Bitcoin

NEW: Blockchain.com App, The Only Crypto App You’ll Ever Need | by Blockchain.com | @blockchain | Mar, 2023

Published

1 year agoon

By

admin

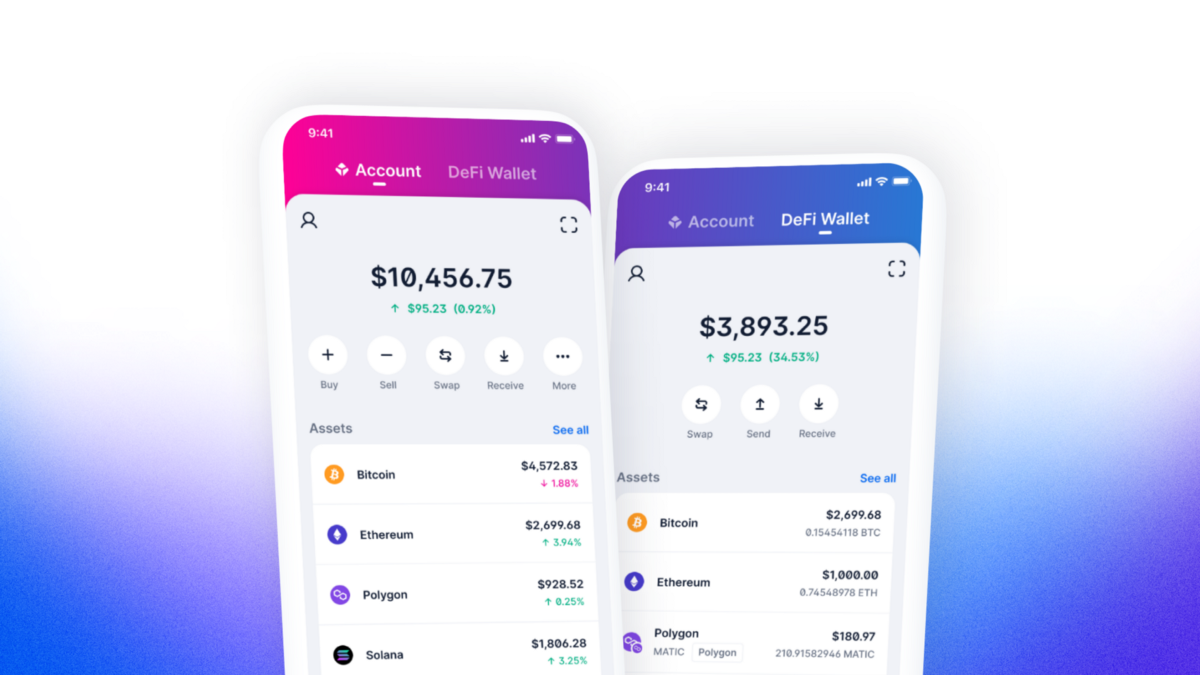

The Blockchain.com Wallet has evolved to become the Blockchain.com App.

Explore a brand new user experience that delivers on all your crypto needs in one place.

The brand new Blockchain.com App

Users often have to make the decision to either trust a third party with theirs private keys or go through the complex process of self-custody. In addition to this, to experience the full value of crypto, users need multiple apps — to buy, sell, access dapps, all across multiple blockchains.

The new Blockchain.com App solves this issue by giving you the best of custody and self-custody all in one place.

The new app consists of two main features:

- Blockchain.com Account (Custodial)

Buy over 30 of the most popular cryptocurrencies with a card or bank account, swap crypto-to-crypto, and earn rewards by staking your crypto and more. Assets in your Blockchain.com Account are held in a custodial account with your keys in custodial of Blockchain.com. - DeFi Wallet (Self-custodial)

Your “gateway” into the world of decentralized finance. Here you can self-custody your crypto on multiple blockchains, use dapps, and manage your NFT collections. You custody your own private keys to your DeFi Wallet. Assets are held on Bitcoin, Ethereum, Polygon, Solana, and other supported blockchains.

Update your Blockchain.com App now

We’re on a mission to make it easy for anyone, anywhere to access the world of crypto and beyond.

Update your iOS or Android app today to experience the new Blockchain.com App.

