account notable for reporting large and exciting transactions in the crypto community, shared the news of a colossal $75.8 million USDC withdrawal from Coinbase institutional to an unknown wallet on Friday night.

The post that went viral in the crypto community has caught the attention of crypto enthusiasts, garnering several reactions. Some enthusiasts insist that the anonymous whale enacted the move to diversify their portfolios and gain big in the upcoming bull market later this year. Others believe that the whale wants to sell off the majority of their holdings and probably settle some of the debts they accrued.

However, whichever the case may be, a click on the web link to the eye-catching transaction shows that the anonymous transaction was made from a Coinbase Institutional account to a new project, ETFSwap (ETFS), firmly believed to be Ethereum’s biggest presale.

ETFSwap (ETFS) Becomes Ethereum’s Biggest Presale

Like the anonymous whale that bought a large amount of the ETFSwap (ETFS) presale tokens, thousands of crypto investors are still flooding into the presale, with over 50 million tokens already sold out in what is now believed to be Ethereum’s biggest pressale. This reiterates the fact that the crypto community believes in the viability and genuineness of the ETFSwap (ETFS) platform.

ETFSwap (ETFS) is an Ethereum-based decentralized finance (DeFi) platform that enables users and investors to buy, trade efficiently, and own a wide variety of cryptocurrencies and tokenized exchange-traded funds (ETFs) in a one-stop shop.

This innovative platform has come at a time when the tokenization of Real-World Assets (RWAs) is being embraced in the cryptocurrency world. At the forefront of this niche, ETFSwap (ETFS) users and investors enjoy the benefits provided by the innovation and flexibility of the decentralized finance realm while trading their various assets.

With the market-making and perpetual futures services available on the platform, trading is fun, seamless, liquid, and efficient on ETFSwap (ETFS). Consequently, users and investors are assured of continuous trading activities without any expiration dates.

Users can also take absolute advantage of the leverage tool on the platform. The ETFSwap (ETFS) platform enables users and investors to amplify their gains with the 10x leverage option provided. This tool is great for seasoned investors who want to maximize their gains by up to 1,000%, meaning a $1,000 gain can easily be turned into a $10,000 gain.

Another feature that has swept crypto enthusiasts off their feet is that on ETFSwap (ETFS), users and investors are not required to undergo rigorous KYC verification. They are afforded the platform to trade anonymously. This will, in return, absolve them of any third-party interference, such as banks or regulated bodies.

Additionally, CyberScope, a leading blockchain security provider, has audited ETFSwap’s (ETFS) smart contracts, and the results show their resistance to cyberattacks.

Whale’s Investment In The ETFSwap (ETFS) Presale Sends Crypto Community Into A Buying Frenzy

After the whale invested a large amount of his withdrawal from Coinbase into the ETFSwap (ETFS) presale, the platform has seen major market activity, with investors actively buying the token.

Presently, in Stage 1 of the presale, the ETFS token is priced at $0.00854 and is selling fast due to this being the lowest price the token will ever be. Therefore, there is no better time to invest in the highly esteemed ETFSwap (ETFS) project than now, especially after analysts have predicted it will go parabolic when the bull run begins.

For more information about the ETFS Presale:

Source link

Analyst

Can Ethereum Reclaim $4,000? Fragile Fundamentals Threaten To Send ETH Crashing

Published

18 hours agoon

May 7, 2024By

admin

Ethereum has put on a disappointing performance for its investors over the last few weeks, leading to concerns on whether the second-largest cryptocurrency by market cap has lost its shine. The cryptocurrency continues to skirt around the $3,100 level, not making any significant breaks upward. This points to weak fundamentals that could trigger a price decline.

Ethereum Fails To Make Meaningful Moves

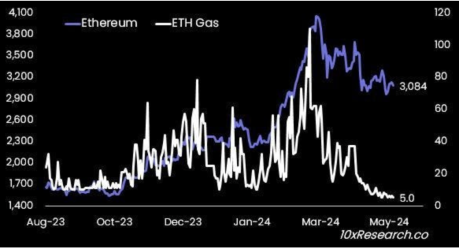

Markus Thielen, Head of Research at 10x Research, has pointed out some worrying developments with the Ethereum price. In a new report shared with NewsBTC, he explains that despite Ethereum remaining highly correlated to Bitcoin with an R-Square of 95%, it continues to perform poorly while the latter has made new all-time highs.

