Analyst

Dogecoin Breaks Out Of Descending Triangle Like It Did In 2021, Analyst Sets $6 Target

Published

2 weeks agoon

By

admin

The Dogecoin price action seems to have turned bearish after a bearish close to April. Projections for the meme cryptocurrency are not bullish in the short term, especially considering the fact that it is now experiencing a 47% price correction from its highest point in the current market cycle. Despite its recent plunge, one analyst believes all is still well with Dogecoin, and the crypto asset is only gearing up for a bull run into new price territories.

Dogecoin Repeating Behavior From Previous Bull Run

According to a recent analysis by popular crypto analyst Ali Martinez, Dogecoin’s current price action is setting up for a potential bull run, despite the cryptocurrency’s ongoing price correction. His analysis is based on interesting patterns on the Dogecoin price chart.

Although they are a very volatile asset class, patterns are an interesting way to predict the future movement of cryptocurrencies. Now, Dogecoin appears to be repeating some of the same patterns that led to its massive breakout in 2017 and 2021.

Specifically, Dogecoin broke out of a descending triangle pattern in the last quarter of 2023, a seemingly occurring trend and a first step for the cryptocurrency. As Martinez noted, the first time this breakout happened was in 2017. However, DOGE went on a 40% correction shortly after before resuming a 982% bull run. Again, a similar breakout of a descending triangle in 2021 saw the crypto retracing by 56% before skyrocketing by 12,197% to reach its current all-time high of $0.7316.

Now, in 2024, #DOGE has yet again broken out of a descending triangle!

It is currently undergoing a 47% price correction, very similar to previous cycles, which could ignite the next $DOGE bull run! pic.twitter.com/ZmuHmvIwei

— Ali (@ali_charts) May 1, 2024

Now, the recent DOGE correction in the past month after breaking out of a descending triangle means the crypto could be gearing up for a similar bounce up. According to the DOGE price chart shared by Martinez, the first step is breaking above resistance at $0.224. If it can hurdle that level, it opens up a run back to the 2021 high and a push-up to a first target of around $1.2.

Looking further out, Martinez’s chart shows an ultimate price surge above $6 in this bull cycle. For this to happen, Dogecoin would need to regain momentum and rally over 4,700% from current levels over the coming months. While this price point looks overachieving, Dogecoin has pulled off epic rallies before, surging over 12,000% at one point in 2021 alone.

It has only been a few months into 2024 Dogecoin has already been on a wild ride this year along with the rest of the crypto market. At the time of writing, DOGE is trading at $0.125 and is down by 16.92% in the past seven days. Trading volume is up by 50% in the past 24 hours, which suggests a return of investor interest.

DOGE bulls reclaim control of price | Source: DOGEUSDT on Tradingview.com

Featured image from MarketWatch, chart from Tradingview.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Source link

You may like

Insight Into The Timing And Factors

Bitcoin About To ‘Blow Higher’ Despite This Week’s Pullback, According to Glassnode Co-Founders – Here’s Why

Azuro and Chiliz Working Together to Boost Adoption of Onchain Sport Prediction Markets – Blockchain News, Opinion, TV and Jobs

Robinhood Bleeds 164 Million Dogecoin

AIGOLD Goes Live, Introducing the First Gold Backed Crypto Project – Blockchain News, Opinion, TV and Jobs

Analyst Benjamin Cowen Warns Ethereum ‘Still Facing Headwinds,’ Says ETH Will Only Go Up if Bitcoin Does This

Analyst

Can Ethereum Reclaim $4,000? Fragile Fundamentals Threaten To Send ETH Crashing

Published

1 week agoon

May 7, 2024By

admin

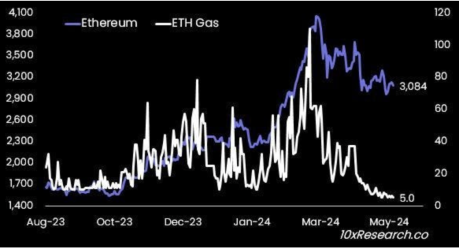

Ethereum has put on a disappointing performance for its investors over the last few weeks, leading to concerns on whether the second-largest cryptocurrency by market cap has lost its shine. The cryptocurrency continues to skirt around the $3,100 level, not making any significant breaks upward. This points to weak fundamentals that could trigger a price decline.

