Ali Martinez

MATIC Price Slumps 10% Amidst Market Downturn

Published

2 months agoon

By

admin

MATIC, the native token of the Polygon network, has witnessed a significant decline in its value. It has fallen by more than 10% in the past week and 8% in less than 24 hours as the general cryptocurrency market continues to grapple with a cloud of negative sentiment.

Fortunately, the latest on-chain analysis has revealed the important levels that investors should look out for following the latest decline in the MATIC price.

Over 10,900 Addresses Bought 600 Million Polygon Tokens At This Price

According to a recent post on X by crypto pundit Ali Martinez, the price of MATIC has established a key support around its current price point. This evaluation is based on analytics firm IntoTheBlock’s on-chain data, which tracks the average acquisition price for any given wallet address.

The distribution of the Polygon token supply across various price ranges | Source: Ali_charts/XAbove is the chart highlighted by Martinez that shows the distribution of the Polygon token supply across various price ranges. The size of the dots in the chart represents the magnitude of coins purchased around the corresponding price range.

Most notably, over 10,900 wallet addresses bought a whopping 608 million MATIC around the $1.02 and $1.05 zone. According to the crypto analyst, this massive buying activity has supported the establishment of crucial support around this price region.

#Polygon has found crucial support between $1.02 and $1.05, supported by 10,900 addresses holding around 608 million #MATIC. Should this support falter, the next essential demand zone lies near $0.91, where 35,700 addresses collectively hold 394.6 million $MATIC. pic.twitter.com/rLn4ymcQf7

— Ali (@ali_charts) March 16, 2024

While the large size of the dot reflects the strength of this particular level, sustained bearish pressure could cause the price of MATIC to breach and fall beneath this support. In this case, investors could see the cryptocurrency drop to around $0.91.

This makes the $0.89 and $0.92 price range another level to watch, as it represents the next vital support area, where 35,680 wallet addresses purchased nearly 400 million Polygon tokens.

MATIC Price Overview

As of this writing, the price of MATIC stands at $1.04, reflecting an 8% decline in the past 24 hours. This price dip comes after the altcoin printed a multi-month high of $1.28 on Thursday, March 14.

According to data from CoinGecko, the Polygon coin has suffered a 9.7% price slump in the last seven days. From a broader perspective, though, the cryptocurrency has had a fairly positive performance in the past month.

With a market capitalization of more than $9.7 billion, the MATIC token ranks as the 18th-largest cryptocurrency in the sector.

MATIC price finds support around $1.04 on the daily timeframe | Source: MATICUSDT chart on TradingViewFeatured image from Getty Images, chart from TradingView

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Source link

You may like

Insight Into The Timing And Factors

Bitcoin About To ‘Blow Higher’ Despite This Week’s Pullback, According to Glassnode Co-Founders – Here’s Why

Azuro and Chiliz Working Together to Boost Adoption of Onchain Sport Prediction Markets – Blockchain News, Opinion, TV and Jobs

Robinhood Bleeds 164 Million Dogecoin

AIGOLD Goes Live, Introducing the First Gold Backed Crypto Project – Blockchain News, Opinion, TV and Jobs

Analyst Benjamin Cowen Warns Ethereum ‘Still Facing Headwinds,’ Says ETH Will Only Go Up if Bitcoin Does This

Ali Martinez

111,000 BTC Move Out Of Exchange Wallets In A Month

Published

1 month agoon

April 7, 2024By

admin

The Bitcoin price has somewhat slowed down since reaching the unprecedented high of $73,000, moving mostly sideways since mid-March. However, with the halving event less than a fortnight away, all eyes will be on the premier cryptocurrency and all that pertains to it over the next couple of weeks.

According to a recent on-chain observation, the BTC supply on exchanges has been on a steady decline over the past few months. This trend has sparked discussions on what this could mean for the Bitcoin price, both in the short and long term.

