Bitcoin

Bitcoin Price Still At Risk of Major Downside Break Below $60K

Published

2 weeks agoon

By

admin

Bitcoin price is showing bearish signs below the $63,000 resistance zone. BTC must stay above the $60,000 support zone to avoid a major decline.

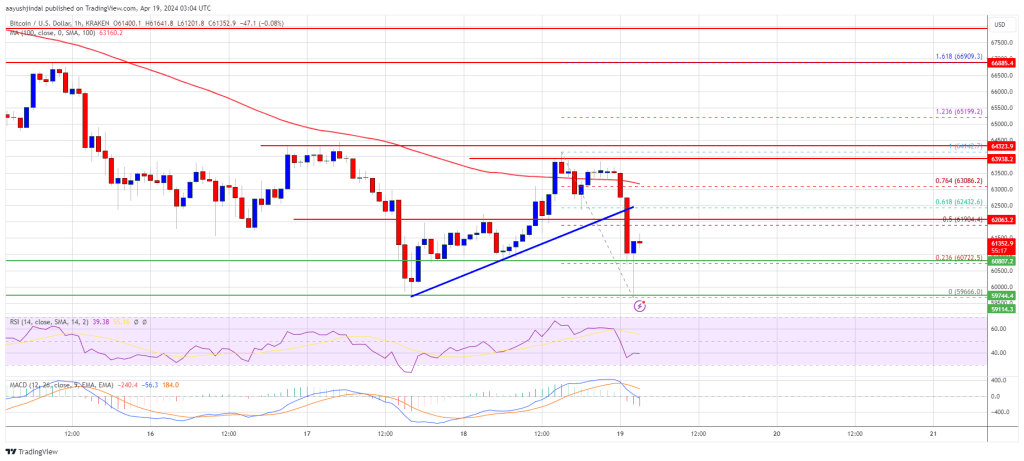

- Bitcoin is still struggling to start a recovery wave above the $63,000 resistance zone.

- The price is trading below $62,800 and the 100 hourly Simple moving average.

- There was a break below a connecting bullish trend line with support at $62,400 on the hourly chart of the BTC/USD pair (data feed from Kraken).

- The pair could gain bearish momentum if it settles below the $60,000 support zone.

Bitcoin Price Struggle Continues

Bitcoin price started another increase above the $61,500 resistance zone. BTC cleared the $62,500 and $63,000 resistance levels. It even spiked above $64,000 but failed to surpass the key level at $65,000.

A high was formed at $64,142 before there was a sharp decline. There was a break below a connecting bullish trend line with support at $62,400 on the hourly chart of the BTC/USD pair. It dived below the $60,800 level and retested $59,650.

A low was formed near $59,666 and the price is now attempting a fresh recovery wave. The price climbed above the 23.6% Fib retracement level of the recent decline from the $64,142 swing high to the $59,666 low.

Bitcoin price is trading below $62,800 and the 100 hourly Simple moving average. Immediate resistance is near the $62,000 level. It is close to the 50% Fib retracement level of the recent decline from the $64,142 swing high to the $59,666 low.

The first major resistance could be $63,000. The next resistance now sits at $64,200. If there is a clear move above the $64,200 resistance zone, the price could continue to move up. In the stated case, the price could rise toward $65,000.

Source: BTCUSD on TradingView.com

The next major resistance is near the $66,500 zone. Any more gains might send Bitcoin toward the $67,500 resistance zone in the near term.

More Losses In BTC?

If Bitcoin fails to rise above the $62,000 resistance zone, it could start another decline. Immediate support on the downside is near the $60,800 level.

The first major support is $60,000. If there is a close below $60,000, the price could start to drop toward the $59,550 level. Any more losses might send the price toward the $58,500 support zone in the near term.

Technical indicators:

Hourly MACD – The MACD is now gaining pace in the bearish zone.

Hourly RSI (Relative Strength Index) – The RSI for BTC/USD is now below the 50 level.

Major Support Levels – $60,800, followed by $60,000.

Major Resistance Levels – $62,000, $63,000, and $64,200.

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Source link

You may like

Here’s When Bitcoin Could Halt the ‘Slide’ and Start To Pump, According to On-Chain Analytics Firm Santiment

Ethereum Price Revisits Key Support, Can Bears Take Over?