Ethereum Fails To Make Meaningful Moves

Markus Thielen, Head of Research at 10x Research, has pointed out some worrying developments with the Ethereum price. In a new report shared with NewsBTC, he explains that despite Ethereum remaining highly correlated to Bitcoin with an R-Square of 95%, it continues to perform poorly while the latter has made new all-time highs.

Thielen points back to ETH’s performance in the last bull market, which was closely tied to new sectors popping out of the network, such as decentralized finance (DeFi) and non-fungible tokens (NFTs). This caused demand to skyrocket, and in turn, the price followed as users gobbled up ETH for the high gas fee required to transact on the blockchain.

However, Ethereum has failed to maintain this momentum, which can be attributed to its inability to bring the upgrades that users needed in time. Thielen explains that the Dencun upgrade which helped solved the high gas fee issues had come three years too late because by 2024 when the upgrade arrived, users had moved on to Layer 2 networks. Also, during this time, other Layer 1 networks have seen a rise in users and Solana is one example of this.

Source: 10x Research

The researcher further explained that the weak fundamentals of ETH are now not only affecting its price but has had a spillover effect to Bitcoin. “Ethereum’s weak fundamentals are becoming a roadblock for Bitcoin as they prevent broad fiat inflow into the crypto ecosystem,” Thielen stated.

Better To Short ETH

Thielen’s analysis of Ethereum also spreads to the drop in stablecoin usage on the network. Back in 2021, Ethereum had dominated stablecoin transactions such as USDT and USDC. However, it seems like, with other things, the high fees have driven users towards other networks. Blockchains such as Tron (TRX) are now dominating stablecoin transactions, leaving ETH in the dust.

Additionally, there is also the fact that ETH’s issuance is turning inflationary once again. After the London Hard Fork, also known as EIP-1559, was completed in 2021, the network saw its issuance turn deflationary for the first time as ETH burned quickly surpassed ETH being brought into circulation.

However, this has now changed in the past months as there have been more ETH issued than those burned, Thielen notes. To put this in perspective, a total of 74,000 ETH were issued compared to only 43,000 ETH burned. This inflation, coupled with the fact that staking rewards have now dropped to 3%, below the 5.1% offered by Treasury Yields, Ethereum has had a hard time maintaining bullish sentiment.

Given these developments, the researcher believes it is better to be bearish on Ethereum right now. “Right now, we would be more comfortable holding a short position in ETH than a long one in BTC as Ethereum’s fundamentals are fragile, which is not yet reflected in ETH prices,” Thielen concludes.

ETH price fails to hold $3,100 | Source: ETHUSD on Tradingview.com

Featured image from Watcher Guru, chart from Tradingview.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Source link

Analyst

Crypto Analyst Says Massive Surge Is Coming, Here’s The Target

Published

2 weeks agoon

May 6, 2024By

admin

Shiba Inu has rebounded by over 19% from its $0.00002081 price point at the beginning of the month. Current price action shows the cryptocurrency might be on its way to performing an interesting price surge in the coming weeks. According to one crypto analyst, SHIB could actually go on a 120% price surge after breaking out of the current consolidation.

Crypto Analyst Says Massive Surge Coming

SHIB kickstarted a price correction immediately after reaching 0.00003556 in early March. Bullish investor sentiment surrounding the meme cryptocurrency at the time quickly changed into a bearish one. This pushed SHIB on a decline that bottomed out at $0.00002117 in the middle of April, indicating a 40% price correction in those two months. Interestingly, this was the worst SHIB price decline since the May 2022 collapse of the Terra ecosystem.

Related Reading: Why Did The Solana (SOL) Price Jump Today?

As noted on the 8-hour timeframe chart shared on social media platform X by crypto analyst World Of Charts, SHIB has been on a consolidation channel for the past two months. However, the analyst foresees a bullish breakout to create a strong bullish wave that’s going to send SHIB holders on a profit margin between 100% and 120%.

