Bitcoin

What To Expect If Historical Bitcoin Halving Cycles Repeat

Published

7 months agoon

By

admin

It’s been quite a bearish week for Bitcoin, as the crypto has fallen around 3% since the beginning of the week. Price action, in particular, has had Bitcoin struggling to break above $27,000, indicating a potential risk of more losses below this resistance level in the near term.

However, according to a crypto analyst, this current retracement might be the beginning of a historical Bitcoin cycle before each halving.

Analyst Shows Bitcoin Price Correction Based On Historical Trends

Crypto analyst Rekt Capital has said in a post that if historical Bitcoin “halving cycles” are any indication, a major price correction could be right around the corner. The Bitcoin halving cuts the block reward for miners in half.

This happens roughly every 4 years to slow the creation of new BTC and control inflation. Based on historical data from the previous two Bitcoin halvings, the price of BTC could drop by up to 38% before the next halving.

In a chart shared on X (formerly Twitter), Rekt Capital showed a major pull back has happened around six months before each halving. In the 2015 cycle, BTC retraced 25% 196 days before the 2016 halving.

In 2019, BTC retraced 38%, 196 days before the 2020 halving. So with the next halving slated to occur around April 2024, it would seem the market is now in a prime position for the next correction.

Previous halving trends | Source: X

Bitcoin is currently 60% below its all-time high, following a similar pattern with past halvings. 200 days before the 2020 halving, BTC was 60% below its all-time high. Likewise, 200 days before the 2016 halving, BTC was 65% below its all-time high.

What A Correction Would Mean For BTC

Bitcoin’s price direction is currently uncertain, especially as on-chain transactions on the blockchain are now at a three-month low. On-chain metrics have shown that 95% of Bitcoin’s circulating supply hasn’t changed hands in the past month, as investors seem to be holding on to the cryptocurrency in anticipation of the SEC’s approval of spot Bitcoin ETFs.

Although past performance doesn’t always repeat, if this pattern shows up again before the next halving, Bitcoin could be in for a big correction. With the current price of BTC now at $26,770, a 38% retracement could see BTC fall below $18,000. If this happens, it would be devastating for BTC holders.

Even though a price correction may be on the horizon, Bitcoin’s long-term growth prospects remain strong. Over the past decade, Bitcoin has shown a consistent upward trend as the largest crypto by market cap despite facing several setbacks.

Bitcoin has been named the best performer this year in terms of asset investing by Reflexivity, a digital asset research firm. According to billionaire hedge fund manager Paul Tudor Jones, this is the best time to buy BTC.

BTC price at $26,782 | Source: BTCUSD on Tradingview.com

Featured image from Asia Crypto Today, chart from Tradingview.com

Source link

You may like

Tron Price Prediction: TRX Outperforms Bitcoin, Can It Hit $0.132?

Ethereum-Based Altcoin Leads Real-World Assets Sector in Development Activity, According to Santiment

Here’s Why This Analyst Is Predicting A Rise To $360

Hackers With $182,000,000 Stolen From Poloniex Starts Moving Funds to Tornado Cash

Cardano Faces Make-Or-Break Price Level For Bullish Revival

A Premier Crypto Exchange Tailored for Seasoned Traders – Blockchain News, Opinion, TV and Jobs

Altcoins

Hackers With $182,000,000 Stolen From Poloniex Starts Moving Funds to Tornado Cash

Published

13 hours agoon

May 8, 2024By

admin

The hacker who looted the crypto exchange Poloniex has started moving Ethereum (ETH) to the mixing service Tornado Cash, according to the digital asset de-anonymizing platform Arkham.

Arkham notes the hacker moved 1126.1 ETH worth more than $3.4 million into Tornado Cash across a series of 20 transactions on Monday and Tuesday.

They represent the exploiter’s first moves into the controversial Ethereum-based crypto mixer, which helps users conceal their digital assets.

The hacker raided Poloniex in early November, stealing $56 million worth of ETH, $48 million worth of Tron (TRX) and $18 million worth of Bitcoin (BTC), as well as smaller amounts of other crypto assets.

The exchange, which is owned by Tron founder Justin Sun, offered a 5% white hat bounty that went unaccepted. and the hacker still holds $181.47 million worth of crypto in their primary address, according to Arkham.

Justin Sun-affiliated projects have endured a prolific string of attacks in the past several months: In September, hackers exploited the Sun-linked exchange giant HTX for approximately 4,999 Ethereum worth $7.9 million, according to the blockchain security firm PeckShield.

Then in November, hackers hit HTX and Heco Bridge, another Sun-linked project that’s used to move funds between Ethereum and energy-saving blockchain Heco Chain, for a combined $100 million, according to cybersecurity firm Cyvers.

And in January, hackers once again struck HTX, hitting the exchange with a distributed denial of service (DDoS) attack that caused a brief outage.