Solana Co-Founder Says Cosmos and One SOL Rival Are Clear Winners in Building Sovereign Blockchains

Achieves Record Net Profit Of $4.5 Billion In Q1

Ripple Forms Partnership With Tokyo Unit of $1,200,000,000 Firm To Push for XRPL-Powered Solutions in Japan

Nektar Network begins Epoch 1 of Nektar Drops

Bitcoin

Here’s When Bitcoin Could Halt the ‘Slide’ and Start To Pump, According to On-Chain Analytics Firm Santiment

Published

59 mins agoon

May 2, 2024By

admin

The director of marketing at blockchain analytics firm Santiment, Brian Quinlivan, is listing two developments that could ignite a recovery in the price of Bitcoin (BTC).

Quinlivan says in a new video that accumulation by whales and sharks (those holding between 10 and 10,000 BTC) as well as widespread fear, uncertainty and doubt (FUD) among crypto traders and investors could inspire an upward trend for Bitcoin.

“Since the beginning of the month [of April], these last four-ish weeks or so we’re looking at the whales and sharks actually taking some profit and the price is seemingly following them.

And until they start to turn it around and resume their accumulation, there can be an argument that we will continue to slide very slowly until either the crowd gets really, really fearful. Like November 2022 was with the FTX [crypto exchange] collapse or the whales just decide ‘you know what, prices are low enough. I’m going to start pumping those prices again.’”

According to Quinlivan, the stock and crypto markets are currently enjoying a directly proportional relationship.

“There is a pretty big correlation right now between crypto and the S&P [500 index]…

The way the Federal Reserve is, the way the inflationary policies have been here in the US at least the last few years have had just a massive kind of impact on the rest of the markets. So until that changes, we have to be conscious of the fact that the way the US stock market has been going lately has had an impact on the way crypto goes.

And it might be emphasizing a greater drop than crypto otherwise would be seeing on its own if the S&P was stable right now. So that could actually be a positive argument indicating that if the S&P starts to recover, then crypto might see a bit of a relief rebound of its own.”

