Meme Coins

69% Of PEPE Holders Left In Profits After 26% Plunge

Published

2 weeks agoon

By

admin

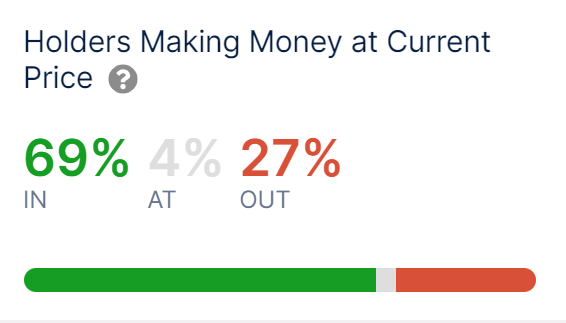

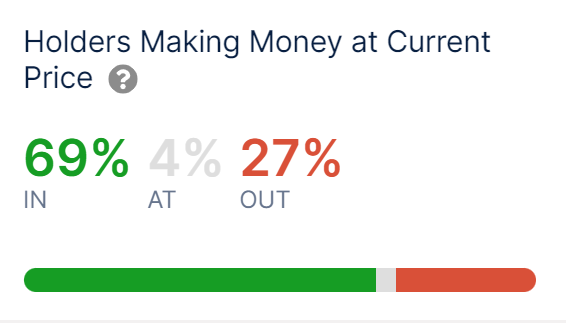

On-chain data shows the percentage of the PEPE investors currently in the green has fallen to 69% after the 26% plunge the memecoin has seen in the past week.

69% Of All PEPE Addresses Are Carrying Some Gains Right Now

In a new post on X, the market intelligence platform IntoTheBlock has posted an update on how the investor profitability is looking for the memecoin PEPE currently.

The analytics firm’s metric gauges whether a holder is in profit or not by reviewing their address’s on-chain history. Based on when the wallet acquired the coins, the indicator calculates the investor’s average cost basis using the spot price of the asset at the time of those purchases.

If the current spot value of the cryptocurrency is higher than this average cost basis for any address, then that particular investor is carrying net gains currently. IntoTheBlock categorizes such addresses to be “in the money.”

Similarly, investors with a cost basis higher than the latest price are considered “out of the money.” Naturally, the two values being exactly equal would suggest the holder is just breaking even on their investment or is “at the money.”

Now, here is the data shared by the analytics firm that shows how this investor breakdown looks like for PEPE at the moment:

The profit-loss status of the investors owning the memecoin | Source: IntoTheBlock on X

As is visible above, 69% of the total addresses holding PEPE have their cost basis higher than the current spot price of the coin, while 27% are in losses. 4% of the investors are sitting on their cost basis right now.

This profitability ratio isn’t that high, as, for example, 89% of Bitcoin investors are currently in profit, according to IntoTheBlock data. The reason behind the lower profits for the memecoin is that its price has seen a steep drawdown recently.

Historically, the addresses in the green have been more likely to sell to harvest their gains. As such, when the market profit-loss balance is overwhelmingly towards profits, a mass selloff can occur.

Naturally, this means the chances of a top being hit increase with increasing investor profits. However, a low percentage of investors being in profits can be conducive to bottoms forming, as profit-selling exhausts at these levels.

At present, PEPE is neither dominated by green investors nor red ones. In bull runs, however, profitability levels generally remain higher, so any cooldown can help prices rebound.

Thus, the fact that investor profitability has returned to the 69% level for the memecoin could be a sign that a bottom is close if the bullish regime has to continue.

PEPE Price

PEPE has returned to the $0.0000050913 mark after having declined more than 26% over the last seven days. The chart below shows the memecoin’s performance over the past month.

