Consumer Price Index

‘Worrying’ Metric Shows Massive Inflation Spike Hammered US, Far Higher Than Reported: Former Treasury Secretary Larry Summers

Published

2 months agoon

By

admin

Former U.S. Treasury Secretary Lawrence Summers says an old school method of tracking inflation may reveal the real amount of economic pain that Americans have had to endure.

Summers has co-authored and released a new paper exploring the effect of high interest rates on the American consumer.

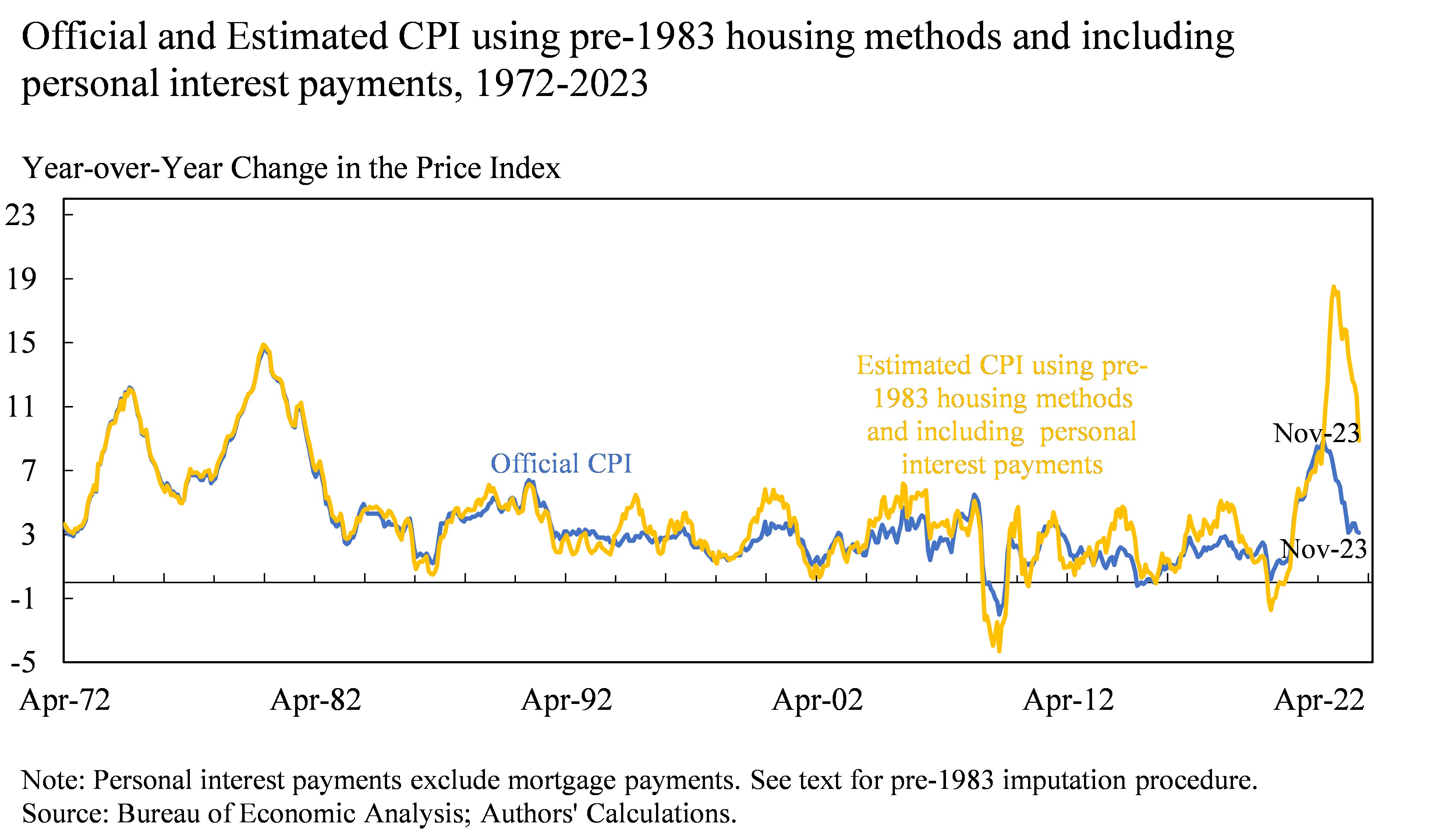

The paper, in part, aims to paint an alternate and more accurate view of inflation by incorporating economist Arthur Okun’s pre-1983 system of measuring inflation, which took into account personal interest rates and housing financing costs.

After 1983, those metrics were taken out of the consumer price index (CPI), which Summers and the authors of the paper argue may be giving an inaccurate portrayal of inflation in the US.

Using the pre-1983 method of measuring inflation, the report says that in November of 2022, CPI spiked by about 18% – contrary to the official 4.1% number determined by the government.

The new numbers paint a darker picture of the inflation that Americans are dealing with to this day, with the report stating the pre-1983 measure offers a “more worrying picture of inflation in the current moment than the official inflation numbers.”