A DDoS attack is a malicious attempt by bad actors to flood the target website with traffic to overwhelm the site’s infrastructure.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney

Source link

In a post on X, crypto analyst Miles Deutscher laid out his strategic predictions for high-performing cryptocurrencies in the upcoming week to his 501,700 followers. His analysis delved deep into Bitcoin’s trading patterns, the surging AI-driven altcoin sector, and specific tokens that are displaying considerable potential due to recent developments and broader market dynamics.

Bitcoin And AI Crypto Tokens Are Set To Dominate This Week

At the forefront of Deutscher’s analysis, Bitcoin has recently returned to its previous trading range between $60,000 and $69,400 after experiencing a sharp drop. This movement was characterized as a significant deviation, suggesting manipulation or a shakeout of weak hands before a potential rally.

“Bitcoin is at the top of my watchlist for this week. Had a big fakeout/deviation to the downside, and now back within the range,” Deutscher stated. He pointed out that the key factor to watch is whether the current range’s lower boundary will hold, which could serve as a strong foundation for an upward trajectory.

Moreover, the AI sector has been particularly resilient and robust recently, bouncing back significantly amidst broader market recoveries. Deutscher highlighted the sector’s potential for outperformance, driven by several upcoming major events.

These include Apple’s Worldwide Developers Conference (WWDC), NVIDIA’s earnings announcement, and the anticipated release of ChatGPT 5. “AI is one of those unique narratives that retains constant mindshare due to its endless real-life news flow/hype,” Deutscher explained.

One specific AI token which Deutscher watches closely due to its alleged partnership with Apple is Render (RNDR), making it a prime candidate for speculation around the upcoming Apple event. Historically, RNDR has also led the AI token sector during market rotations.

Furthermore, Deutsches focuses on Near Protocol (NEAR), Fetch.ai (FET), AIOZ Network (AIOZ). He grouped these tokens together due to their correlation but noted their recent technical performance, where they bounced cleanly off daily support levels and established higher lows.

More Altcoins To Watch

TON: Recently the center of attention, TON experienced a drop after the Token2049 event in what Deutscher described as a “sell-the-news” scenario. However, recent investments by firms like Pantera signal continued interest and potential undercurrents of growth.

Ethena (ENA): With the market sentiment turning bullish again, Deutscher anticipates a return to positive funding rates, which typically benefit tokens like Ethena. Recent activity from the Ethena team, including increased reward boosts and optimistic social media posts from its founders, further bolster the bullish case. “Also hearing rumors of a T1 exchange listing,” Deutscher added, suggesting an impending increase in liquidity and exposure.

Jito (JTO): Jito is reportedly developing what Deutscher referred to as the “Eigen Layer of Solana,” aiming to replicate the success and hype surrounding the Eigen project’s layer solutions. Despite the challenges of a recent airdrop, Deutscher sees potential if the team executes well, particularly as the restaking narrative has not yet fully penetrated the market.

PopCat (POPCAT): Despite facing some fear, uncertainty, and doubt (FUD) related to copyright issues over the weekend, POPCAT continues to exhibit strong price action, pushing toward new highs. “POPCAT seems the best contender, for now, not a single cat meme coin has yet to hit a $1B market cap,” noted Deutscher, highlighting its standout performance.

Ethereum Finance (ETHFI): In the realm of liquidity reward tokens (LRT), ETHFI remains a notable mention despite a broader sector sell-off post-Eigen. Deutscher believes the selling may have been overreactive, and with total value locked (TVL) still on the rise, a reversion to mean on prices could be imminent.

SEI Network (SEI): As anticipation builds for the launch of the new layer one blockchain, Monad, later this year, SEI is seen as a strategic play. Categorized within the parallelized Ethereum Virtual Machine (EVM) narrative, SEI experienced a substantial sell-off but is poised for recovery as the market focus shifts towards upcoming launches.

Friend (FRIEND): After recommending FRIEND at $1.30, Deutscher continues to see upside potential, particularly as it approaches more significant centralized exchange listings. He advises keeping an eye out for major pullbacks as opportunities to buy.