$7.55 Billion Transferred Out Of Exchange Wallets In The Past Month

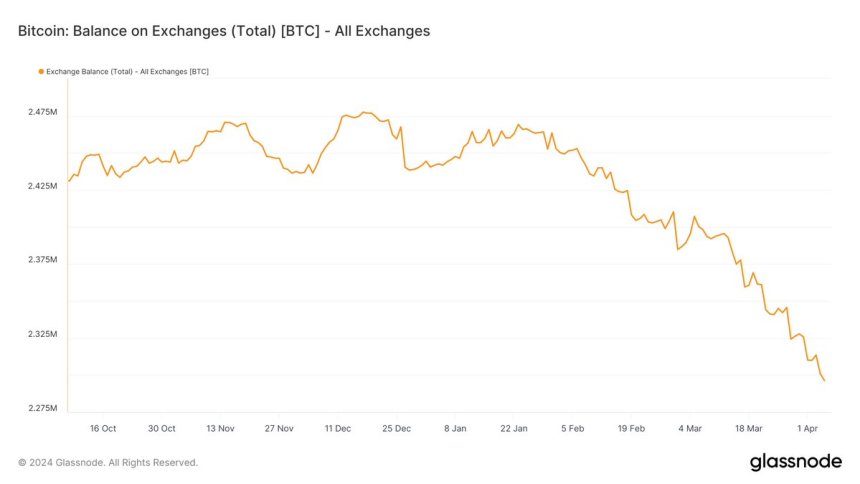

Prominent crypto pundit Ali Martinez took to the X platform to share that a significant amount of Bitcoin has been moved out of crypto exchanges over the past month. The relevant metric here is Glassnode’s Balance on Exchanges, which tracks the total amount of a cryptocurrency (Bitcoin, in this case) held across all exchange addresses.

A decrease in the value of this indicator implies that investors are making more withdrawals than deposits of Bitcoin into centralized exchanges. The metric’s increase, on the other hand, indicates that more BTC is flowing into these exchanges than leaving.

Chart showing Bitcoin balance on all exchanges | Source: Ali_charts/X

According to Martinez, about 111,000 BTC (worth approximately $7.55 billion) have been transferred out of known crypto exchange wallets in the past month. Typically, an exodus of funds (of this magnitude) suggests a significant shift in the sentiment of Bitcoin investors.

While the exact rationale behind such a massive movement of Bitcoin remains unclear, the flow of funds from trading platforms suggests a growth in investor confidence. This implies that BTC owners are more interested in holding their assets in the long term rather than selling for short-term gains.

Furthermore, this continuous downward trend in BTC’s balance on exchanges could set the stage for a bullish rally for the Bitcoin price. A sustained drop in the BTC’s supply on centralized exchanges could result in a supply crunch – a scenario where the supply of a particular asset is lower than its demand, leading to a surge in its value.

Another potential bullish catalyst for the Bitcoin price is the upcoming halving event, which is expected to occur on April 18, 2024. With the miners’ rewards slashed in half and the production of Bitcoin slowed, this event is expected to impact the value of BTC positively.

Bitcoin Price At A Glance

As of this writing, the Bitcoin price stands at around $69,537, reflecting a 2.7% increase in the last 24 hours.

Bitcoin price on the verge of $70,000 on the daily timeframe | Source: BTCUSDT chart on TradingView

Featured image from iStock, chart from TradingView

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Source link

ADA Price

Can Whales Drive ADA’s Resurrection From Recent Dump?

Published

1 month agoon

April 6, 2024By

admin

The Cardano price has been facing a significant amount of bearish pressure over the past week, declining by more than 12%. This recent fall coincides with a broader crypto market downturn, with other major altcoins suffering huge losses over the past week.

Specifically, Cardano’s price decline has been largely linked to the recent sell-off of all ADA holdings by the Grayscale Digital Large Cap Fund (GDLC). On Thursday, April 4, the fund disclosed its decision to rebalance its portfolio by liquidating its Cardano assets (about 1.6% of the entire holdings).

Registering such a negative start to April after an underwhelming performance in March doesn’t do well to dispel the increasing concerns of investors. Moreover, the latest on-chain data suggests that the Cardano price might continue to succumb to the bearish pressure.

Analyst Predicts ADA Price Slump As Whale Activity Slows Down

Popular crypto pundit Ali Martinez has shared a post on X that Cardano whales have been making fewer moves in the market in recent days. This revelation is based on Santiment’s Whale Transaction Count metric, which tracks the number of ADA transactions worth more than $1 million.

Whales refer to entities or individuals that own significant amounts of a particular cryptocurrency (Cardano, in this case). They are often viewed as key players in the market, as their buying or selling activities can have a significant impact on the Cardano price, leading to speculation and potential market shifts.

According to Martinez, the on-chain data shows that there has been a noticeable dip in the activity of Cardano whales, suggesting a possible decline in significant ADA transactions. In an almost vertical move, the whale transaction count dropped from around 400 daily transactions at the beginning of last week to 200 daily transactions by Friday, April 5.

Chart showing ADA whale transaction count, whale holdings, and price | Source: Ali_charts/X

The crypto analyst mentioned that the recent downturn in whale activity could be a signal for “further price consolidation” or an imminent decline in the Cardano price. A loss of substantial buying activity from large investors can cause the cryptocurrency to succumb to bearish pressure, especially from small traders looking to take some profit.

Indeed, the Cardano token has made a positive start to the year, reaching a high of $0.8 in early March. However, the altcoin has been on a downward trend since hitting the 2024 peak – collapsing under the pressure of Bitcoin’s price decline.

