Aave

The Definition of Decentralized Finance (DeFi) | by Blockchain.com | @blockchain | Sep, 2022

Published

2 years agoon

By

admin

Decentralized finance (DeFi) empowers people to perform peer-to-peer financial transactions without third parties.

Users of DeFi rely on decentralized networks and applications instead of banks, exchanges, or brokerages to enable trading, borrowing, lending, earning yield, and more.

Most of all, DeFi marks a shift from trusting centralized institutions to trusting decentralized software.

The benefits of DeFi

DeFi offers many benefits in comparison to TradFi (traditional finance, such as banks). DeFi is:

- Inclusive. Crypto and blockchain technologies are open to anyone with an Internet connection, giving financial power to traditionally marginalized groups.

- Permissionless. Crypto networks don’t require approval from centralized institutions to participate, so most people can enjoy unrestricted access.

- Transparent. Crypto networks rely on public blockchains, where transaction data can be viewed by anyone and is immutable, meaning it can’t be changed or tampered with.

- Secure. To interact with DeFi, you’ll need to use a non-custodial wallet, this means you retain control of your private keys and crypto assets and don’t have to put your trust in a centralized entity.

- Fast. While bank transactions settle within 3–5 days, crypto transactions settle in a matter of minutes or hours, increasing how fast money changes hands throughout the financial system.

- Censorship resistant. Because crypto transactions happen on decentralized networks, they can’t be censored or stopped by a single entity. This can protect crypto users from fraudulent activity, government overreach, and more.

- Programmable. Tasks that would traditionally require a human can be automated using crypto smart contracts. This opens up new possibilities for financial products and services and lowers the chances of human error.

The risks of DeFi

With great power comes great responsibility. Risks in DeFi include:

- Loss of crypto keys. As with all crypto custody, if you lose your keys, you can lose access to your crypto funds.

- Actions are irreversible. The user is ultimately responsible for what they do. When you click send on a cryptocurrency transaction, it can’t be undone.

- Phishing scams. Hackers are prevalent in all areas of the internet, misleading emails and messages can trick you into sharing your crypto keys and ultimately finances.

- Unclear regulation. Regulations around DeFi aren’t crystal clear yet, so there’s a risk that crypto assets could be subject to stricter regulations in the future.

- Coding bugs and errors. Smart contracts are code, and code can have vulnerabilities that hackers can exploit. This is called smart contract risk.

How DeFi works

In the current traditional financial system, when you want to open a bank account or take out a loan, you have to go through a centralized institution like a bank.

If the bank can verify your identity, they’ll let you open an account.

If they can establish your creditworthiness, they can decide to grant you a loan.

In both cases, the bank calls the shots.

If you lack proper identification or aren’t “creditworthy” in the opinion of the institution, they can restrict your access to those services or deny you altogether.

DeFi replaces the bank with a series of decentralized applications (dApps) powered by smart contracts.

The definition of a dApp

A dApp is a decentralized application. While standard web applications — like Twitter — run on systems owned by a single organization, in the crypto world, dApps operate on public blockchain networks, which are open-source, and therefore not controlled by one single authority.

DApps work on their own and usually consist of multiple smart contracts.

What is a smart contract?

Smart contracts are computer programs that can automatically execute the terms of an agreement — a loan, a trade, a purchase, and other transactions — when certain conditions are met without the approval of a third party.

Smart contracts follow “if/when…then…” statements written into code on a blockchain, making them self-executing. If a certain event occurs, the smart contract activates and completes the next action in the agreement.

Smart contracts pull in information through DeFi components called oracles that provide data from the real world to blockchains.

For example, say you choose to take out a loan from a decentralized lending platform like Maker. The platform issues you a loan in the form of token Dai, its stablecoin, and puts your crypto collateral (say, Ethereum) into a smart contract.

The terms of the loan — the interest rate, the length of the loan, and so on — are programmed into the smart contract. If you don’t repay the loan in Dai by the due date, the smart contract sells your ETH to repay the debt plus interest.

On the other hand, if you do repay the loan on time, the smart contract releases your ETH back to you.

In traditional finance, all these steps would be completed by a human bank teller or loan officer — and they would probably take days or weeks.

With DeFi and smart contracts, everything happens near-instantly and without any intermediaries.