Consolidating In Bullish Flag In H8 Timeframe Incase Of Successful Breakout Expecting Solid Bullish Wave Expecting 100-120% Bullish Wave#Crypto #Shib pic.twitter.com/vfLClaexvu

— World Of Charts (@WorldOfCharts1) May 3, 2024

Interestingly, a further look into the chart shared by World Of Charts shows that the analyst is open to a higher price surge over a longer period of time. The last price target indicated on the chart is $0.00009500, which is a 280% target from the current price levels.

Can Shiba Inu Push Higher?

Shiba Inu recently formed a higher low on the weekly timeframe, an indicator that the bulls might be starting to gain the upper hand. Despite the past decline, over 56% of SHIB holders remained in profit as many long-term holders opted to hold on to their tokens. At the time of writing, SHIB is trading at $0.00002489 and is up by 6.4% in the past seven days. This price increase has seen the number of SHIB holders in profit rising concurrently to 61%.

Related Reading: Bitcoin Relative Strength Jumps To 40%: 10x Research Reveals Next Steps From Here

Many addresses that just moved into profit margin are not taking profit indicating that majority of investors are anticipating a price increase in May. One catalyst that could lead to a further price increase is the recent partnership between PayPal and MoonPay which will allow PayPal users within the United States to buy the dog-themed cryptocurrency easily.

Popular crypto analyst Ali Martinez also predicted a SHIB price surge based on a bull flag that has recently appeared on the token’s price chart.

SHIB falls after brief recovery | Source: SHIBUSDT on Tradingview.com

Featured image from Times Tabloid, chart from Tradingview.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Source link

Analyst

Crypto Expert Says ETH Is Yet To Bottom Against Bitcoin

Published

2 weeks agoon

April 30, 2024By

admin

A crypto analyst has predicted when Ethereum, the world’s second-largest cryptocurrency, will bottom against Bitcoin, however, under certain conditions.

Analyst Predicts ETH/BTC Bottom Timeline

In a recent X (formerly Twitter) post, crypto analyst and founder of ITC Crypto, Benjamin Cowen, shared his forecast regarding the Ethereum to Bitcoin price ratio, projecting the timeline for when ETH/BTC would hit its lowest value in the current market cycle.

Sharing insights on the market conditions, Cowen noted striking similarities between the present market’s dynamics and the one seen in 2019. He disclosed that ETH/BTC’s recent bounce mirrored the market’s behavior in 2019, two months before the Federal Reserve (FED) cut down rates.

Cowen predicts that the ETH/BTC ratio will reach the lowest point in its price cycle when the FED makes a significant change in its monetary policy, often referred to as a “pivot.” The crypto expert expects this pivot to occur in a few months, ultimately suggesting that Ethereum would bottom against Bitcoin in the coming months.

His analysis is also based on the assumption that macroeconomic conditions and the FED’s monetary policies can significantly impact the cryptocurrency market. Sharing a price chart of Ethereum against Bitcoin in another post, Cowen projected that the ETH/BTC ratio will head towards a range of 0.03 and 0.04 by summer.

Commenting on his prediction of ETH/BTC’s bottom, a crypto community member expressed skepticism about the FED’s likelihood of cutting down rates while inflation was still high. Cowen responded that the absence of a rate cut further reinforced his beliefs that the ETH/BTC ratio has not yet reached its lowest point. He suggests that unless inflationary pressures are addressed, the ETH/BTC ratio may continue on its downward trend.

Crypto Expert Calls Ethereum A Higher Risk Asset

In another post, Cowen referred to Ethereum as a higher-risk asset and Bitcoin as a lower-risk asset. The crypto analyst’s forecast on Ethereum against Bitcoin is underpinned by his interpretation of capital migration dynamics, suggesting that higher-risk assets typically depreciate relative to lower-risk assets.

He highlighted the uncertainty surrounding the future market movements of ETH/BTC following the halving event. Cowen predicted that if ETH/BTC witnesses a “relief rebound” after the halving, then he expects a rejection by the bull market support band, particularly in the context of weekly closing prices, estimated to range between $0.053 to $0.054.

While acknowledging his past successes in predicting ETH/BTC price movements, Cowen highlighted that his predictions remain speculative, stating, “Just because I have been right so far about ETH/BTC does not mean I will continue being right.”

