cryptocurrency

Successful Beta Service launch of SOMESING, ‘My Hand-Carry Studio Karaoke App’

Published

2 weeks agoon

By

adminApr 18, 2024 07:47 UTC

| Updated:

Apr 18, 2024 at 07:50 UTC

By Clark

Staking cryptocurrency can be a lucrative way to earn passive income, and StakingFarm.com provides an accessible and robust platform for both beginners and experienced crypto enthusiasts. By staking your digital assets, you participate in network operations, which in turn rewards you with additional tokens, enhancing your investment over time. This process not only supports the underlying blockchain but also offers you a steady income stream without the need to actively trade your assets.

StakingFarm.com stands out due to its user-friendly interface, a variety of staking options tailored to different risk appetites, and a commitment to security that ensures your digital holdings are protected. Whether you’re looking to diversify your investment portfolio or get started with your first staking venture, StakingFarm.com offers a comprehensive environment to do so. This guide will walk you through the initial steps of setting up your staking on StakingFarm.com, ensuring you have all the information needed to make informed decisions.

Getting Started with Staking on StakingFarm.com

1. Navigating to StakingFarm.com

To begin your staking journey, first visit the StakingFarm.com website. The homepage is designed with simplicity in mind, making it straightforward to find your way around. You can easily locate the registration or login options to access the platform. For new users, registering an account is a quick process requiring basic information such as an email address and a strong password.

2. Setting Up Your Account

Once registered, you’ll need to set up your account. This involves verifying your email address to ensure the security of your account and setting up two-factor authentication (2FA) for additional security. StakingFarm.com emphasizes the importance of security to protect your assets, so adhering to these steps is crucial.

3. Familiarizing Yourself with the Interface

StakingFarm.com’s interface is intuitive, allowing you to navigate through different staking options and account settings with ease. The dashboard provides a comprehensive view of your current stakes, potential rewards, and performance statistics of your investments. You’ll find various tools and settings to manage your account effectively:

a. Wallet Integration: Connect your external wallet where your cryptocurrencies are stored. Currently supports BTC USDT ETH and more.

b. Staking Pools: Explore different pools available for staking, each with detailed descriptions about the expected returns, staking requirements, and duration.

c. Transactions History: Track your past transactions to monitor the flow of rewards and stakes.

Getting acquainted with these features will provide a solid foundation as you prepare to delve deeper into the staking process on StakingFarm.com.

Selecting the appropriate staking plan is crucial to aligning your financial goals with the potential risks and rewards. StakingFarm.com offers a variety of staking plans designed to cater to different investment preferences and risk tolerance levels.

1. Assessing Your Investment Goals

Begin by clearly defining your investment objectives. Are you looking for short-term gains, or are you more interested in long-term growth? Understanding your own risk tolerance is also critical as it will guide you in selecting a plan that you are comfortable with, both financially and psychologically.

2. Evaluating Staking Options

StakingFarm.com presents several options that vary primarily in terms of lock-up period, minimum staking amount, and expected returns:

a. Short-Term Plans: These plans often feature smaller reward percentages but require a shorter commitment period. They are ideal for those new to staking or those looking to test the waters before committing to longer terms.

b. Long-Term Plans: For those with a longer investment horizon, these plans usually offer higher returns as a reward for locking in your assets for an extended period. They suit investors focused on maximum growth over time.

c. Flexible Staking: Some investors prefer not to commit to a fixed term and instead opt for plans that allow withdrawal at any time. These plans usually offer lower returns but provide maximum liquidity.

3. Risk Assessment

Each staking plan comes with its own set of risks, including market volatility and liquidity issues. It’s important to thoroughly analyze each plan’s details and understand the terms and conditions before committing your assets.

4.The Staking Packages

- ETH Trial Plan: Ideal for beginners, this plan requires a minimal $50 investment and delivers daily rewards of $1.00, with no referral obligations.

- Solana Plan: With a $100 investment, this 2-day staking opportunity in Solana generates $2.00 daily, plus a $5 referral bonus.

- Polygon Plan: This 7-day staking option involves a $700 investment, rewarding users with $7.00 daily and a $35 referral bonus.

- Cardano Plan: A 15-day commitment with a $1,500 investment, providing daily rewards of $16.50 and a $75 referral bonus.

- Axelar Plan: Engage in a 15-day staking experience with a $3,000 investment, accruing $36.00 daily alongside a $150 referral bonus.