Thielen points back to ETH’s performance in the last bull market, which was closely tied to new sectors popping out of the network, such as decentralized finance (DeFi) and non-fungible tokens (NFTs). This caused demand to skyrocket, and in turn, the price followed as users gobbled up ETH for the high gas fee required to transact on the blockchain.

However, Ethereum has failed to maintain this momentum, which can be attributed to its inability to bring the upgrades that users needed in time. Thielen explains that the Dencun upgrade which helped solved the high gas fee issues had come three years too late because by 2024 when the upgrade arrived, users had moved on to Layer 2 networks. Also, during this time, other Layer 1 networks have seen a rise in users and Solana is one example of this.

Source: 10x Research

The researcher further explained that the weak fundamentals of ETH are now not only affecting its price but has had a spillover effect to Bitcoin. “Ethereum’s weak fundamentals are becoming a roadblock for Bitcoin as they prevent broad fiat inflow into the crypto ecosystem,” Thielen stated.

Better To Short ETH

Thielen’s analysis of Ethereum also spreads to the drop in stablecoin usage on the network. Back in 2021, Ethereum had dominated stablecoin transactions such as USDT and USDC. However, it seems like, with other things, the high fees have driven users towards other networks. Blockchains such as Tron (TRX) are now dominating stablecoin transactions, leaving ETH in the dust.

Additionally, there is also the fact that ETH’s issuance is turning inflationary once again. After the London Hard Fork, also known as EIP-1559, was completed in 2021, the network saw its issuance turn deflationary for the first time as ETH burned quickly surpassed ETH being brought into circulation.

However, this has now changed in the past months as there have been more ETH issued than those burned, Thielen notes. To put this in perspective, a total of 74,000 ETH were issued compared to only 43,000 ETH burned. This inflation, coupled with the fact that staking rewards have now dropped to 3%, below the 5.1% offered by Treasury Yields, Ethereum has had a hard time maintaining bullish sentiment.

Given these developments, the researcher believes it is better to be bearish on Ethereum right now. “Right now, we would be more comfortable holding a short position in ETH than a long one in BTC as Ethereum’s fundamentals are fragile, which is not yet reflected in ETH prices,” Thielen concludes.

ETH price fails to hold $3,100 | Source: ETHUSD on Tradingview.com

Featured image from Watcher Guru, chart from Tradingview.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Source link

coinbase

Coinbase Gets Hit With New Class Action Lawsuit Accusing Crypto Exchange of Selling Digital Asset Securities

Published

22 hours agoon

May 7, 2024By

admin

A newly filed class-action complaint alleges that Coinbase violated US securities laws.

The complaint, which was filed in the Northern District of California’s San Francisco division on Friday, claims that the top US crypto exchange has been operating as “part of a shadowy crypto ecosystem operating just outside of the law.”

“Its entire business model has been built upon a lie and a dream: the lie is that ‘we do not sell securities,’ and the dream is that, knowing it would eventually be caught in the lie, ‘it is better to ask for forgiveness than permission.’

Coinbase has knowingly, intentionally, and repeatedly violated state securities laws since it began doing business.”

The complainants accuse the exchange of offering numerous unregistered “digital asset securities,” including the layer-1 blockchain projects Solana (SOL), NEAR Protocol (NEAR), Algorand (ALGO), Stellar (XLM) and Tezos (XTZ); the blockchain scaling solution Polygon (MATIC); the decentralized exchange Uniswap (UNI); and the Ethereum (ETH)-based virtual reality platform Decentraland (MANA).

The U.S. Securities and Exchange Commission (SEC) has also accused Coinbase of violating securities laws, launching a lawsuit against the exchange in June 2023.