Getting a crypto-backed loan through Aave

Aave, a decentralized lending and borrowing platform, is one of the most popular DeFi protocols in existence today. On the platform, you can use crypto as collateral and receive a loan without even giving your name or email address.

If you already own ether (ETH) in your crypto wallet, you can borrow stablecoins and other cryptos against it easily.

- First, connect your Blockchain.com wallet to Aave via WalletConnect: Click “Connect Wallet” then “WalletConnect” then scan the QR code from your Blockchain.com Wallet mobile app and accept the connection.

2. Next, deposit ETH onto the Aave platform. This ETH serves as collateral for loan, or the asset you will borrow against. On Aave, you can deposit over a dozen different cryptos as collateral.

3. With your ETH deposited, the smart contract will let you borrow up to 60% of its value in stablecoins like USD Tether (USDT), USD Coin (USDC), and other cryptocurrencies.

4. As long as your loan stays below 60% of your collateral’s value, Aave will keep your loan open and charge interest. If your loan’s value goes over the 60% threshold, the smart contract will automatically sell, or liquidate, your crypto to repay the loan.

5. Finally, the user can end the loan by repaying the amount of the loan plus interest. As soon as that transaction clears, the user can pull all their collateral off of the Aave platform.

The only fees you pay throughout the process are ones to support the Ethereum network. The Aave platform doesn’t charge any other fees or put you through a frustrating approval process.

Examples of DeFi

The crypto community is still experimenting with different ways to use DeFi protocols. Some popular applications include:

Decentralized exchanges (DEXes)

These are marketplaces where you can buy and sell crypto assets without entrusting your funds to a centralized exchange. The most popular decentralized exchange is Uniswap.

On this platform, you can exchange between thousands of cryptos with a few clicks.

Lending and borrowing platforms

These are platforms where you can lend or borrow crypto assets, using cryptocurrency as collateral. One of the most popular lending and borrowing platforms is Aave.

Compliance and Know-Your-Transaction (KYT) tools

These are tools that help crypto businesses meet compliance requirements, such as anti-money laundering (AML) and countering-the-financing-of-terrorism (CFT) regulations. Chainalysis KYT is a popular example of a compliance tool.

DeFi FAQ

Can anyone be denied access to DeFi?

No — crypto networks are permissionless, meaning anyone with an Internet connection can use them. This is one of crypto’s defining characteristics.

Is DeFi trustworthy?

In crypto, users rely on code to be the banker, broker, and lender. With open source software, anybody can inspect it and verify that it works as intended.

That said, smart contracts are only as good as their code. There have been a few high-profile hacks in the DeFi space that have lost users millions of dollars. It’s critical to do your own research before using any crypto product or service.

How do prices stay current in DeFi if no one manages them?

To make sure that crypto prices are accurate on the blockchain, DeFi protocols use what are called oracles. You can think of oracles as “crypto price feeds” that provide real-time data about crypto prices to the blockchain.

For example, an oracle might tell a crypto network what the price of Ethereum or Bitcoin is at any given moment to establish the basis for a loan. This is yet another example of a DeFi component replacing what a third party would do — and potentially charge for — in the traditional system.

By using crypto networks and smart contracts instead of centralized intermediaries, DeFi protocols can offer financial services that are available to anyone with an Internet connection — 24 hours a day, 7 days a week.

Source link

You may like

Russian Authorities Introduce New Restrictions on Cryptocurrency To Prevent Ruble From Being Replaced: Report

CARV Announces Decentralized Node Sale to Revolutionize Data Ownership in Gaming and AI – Blockchain News, Opinion, TV and Jobs

Yue Minjun Revolutionizes Bitcoin Art Scene with Pioneering Ordinals Collection on LiveArt – Blockchain News, Opinion, TV and Jobs

Sui Teams Up with Google Cloud to Drive Web3 Innovation with Enhanced Security, Scalability and AI Capabilities

Fantasy Metaverse Darklume – Presale is LIVE – Blockchain News, Opinion, TV and Jobs

XRP Can This 23 Million Token Purchase Spark A Rally?