- Ethereum Plan: The flagship 30-day plan involves a $6,000 investment and offers substantial daily earnings of $78.00 with a $300 referral bonus.

Initiating Your Staking Transaction

After choosing a suitable staking plan, the next step is to initiate your staking transaction. This process involves several key actions to ensure that your assets are successfully staked and that you start earning rewards.

1. Funding Your Account

Before you can stake, you need to transfer the cryptocurrency that you plan to stake into your StakingFarm.com wallet. Make sure to check the minimum staking requirements for your chosen plan.

2. Starting the Staking Process

a) Navigate to the Staking Section: On your dashboard, locate the ‘Stake Now’ button, which will direct you to the staking page.

b) Select Your Staking Plan: Choose the plan you’ve decided on from a list of available options.

c) Enter the Amount: Input the amount of cryptocurrency you want to stake. Ensure it meets the plan’s minimum requirements.

d) Confirm the Transaction: Review all the details, then confirm your transaction. You might be required to complete a security verification process to finalize the transaction.

3. Monitoring Your Staking

Once the staking is active, you can track your investment from your dashboard. You’ll be able to see your accrued rewards and the remaining time for your staking plan. StakingFarm.com updates this information in real-time, allowing you to make informed decisions about your investments.

Benefits of Staking with StakingFarm.com

Choosing StakingFarm.com for your staking needs comes with several distinctive advantages:

| Benefit Category | Description |

| High Staking Rewards | One of the primary benefits of staking on StakingFarm.com is the competitive staking rewards. The platform offers attractive rates, particularly on longer-term plans, making it a lucrative option for those looking to maximize their passive income. |

| Security and Transparency | StakingFarm.com employs advanced security measures to protect your assets and personal information. This includes using secure servers, advanced encryption technology, and regular security audits. All transactions on the platform are transparent, with clear terms and detailed records available to users. |

| User-Friendly Interface | The platform is designed to be intuitive and easy to navigate, making it accessible even for those new to cryptocurrency and staking. This ease of use extends to all processes, from setting up an account to managing staking transactions. |

| Community and Support | StakingFarm.com has a robust support system and an active community. The platform provides comprehensive support through FAQs, guides, and a responsive customer service team. The community forums and social media channels are great resources for tips, updates, and advice from other users. |

Maximizing Your Returns

To fully capitalize on the benefits of staking with StakingFarm.com, adopting a strategic approach can significantly enhance your passive income potential. Here are some strategies to consider:

1. Diversify Your Portfolio

Just as with traditional investments, diversification is key to mitigating risk in the volatile world of cryptocurrency. Spread your investments across different staking plans and cryptocurrencies offered on StakingFarm.com. This approach helps balance potential losses in one asset with gains in another.

2. Stay Informed

Keep abreast of market trends and updates related to the cryptocurrencies you have staked. StakingFarm.com offers tools and analytics that can help you make informed decisions. Additionally, keeping track of the broader crypto market will provide you with insights that can influence your staking strategies.

3. Reinvest Your Earnings

Consider reinvesting your staking rewards to compound your earnings. This strategy increases the total amount of your staked assets, which can lead to higher returns over time, leveraging the power of compounding interest.

4. Utilize Alerts and Tools

Set up alerts for changes in staking rewards or significant market movements. StakingFarm.com’s platform tools allow you to monitor your investments efficiently and react quickly to any changes, ensuring you can adjust your strategy to optimize returns.

Security Measures and Risk Management

Securing your investments is paramount when staking on StakingFarm.com. Here’s how you can protect your assets and manage risks effectively:

1. Use Strong Security Practices

a) Two-Factor Authentication (2FA): Always enable 2FA on your StakingFarm.com account. This adds an extra layer of security beyond just your password.

b) Secure Your Private Keys: Never share your private keys or wallet seed phrases. Consider using a hardware wallet for added security, especially for larger cryptocurrency holdings.

c) Regular Updates: Keep your software and wallets updated to protect against vulnerabilities.

2. Implement Risk Management Techniques

a) Set Stop-Loss Orders: Some staking options might allow you to set conditions under which your assets will be unstaked to prevent losses in declining markets.

b) Regular Portfolio Reviews: Regularly review and adjust your staking portfolio. This helps ensure that your investments align with your risk tolerance and investment goals.

Community and Governance

Engaging with the community and participating in governance are integral parts of staking on StakingFarm.com. These activities not only enhance your staking experience but also contribute to the platform’s development.