Coinbase has argued that trading digital assets doesn’t qualify as an “investment contract” under the Howey Test, an assessment created by the Supreme Court more than 90 years ago to determine whether assets should be classified as securities.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney

Source link

Cardano Faces Make-Or-Break Price Level For Bullish Revival

A Premier Crypto Exchange Tailored for Seasoned Traders – Blockchain News, Opinion, TV and Jobs

Crypto Whale Withdraws $75.8 Million in USDC From Coinbase To Invest In Ethereum’s Biggest Presale – Blockchain News, Opinion, TV and Jobs

CFTC Chair Says ‘Another Cycle of Enforcement Actions’ Coming As Crypto Enters New Phase of Asset Appreciation

Spectral Labs Joins Hugging Face’s ESP Program to advance the Onchain x Open-Source AI Community – Blockchain News, Opinion, TV and Jobs

DOT Price (Polkadot) Reaches Key Juncture, Is This Bulls Trap or Correction?

‘Last Dip Ever’ – Analyst Predicts Solana Rally, Says Three Memecoins Will Surge Alongside SOL

Can Ethereum Reclaim $4,000? Fragile Fundamentals Threaten To Send ETH Crashing

Coinbase Gets Hit With New Class Action Lawsuit Accusing Crypto Exchange of Selling Digital Asset Securities

Ethernity Transitions to an AI Enhanced Ethereum Layer 2, Purpose-Built for the Entertainment Industry – Blockchain News, Opinion, TV and Jobs

New Crypto Casino TG.Casino Becomes Regional iGaming Partner of AC Milan – Blockchain News, Opinion, TV and Jobs

Top Coins Poised For Gains

Survive, Conquer and Thrive in a Post-Apocalyptic Playground with DECIMATED – Blockchain News, Opinion, TV and Jobs

StakingFarm’s Revolutionary Approach to Democratizing Crypto Staking – Blockchain News, Opinion, TV and Jobs

Macro Expert Names Four Catalysts That Could Trigger ‘Historic’ Stock Market Melt-Up This Year

Bitcoin Dropped Below 2017 All-Time-High but Could Sellers be Getting Exhausted? – Blockchain News, Opinion, TV and Jobs

What does the Coinbase Premium Gap Tell us about Investor Activity? – Blockchain News, Opinion, TV and Jobs

BNM DAO Token Airdrop

NFT Sector Keeps Developing – Number of Unique Ethereum NFT Traders Surged 276% in 2022 – Blockchain News, Opinion, TV and Jobs

New Minting Services

Block News Media Live Stream

A String of 200 ‘Sleeping Bitcoins’ From 2010 Worth $4.27 Million Moved on Friday

SEC’s Chairman Gensler Takes Aggressive Stance on Tokens – Blockchain News, Opinion, TV and Jobs

Friends or Enemies? – Blockchain News, Opinion, TV and Jobs

Enjoy frictionless crypto purchases with Apple Pay and Google Pay | by Jim | @blockchain | Jun, 2022

Block News Media Live Stream

How Web3 can prevent Hollywood strikes

Block News Media Live Stream

XRP Explodes With 1,300% Surge In Trading Volume As crypto Exchanges Jump On Board

Block News Media Live Stream

Trending

Altcoins2 years ago

Altcoins2 years agoBitcoin Dropped Below 2017 All-Time-High but Could Sellers be Getting Exhausted? – Blockchain News, Opinion, TV and Jobs

Binance2 years ago

Binance2 years agoWhat does the Coinbase Premium Gap Tell us about Investor Activity? – Blockchain News, Opinion, TV and Jobs

- Uncategorized2 years ago

BNM DAO Token Airdrop

BTC1 year ago

BTC1 year agoNFT Sector Keeps Developing – Number of Unique Ethereum NFT Traders Surged 276% in 2022 – Blockchain News, Opinion, TV and Jobs

- Uncategorized2 years ago

New Minting Services

Video2 years ago

Video2 years agoBlock News Media Live Stream

Bitcoin miners2 years ago

Bitcoin miners2 years agoA String of 200 ‘Sleeping Bitcoins’ From 2010 Worth $4.27 Million Moved on Friday

Bitcoin1 year ago

Bitcoin1 year agoSEC’s Chairman Gensler Takes Aggressive Stance on Tokens – Blockchain News, Opinion, TV and Jobs