Featured image from Matt Paul Catalano / Unsplash, chart from TradingView.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Source link

Altcoins

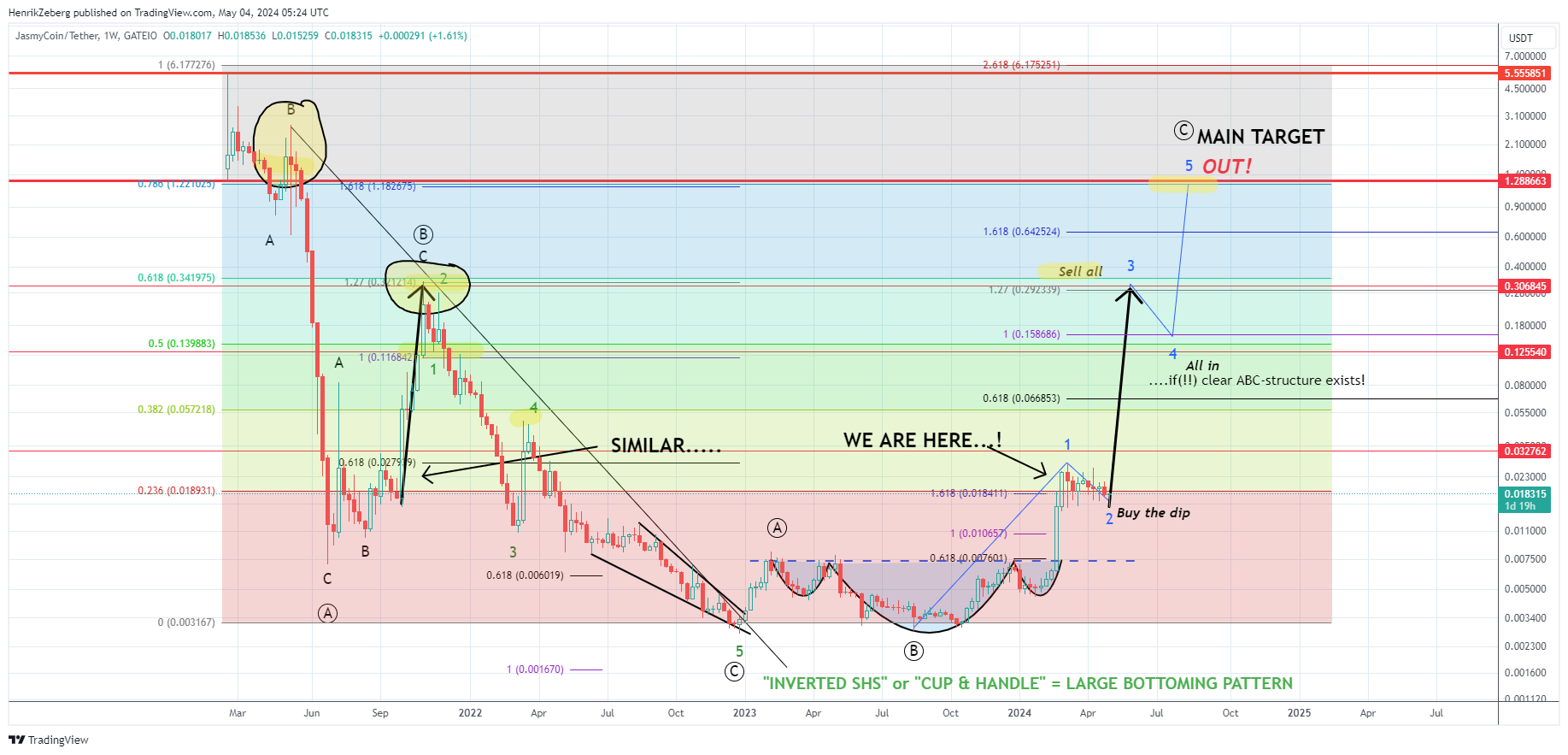

Weakening Dollar Could Boost Crypto and Push One Altcoin to Astronomical Price Target: Economist Henrik Zeberg

Published

3 days agoon

May 6, 2024By

admin

Economist Henrik Zeberg says that a loss of strength for the dollar could be the catalyst that breathes new life into crypto assets.

Zeberg tells his 136,000 followers on the social media platform X that lower bond yields and a weakening dollar index (DXY), which pits the dollar against a basket of other major foreign currencies, will create an “amazing environment” for risk assets like crypto.

To ride the crypto rally, Zeberg says he has his eye on JasmyCoin (JASMY), a blockchain-based personal data storage project.

“I think a push lower in DXY and yields will create an amazing environment for crypto into the last phase of this risk asset bull market.

I think the next phase for Jasmy is wave three!

Later wave four into summer (while DXY bounces) – and then the final boost into late summer – early Autumn.

It may be that the target “only” becomes $0.3ish… but for now, the above is my main thesis.

I AM THE JASMY-FATHER!”

The economist appears to be using the Elliott Wave theory in his analysis. The theory states that a bullish asset will witness a five-wave move to the upside before topping out.

Zooming in on JASMY’s technicals, Zeberg says that the moving average convergence divergence (MACD) and the relative strength index (RSI) indicators are in the process of crossing bullish on the daily chart.

The RSI and MACD are both momentum indicators that traders use to spot points of potential trend reversals.

Says Zeberg,

“Bullish cross-over on MACD.

RSI breaking the downward trend.