1. Participate in Community Discussions

Join forums and social media groups related to StakingFarm.com. These platforms are great for sharing experiences, tips, and getting advice from more experienced stakers. They can also provide insights into the best-performing staking pools and alert you to new opportunities.

2. Get Involved in Governance

If StakingFarm.com offers governance tokens or features, participating can give you a say in the platform’s future. Voting on proposals about new features or changes in staking protocols helps shape the ecosystem to better serve your needs as a user.

3. Utilize Educational Resources

Take advantage of educational resources provided by StakingFarm.com. These might include tutorials, webinars, and articles that can enhance your understanding of staking and blockchain technology, leading to more informed investment decisions.

Conclusion

Staking on StakingFarm.com offers a compelling opportunity for both novice and experienced cryptocurrency investors seeking to generate passive income through crypto staking. With its user-friendly interface, diverse staking plans, and strong security measures, StakingFarm.com provides an optimal environment to safely and efficiently grow your digital assets.

By implementing the strategies outlined in this guide, diversifying your portfolio, and staying engaged with the community, you can maximize your returns and play an active role in the governance of the platform. Start your staking journey today to unlock the potential of your crypto investments and enjoy the rewards of participating in the digital economy.

Frequently Asked Questions (FAQ)

Q1: What is staking?

A: Staking involves locking up cryptocurrencies to support the operation of a blockchain network. In return, stakers receive rewards, typically in the form of additional cryptocurrency.

Q2: Is staking safe?

A: While staking generally involves less risk than trading cryptocurrencies, it’s not without its risks, including market volatility and potential security threats. Implementing strong security practices and choosing reliable platforms like StakingFarm.com can mitigate these risks.

Q3: How do I choose the best staking plan?

A: Consider your investment goals, risk tolerance, and the specifics of each plan, including the required lock-up period and potential returns. Diversification across different plans can also help manage risk.

Q4: Can I unstake my assets anytime?

A: This depends on the specific staking plan. Some plans offer flexibility with no fixed term, while others may require you to lock your assets for a set period.

Q5: How often will I receive staking rewards?

A: The frequency of rewards varies by staking plan. Some plans distribute rewards daily, others might do so weekly or monthly. Check the terms of your chosen plan for details.

Additional Resources

To further enhance your knowledge and stay updated on the latest in staking and cryptocurrency, consider exploring the following resources:

| Resource Name | Description | Link |

| StakingFarm.com Blog | Updates, tips, and in-depth guides on staking and platform features. | Visit Blog |

| CoinGecko | Provides comprehensive data on cryptocurrencies including prices, market cap, and trading volume. | Visit CoinGecko |

Clark

Head of the technology.

#Press Release

This is a paid press release. Btcwires does not endorse and is not responsible for or liable for any content, accuracy, quality, advertising, products or other materials on this page. Readers should do their own research before taking any actions related to the company.

Source link

You may like

Ripple Forms Partnership With Tokyo Unit of $1,200,000,000 Firm To Push for XRPL-Powered Solutions in Japan

Nektar Network begins Epoch 1 of Nektar Drops

Polkadot-native Acala Expands to Multichain Horizons Through The Sinai Upgrade – Blockchain News, Opinion, TV and Jobs

Bitcoin Price Dips Below $57,000: 4 Key Reasons

Bitcoin Is a Multi-Decade Story That Will Eat Other Massive Asset Classes, Says Macro Expert Lyn Alden

World of Dypians Offers Up to 1M $WOD and $225,000 in Premium Subscriptions via the BNB Chain Airdrop Alliance Program

cryptocurrency

Forget Meme Coins And NFTs, RWA And DePin Are The Next Big Things – Blockchain News, Opinion, TV and Jobs

Published

2 days agoon

April 29, 2024By

admin

Meme coins and NFTs have outlived their relevance, and it is now time for crypto investors to focus on DePin and RWA projects like ETFSwap (ETFS).

Over the last three years, meme coins and non-fungible tokens (NFTs) have been among the leading narratives in the crypto space. Thanks to the hype around these meme coins and NFTs, crypto investors have made insane returns on their investments,

However, there is a change in the tide that the time has come to pivot from these meme coins and NFT projects and focus on new narratives such as RWA and DePin.

Real World Assets (RWA) and Decentralized Physical Infrastructure (DePin) are two sectors that are gaining traction and could become the center of attraction soon enough.