If you’re new to Blockchain.com, download the app from the Apple App Store or Google Play Store today.

. . .

IMPORTANT NOTE:

The purchase of crypto entails a risk. The value of crypto can fluctuate and capital involved in a crypto transaction is subject to market volatility and loss.

Digital currencies are not bank deposits, are not legal tender, and are not backed by the government. Blockchain.com’s products and services are not subject to any governmental or government-backed deposit protection schemes. Legislative and regulatory changes or actions in any jurisdiction in which Blockchain.com’s customers are located may adversely affect the use, transfer, exchange, and value of digital currencies.

Source link

You may like

Analyst Benjamin Cowen Warns Ethereum ‘Still Facing Headwinds,’ Says ETH Will Only Go Up if Bitcoin Does This

Tron Price Prediction: TRX Outperforms Bitcoin, Can It Hit $0.132?

Ethereum-Based Altcoin Leads Real-World Assets Sector in Development Activity, According to Santiment

Here’s Why This Analyst Is Predicting A Rise To $360

Hackers With $182,000,000 Stolen From Poloniex Starts Moving Funds to Tornado Cash

Cardano Faces Make-Or-Break Price Level For Bullish Revival

Bitcoin

Analyst Benjamin Cowen Warns Ethereum ‘Still Facing Headwinds,’ Says ETH Will Only Go Up if Bitcoin Does This

Published

3 hours agoon

May 9, 2024By

admin

The widely followed analyst Benjamin Cowen is saying that Ethereum (ETH) is at risk of facing more downside over the coming months.

In a new video, Cowen tells his 801,000 YouTube subscribers that monetary policy is likely to negatively affect Ethereum.

“I think that ETH/USD is still facing some headwinds here, especially following the potential rejection of the spot exchange-traded fund (ETF)…

…I think the impact that people are going to feel is just from tighter monetary policy. They’re going to blame it on the spot ETF and they’re going to capitulate potentially into that.”

According to Cowen, the Ethereum could go up on one condition.

“If ETH goes up from here, it would only be due to Bitcoin going up a lot more.”

The widely followed analyst says that the Ethereum/Bitcoin (ETH/BTC) pair, on the other hand, is likely to keep falling under most circumstances based on history.

“So if Ethereum goes up, Ethereum/Bitcoin is probably going to keep going down. If Bitcoin goes sideways, Ethereum/Bitcoin is going to keep going down in my opinion. And if Bitcoin goes down, Ethereum/Bitcoin probably goes down because Bitcoin has been doing all s of things since 2022 began. In eight of 10 quarters, Ethereum/Bitcoin has gone down whether Bitcoin went up, down or sideways. Ethereum/Bitcoin generally went down.”

ETH is trading at $3,002 at time of writing.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: DALLE3

Source link

Altcoins

Hackers With $182,000,000 Stolen From Poloniex Starts Moving Funds to Tornado Cash

Published

19 hours agoon

May 8, 2024By

admin

The hacker who looted the crypto exchange Poloniex has started moving Ethereum (ETH) to the mixing service Tornado Cash, according to the digital asset de-anonymizing platform Arkham.

Arkham notes the hacker moved 1126.1 ETH worth more than $3.4 million into Tornado Cash across a series of 20 transactions on Monday and Tuesday.

They represent the exploiter’s first moves into the controversial Ethereum-based crypto mixer, which helps users conceal their digital assets.

The hacker raided Poloniex in early November, stealing $56 million worth of ETH, $48 million worth of Tron (TRX) and $18 million worth of Bitcoin (BTC), as well as smaller amounts of other crypto assets.

The exchange, which is owned by Tron founder Justin Sun, offered a 5% white hat bounty that went unaccepted. and the hacker still holds $181.47 million worth of crypto in their primary address, according to Arkham.

Justin Sun-affiliated projects have endured a prolific string of attacks in the past several months: In September, hackers exploited the Sun-linked exchange giant HTX for approximately 4,999 Ethereum worth $7.9 million, according to the blockchain security firm PeckShield.

Then in November, hackers hit HTX and Heco Bridge, another Sun-linked project that’s used to move funds between Ethereum and energy-saving blockchain Heco Chain, for a combined $100 million, according to cybersecurity firm Cyvers.