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: DALLE3

Source link

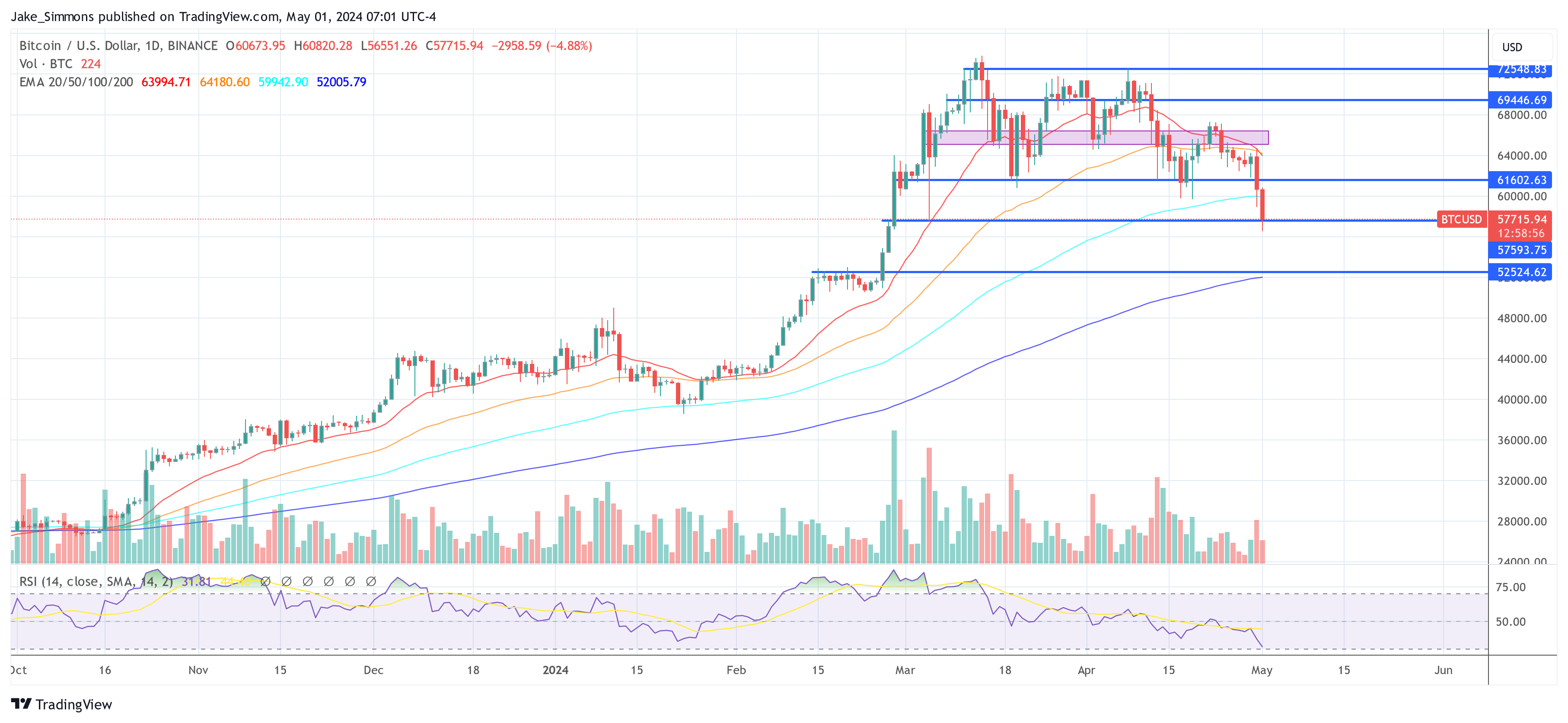

Bitcoin (BTC) has witnessed a significant drop, falling to $56,556 during Wednesday morning in Europe, marking the lowest point since late February. This downturn represents the sharpest monthly decline since November 2022, with BTC tumbling approximately 7.5% within the last 24 hours and breaching the previously stable $60,000 support late Tuesday.

#1 Derisking Before Today’s FOMC Meeting

Anticipation and anxiety are high in financial circles as the Federal Open Market Committee (FOMC) is set to announce its interest rate decision later today. This event is crucial as the crypto market, notably Bitcoin, has grown increasingly reactive to macroeconomic signals.

Recent data, reflecting a slowdown in GDP growth coupled with persistent inflation, has significantly reduced expectations of interest rate cuts by the Federal Reserve. “Bitcoin and other risk assets are currently feeling the pressure from a stagflationary environment, geopolitical tensions, and seasonal liquidity variations,” remarked Ted from TalkingMacro.

Initially, up to seven rate cuts were anticipated by the end of 2024, a sentiment that has shifted dramatically with the market now pricing in only one potential cut by December 2024. This shift comes amidst an environment where inflation data is trending upwards, challenging the Federal Reserve’s position and potentially leading to a more cautious approach from Jerome Powell, the Fed Chairman.

“For the first time in recent memory, the market is calling the Fed’s bluff, quickly front-running the idea that the Fed may not cut at all in 2024,” noted Ted.

#2 Cyclical Bitcoin Correction Phase

Following an exceptional rally since the year’s start, the market is undergoing a natural correction phase. Prior to the price crash, Charles Edwards, founder of Capriole Investments, noted: “We are a day short of breaking the record set in 2011 for days without a meaningful dip [-25%],” emphasizing the extraordinary nature of Bitcoin’s recent performance.

Scott Melker, known as “The Wolf Of All Streets,” highlighted technical indicators that suggested an impending correction. “Broke and retested range lows as resistance. […] My biggest concern I have been discussing for months [was] that RSI never made the trip to oversold. Almost there now, all lower time frames oversold. This is still ONLY A 23% correction, very shallow for a bull market and consistent with other corrections on this run. We are yet to see a 30-40% pull back during this bull market, like those of the past.”

$BTC Daily

Broke and retested range lows as resistance. Nothing but air until around $52,000 on the chart.

My biggest concern I have been discussing for months (in newsletter) is that RSI never made the trip to oversold.

Almost there now, all lower time frames oversold.