RWA And DePin Take Over From Meme Coins And NFTs

Asset tokenization continues to be widely discussed, with BlackRock’s CEO Larry Fink even referring to it as the “next generation for markets.” This has put more focus on RWA projects, which are bringing this concept to life. Basically, these projects are tokenizing real-world assets like real estate, royalties, securities, contracts, ETFs, and art with the aid of blockchain technology.

This changes how investors interact with these assets since they will become more accessible and easier to trade. On accessibility, asset tokenization further promotes fractional ownership, which means that individuals can now own a share of assets they wouldn’t otherwise have the means to access.

With these assets being easier to trade, previously illiquid assets will become more liquid. Generally, all asset classes will become more liquid since there is expected to be an inflow of new money into all of them. That is why the RWA industry is projected to become a trillion-dollar market by 2030.

Meanwhile, it is worth noting that RWA projects will be the tunnel through which this liquidity will pass through. That is why crypto investors should pay more attention to them and look to position themselves accordingly.

Like the RWA industry, the DePin market also boasts great potential. As the name suggests, these projects, with the aid of blockchain technology and tokenization, manage their physical infrastructure in a decentralized manner. These physical infrastructures include telecommunications, health systems, power grids, and road networks.

Unlike traditional companies, these projects’ decentralized mode of operation helps simplify their operations and reduce their operating costs. Meanwhile, this business model is also a win for their users, as they are incentivized (with tokens) to contribute to the services these projects provide.

Given such massive potential, the narrative shift from meme coins and NFTs to these RWA and DePin projects is expected to happen sooner rather than later. In fact, these projects could already be the leading narratives, seeing how they have recently achieved more success than meme coins and NFT projects in this cycle.

Crypto expert Michaël van de Poppe called this correctly, as before the Bitcoin Halving took place, he mentioned that there would be a narrative shift to RWA and DePin projects after the Halving.

ETFSwap (ETFS) Presale Sees Increased Demand

The ETFSwap (ETFS) token presale is already seeing increased demand, with crypto investors turning their attention to RWA and DePin projects. ETFS is the native token of ETFSwap, a decentralized finance (DeFi) platform that enables on-chain trading of exchange-traded funds (ETFs).

That explains why investors are rushing to accumulate as many ETFSwap (ETFS) tokens as possible since the platform is already ranked as one of the most promising RWA projects.

Meanwhile, with RWA and DePin projected as the next big things in the crypto space, the ETFSwap (ETFS) is an instant pick as one of the tokens likely to run hard in this market cycle. Experts have also predicted impressive price gains for the crypto token in particular, saying it could rise as Shiba Inu (SHIB) did in 2021.

They say this is possible because ETFSwap (ETFS) has many bullish narratives working in its favor. Besides the RWA narrative, ETFSwap will offer ETFs like the Spot Bitcoin ETF, which has already gained a lot of attention in the crypto space since launching.

Furthermore, staking rewards have recently become more attractive to investors looking for passive income. ETFSwap (ETFS) is set to stand out in this regard since it provides attractive yields that are second to none.

Privacy concerns also continue to be raised in the crypto space, with users complaining that many projects are not truly decentralized and do not protect users’ data. This plays out in ETFSwap’s (ETFS) favor since the platform prioritizes its users’ privacy above anything else. For instance, Know-Your-Customer (KYC) requirements are non-mandatory on the platform, so users do not have to worry about sharing sensitive data or their information being tracked and leaked.

So far, over 30 million ETFSwap (ETFS) tokens have been sold in stage 1 of the ongoing presale. This presale stage is still ongoing, and each token costs $0.00854. However, with the increased demand for these tokens, they are expected to sell out even before the scheduled end date.

For more information about the ETFS Presale:

