Banking

Web3’s Swiss Army knife of personal finance Changex joins Cointelegraph Accelerator

Published

8 months agoon

By

admin

Decentralized finance (DeFi) gave birth to a wide range of financial services that aim to challenge what traditional finance (TradFi) offers. However, the user experience persists as a major issue hindering the widespread adoption of DeFi apps and solutions. For years, the DeFi ecosystem has been seeking an entry point that can onboard the next wave of users to decentralized apps.

One potential solution is a financial technology (fintech) app that’s catered toward TradFi users and also offers easy-to-use DeFi functionality. This way, users can realize that self-custody, a practice that enables safeguarding digital assets in personal wallets without the help of a third party, can be a way forward and start ditching centralized intermediaries like banks.

While users’ quest to take full responsibility for storing and managing crypto assets picked up the pace with self-custody, the Web3 space created new services to let people swap, spend and earn crypto that utilizes both CeFi and DeFi aspects to help the migration process.

Envisioning a demand and emergence of new sophisticated decentralized financial apps, Changex, an all-in-one mobile wallet, employs a CeDeFi model, combining centralized and decentralized finance in a single screen in a bid to attract users coming from traditional services with a familiar environment.

DeFi meets CeFi

The Changex app offers a crypto trading exchange in a non-custodial environment, leaving the keys to crypto assets with users. Users can buy, sell or transfer crypto on the platform, which also supports buying crypto with debit cards and bank transfers. The exchange supports multiple blockchains, including Ethereum, Polygon and Binance Smart Chain.

DeFi users can take advantage of the most common alternative finance practices, including staking, with lending and stablecoin interests coming later this year, all from within the same app. Changex also gives additional APR on staking rewards with the platform’s native token, CHANGE.

The upcoming Changex Visa Debit Card will give cashback for shopping. Source: Changex

Changex app is also working on issuing European Union-regulated IBANs to users for managing fiat assets, opening the door for cross-border transactions across the EU and bridging the gap between the crypto world and traditional financial systems. Scheduled for the fourth quarter of 2023, the upcoming Changex Visa Debit Card will give cashback bonuses to its owners. Users will also be able to spend their staked assets without impairing APR.

Changex joins Cointelegraph Accelerator

Cointelegraph Accelerator picked Changex as a participant for the expertise of its team, which has over 20 members, an office in Bulgaria and a track record of delivering robust financial solutions. The app provides a user-friendly, streamlined experience, efficiently catering to both Web2 and Web3 users. The product also displayed good traction, with an average of 25,000 monthly active users and nearly $3 million worth of staked assets.

Next for Changex is the integration of the Avalanche blockchain. This integration will also bring several Avalanche-based staking pools. What’s more, Changex is working on releasing a unique leveraged staking functionality on the platform in the coming months. Following that, in the fourth quarter of 2023, Changex will roll out its biggest update – the Changex Visa Debit Card and IBAN – which will enable users to claim complete control over their finances and turn Changex into a comprehensive one-stop-shop for crypto and fiat alike.

Source link

You may like

Azuro and Chiliz Working Together to Boost Adoption of Onchain Sport Prediction Markets – Blockchain News, Opinion, TV and Jobs

Robinhood Bleeds 164 Million Dogecoin

AIGOLD Goes Live, Introducing the First Gold Backed Crypto Project – Blockchain News, Opinion, TV and Jobs

Analyst Benjamin Cowen Warns Ethereum ‘Still Facing Headwinds,’ Says ETH Will Only Go Up if Bitcoin Does This

Tron Price Prediction: TRX Outperforms Bitcoin, Can It Hit $0.132?

Ethereum-Based Altcoin Leads Real-World Assets Sector in Development Activity, According to Santiment

bank of america

Bank of America To Pay $12,000,000 Fine for Repeatedly Breaking the Law, Sending False Information to Regulators

Published

5 months agoon

December 4, 2023By

admin

One of the largest banks in the country is getting slapped with a multi-million dollar fine from the Consumer Financial Protection Bureau (CFPB).

The agency says Bank of America will pay $12 million for repeatedly sending false information to federal regulators.

The CFPB says BofA has routinely violated the Home Mortgage Disclosure Act, which was enacted in 1975.

The law requires lenders to maintain certain records and submit data about loan applications and originations to the CFPB to protect consumers against predatory practices in the residential mortgage market.

The CPFB says that hundreds of BofA loan officers neglected their duty to ask mortgage applicants a number of demographic questions as mandated by federal law. But instead of following up to get the necessary details, the loan officers falsely reported that 100% of mortgage applicants opted not to provide their demographic data over a three-month period.

The regulator also says that BofA failed to ensure that its loan officers were providing accurate information on mortgage applications. According to the CFPB, the lender’s loan officers were not collecting the required demographic data from mortgage applicants as early as 2013 but BofA chose to overlook the shortcoming.

Says CFPB Director Rohit Chopra,

“Bank of America violated a federal law that thousands of mortgage lenders have routinely followed for decades. It is illegal to report false information to federal regulators, and we will be taking additional steps to ensure that Bank of America stops breaking the law.”