Looks like the price of the coin has witnessed a steep decline over the last few days | Source: PEPEUSD on TradingView

Featured image from Shutterstock.com, IntoTheBlock.com, chart from TradingView.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Source link

You may like

Russian Authorities Introduce New Restrictions on Cryptocurrency To Prevent Ruble From Being Replaced: Report

CARV Announces Decentralized Node Sale to Revolutionize Data Ownership in Gaming and AI – Blockchain News, Opinion, TV and Jobs

Yue Minjun Revolutionizes Bitcoin Art Scene with Pioneering Ordinals Collection on LiveArt – Blockchain News, Opinion, TV and Jobs

Sui Teams Up with Google Cloud to Drive Web3 Innovation with Enhanced Security, Scalability and AI Capabilities

Fantasy Metaverse Darklume – Presale is LIVE – Blockchain News, Opinion, TV and Jobs

XRP Can This 23 Million Token Purchase Spark A Rally?

cryptocurrency

Forget Meme Coins And NFTs, RWA And DePin Are The Next Big Things – Blockchain News, Opinion, TV and Jobs

Published

1 day agoon

April 29, 2024By

admin

Meme coins and NFTs have outlived their relevance, and it is now time for crypto investors to focus on DePin and RWA projects like ETFSwap (ETFS).

Over the last three years, meme coins and non-fungible tokens (NFTs) have been among the leading narratives in the crypto space. Thanks to the hype around these meme coins and NFTs, crypto investors have made insane returns on their investments,

However, there is a change in the tide that the time has come to pivot from these meme coins and NFT projects and focus on new narratives such as RWA and DePin.

Real World Assets (RWA) and Decentralized Physical Infrastructure (DePin) are two sectors that are gaining traction and could become the center of attraction soon enough.

RWA And DePin Take Over From Meme Coins And NFTs

Asset tokenization continues to be widely discussed, with BlackRock’s CEO Larry Fink even referring to it as the “next generation for markets.” This has put more focus on RWA projects, which are bringing this concept to life. Basically, these projects are tokenizing real-world assets like real estate, royalties, securities, contracts, ETFs, and art with the aid of blockchain technology.

This changes how investors interact with these assets since they will become more accessible and easier to trade. On accessibility, asset tokenization further promotes fractional ownership, which means that individuals can now own a share of assets they wouldn’t otherwise have the means to access.

With these assets being easier to trade, previously illiquid assets will become more liquid. Generally, all asset classes will become more liquid since there is expected to be an inflow of new money into all of them. That is why the RWA industry is projected to become a trillion-dollar market by 2030.

Meanwhile, it is worth noting that RWA projects will be the tunnel through which this liquidity will pass through. That is why crypto investors should pay more attention to them and look to position themselves accordingly.

Like the RWA industry, the DePin market also boasts great potential. As the name suggests, these projects, with the aid of blockchain technology and tokenization, manage their physical infrastructure in a decentralized manner. These physical infrastructures include telecommunications, health systems, power grids, and road networks.

Unlike traditional companies, these projects’ decentralized mode of operation helps simplify their operations and reduce their operating costs. Meanwhile, this business model is also a win for their users, as they are incentivized (with tokens) to contribute to the services these projects provide.

Given such massive potential, the narrative shift from meme coins and NFTs to these RWA and DePin projects is expected to happen sooner rather than later. In fact, these projects could already be the leading narratives, seeing how they have recently achieved more success than meme coins and NFT projects in this cycle.

Crypto expert Michaël van de Poppe called this correctly, as before the Bitcoin Halving took place, he mentioned that there would be a narrative shift to RWA and DePin projects after the Halving.

ETFSwap (ETFS) Presale Sees Increased Demand

The ETFSwap (ETFS) token presale is already seeing increased demand, with crypto investors turning their attention to RWA and DePin projects. ETFS is the native token of ETFSwap, a decentralized finance (DeFi) platform that enables on-chain trading of exchange-traded funds (ETFs).

That explains why investors are rushing to accumulate as many ETFSwap (ETFS) tokens as possible since the platform is already ranked as one of the most promising RWA projects.

Meanwhile, with RWA and DePin projected as the next big things in the crypto space, the ETFSwap (ETFS) is an instant pick as one of the tokens likely to run hard in this market cycle. Experts have also predicted impressive price gains for the crypto token in particular, saying it could rise as Shiba Inu (SHIB) did in 2021.

