MATIC

Coffee Giant Starbucks Announces Shutdown of NFT Rewards Program

Published

2 months agoon

By

admin

Starbucks is shutting down its loyalty program that rewards participants with non-fungible tokens (NFTs) minted on the Polygon (MATIC) blockchain.

The world’s largest coffeehouse chain rolled out the Starbucks Odyssey program for beta testing in December 2022.

Members complete themed activities to earn NFTs called “Journey Stamps” and bonus points to access benefits and interactive experiences.

But after nearly two years, Starbucks revealed on Monday that it will discontinue the program.

The coffee giant says Odyssey will end on March 31st and members have until March 25th to complete their remaining Journeys.

“The Starbucks Odyssey Beta must come to an end to prepare for what comes next as we continue to evolve the program.”

Although Starbucks will discontinue the program, the stamps will remain accessible on the NFT marketplace Nifty Gateway. The digital collectibles are also tradable on other platforms.

“The Odyssey marketplace will transition to the Nifty marketplace. You can continue to buy, sell, and transfer Odyssey stamps on the Nifty marketplace.

You can withdraw your Stamps to an external wallet and trade on other platforms.”

Some collectors have shown interest in Starbucks’ NFTs. The Seattle-based firm’s Holiday Cheer Edition stamp that was released on December 16th, 2022 sold for an average price of $883.20. The 2,000 Siren Collection stamps priced at $100 each were also sold out in minutes when they were launched in March last year.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any loses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/Emon373

Source link

You may like

Bitcoin About To ‘Blow Higher’ Despite This Week’s Pullback, According to Glassnode Co-Founders – Here’s Why

Azuro and Chiliz Working Together to Boost Adoption of Onchain Sport Prediction Markets – Blockchain News, Opinion, TV and Jobs

Robinhood Bleeds 164 Million Dogecoin

AIGOLD Goes Live, Introducing the First Gold Backed Crypto Project – Blockchain News, Opinion, TV and Jobs

Analyst Benjamin Cowen Warns Ethereum ‘Still Facing Headwinds,’ Says ETH Will Only Go Up if Bitcoin Does This

Tron Price Prediction: TRX Outperforms Bitcoin, Can It Hit $0.132?

An analyst has explained how a buy signal forming in the price of Polygon (MATIC) could lead to the asset rebounding towards these price targets.

Polygon Is Showing A TD Sequential Buy Signal Right Now

In a new post on X, analyst Ali has discussed about the a Tom Demark (TD) Sequential signal forming in the MATIC price chart. The TD Sequential here refers to an indicator in technical analysis that’s generally used for pinpointing probable locations of reversal in any given asset’s value.

This indicator has two phases to it, the first of which is known as the “setup.” In this phase, candles of the same polarity are counted up to nine, at the end of which the price may be assumed to have encountered a point of reversal.

Naturally, if the candles leading up to the completion of the setup had been red, the reversal would be towards the upside, while green candles would suggest a potential top for the asset.

Once the setup is done with, the second phase called the “countdown” begins. This phase works similarly to the setup, except for the fact that it lasts for thirteen candles instead of nine. After these thirteen candles of the same polarity are also in, the price may be considered to have attained another likely point of reversal.

Polygon has recently completed a TD Sequential phase of the former type. Below is the chart shared by Ali that shows the formation of this TD Sequential signal for the MATIC daily price.

The recent pattern forming in the 1-day price of the cryptocurrency | Source: @ali_charts on X

As displayed in the above graph, the Polygon daily price has finished a TD Sequential setup with a downtrend recently. This would suggest that the asset may be at a potential bottom at the moment.

“If MATIC stays strong above $0.87, we could see a rebound to $0.95, or better yet, $1!” says the analyst. A potential rally to the former of these targets would suggest an increase of more than 8% from the current price, while a run to the latter level would mean growth of almost 14%.

It now remains to be seen how the Polygon price will develop from here and if the TD Sequential buy signal will end up holding or not.

MATIC Price

The past few weeks have been a bad time for Polygon investors as the cryptocurrency’s price has slid down all the way from around the $1.3 level to now the $0.87 mark, corresponding to a drawdown of over 33%.

The chart below shows what the trend in MATIC’s value has looked like over the past month.

Looks like the price of the asset has plunged over the past month | Source: MATICUSD on TradingView

Amid this downward trajectory, the TD Sequential buy signal may perhaps end up being at least a glimmer of hope for the Polygon holders.