Aave

Analyst Nicholas Merten Says XRP Competitor Could Go Up by 200%, Updates Outlook on Aave, Compound and Uniswap

Published

2 months agoon

March 9, 2024By

admin

Widely followed analyst Nicholas Merten is offering his forecast on four crypto assets amid an industry-wide market rally.

Starting with payments-focused blockchain network Stellar (XLM), Merten tells the 510,000 YouTube subscribers of the DataDash channel that the XRP rival is sitting at a “typical discount range”.

According to Merten, XLM could appreciate by around 200% against Bitcoin (XLM/BTC).

“You’ve got an opportunity here [with XLM] to have a 3X against Bitcoin, right from 0.00000200 BTC to 0.00000600 BTC. I like those kind of plays.”

XLM is trading at 0.00000210 BTC ($0.14) at time of writing.

Turning to decentralized finance (DeFi), the widely followed analyst says that some of the altcoins in the sector such as Aave (AAVE), Compound (COMP) and Uniswap (UNI) are oversold.

On Aave, Merten says that the decentralized lending protocol is in a “nice trend” against the US dollar, signifying the potential for more upside.

AAVE is trading at $130 at time of writing.

On Compound, the crypto analyst says,

“Nice solid momentum. Solid foundation here built up on some of these plays, far away from those prior May 2021 highs [of ~ $854]… And I’m not saying it’s going to go all the way up there.”

Compound is trading at $87.07 at time of writing.

Turning to decentralized exchange Uniswap, Merten says that UNI is “another really strong play.” According to the crypto strategist, Ethereum (ETH) could act as a catalyst for Uniswap and other DeFi tokens that are built on the second-largest blockchain by market cap.

“I think some of these plays could really start to pick up as Ethereum is starting to pick up as well on the market.”

UNI is trading at $14.95 at time of writing. Ethereum is trading at $3,975 at time of writing, up about 150% since mid-October.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any loses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: DALLE3

Source link

Aave

Ethereum DeFi Altcoin Showing Bullish Divergence As Indicator Enters ‘Bounce Zone’: Santiment

Published

5 months agoon

December 15, 2023By

admin

An Ethereum (ETH)-based native token for a decentralized finance (DeFi) project is flashing a couple of bullish divergences, according to the crypto analytics firm Santiment.

Aave (AAVE), a DeFi lending protocol, is trading at $93.89 at time of writing and is up more than 2.3% in the past 24 hours.

Santiment notes that the asset’s top 150 non-exchange wallets now hold 9.61 million AAVE, a five-month high.

The analytics firm also says AAVE’s Relative Strength Index (RSI) has dropped below 40, which has historically been a “bounce zone” for the asset.

The RSI is a widely used momentum indicator that aims to determine if an asset is overbought or oversold. The indicator scales from 0 to 100, and a reading of below 30 is typically considered bullish while a reading of over 70 is typically considered to be a bearish sign.