Source link

Bitcoin

Forbes Unveils 20 Crypto ‘Zombies,’ Declares Ripple And XRP Among The Undead

Published

5 days agoon

April 27, 2024By

admin

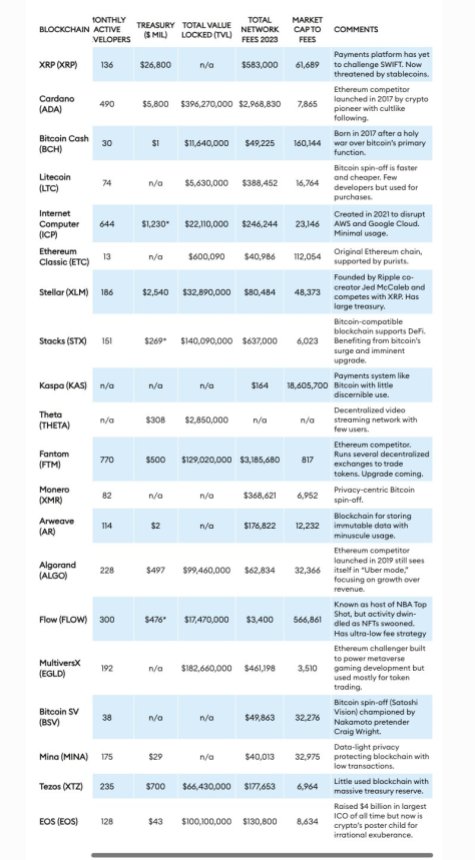

In a controversial report, Forbes unveiled a list of 20 “crypto billion-dollar zombies,” Layer 1 (L1) tokens, which the news outlet defines as crypto assets with substantial valuations but “limited utility beyond speculative trading.”

These cryptocurrencies and projects include Ripple, XRP, Ethereum Classic (ETC), Tezos (XTZ), Algorand (ALGO), and Cardano (ADA), among others.

XRP And Ethereum Classic In The Spotlight

Ripple Labs, the company behind XRP, was highlighted as a prominent crypto zombie. Despite XRP’s active trading volume of around $2 billion daily, Forbes asserts that the token’s primary purpose remains “speculative” and “lacking meaningful utility.”

However, Ripple Labs and XRP are not alone in this regard. Forbes reveals that 50 blockchains, excluding Bitcoin (BTC) and Ethereum (ETH), currently trade at values surpassing $1 billion, with at least 20 of them classified as “functional zombies.” Collectively, these 20 blockchains hold a market value of $116 billion, despite having “limited user bases.”

According to Forbes, an example of a “functional zombie” is Ethereum Classic, which maintains the distinction of being the original Ethereum chain.

While ETC has a market value of $4.6 billion, its fee generation in 2023 was less than $41,000, raising questions about the blockchain’s viability for the news organization.

Another crypto project in Forbes’ report is Tezos, which raised $230 million through an initial coin offering (ICO) in 2017.

Tezos’ XTZ token currently holds a market capitalization of $1.2 billion. However, the blockchain’s fee earnings were meager, with $5,640 in February 2024 and a total of $177,653 for all of 2023.

Algorand, once hailed as an “Ethereum killer” due to its capability of processing 7,500 transactions per second, faces similar challenges.

Despite a market cap of $2 billion and a treasury holding of $500 million, Algorand earned $63,000 in blockchain transaction fees throughout 2023. For Forbes, this casts doubt on its actual adoption and utility.

Crypto ‘Zombie’ Blockchains

The zombie blockchains are categorized into two groups by Forbes: spin-offs and direct competitors to established blockchains like Bitcoin and Ethereum.

Spin-off zombies include Bitcoin Cash (BCH), Litecoin (LTC), Monero (XMR), Bitcoin SV (BSV), and Ethereum Classic.

These blockchains, collectively valued at $23 billion, reportedly emerged from “disagreements” among programmers regarding the governance and direction of the original chains.

Forbes notes that when such conflicts arise, hard forks occur, resulting in new networks that share the same transaction history as their predecessors. The agency claims that their market value “often exceeds” their real-world usage.

Overall, The report highlights a growing disparity between the valuations of certain projects in the cryptocurrency industry and their actual utility and usage. Consequently, Forbes refers to these projects as “zombies.”

Featured image from Shutterstock, chart from TradingView.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Source link

Altcoin

85% Of Altcoins In “Opportunity Zone,” Santiment Reveals

Published

6 days agoon

April 26, 2024By

admin

The on-chain analytics firm Santiment has revealed that over 85% of all altcoins in the sector are currently in the historical “opportunity zone.”