Featured image from Shutterstock.com, charts from TradingView.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Source link

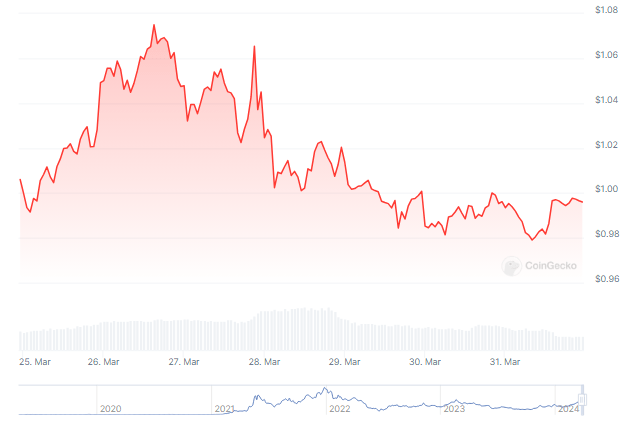

Polygon’s native token, MATIC, finds itself at a crossroads as it grapples with price volatility amidst an impending network upgrade and challenges surrounding Total Value Locked (TVL). In the past week, MATIC has witnessed a notable downturn in price, slipping by 4.44% according to data from CoinMarketCap. Despite earlier optimism that drove MATIC close to the $2 mark, the token has encountered resistance at the $1 level, with bullish momentum struggling to gain traction amidst prevailing market conditions.

MATIC Investors Feel The Pinch

Data analysis from IntoTheBlock paints a mixed picture for MATIC holders, revealing that 51% are currently facing losses, while 43% are enjoying profits, leaving a mere 5% at the break-even point. This volatility serves as a stark reminder of the inherent risks associated with investments in the cryptocurrency market.

Source: IntoTheBlock

However, amidst the market turbulence, a ray of hope emerges for MATIC holders in the form of Polygon’s recently announced “Napoli upgrade.” This upgrade, designed to bolster the network’s consensus mechanisms, is set to introduce enhancements in parallel execution and incorporate novel operational codes for the Ethereum Virtual Machine (EVM). Analysts speculate that the Napoli upgrade could inject renewed buying pressure into the market, with projections hinting at a potential price rise towards $1.30 if bullish sentiment prevails.

MATIC market cap currently at $9.8 billion. Chart: TradingView.com

Despite the anticipation surrounding the Napoli upgrade, Polygon faces challenges on other fronts, notably concerning its Total Value Locked (TVL). In a remarkable turnaround from its peak in 2021, TVL has plummeted to $1 billion, according to data from DeFiLlama. This decline reflects a waning participation in liquidity provision, raising concerns about the protocol’s health and resilience.

MATIC price down in the last week. Source: Coingecko

The Road Ahead For Polygon

Polygon’s leadership remains optimistic about the project’s future, emphasizing its resilience amidst market fluctuations. They believe that the Napoli upgrade, coupled with strategic initiatives aimed at addressing challenges such as TVL, will fortify Polygon’s position for sustained success in the dynamic cryptocurrency landscape.

As investors and industry observers closely monitor developments within the Polygon ecosystem, navigating the delicate balance between the potential catalyst of the Napoli upgrade and the headwinds posed by declining TVL, the road ahead for MATIC remains uncertain. The cryptocurrency’s ability to weather market volatility and regain momentum in the face of recent setbacks will be pivotal in shaping its trajectory in the coming weeks and months.

MATIC’s recent price gyrations, punctuated by the announcement of the Napoli upgrade and challenges surrounding TVL, underscore the complexities inherent in navigating the cryptocurrency market. As Polygon continues to chart its course, adaptation and innovation will be key drivers in determining its long-term viability amidst an ever-evolving landscape.

Featured image from Andrea Piacquadio/Pexels, chart from TradingView

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Source link

Ali Martinez

MATIC Price Slumps 10% Amidst Market Downturn

Published

2 months agoon

March 17, 2024By

admin

MATIC, the native token of the Polygon network, has witnessed a significant decline in its value. It has fallen by more than 10% in the past week and 8% in less than 24 hours as the general cryptocurrency market continues to grapple with a cloud of negative sentiment.

Fortunately, the latest on-chain analysis has revealed the important levels that investors should look out for following the latest decline in the MATIC price.

Over 10,900 Addresses Bought 600 Million Polygon Tokens At This Price

According to a recent post on X by crypto pundit Ali Martinez, the price of MATIC has established a key support around its current price point. This evaluation is based on analytics firm IntoTheBlock’s on-chain data, which tracks the average acquisition price for any given wallet address.

The distribution of the Polygon token supply across various price ranges | Source: Ali_charts/XAbove is the chart highlighted by Martinez that shows the distribution of the Polygon token supply across various price ranges. The size of the dots in the chart represents the magnitude of coins purchased around the corresponding price range.

Most notably, over 10,900 wallet addresses bought a whopping 608 million MATIC around the $1.02 and $1.05 zone. According to the crypto analyst, this massive buying activity has supported the establishment of crucial support around this price region.

#Polygon has found crucial support between $1.02 and $1.05, supported by 10,900 addresses holding around 608 million #MATIC. Should this support falter, the next essential demand zone lies near $0.91, where 35,700 addresses collectively hold 394.6 million $MATIC. pic.twitter.com/rLn4ymcQf7

— Ali (@ali_charts) March 16, 2024

While the large size of the dot reflects the strength of this particular level, sustained bearish pressure could cause the price of MATIC to breach and fall beneath this support. In this case, investors could see the cryptocurrency drop to around $0.91.