Cardano Price At A Glance

As of this writing, the Cardano price stands at around $0.577, reflecting a 1% decline in the past 24 hours.

Cardano price hovers around $0.58 on the daily timeframe | Source: ADAUSDT chart on TradingView

Featured image from iStock, chart from TradingView

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Source link

Ali Martinez

Solana Flashing Sign of a Potential Correction, Says Crypto Trader Ali Martinez – Here Are His Targets

Published

2 months agoon

March 16, 2024By

admin

A popular crypto trader says he believes Ethereum (ETH) rival Solana (SOL) is flashing signs of a possible correction.

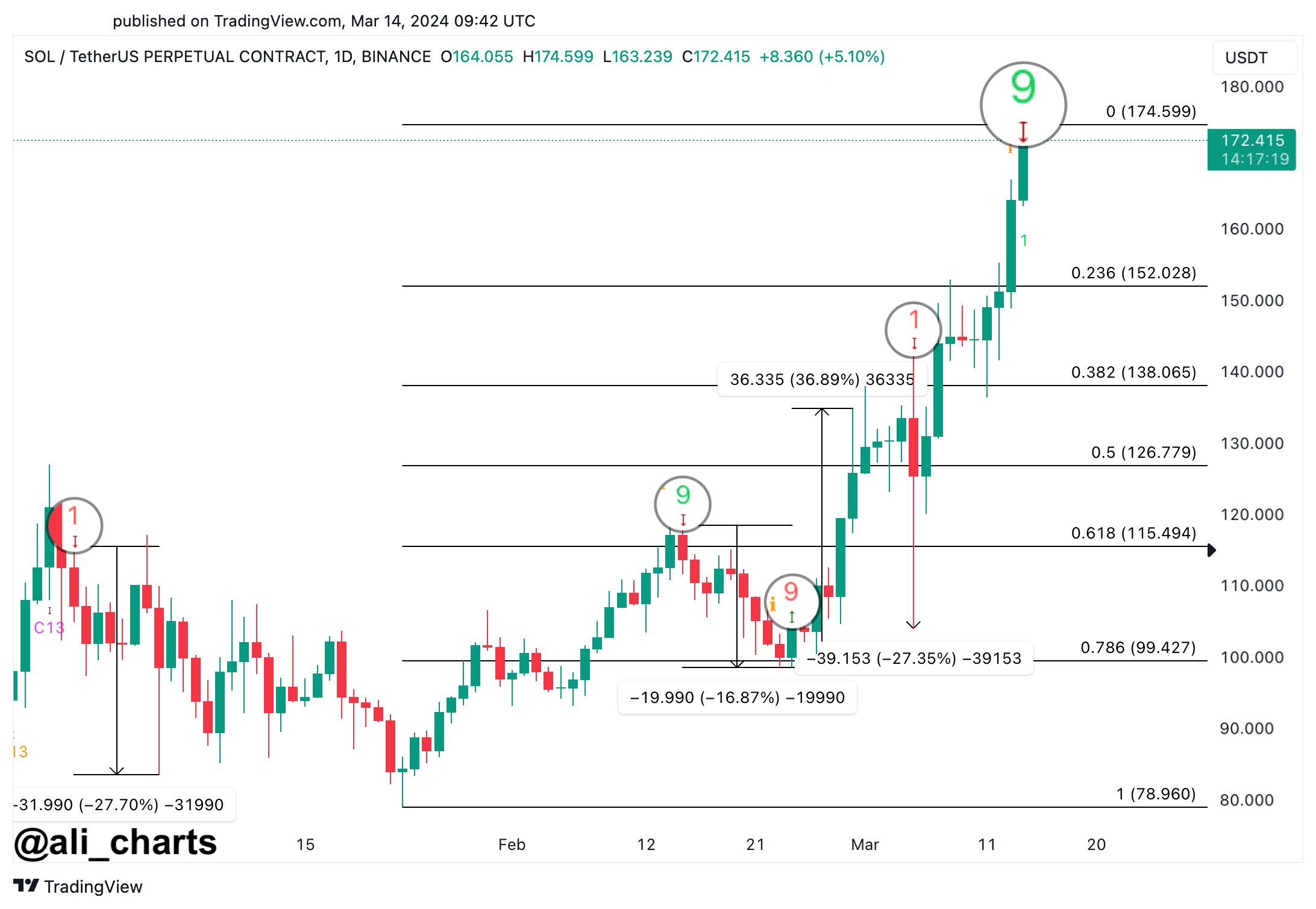

In a new thread, Ali Martinez tells his 52,700 followers on the social media platform X that SOL’s Tom DeMark (TD) sequential indicator flashed a sell signal on its daily chart, which historically signals a price drop for the smart contract platform.

The TD Sequential indicator is typically used to identify the potential turning point for an asset’s price.