Summers broke down the discrepancy via Twitter,

“Pre-1983, mortgage costs were in the CPI as were car payments pre-1998. Now, price indexes do not include borrowing costs. Thus, when interest rates jumped last year, official inflation did not fully capture the effects it would have on consumer well-being…

We show that if we make an effort to reconstruct the CPI of Okun’s era—which would have had inflation peak last year around 18%, we are able to explain 70% of the gap in consumer sentiment we saw last year.”

The revelation that inflation was likely much higher than reported may explain the discrepancy between the official numbers and the soaring cost of everyday expenses like groceries and housing.

Summers also notes that personal interest payments, which are not incorporated into the government’s CPI system, increased by more than 50% in 2023.

Summers and the co-authors of the paper also argue that the higher cost of borrowing has created a “deeply felt pain point” for consumers by putting the housing market in a “lock-in” state whereby homeowners are deterred from selling due to potentially higher mortgage payments on their next home, while underwhelming price drops aren’t enticing new buyers.

“The Federal Reserve’s rate hikes have pushed mortgage rates to two-decade highs while house prices have yet to come down towards pre-pandemic levels. The market is in stasis with both homeowners and would-be buyers reporting high levels of disappointment.”

The paper, titled “The Cost of Money is Part of the Cost of Living: New Evidence on the Consumer Sentiment Anomaly,” can be read here.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any loses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney

Source link

You may like

Insight Into The Timing And Factors

Bitcoin About To ‘Blow Higher’ Despite This Week’s Pullback, According to Glassnode Co-Founders – Here’s Why

Azuro and Chiliz Working Together to Boost Adoption of Onchain Sport Prediction Markets – Blockchain News, Opinion, TV and Jobs

Robinhood Bleeds 164 Million Dogecoin

AIGOLD Goes Live, Introducing the First Gold Backed Crypto Project – Blockchain News, Opinion, TV and Jobs

Analyst Benjamin Cowen Warns Ethereum ‘Still Facing Headwinds,’ Says ETH Will Only Go Up if Bitcoin Does This

Chamath Palihapitiya

Billionaire Chamath Palihapitiya Predicts Market Rally, Says $6,000,000,000,000 Waiting To Be Deployed

Published

6 months agoon

November 15, 2023By

admin

Billionaire venture capitalist Chamath Palihapitiya says that markets are ripe for a strong rally as a deluge of capital looks to find a new home.

In a new episode of the All-In Podcast, the billionaire says that the macro picture is starting to look positive for the United States.

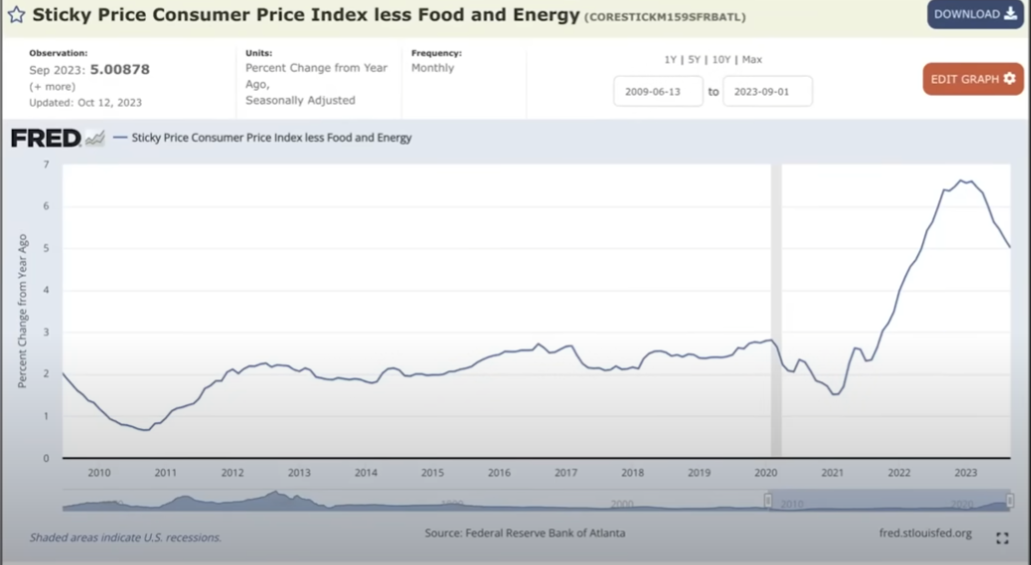

The Social Capital founder first looks at the consumer price index (CPI), which tracks the country’s rate of inflation over time. According to Palihapitiya, the CPI is starting to roll over indicating that high inflation rates are a thing of the past.

“We are really in a decent place with inflation. If you think about what’s going to happen in the next six months, it’s mostly in the bag… There’s a lag effect on a handful of [CPI] components, specifically rents, which when you roll them into this inflation rate, you’re going to see it really, really turn over very quickly.

So we know that inflation is falling. It’s going to fall even more.”