And in January, hackers once again struck HTX, hitting the exchange with a distributed denial of service (DDoS) attack that caused a brief outage.

A DDoS attack is a malicious attempt by bad actors to flood the target website with traffic to overwhelm the site’s infrastructure.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney

Source link

In a post on X, crypto analyst Miles Deutscher laid out his strategic predictions for high-performing cryptocurrencies in the upcoming week to his 501,700 followers. His analysis delved deep into Bitcoin’s trading patterns, the surging AI-driven altcoin sector, and specific tokens that are displaying considerable potential due to recent developments and broader market dynamics.

Bitcoin And AI Crypto Tokens Are Set To Dominate This Week

At the forefront of Deutscher’s analysis, Bitcoin has recently returned to its previous trading range between $60,000 and $69,400 after experiencing a sharp drop. This movement was characterized as a significant deviation, suggesting manipulation or a shakeout of weak hands before a potential rally.

“Bitcoin is at the top of my watchlist for this week. Had a big fakeout/deviation to the downside, and now back within the range,” Deutscher stated. He pointed out that the key factor to watch is whether the current range’s lower boundary will hold, which could serve as a strong foundation for an upward trajectory.

Moreover, the AI sector has been particularly resilient and robust recently, bouncing back significantly amidst broader market recoveries. Deutscher highlighted the sector’s potential for outperformance, driven by several upcoming major events.

These include Apple’s Worldwide Developers Conference (WWDC), NVIDIA’s earnings announcement, and the anticipated release of ChatGPT 5. “AI is one of those unique narratives that retains constant mindshare due to its endless real-life news flow/hype,” Deutscher explained.

One specific AI token which Deutscher watches closely due to its alleged partnership with Apple is Render (RNDR), making it a prime candidate for speculation around the upcoming Apple event. Historically, RNDR has also led the AI token sector during market rotations.

Furthermore, Deutsches focuses on Near Protocol (NEAR), Fetch.ai (FET), AIOZ Network (AIOZ). He grouped these tokens together due to their correlation but noted their recent technical performance, where they bounced cleanly off daily support levels and established higher lows.

More Altcoins To Watch

TON: Recently the center of attention, TON experienced a drop after the Token2049 event in what Deutscher described as a “sell-the-news” scenario. However, recent investments by firms like Pantera signal continued interest and potential undercurrents of growth.

Ethena (ENA): With the market sentiment turning bullish again, Deutscher anticipates a return to positive funding rates, which typically benefit tokens like Ethena. Recent activity from the Ethena team, including increased reward boosts and optimistic social media posts from its founders, further bolster the bullish case. “Also hearing rumors of a T1 exchange listing,” Deutscher added, suggesting an impending increase in liquidity and exposure.

Jito (JTO): Jito is reportedly developing what Deutscher referred to as the “Eigen Layer of Solana,” aiming to replicate the success and hype surrounding the Eigen project’s layer solutions. Despite the challenges of a recent airdrop, Deutscher sees potential if the team executes well, particularly as the restaking narrative has not yet fully penetrated the market.

PopCat (POPCAT): Despite facing some fear, uncertainty, and doubt (FUD) related to copyright issues over the weekend, POPCAT continues to exhibit strong price action, pushing toward new highs. “POPCAT seems the best contender, for now, not a single cat meme coin has yet to hit a $1B market cap,” noted Deutscher, highlighting its standout performance.

Ethereum Finance (ETHFI): In the realm of liquidity reward tokens (LRT), ETHFI remains a notable mention despite a broader sector sell-off post-Eigen. Deutscher believes the selling may have been overreactive, and with total value locked (TVL) still on the rise, a reversion to mean on prices could be imminent.

SEI Network (SEI): As anticipation builds for the launch of the new layer one blockchain, Monad, later this year, SEI is seen as a strategic play. Categorized within the parallelized Ethereum Virtual Machine (EVM) narrative, SEI experienced a substantial sell-off but is poised for recovery as the market focus shifts towards upcoming launches.

Friend (FRIEND): After recommending FRIEND at $1.30, Deutscher continues to see upside potential, particularly as it approaches more significant centralized exchange listings. He advises keeping an eye out for major pullbacks as opportunities to buy.