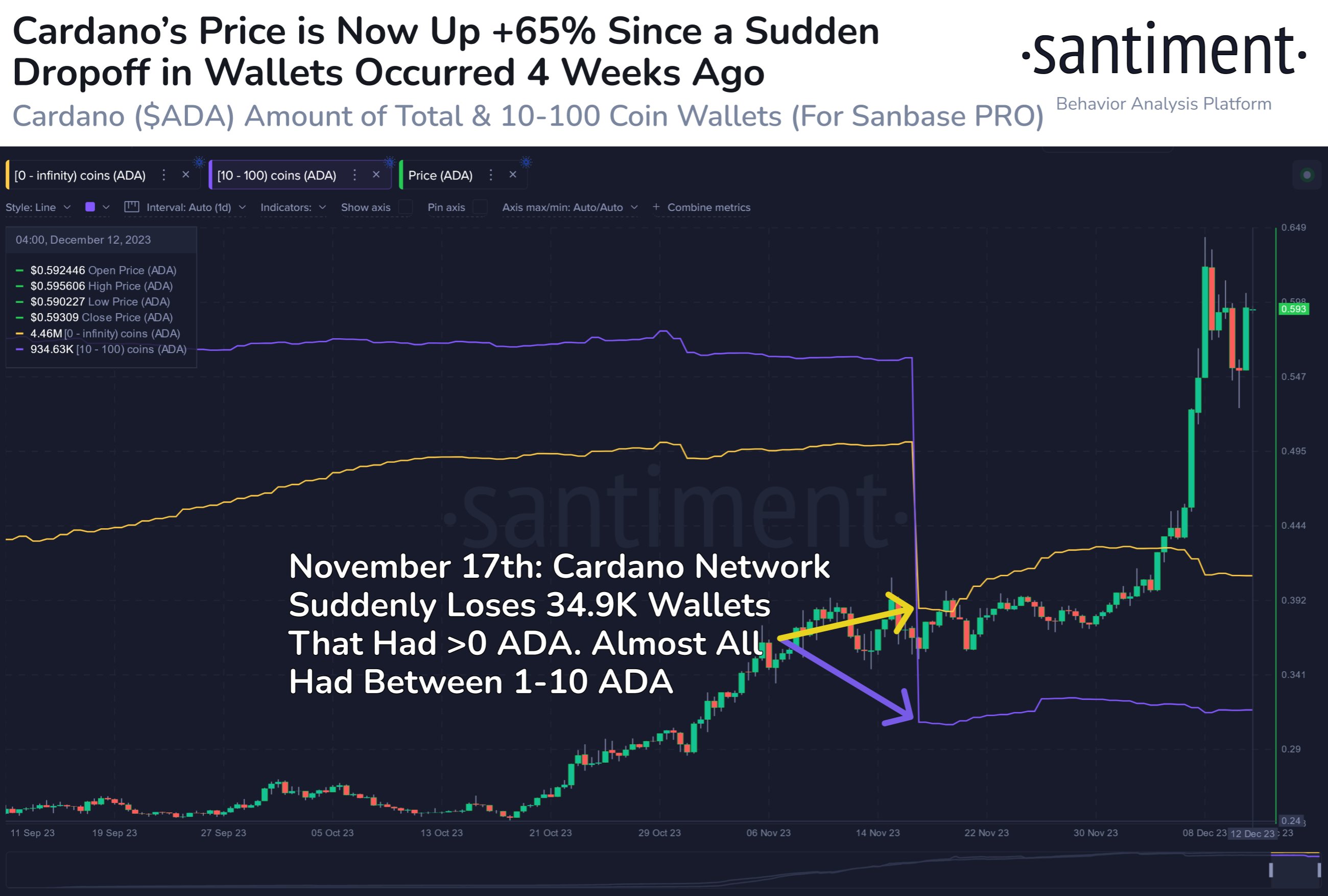

In terms of other crypto assets, Santiment notes that Ethereum competitor Cardano (ADA) noticed a sudden loss of small wallets back in mid-November.

“A drop of addresses this size or smaller often indicates capitulation, and a potential price turning point. ADA is +65% since.”

ADA is trading at $0.635 at time of writing. The eighth-ranked crypto asset by market cap is up nearly 8% in the past 24 hours.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any loses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney

Source link

Aave

Top Analyst Predicts Breakout Rally for XRP, Updates Outlook on Solana and Ethereum-Based Altcoin

Published

6 months agoon

November 2, 2023By

admin

A crypto strategist who accurately called the top of Bitcoin’s (BTC) 2021 bull market is expecting another leg up for XRP.

Pseudonymous analyst Pentoshi tells his 706,900 followers on the social media platform X that XRP looks bullish after taking out a key resistance level at $0.548.

“XRP fans.

A breakout above $0.548 should lead towards $0.62-$0.63.”

At time of writing, XRP is trading for $0.59, up about 3% in the last 24 hours.

The analyst is also updating his forecast on the layer-1 protocol Solana (SOL). According to Pentoshi, the bulls are already celebrating SOL’s big rallies as of late which tells him that the crypto asset may be close to witnessing a pullback.

“The timeline is getting a little loud on this one. Probably local top soonish, in the purple box.”

Looking at the trader’s chart, he seems to predict that SOL will likely meet resistance at $38.70. At time of writing, SOL is worth $38.59.

Another altcoin on the analyst’s radar is the governance token of the Ethereum (ETH)-based decentralized finance lending protocol Aave (AAVE). According to Pentoshi, AAVE will see a big breakout rally if it manages to breach resistance at $90.

“This one likely consolidates a bit more. A break above $90 likely brings $112-$115. For now, it’s under resistance that opens that up.”