In addition to the $12 million fine, the CFPB is requiring Bank of America to take measures that would stop its illegal data-collection practice.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any loses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney

Source link

Banking

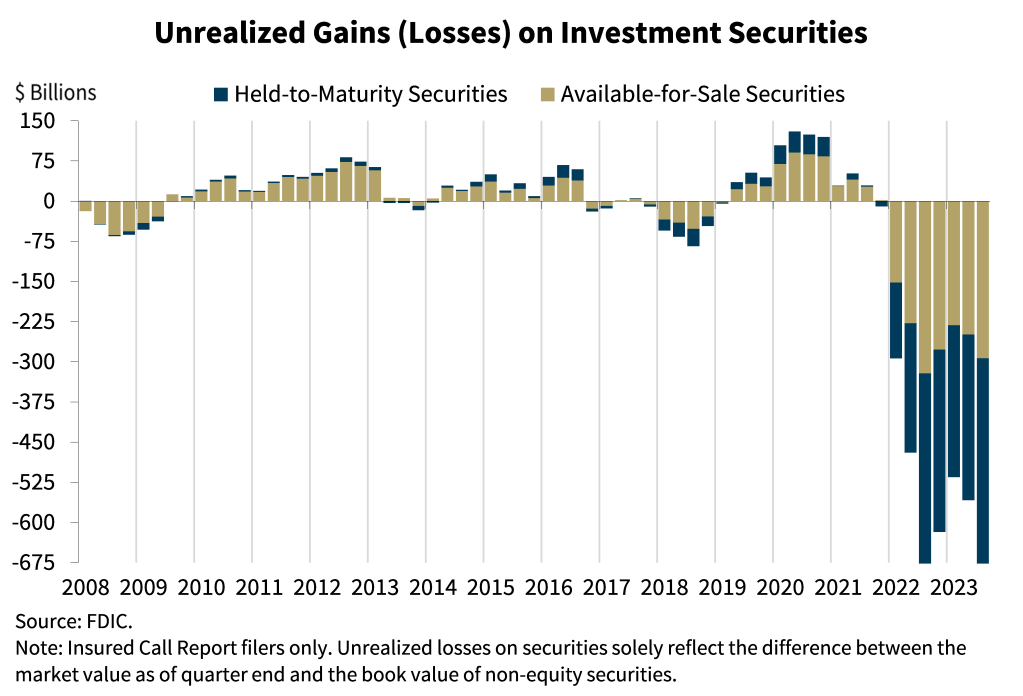

$684,000,000,000 in Unrealized Losses Hammer US Banks As Fed Reveals Surge in Underwater Assets

Published

5 months agoon

December 3, 2023By

admin

US banks are now saddled with a staggering $684 billion in losses on securities, according to a new report from the Federal Deposit Insurance Corporation (FDIC).

The agency says the total number of unrealized securities in the banking system at the end of Q3 surged by $126 billion – a 22.5% increase in the span of a few months.

Unrealized losses represent the difference between the price banks paid for bonds and the current value of those securities on the open market.

Although banks can simply hold their bonds until they mature, they can become an extreme liability when banks need injection of liquidity.

The dangers of unrealized losses came into focus early this year amid the collapse of Silicon Valley Bank.

The bank’s sudden failure back in March was sparked by an announcement that it had booked a $1.8 billion loss from selling a portion of its underwater bond portfolio.

Those losses stem from a historic collapse in bonds amid the Fed’s push to keep interest rates higher for longer.

In response to the failures of SVB and Signature bank, the Federal Reserve launched the Bank Term Funding Program (BTFP), which offers one-year emergency funding to banks in distress.

The FDIC says the banking industry’s profits margins have remained remarkably resilient, although deposit flight continues.

“In the third quarter, domestic deposits declined for the sixth consecutive quarter, though the outflow of deposits continued to moderate from the large outflows experienced in the first quarter. The level of liquid assets fell in the third quarter due to a reduction in securities portfolios…

Though the U.S. economy has remained strong in 2023, the banking industry still faces significant downside risks from the continued effects of inflation, rising market interest rates, and geopolitical uncertainty. These issues could cause credit quality, earnings, and liquidity challenges for the industry.”

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any loses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney

Source link

Banking

$120,000 Exits Citibank Account in Mysterious Scam – And Bank Tells Customer to Get a Lawyer

Published

6 months agoon

November 12, 2023By

admin

A resident of Skokie, Illinois is suing banking giant Citibank on behalf of his disabled sister over the sudden disappearance of $120,000.

Scott Jacobson says his mother left $150,000 in a Citibank trust account to pay for the expenses of his 65 year-old sister, who’s been fighting Alzheimer’s disease for years, reports NBC Chicago.

Jacobson says that caring for her disabled sister was manageable until October 14th, 2021, when he realized thieves somehow stole $120,000 from the account.

“I was shaking because I was more concerned about my sister than I was about anything else.”