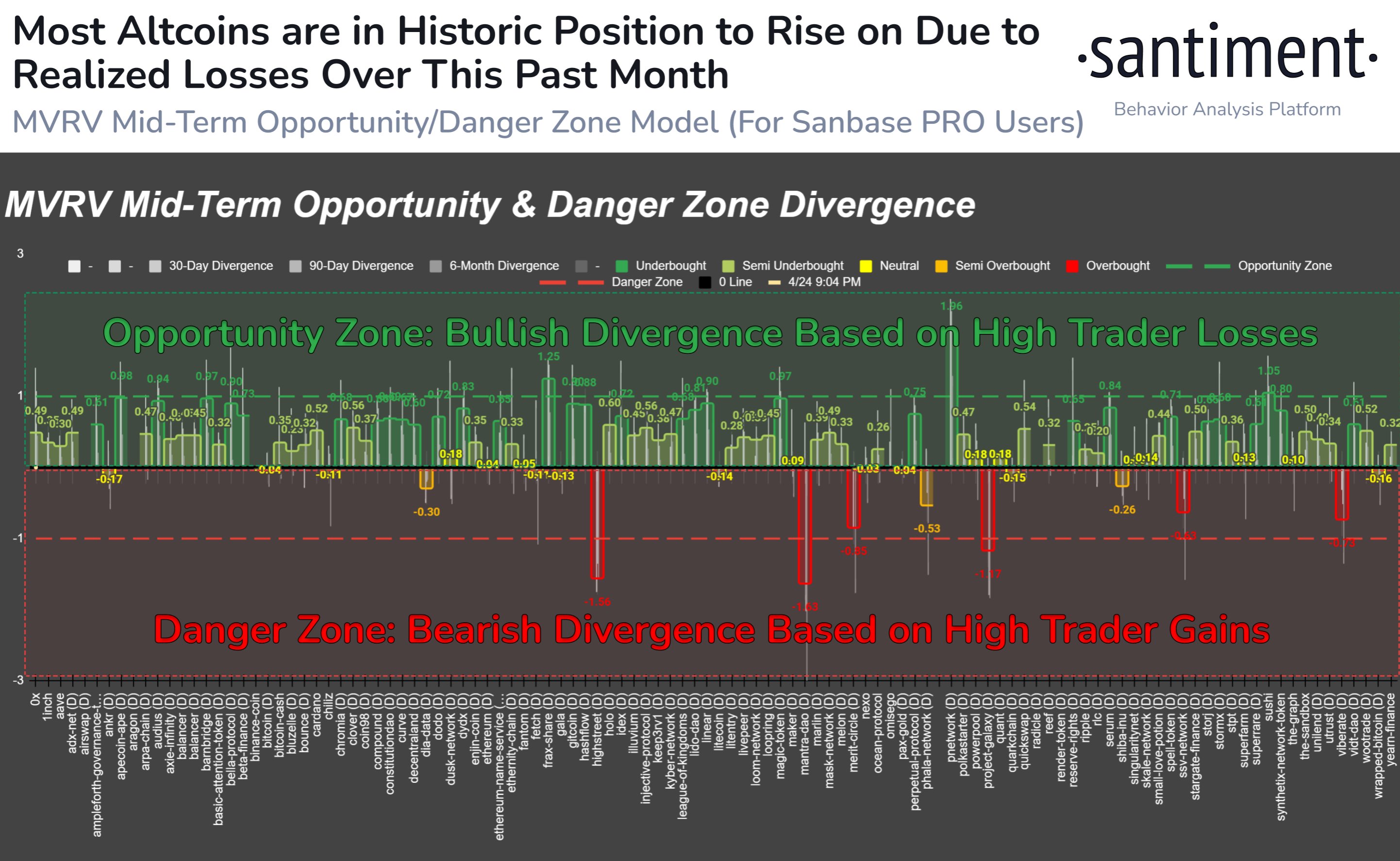

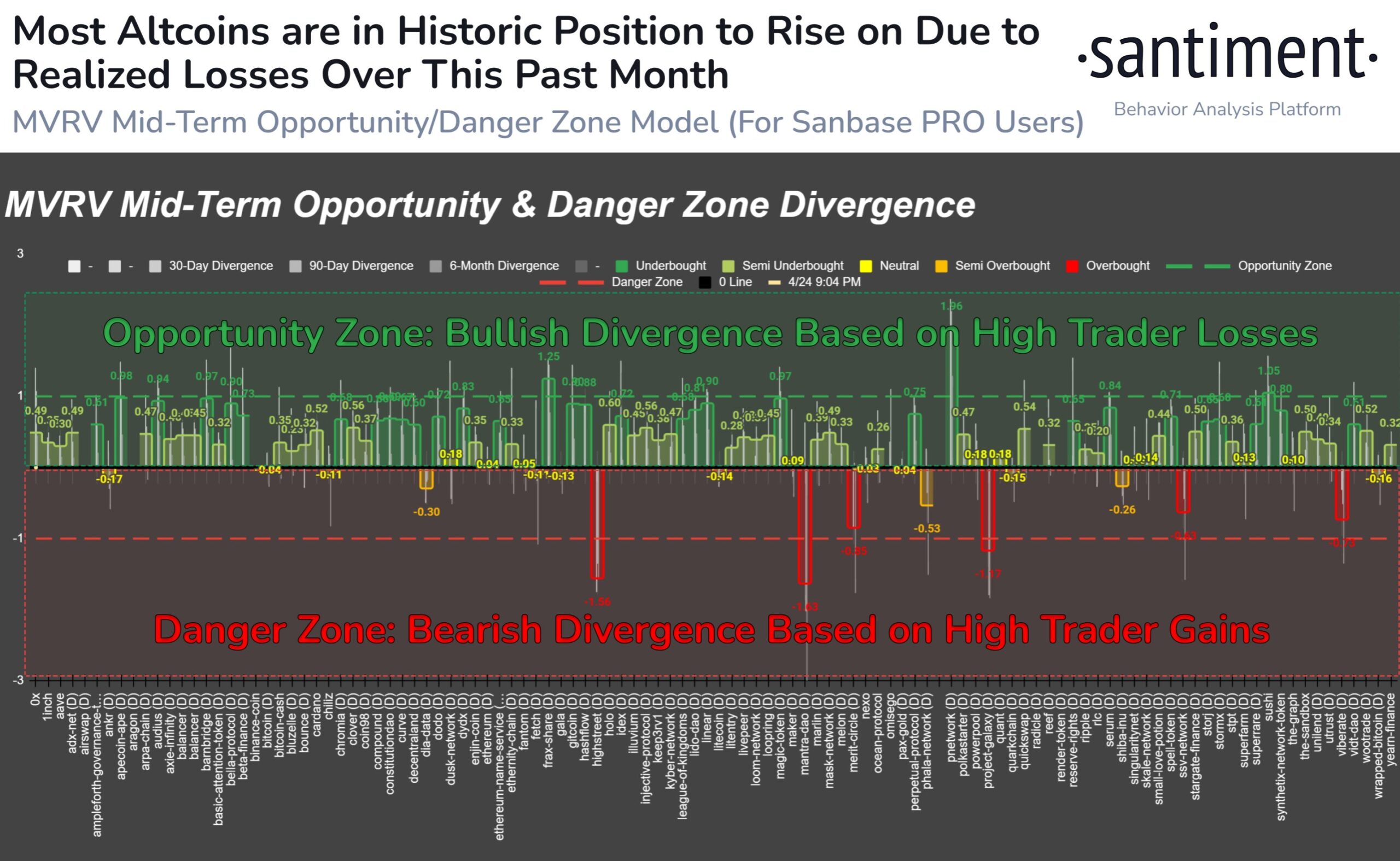

MVRV Would Suggest Most Altcoins Are Ready For A Bounce

In a new post on X, Santiment discussed how the altcoin market looks based on their MVRV ratio model. The “Market Value to Realized Value (MVRV) ratio” is a popular on-chain indicator that compares the market cap of Bitcoin against its realized cap.

The market cap here is the usual total valuation of the asset’s circulating supply based on the current spot price. At the same time, the latter is an on-chain capitalization model that calculates the asset’s value by assuming the “true” value of any coin in circulation is the last price at which it is transferred on the blockchain.

Given that the last transaction of any coin would have likely been the last time it changed hands, the price at its time would act as its current cost basis. As such, the realized cap essentially sums up the cost basis of every token in the circulating supply.

Therefore, one way to view the model is as a measure of the total amount of capital the investors have put into the asset. In contrast, the market cap measures the value holders are carrying.

Since the MVRV ratio compares these two models, its value can tell whether Bitcoin investors hold more or less than their total initial investment.

Historically, when investors have been in high profits, tops have become probable to form, as the risk of profit-taking can spike in such periods. On the other hand, a dominance of losses could lead to bottom formations as selling pressure runs out in the market.

Based on these facts, Santiment has defined an “opportunity” and “danger” zone model for altcoins. The chart below shows how the market currently looks from the perspective of this MVRV model.

The data for the MVRV divergence for the various altcoins | Source: Santiment on X

Under this model, when the MVRV divergence for any asset on some timeframe is higher than 1, the coin is considered to be inside the bullish opportunity zone. Similarly, if it is less than -1, it suggests it’s in the bearish danger zone.

The chart shows that MVRV divergence for a large part of the market is in the opportunity zone right now. As the analytics firm explains,

Over 85% of assets we track are in a historic opportunity zone when calculating the market value to realized value (MVRV) of wallets’ collective returns over 1-month, 3-month, and 6-month cycles.