This… pic.twitter.com/5YZTWipBo8

— The Wolf Of All Streets (@scottmelker) May 1, 2024

#3 Profit-Taking

Traditional finance markets and seasoned investors are seizing the opportunity to take profits following substantial gains. “TradFi/Boomers are taking profits: CME Open Interest is decreasing rapidly, April 29th 135,6k coins, April 30th 123,9k coins, topped around 170.4k coins (March 20th),” explained crypto analyst RunnerXBT.

This trend confirms a broader profit-taking strategy post significant events like the ETF approval and the anticipation around the Bitcoin halving. “That […] confirms my thesis that a lot of these guys longed in October 2023 because of ETF approval and BTC halving, trade played out and now they are taking profits (yes they are still up a lot), because they longed BTC not dead altcoins.”

TradFi/Boomers are taking profits ✅

CME Open Interest is decreasing rapidly

April 29th 135,6k coins

April 30th 123,9k coinsTopped around 170.4k coins (March 20th)

That at least for me confirms my thesis that a lot of these guys longed in October 2023 because of ETF approval… pic.twitter.com/M8KY1NfCtK

— RunnerXBT (@RunnerXBT) May 1, 2024

#4 US ETF Flows And Hong Kong Disappointment

The dynamics surrounding spot Bitcoin ETFs have shown significant strains, evidenced by recent activities in both US and Hong Kong markets. In the United States, Bitcoin exchange-traded funds (ETFs) faced substantial outflows, indicating a cooling investor sentiment.

According to recent data, the total outflows from US spot Bitcoin ETFs amounted to $161.6 million. Notably, the Grayscale Bitcoin Trust (GBTC) experienced outflows of $93.2 million, while Fidelity and Bitwise registered outflows of $35.3 million and $34.3 million, respectively. BlackRock had zero net flows once again. These numbers suggest a retreat in institutional interest, which has traditionally been a bulwark against price volatility.

Parallel to the US, the debut of Bitcoin ETFs in Hong Kong also faltered significantly below expectations. Six newly launched ETFs, intended to capture both Bitcoin and Ethereum markets, collectively reached just $11 million in trading volume, starkly underperforming against the anticipated $100 million. The spot Bitcoin ETFs accounted for $8.5 million in trading volume. This was markedly lower than the launch day volumes of US-based spot Bitcoin ETFs, which had reached $655 million on their first day.

#5 Long Liquidations

The market has also been impacted by substantial long liquidations, with a total of $451.28 million liquidated in the last 24 hours alone. The largest single liquidation was an ETH-USDT-SWAP on OKX valued at $6.07 million, but Bitcoin-specific liquidations were significant as well, totaling $143.04 million, according to data from CoinGlass. These liquidations have amplified the selling pressure on Bitcoin.

At press time, BTC traded at $57,715.

Featured image from iStock, chart from TradingView.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Source link

Bitcoin

Bitcoin Is a Multi-Decade Story That Will Eat Other Massive Asset Classes, Says Macro Expert Lyn Alden

Published

1 day agoon

May 1, 2024By

admin

Macro guru Lyn Alden thinks that Bitcoin’s (BTC) ascent to prominence en route to becoming a giant asset class will take more than 10 years.

Speaking at an event organized by the What Bitcoin Did podcast, Alden says people tend to think that technologies like Bitcoin will immediately disrupt the incumbent system.

However, Alden highlights that change happens over a long arc of time and that people are underestimating the potential impact of Bitcoin on the financial system.

“It’s not a one-year, three-year, five-year story. It’s not even a 10-year story. That’s a multi-decade story.

With technologies, people often overestimate the speed and then underestimate the final magnitude, and I think that’s going to be true for Bitcoin.

I think people routinely overestimate the speed with which it will fundamentally change the ‘system,’ but I think they underestimate the magnitude of what it can do over say a 30-year period or more like the transformational change that can happen with how we do payments, what things we decide to store value in [and] the success rate of our investments.”

For now, Alden says that Bitcoin’s market cap is too small compared to more established asset classes. But the macroeconomist believes that over the long haul, BTC will come out on top by eating the market share of other assets.

“Bitcoin’s over a trillion dollars in market cap. The global wealth, depending on what measurement you look at, is something like $500 trillion or a thousand trillion, which is a quadrillion [dollars].

So Bitcoin is like a fraction of 1%.

I think over the long arc of time it starts eating into savings accounts. It starts eating into sovereign bonds. It starts eating into things that we monetize for a lack of good money.