At time of writing, AAVE is trading at $81.81.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any loses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney

Source link

Russian Authorities Introduce New Restrictions on Cryptocurrency To Prevent Ruble From Being Replaced: Report

CARV Announces Decentralized Node Sale to Revolutionize Data Ownership in Gaming and AI – Blockchain News, Opinion, TV and Jobs

Yue Minjun Revolutionizes Bitcoin Art Scene with Pioneering Ordinals Collection on LiveArt – Blockchain News, Opinion, TV and Jobs

Sui Teams Up with Google Cloud to Drive Web3 Innovation with Enhanced Security, Scalability and AI Capabilities

Fantasy Metaverse Darklume – Presale is LIVE – Blockchain News, Opinion, TV and Jobs

XRP Can This 23 Million Token Purchase Spark A Rally?

Legendary Trader Peter Brandt Says Bitcoin Has 25% Chance of Hitting $160,000 – Here’s His Timeline

Ethereum Price Topside Bias Vulnerable If It Continues To Struggle Below $3.5K

Ethereum Showing Serious Strength as One Low-Cap Altcoin Flashes Bullish Signal for First Time Since 2022: Analyst

Ethereum Flashes Bullish Signals, Can It Rally 50% From Here?

Consensys Takes Legal Action Against SEC to Safeguard U.S. Ethereum Community – Blockchain News, Opinion, TV and Jobs

Billion-Dollar Bank Paying $700,000 Penalty for Illegally Freezing Accounts, Transferring Customers’ Cash to Debt Collectors

MetaWin Founder Launches $ROCKY Meme Coin on Base Network – Blockchain News, Opinion, TV and Jobs

Forget Meme Coins And NFTs, RWA And DePin Are The Next Big Things – Blockchain News, Opinion, TV and Jobs

Successful Beta Service launch of SOMESING, ‘My Hand-Carry Studio Karaoke App’

Bitcoin Dropped Below 2017 All-Time-High but Could Sellers be Getting Exhausted? – Blockchain News, Opinion, TV and Jobs

What does the Coinbase Premium Gap Tell us about Investor Activity? – Blockchain News, Opinion, TV and Jobs

BNM DAO Token Airdrop

NFT Sector Keeps Developing – Number of Unique Ethereum NFT Traders Surged 276% in 2022 – Blockchain News, Opinion, TV and Jobs

New Minting Services

Block News Media Live Stream

A String of 200 ‘Sleeping Bitcoins’ From 2010 Worth $4.27 Million Moved on Friday

SEC’s Chairman Gensler Takes Aggressive Stance on Tokens – Blockchain News, Opinion, TV and Jobs

Friends or Enemies? – Blockchain News, Opinion, TV and Jobs

Enjoy frictionless crypto purchases with Apple Pay and Google Pay | by Jim | @blockchain | Jun, 2022

Block News Media Live Stream

Block News Media Live Stream

How Web3 can prevent Hollywood strikes

XRP Explodes With 1,300% Surge In Trading Volume As crypto Exchanges Jump On Board

Block News Media Live Stream

Trending

Altcoins2 years ago

Altcoins2 years agoBitcoin Dropped Below 2017 All-Time-High but Could Sellers be Getting Exhausted? – Blockchain News, Opinion, TV and Jobs

Binance2 years ago

Binance2 years agoWhat does the Coinbase Premium Gap Tell us about Investor Activity? – Blockchain News, Opinion, TV and Jobs

- Uncategorized2 years ago

BNM DAO Token Airdrop

BTC1 year ago

BTC1 year agoNFT Sector Keeps Developing – Number of Unique Ethereum NFT Traders Surged 276% in 2022 – Blockchain News, Opinion, TV and Jobs

- Uncategorized2 years ago

New Minting Services

Video2 years ago

Video2 years agoBlock News Media Live Stream

Bitcoin miners2 years ago

Bitcoin miners2 years agoA String of 200 ‘Sleeping Bitcoins’ From 2010 Worth $4.27 Million Moved on Friday

Bitcoin1 year ago

Bitcoin1 year agoSEC’s Chairman Gensler Takes Aggressive Stance on Tokens – Blockchain News, Opinion, TV and Jobs