According to Jacobson, a Citibank teller told him that someone made three international wire transfers from Bangkok, Thailand, which he says he never authorized.

In his effort to recoup the funds, Jacobson says he filed three fraud affidavits with the lending titan on the same day, expecting the bank to get to the bottom of the case. However, a bank representative told him that he should seek help from the US justice system.

“I had a personal banker, and I went in there and I asked him about all this. He says, ‘Well, you’re gonna have to get attorneys.’”

Jacobson also says he did not receive any notifications about the wire transfers.

Although the bank says it did not get Jacobson’s approval before greenlighting the wire transfers, Citibank says it did alert him via text and email, and is “in compliance with all regulations regarding wire transfers.”

Jacobson says he filed fraud affidavits on October 14th, 2021, but Citibank argues that he took legal action long after the 60-day record-keeping deadline had passed.

“Jacobson, through counsel, first made demand on Citibank to repay the three wire amounts on Aug. 29, 2022. By that time, [the third-party vendor] had already deleted the emails and text messages sent to Jacobson.”

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any loses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney

Source link

Azuro and Chiliz Working Together to Boost Adoption of Onchain Sport Prediction Markets – Blockchain News, Opinion, TV and Jobs

Robinhood Bleeds 164 Million Dogecoin

AIGOLD Goes Live, Introducing the First Gold Backed Crypto Project – Blockchain News, Opinion, TV and Jobs

Analyst Benjamin Cowen Warns Ethereum ‘Still Facing Headwinds,’ Says ETH Will Only Go Up if Bitcoin Does This

Tron Price Prediction: TRX Outperforms Bitcoin, Can It Hit $0.132?

Ethereum-Based Altcoin Leads Real-World Assets Sector in Development Activity, According to Santiment

Here’s Why This Analyst Is Predicting A Rise To $360

Hackers With $182,000,000 Stolen From Poloniex Starts Moving Funds to Tornado Cash

Cardano Faces Make-Or-Break Price Level For Bullish Revival

A Premier Crypto Exchange Tailored for Seasoned Traders – Blockchain News, Opinion, TV and Jobs

Crypto Whale Withdraws $75.8 Million in USDC From Coinbase To Invest In Ethereum’s Biggest Presale – Blockchain News, Opinion, TV and Jobs

CFTC Chair Says ‘Another Cycle of Enforcement Actions’ Coming As Crypto Enters New Phase of Asset Appreciation

Spectral Labs Joins Hugging Face’s ESP Program to advance the Onchain x Open-Source AI Community – Blockchain News, Opinion, TV and Jobs

DOT Price (Polkadot) Reaches Key Juncture, Is This Bulls Trap or Correction?

‘Last Dip Ever’ – Analyst Predicts Solana Rally, Says Three Memecoins Will Surge Alongside SOL

Bitcoin Dropped Below 2017 All-Time-High but Could Sellers be Getting Exhausted? – Blockchain News, Opinion, TV and Jobs

What does the Coinbase Premium Gap Tell us about Investor Activity? – Blockchain News, Opinion, TV and Jobs

BNM DAO Token Airdrop

NFT Sector Keeps Developing – Number of Unique Ethereum NFT Traders Surged 276% in 2022 – Blockchain News, Opinion, TV and Jobs

New Minting Services

Block News Media Live Stream

A String of 200 ‘Sleeping Bitcoins’ From 2010 Worth $4.27 Million Moved on Friday

SEC’s Chairman Gensler Takes Aggressive Stance on Tokens – Blockchain News, Opinion, TV and Jobs

Friends or Enemies? – Blockchain News, Opinion, TV and Jobs

Enjoy frictionless crypto purchases with Apple Pay and Google Pay | by Jim | @blockchain | Jun, 2022

Block News Media Live Stream

How Web3 can prevent Hollywood strikes

Block News Media Live Stream

XRP Explodes With 1,300% Surge In Trading Volume As crypto Exchanges Jump On Board

Block News Media Live Stream

Trending

Altcoins2 years ago

Altcoins2 years agoBitcoin Dropped Below 2017 All-Time-High but Could Sellers be Getting Exhausted? – Blockchain News, Opinion, TV and Jobs

Binance2 years ago

Binance2 years agoWhat does the Coinbase Premium Gap Tell us about Investor Activity? – Blockchain News, Opinion, TV and Jobs

- Uncategorized2 years ago

BNM DAO Token Airdrop

BTC1 year ago

BTC1 year agoNFT Sector Keeps Developing – Number of Unique Ethereum NFT Traders Surged 276% in 2022 – Blockchain News, Opinion, TV and Jobs

- Uncategorized2 years ago

New Minting Services

Video2 years ago

Video2 years agoBlock News Media Live Stream

Bitcoin miners2 years ago

Bitcoin miners2 years agoA String of 200 ‘Sleeping Bitcoins’ From 2010 Worth $4.27 Million Moved on Friday

Bitcoin1 year ago

Bitcoin1 year agoSEC’s Chairman Gensler Takes Aggressive Stance on Tokens – Blockchain News, Opinion, TV and Jobs