Thus, if the model is to go by, now may be the time to go around altcoin shopping.

ETH Price

Ethereum, the largest among the altcoins, has observed a 3% surge over the past week, which has taken its price to $3,150.

Looks like the price of the asset has gone up over the last few days | Source: ETHUSD on TradingView

Featured image from Shutterstock.com, Santiment.net, chart from TradingView.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Source link

Ripple Forms Partnership With Tokyo Unit of $1,200,000,000 Firm To Push for XRPL-Powered Solutions in Japan

Nektar Network begins Epoch 1 of Nektar Drops

Polkadot-native Acala Expands to Multichain Horizons Through The Sinai Upgrade – Blockchain News, Opinion, TV and Jobs

Bitcoin Price Dips Below $57,000: 4 Key Reasons

Bitcoin Is a Multi-Decade Story That Will Eat Other Massive Asset Classes, Says Macro Expert Lyn Alden

World of Dypians Offers Up to 1M $WOD and $225,000 in Premium Subscriptions via the BNB Chain Airdrop Alliance Program

DOT Price (Polkadot) Approaches Key Level: Should Traders Brace for Sharp Drop?

Ethereum and Altcoins Associated With ETH May Witness Rallies Sooner Than Expected, According to Santiment

Crypto Expert Says ETH Is Yet To Bottom Against Bitcoin

Russian Authorities Introduce New Restrictions on Cryptocurrency To Prevent Ruble From Being Replaced: Report

CARV Announces Decentralized Node Sale to Revolutionize Data Ownership in Gaming and AI – Blockchain News, Opinion, TV and Jobs

Yue Minjun Revolutionizes Bitcoin Art Scene with Pioneering Ordinals Collection on LiveArt – Blockchain News, Opinion, TV and Jobs

Sui Teams Up with Google Cloud to Drive Web3 Innovation with Enhanced Security, Scalability and AI Capabilities

Fantasy Metaverse Darklume – Presale is LIVE – Blockchain News, Opinion, TV and Jobs

XRP Can This 23 Million Token Purchase Spark A Rally?

Bitcoin Dropped Below 2017 All-Time-High but Could Sellers be Getting Exhausted? – Blockchain News, Opinion, TV and Jobs

What does the Coinbase Premium Gap Tell us about Investor Activity? – Blockchain News, Opinion, TV and Jobs

BNM DAO Token Airdrop

NFT Sector Keeps Developing – Number of Unique Ethereum NFT Traders Surged 276% in 2022 – Blockchain News, Opinion, TV and Jobs

New Minting Services

Block News Media Live Stream

A String of 200 ‘Sleeping Bitcoins’ From 2010 Worth $4.27 Million Moved on Friday

SEC’s Chairman Gensler Takes Aggressive Stance on Tokens – Blockchain News, Opinion, TV and Jobs

Friends or Enemies? – Blockchain News, Opinion, TV and Jobs

Enjoy frictionless crypto purchases with Apple Pay and Google Pay | by Jim | @blockchain | Jun, 2022

Block News Media Live Stream

Block News Media Live Stream

How Web3 can prevent Hollywood strikes

XRP Explodes With 1,300% Surge In Trading Volume As crypto Exchanges Jump On Board

Block News Media Live Stream

Trending

Altcoins2 years ago

Altcoins2 years agoBitcoin Dropped Below 2017 All-Time-High but Could Sellers be Getting Exhausted? – Blockchain News, Opinion, TV and Jobs

Binance2 years ago

Binance2 years agoWhat does the Coinbase Premium Gap Tell us about Investor Activity? – Blockchain News, Opinion, TV and Jobs

- Uncategorized2 years ago

BNM DAO Token Airdrop

BTC1 year ago

BTC1 year agoNFT Sector Keeps Developing – Number of Unique Ethereum NFT Traders Surged 276% in 2022 – Blockchain News, Opinion, TV and Jobs

- Uncategorized2 years ago

New Minting Services

Video2 years ago

Video2 years agoBlock News Media Live Stream

Bitcoin miners2 years ago

Bitcoin miners2 years agoA String of 200 ‘Sleeping Bitcoins’ From 2010 Worth $4.27 Million Moved on Friday

Bitcoin1 year ago

Bitcoin1 year agoSEC’s Chairman Gensler Takes Aggressive Stance on Tokens – Blockchain News, Opinion, TV and Jobs