During the phase where that’s happening, that can be disruptive… Nation-states are going to push back on it in various ways. They already have been in various capacities for the past 15 years. It’s going to be this ongoing story.”

At time of writing, Bitcoin is trading for $60,505, down over 5% in the past day.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: DALLE3

Source link

Here’s When Bitcoin Could Halt the ‘Slide’ and Start To Pump, According to On-Chain Analytics Firm Santiment

Ethereum Price Revisits Key Support, Can Bears Take Over?

Solana Co-Founder Says Cosmos and One SOL Rival Are Clear Winners in Building Sovereign Blockchains

Achieves Record Net Profit Of $4.5 Billion In Q1

Ripple Forms Partnership With Tokyo Unit of $1,200,000,000 Firm To Push for XRPL-Powered Solutions in Japan

Nektar Network begins Epoch 1 of Nektar Drops

Polkadot-native Acala Expands to Multichain Horizons Through The Sinai Upgrade – Blockchain News, Opinion, TV and Jobs

Bitcoin Price Dips Below $57,000: 4 Key Reasons

Bitcoin Is a Multi-Decade Story That Will Eat Other Massive Asset Classes, Says Macro Expert Lyn Alden

World of Dypians Offers Up to 1M $WOD and $225,000 in Premium Subscriptions via the BNB Chain Airdrop Alliance Program

DOT Price (Polkadot) Approaches Key Level: Should Traders Brace for Sharp Drop?

Ethereum and Altcoins Associated With ETH May Witness Rallies Sooner Than Expected, According to Santiment

Crypto Expert Says ETH Is Yet To Bottom Against Bitcoin

Russian Authorities Introduce New Restrictions on Cryptocurrency To Prevent Ruble From Being Replaced: Report

CARV Announces Decentralized Node Sale to Revolutionize Data Ownership in Gaming and AI – Blockchain News, Opinion, TV and Jobs

Bitcoin Dropped Below 2017 All-Time-High but Could Sellers be Getting Exhausted? – Blockchain News, Opinion, TV and Jobs

What does the Coinbase Premium Gap Tell us about Investor Activity? – Blockchain News, Opinion, TV and Jobs

BNM DAO Token Airdrop

NFT Sector Keeps Developing – Number of Unique Ethereum NFT Traders Surged 276% in 2022 – Blockchain News, Opinion, TV and Jobs

New Minting Services

Block News Media Live Stream

A String of 200 ‘Sleeping Bitcoins’ From 2010 Worth $4.27 Million Moved on Friday

SEC’s Chairman Gensler Takes Aggressive Stance on Tokens – Blockchain News, Opinion, TV and Jobs

Friends or Enemies? – Blockchain News, Opinion, TV and Jobs

Enjoy frictionless crypto purchases with Apple Pay and Google Pay | by Jim | @blockchain | Jun, 2022

Block News Media Live Stream

How Web3 can prevent Hollywood strikes

Block News Media Live Stream

XRP Explodes With 1,300% Surge In Trading Volume As crypto Exchanges Jump On Board

Block News Media Live Stream

Trending

Altcoins2 years ago

Altcoins2 years agoBitcoin Dropped Below 2017 All-Time-High but Could Sellers be Getting Exhausted? – Blockchain News, Opinion, TV and Jobs

Binance2 years ago

Binance2 years agoWhat does the Coinbase Premium Gap Tell us about Investor Activity? – Blockchain News, Opinion, TV and Jobs

- Uncategorized2 years ago

BNM DAO Token Airdrop

BTC1 year ago

BTC1 year agoNFT Sector Keeps Developing – Number of Unique Ethereum NFT Traders Surged 276% in 2022 – Blockchain News, Opinion, TV and Jobs

- Uncategorized2 years ago

New Minting Services

Video2 years ago

Video2 years agoBlock News Media Live Stream

Bitcoin miners2 years ago

Bitcoin miners2 years agoA String of 200 ‘Sleeping Bitcoins’ From 2010 Worth $4.27 Million Moved on Friday

Bitcoin1 year ago

Bitcoin1 year agoSEC’s Chairman Gensler Takes Aggressive Stance on Tokens – Blockchain News, Opinion, TV and Jobs