We have seen that before….. just before the 400-500% Run higher.

This time, I expect the move to be BIGGER!

All onboard?”

At time of writing, JASMY is worth $0.02, up over 6% in the past day.

As for Bitcoin (BTC), Zeberg previously said the crypto king will be ready to enter a “melt-up” phase once its monthly RSI hits 70.

”So I got $110,000-$115,000 for Bitcoin. It is actually a part of a larger pattern. I see that this is either the beginning of a new bull [run], but it needs to take a long break after the blow-off top.

But we haven’t gotten to the really steep part of it yet. We see that we get to [an] RSI above 70, that is really when we see the steep part.”

At time of writing, Bitcoin is trading for $64,400 with its monthly RSI hovering at 68.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney

Source link

Tron Price Prediction: TRX Outperforms Bitcoin, Can It Hit $0.132?

Ethereum-Based Altcoin Leads Real-World Assets Sector in Development Activity, According to Santiment

Here’s Why This Analyst Is Predicting A Rise To $360

Hackers With $182,000,000 Stolen From Poloniex Starts Moving Funds to Tornado Cash

Cardano Faces Make-Or-Break Price Level For Bullish Revival

A Premier Crypto Exchange Tailored for Seasoned Traders – Blockchain News, Opinion, TV and Jobs

Crypto Whale Withdraws $75.8 Million in USDC From Coinbase To Invest In Ethereum’s Biggest Presale – Blockchain News, Opinion, TV and Jobs

CFTC Chair Says ‘Another Cycle of Enforcement Actions’ Coming As Crypto Enters New Phase of Asset Appreciation

Spectral Labs Joins Hugging Face’s ESP Program to advance the Onchain x Open-Source AI Community – Blockchain News, Opinion, TV and Jobs

DOT Price (Polkadot) Reaches Key Juncture, Is This Bulls Trap or Correction?

‘Last Dip Ever’ – Analyst Predicts Solana Rally, Says Three Memecoins Will Surge Alongside SOL

Can Ethereum Reclaim $4,000? Fragile Fundamentals Threaten To Send ETH Crashing

Coinbase Gets Hit With New Class Action Lawsuit Accusing Crypto Exchange of Selling Digital Asset Securities

Ethernity Transitions to an AI Enhanced Ethereum Layer 2, Purpose-Built for the Entertainment Industry – Blockchain News, Opinion, TV and Jobs

New Crypto Casino TG.Casino Becomes Regional iGaming Partner of AC Milan – Blockchain News, Opinion, TV and Jobs

Bitcoin Dropped Below 2017 All-Time-High but Could Sellers be Getting Exhausted? – Blockchain News, Opinion, TV and Jobs

What does the Coinbase Premium Gap Tell us about Investor Activity? – Blockchain News, Opinion, TV and Jobs

BNM DAO Token Airdrop

NFT Sector Keeps Developing – Number of Unique Ethereum NFT Traders Surged 276% in 2022 – Blockchain News, Opinion, TV and Jobs

New Minting Services

Block News Media Live Stream

A String of 200 ‘Sleeping Bitcoins’ From 2010 Worth $4.27 Million Moved on Friday

SEC’s Chairman Gensler Takes Aggressive Stance on Tokens – Blockchain News, Opinion, TV and Jobs

Friends or Enemies? – Blockchain News, Opinion, TV and Jobs

Enjoy frictionless crypto purchases with Apple Pay and Google Pay | by Jim | @blockchain | Jun, 2022

Block News Media Live Stream

How Web3 can prevent Hollywood strikes

Block News Media Live Stream

XRP Explodes With 1,300% Surge In Trading Volume As crypto Exchanges Jump On Board

Block News Media Live Stream

Trending

Altcoins2 years ago

Altcoins2 years agoBitcoin Dropped Below 2017 All-Time-High but Could Sellers be Getting Exhausted? – Blockchain News, Opinion, TV and Jobs

Binance2 years ago

Binance2 years agoWhat does the Coinbase Premium Gap Tell us about Investor Activity? – Blockchain News, Opinion, TV and Jobs

- Uncategorized2 years ago

BNM DAO Token Airdrop

BTC1 year ago

BTC1 year agoNFT Sector Keeps Developing – Number of Unique Ethereum NFT Traders Surged 276% in 2022 – Blockchain News, Opinion, TV and Jobs

- Uncategorized2 years ago

New Minting Services

Video2 years ago

Video2 years agoBlock News Media Live Stream

Bitcoin miners2 years ago

Bitcoin miners2 years agoA String of 200 ‘Sleeping Bitcoins’ From 2010 Worth $4.27 Million Moved on Friday

Bitcoin1 year ago

Bitcoin1 year agoSEC’s Chairman Gensler Takes Aggressive Stance on Tokens – Blockchain News, Opinion, TV and Jobs