ETH bulls fail to hold $3,000 | Source: ETHUSDT on Tradingview.com

Featured image from Finbold, chart from Tradingview.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Source link

Insight Into The Timing And Factors

Bitcoin About To ‘Blow Higher’ Despite This Week’s Pullback, According to Glassnode Co-Founders – Here’s Why

Azuro and Chiliz Working Together to Boost Adoption of Onchain Sport Prediction Markets – Blockchain News, Opinion, TV and Jobs

Robinhood Bleeds 164 Million Dogecoin

AIGOLD Goes Live, Introducing the First Gold Backed Crypto Project – Blockchain News, Opinion, TV and Jobs

Analyst Benjamin Cowen Warns Ethereum ‘Still Facing Headwinds,’ Says ETH Will Only Go Up if Bitcoin Does This

Tron Price Prediction: TRX Outperforms Bitcoin, Can It Hit $0.132?

Ethereum-Based Altcoin Leads Real-World Assets Sector in Development Activity, According to Santiment

Here’s Why This Analyst Is Predicting A Rise To $360

Hackers With $182,000,000 Stolen From Poloniex Starts Moving Funds to Tornado Cash

Cardano Faces Make-Or-Break Price Level For Bullish Revival

A Premier Crypto Exchange Tailored for Seasoned Traders – Blockchain News, Opinion, TV and Jobs

Crypto Whale Withdraws $75.8 Million in USDC From Coinbase To Invest In Ethereum’s Biggest Presale – Blockchain News, Opinion, TV and Jobs

CFTC Chair Says ‘Another Cycle of Enforcement Actions’ Coming As Crypto Enters New Phase of Asset Appreciation

Spectral Labs Joins Hugging Face’s ESP Program to advance the Onchain x Open-Source AI Community – Blockchain News, Opinion, TV and Jobs

Bitcoin Dropped Below 2017 All-Time-High but Could Sellers be Getting Exhausted? – Blockchain News, Opinion, TV and Jobs

What does the Coinbase Premium Gap Tell us about Investor Activity? – Blockchain News, Opinion, TV and Jobs

BNM DAO Token Airdrop

NFT Sector Keeps Developing – Number of Unique Ethereum NFT Traders Surged 276% in 2022 – Blockchain News, Opinion, TV and Jobs

New Minting Services

Block News Media Live Stream

A String of 200 ‘Sleeping Bitcoins’ From 2010 Worth $4.27 Million Moved on Friday

SEC’s Chairman Gensler Takes Aggressive Stance on Tokens – Blockchain News, Opinion, TV and Jobs

Friends or Enemies? – Blockchain News, Opinion, TV and Jobs

Enjoy frictionless crypto purchases with Apple Pay and Google Pay | by Jim | @blockchain | Jun, 2022

Block News Media Live Stream

How Web3 can prevent Hollywood strikes

Block News Media Live Stream

XRP Explodes With 1,300% Surge In Trading Volume As crypto Exchanges Jump On Board

Block News Media Live Stream

Trending

Altcoins2 years ago

Altcoins2 years agoBitcoin Dropped Below 2017 All-Time-High but Could Sellers be Getting Exhausted? – Blockchain News, Opinion, TV and Jobs

Binance2 years ago

Binance2 years agoWhat does the Coinbase Premium Gap Tell us about Investor Activity? – Blockchain News, Opinion, TV and Jobs

- Uncategorized2 years ago

BNM DAO Token Airdrop

BTC1 year ago

BTC1 year agoNFT Sector Keeps Developing – Number of Unique Ethereum NFT Traders Surged 276% in 2022 – Blockchain News, Opinion, TV and Jobs

- Uncategorized3 years ago

New Minting Services

Video2 years ago

Video2 years agoBlock News Media Live Stream

Bitcoin miners2 years ago

Bitcoin miners2 years agoA String of 200 ‘Sleeping Bitcoins’ From 2010 Worth $4.27 Million Moved on Friday

Bitcoin1 year ago

Bitcoin1 year agoSEC’s Chairman Gensler Takes Aggressive Stance on Tokens – Blockchain News, Opinion, TV and Jobs