Explains the analyst,

“Since December 2023, every time this indicator suggested selling, the price of SOL dropped by 17% to 28%. A similar outlook could see SOL retrace to $152 or even $127.”

SOL is trading at $184.13 at time of writing. The 5th-ranked crypto asset by market cap is up 12% in the past 24 hours and nearly 27% in the past week.

Martinez cautions traders not to short assets during a bull market and instead says to just “buy the dips.” He predicts SOL will only endure a brief correction before heading to higher highs.

Not all traders think the Ethereum competitor is primed to dip, however. Pseudonymous analyst Kaleo told his 629,500 X followers earlier this week that SOL could soar to $200 after breaking out of a bullish trendline in the $150 range.

Despite SOL’s gains in the past month, it remains more than 29% down from its all-time high of which it set in November 2021.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any loses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney

Source link

Insight Into The Timing And Factors

Bitcoin About To ‘Blow Higher’ Despite This Week’s Pullback, According to Glassnode Co-Founders – Here’s Why

Azuro and Chiliz Working Together to Boost Adoption of Onchain Sport Prediction Markets – Blockchain News, Opinion, TV and Jobs

Robinhood Bleeds 164 Million Dogecoin

AIGOLD Goes Live, Introducing the First Gold Backed Crypto Project – Blockchain News, Opinion, TV and Jobs

Analyst Benjamin Cowen Warns Ethereum ‘Still Facing Headwinds,’ Says ETH Will Only Go Up if Bitcoin Does This

Tron Price Prediction: TRX Outperforms Bitcoin, Can It Hit $0.132?

Ethereum-Based Altcoin Leads Real-World Assets Sector in Development Activity, According to Santiment

Here’s Why This Analyst Is Predicting A Rise To $360

Hackers With $182,000,000 Stolen From Poloniex Starts Moving Funds to Tornado Cash

Cardano Faces Make-Or-Break Price Level For Bullish Revival

A Premier Crypto Exchange Tailored for Seasoned Traders – Blockchain News, Opinion, TV and Jobs

Crypto Whale Withdraws $75.8 Million in USDC From Coinbase To Invest In Ethereum’s Biggest Presale – Blockchain News, Opinion, TV and Jobs

CFTC Chair Says ‘Another Cycle of Enforcement Actions’ Coming As Crypto Enters New Phase of Asset Appreciation

Spectral Labs Joins Hugging Face’s ESP Program to advance the Onchain x Open-Source AI Community – Blockchain News, Opinion, TV and Jobs

Bitcoin Dropped Below 2017 All-Time-High but Could Sellers be Getting Exhausted? – Blockchain News, Opinion, TV and Jobs

What does the Coinbase Premium Gap Tell us about Investor Activity? – Blockchain News, Opinion, TV and Jobs

BNM DAO Token Airdrop

NFT Sector Keeps Developing – Number of Unique Ethereum NFT Traders Surged 276% in 2022 – Blockchain News, Opinion, TV and Jobs

New Minting Services

Block News Media Live Stream

A String of 200 ‘Sleeping Bitcoins’ From 2010 Worth $4.27 Million Moved on Friday

SEC’s Chairman Gensler Takes Aggressive Stance on Tokens – Blockchain News, Opinion, TV and Jobs

Friends or Enemies? – Blockchain News, Opinion, TV and Jobs

Enjoy frictionless crypto purchases with Apple Pay and Google Pay | by Jim | @blockchain | Jun, 2022

Block News Media Live Stream

How Web3 can prevent Hollywood strikes

Block News Media Live Stream

XRP Explodes With 1,300% Surge In Trading Volume As crypto Exchanges Jump On Board

Block News Media Live Stream

Trending

Altcoins2 years ago

Altcoins2 years agoBitcoin Dropped Below 2017 All-Time-High but Could Sellers be Getting Exhausted? – Blockchain News, Opinion, TV and Jobs

Binance2 years ago

Binance2 years agoWhat does the Coinbase Premium Gap Tell us about Investor Activity? – Blockchain News, Opinion, TV and Jobs

- Uncategorized2 years ago

BNM DAO Token Airdrop

BTC1 year ago

BTC1 year agoNFT Sector Keeps Developing – Number of Unique Ethereum NFT Traders Surged 276% in 2022 – Blockchain News, Opinion, TV and Jobs

- Uncategorized3 years ago

New Minting Services

Video2 years ago

Video2 years agoBlock News Media Live Stream

Bitcoin miners2 years ago

Bitcoin miners2 years agoA String of 200 ‘Sleeping Bitcoins’ From 2010 Worth $4.27 Million Moved on Friday

Bitcoin1 year ago

Bitcoin1 year agoSEC’s Chairman Gensler Takes Aggressive Stance on Tokens – Blockchain News, Opinion, TV and Jobs