Palihapitiya then looks at the amount of capital stockpiled in money market funds. According to the venture capitalist, trillions of dollars worth of capital may move out of money market funds and flow into the stock market to chase higher gains.

“I think the setup is basically the following. There’s less money in the system. That’s a positive.

There’s more money on the sidelines… Look at the amount of money in money market funds – $6 trillion and growing, so that’s a really positive sign which is money will need to find a home…

So that’s trillions of dollars that have to get deployed… Now you introduce rate cuts and that’s a real accelerant. More than likely, I think what that means is that markets are set up to do pretty well, equity markets specifically.”

Palihapitiya ends his analysis by saying that he’s optimistic about the prospects of the US economy with the Federal Reserve poised to cut rates by mid-2024.

“Inflation is very much in the rearview mirror. Rates are going to get cut by the middle part of the year. The economy looks like it’s going to be a soft landing. That is actually very beneficial for the sitting president. It’s also good for equities. It’s good for us… I think we’ve had a fundamental change.”

I

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any loses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: DALLE3

Source link

Insight Into The Timing And Factors

Bitcoin About To ‘Blow Higher’ Despite This Week’s Pullback, According to Glassnode Co-Founders – Here’s Why

Azuro and Chiliz Working Together to Boost Adoption of Onchain Sport Prediction Markets – Blockchain News, Opinion, TV and Jobs

Robinhood Bleeds 164 Million Dogecoin

AIGOLD Goes Live, Introducing the First Gold Backed Crypto Project – Blockchain News, Opinion, TV and Jobs

Analyst Benjamin Cowen Warns Ethereum ‘Still Facing Headwinds,’ Says ETH Will Only Go Up if Bitcoin Does This

Tron Price Prediction: TRX Outperforms Bitcoin, Can It Hit $0.132?

Ethereum-Based Altcoin Leads Real-World Assets Sector in Development Activity, According to Santiment

Here’s Why This Analyst Is Predicting A Rise To $360

Hackers With $182,000,000 Stolen From Poloniex Starts Moving Funds to Tornado Cash

Cardano Faces Make-Or-Break Price Level For Bullish Revival

A Premier Crypto Exchange Tailored for Seasoned Traders – Blockchain News, Opinion, TV and Jobs

Crypto Whale Withdraws $75.8 Million in USDC From Coinbase To Invest In Ethereum’s Biggest Presale – Blockchain News, Opinion, TV and Jobs

CFTC Chair Says ‘Another Cycle of Enforcement Actions’ Coming As Crypto Enters New Phase of Asset Appreciation

Spectral Labs Joins Hugging Face’s ESP Program to advance the Onchain x Open-Source AI Community – Blockchain News, Opinion, TV and Jobs

Bitcoin Dropped Below 2017 All-Time-High but Could Sellers be Getting Exhausted? – Blockchain News, Opinion, TV and Jobs

What does the Coinbase Premium Gap Tell us about Investor Activity? – Blockchain News, Opinion, TV and Jobs

BNM DAO Token Airdrop

NFT Sector Keeps Developing – Number of Unique Ethereum NFT Traders Surged 276% in 2022 – Blockchain News, Opinion, TV and Jobs

New Minting Services

Block News Media Live Stream

A String of 200 ‘Sleeping Bitcoins’ From 2010 Worth $4.27 Million Moved on Friday

SEC’s Chairman Gensler Takes Aggressive Stance on Tokens – Blockchain News, Opinion, TV and Jobs

Friends or Enemies? – Blockchain News, Opinion, TV and Jobs

Enjoy frictionless crypto purchases with Apple Pay and Google Pay | by Jim | @blockchain | Jun, 2022

Block News Media Live Stream

How Web3 can prevent Hollywood strikes

Block News Media Live Stream

XRP Explodes With 1,300% Surge In Trading Volume As crypto Exchanges Jump On Board

Block News Media Live Stream

Trending

Altcoins2 years ago

Altcoins2 years agoBitcoin Dropped Below 2017 All-Time-High but Could Sellers be Getting Exhausted? – Blockchain News, Opinion, TV and Jobs

Binance2 years ago

Binance2 years agoWhat does the Coinbase Premium Gap Tell us about Investor Activity? – Blockchain News, Opinion, TV and Jobs

- Uncategorized2 years ago

BNM DAO Token Airdrop

BTC1 year ago

BTC1 year agoNFT Sector Keeps Developing – Number of Unique Ethereum NFT Traders Surged 276% in 2022 – Blockchain News, Opinion, TV and Jobs

- Uncategorized3 years ago

New Minting Services

Video2 years ago

Video2 years agoBlock News Media Live Stream

Bitcoin miners2 years ago

Bitcoin miners2 years agoA String of 200 ‘Sleeping Bitcoins’ From 2010 Worth $4.27 Million Moved on Friday

Bitcoin1 year ago

Bitcoin1 year agoSEC’s Chairman Gensler Takes Aggressive Stance on Tokens – Blockchain News, Opinion, TV and Jobs