Featured image from Matt Paul Catalano / Unsplash, chart from TradingView.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Source link

Analyst Benjamin Cowen Warns Ethereum ‘Still Facing Headwinds,’ Says ETH Will Only Go Up if Bitcoin Does This

Tron Price Prediction: TRX Outperforms Bitcoin, Can It Hit $0.132?

Ethereum-Based Altcoin Leads Real-World Assets Sector in Development Activity, According to Santiment

Here’s Why This Analyst Is Predicting A Rise To $360

Hackers With $182,000,000 Stolen From Poloniex Starts Moving Funds to Tornado Cash

Cardano Faces Make-Or-Break Price Level For Bullish Revival

A Premier Crypto Exchange Tailored for Seasoned Traders – Blockchain News, Opinion, TV and Jobs

Crypto Whale Withdraws $75.8 Million in USDC From Coinbase To Invest In Ethereum’s Biggest Presale – Blockchain News, Opinion, TV and Jobs

CFTC Chair Says ‘Another Cycle of Enforcement Actions’ Coming As Crypto Enters New Phase of Asset Appreciation

Spectral Labs Joins Hugging Face’s ESP Program to advance the Onchain x Open-Source AI Community – Blockchain News, Opinion, TV and Jobs

DOT Price (Polkadot) Reaches Key Juncture, Is This Bulls Trap or Correction?

‘Last Dip Ever’ – Analyst Predicts Solana Rally, Says Three Memecoins Will Surge Alongside SOL

Can Ethereum Reclaim $4,000? Fragile Fundamentals Threaten To Send ETH Crashing

Coinbase Gets Hit With New Class Action Lawsuit Accusing Crypto Exchange of Selling Digital Asset Securities

Ethernity Transitions to an AI Enhanced Ethereum Layer 2, Purpose-Built for the Entertainment Industry – Blockchain News, Opinion, TV and Jobs

Bitcoin Dropped Below 2017 All-Time-High but Could Sellers be Getting Exhausted? – Blockchain News, Opinion, TV and Jobs

What does the Coinbase Premium Gap Tell us about Investor Activity? – Blockchain News, Opinion, TV and Jobs

BNM DAO Token Airdrop

NFT Sector Keeps Developing – Number of Unique Ethereum NFT Traders Surged 276% in 2022 – Blockchain News, Opinion, TV and Jobs

New Minting Services

Block News Media Live Stream

A String of 200 ‘Sleeping Bitcoins’ From 2010 Worth $4.27 Million Moved on Friday

SEC’s Chairman Gensler Takes Aggressive Stance on Tokens – Blockchain News, Opinion, TV and Jobs

Friends or Enemies? – Blockchain News, Opinion, TV and Jobs

Enjoy frictionless crypto purchases with Apple Pay and Google Pay | by Jim | @blockchain | Jun, 2022

Block News Media Live Stream

How Web3 can prevent Hollywood strikes

Block News Media Live Stream

XRP Explodes With 1,300% Surge In Trading Volume As crypto Exchanges Jump On Board

Block News Media Live Stream

Trending

Altcoins2 years ago

Altcoins2 years agoBitcoin Dropped Below 2017 All-Time-High but Could Sellers be Getting Exhausted? – Blockchain News, Opinion, TV and Jobs

Binance2 years ago

Binance2 years agoWhat does the Coinbase Premium Gap Tell us about Investor Activity? – Blockchain News, Opinion, TV and Jobs

- Uncategorized2 years ago

BNM DAO Token Airdrop

BTC1 year ago

BTC1 year agoNFT Sector Keeps Developing – Number of Unique Ethereum NFT Traders Surged 276% in 2022 – Blockchain News, Opinion, TV and Jobs

- Uncategorized2 years ago

New Minting Services

Video2 years ago

Video2 years agoBlock News Media Live Stream

Bitcoin miners2 years ago

Bitcoin miners2 years agoA String of 200 ‘Sleeping Bitcoins’ From 2010 Worth $4.27 Million Moved on Friday

Bitcoin1 year ago

Bitcoin1 year agoSEC’s Chairman Gensler Takes Aggressive Stance on Tokens – Blockchain News, Opinion, TV and Jobs