This makes the $0.89 and $0.92 price range another level to watch, as it represents the next vital support area, where 35,680 wallet addresses purchased nearly 400 million Polygon tokens.

MATIC Price Overview

As of this writing, the price of MATIC stands at $1.04, reflecting an 8% decline in the past 24 hours. This price dip comes after the altcoin printed a multi-month high of $1.28 on Thursday, March 14.

According to data from CoinGecko, the Polygon coin has suffered a 9.7% price slump in the last seven days. From a broader perspective, though, the cryptocurrency has had a fairly positive performance in the past month.

With a market capitalization of more than $9.7 billion, the MATIC token ranks as the 18th-largest cryptocurrency in the sector.

MATIC price finds support around $1.04 on the daily timeframe | Source: MATICUSDT chart on TradingViewFeatured image from Getty Images, chart from TradingView

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Source link

Bitcoin About To ‘Blow Higher’ Despite This Week’s Pullback, According to Glassnode Co-Founders – Here’s Why

Azuro and Chiliz Working Together to Boost Adoption of Onchain Sport Prediction Markets – Blockchain News, Opinion, TV and Jobs

Robinhood Bleeds 164 Million Dogecoin

AIGOLD Goes Live, Introducing the First Gold Backed Crypto Project – Blockchain News, Opinion, TV and Jobs

Analyst Benjamin Cowen Warns Ethereum ‘Still Facing Headwinds,’ Says ETH Will Only Go Up if Bitcoin Does This

Tron Price Prediction: TRX Outperforms Bitcoin, Can It Hit $0.132?

Ethereum-Based Altcoin Leads Real-World Assets Sector in Development Activity, According to Santiment

Here’s Why This Analyst Is Predicting A Rise To $360

Hackers With $182,000,000 Stolen From Poloniex Starts Moving Funds to Tornado Cash

Cardano Faces Make-Or-Break Price Level For Bullish Revival

A Premier Crypto Exchange Tailored for Seasoned Traders – Blockchain News, Opinion, TV and Jobs

Crypto Whale Withdraws $75.8 Million in USDC From Coinbase To Invest In Ethereum’s Biggest Presale – Blockchain News, Opinion, TV and Jobs

CFTC Chair Says ‘Another Cycle of Enforcement Actions’ Coming As Crypto Enters New Phase of Asset Appreciation

Spectral Labs Joins Hugging Face’s ESP Program to advance the Onchain x Open-Source AI Community – Blockchain News, Opinion, TV and Jobs

DOT Price (Polkadot) Reaches Key Juncture, Is This Bulls Trap or Correction?

Bitcoin Dropped Below 2017 All-Time-High but Could Sellers be Getting Exhausted? – Blockchain News, Opinion, TV and Jobs

What does the Coinbase Premium Gap Tell us about Investor Activity? – Blockchain News, Opinion, TV and Jobs

BNM DAO Token Airdrop

NFT Sector Keeps Developing – Number of Unique Ethereum NFT Traders Surged 276% in 2022 – Blockchain News, Opinion, TV and Jobs

New Minting Services

Block News Media Live Stream

A String of 200 ‘Sleeping Bitcoins’ From 2010 Worth $4.27 Million Moved on Friday

SEC’s Chairman Gensler Takes Aggressive Stance on Tokens – Blockchain News, Opinion, TV and Jobs

Friends or Enemies? – Blockchain News, Opinion, TV and Jobs

Enjoy frictionless crypto purchases with Apple Pay and Google Pay | by Jim | @blockchain | Jun, 2022

Block News Media Live Stream

How Web3 can prevent Hollywood strikes

Block News Media Live Stream

XRP Explodes With 1,300% Surge In Trading Volume As crypto Exchanges Jump On Board

Block News Media Live Stream

Trending

Altcoins2 years ago

Altcoins2 years agoBitcoin Dropped Below 2017 All-Time-High but Could Sellers be Getting Exhausted? – Blockchain News, Opinion, TV and Jobs

Binance2 years ago

Binance2 years agoWhat does the Coinbase Premium Gap Tell us about Investor Activity? – Blockchain News, Opinion, TV and Jobs

- Uncategorized2 years ago

BNM DAO Token Airdrop

BTC1 year ago

BTC1 year agoNFT Sector Keeps Developing – Number of Unique Ethereum NFT Traders Surged 276% in 2022 – Blockchain News, Opinion, TV and Jobs

- Uncategorized2 years ago

New Minting Services

Video2 years ago

Video2 years agoBlock News Media Live Stream

Bitcoin miners2 years ago

Bitcoin miners2 years agoA String of 200 ‘Sleeping Bitcoins’ From 2010 Worth $4.27 Million Moved on Friday

Bitcoin1 year ago

Bitcoin1 year agoSEC’s Chairman Gensler Takes Aggressive Stance on Tokens – Blockchain News, Opinion, TV and Jobs