They say this is possible because ETFSwap (ETFS) has many bullish narratives working in its favor. Besides the RWA narrative, ETFSwap will offer ETFs like the Spot Bitcoin ETF, which has already gained a lot of attention in the crypto space since launching.

Furthermore, staking rewards have recently become more attractive to investors looking for passive income. ETFSwap (ETFS) is set to stand out in this regard since it provides attractive yields that are second to none.

Privacy concerns also continue to be raised in the crypto space, with users complaining that many projects are not truly decentralized and do not protect users’ data. This plays out in ETFSwap’s (ETFS) favor since the platform prioritizes its users’ privacy above anything else. For instance, Know-Your-Customer (KYC) requirements are non-mandatory on the platform, so users do not have to worry about sharing sensitive data or their information being tracked and leaked.

So far, over 30 million ETFSwap (ETFS) tokens have been sold in stage 1 of the ongoing presale. This presale stage is still ongoing, and each token costs $0.00854. However, with the increased demand for these tokens, they are expected to sell out even before the scheduled end date.

For more information about the ETFS Presale:

Source link

Altcoins

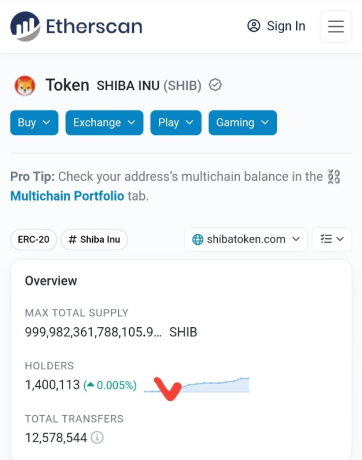

Shiba Inu (SHIB) Price Jumps On Growing Support From 1.4 Million Holders

Published

1 week agoon

April 20, 2024By

adminShiba Inu (SHIB), the self-proclaimed “Dogecoin Killer,” is making headlines again. After a rollercoaster year in 2023, the canine-themed meme coin is exhibiting signs of life in the first half of 2024.

With a growing holder base, a strategic support network, and a recent price jump, SHIB seems poised for a potential climb. However, lingering sell pressure and the ever-present shadow of its all-time high keep investors cautious.

Shiba Inu Finds Strength In Numbers

SHIB’s popularity continues to rise. The number of Shiba Inu holders on the Ethereum blockchain has surpassed a staggering 1.4 million, a new milestone that reflects the coin’s expanding reach.

This surge in holders indicates a growing community of believers in SHIB’s potential, potentially translating to a more stable and resilient market presence.

#Shiba holders reaching 1.4M

mark 🔥🔥🔥

We just grow,only up!!!#Shibarium #shib #bone #leash #crypto #ShibaSwap #ShibTheMetaverse #btc #eth # pic.twitter.com/Ha1R7phBOt— SHIBKIND 🔥 (@SHIBKIND) April 19, 2024

Shiba Inu Establishes Support System For Price Stability

Beyond the expanding holder base, SHIB has built a strategic support system that could act as a safety net in case of price fluctuations. These zones, dubbed “support clusters,” sit at $0.00001 and $0.000014, and concentrate buying pressure zones.

Essentially, a significant number of holders originally bought Shiba Inu at these price points, meaning a large number of tokens would be bought again if the price dips below these levels.

Total crypto market cap currently at $2.259 trillion. Chart: TradingView

Additionally, data suggests that a large portion of current SHIB holders are in profit. This metric, often visualized as “In & Out of the Money” by blockchain analysis tools, incentivizes them to hold onto their tokens rather than sell at a loss.

Shiba Inu Still Barks For Its All-Time High

Despite the positive developments, a cloud of caution hangs over SHIB. The current price sits comfortably above the aforementioned support clusters, but it remains significantly lower than its all-time high of $0.00008616, reached in the meme coin frenzy of 2021.

Furthermore, while the recent price increase is encouraging, there’s still more sell pressure than buy pressure in the spot markets. This imbalance suggests that some investors are eager to cash out, potentially hindering a sustained price surge.

The Road Ahead For The Meme Coin

Shiba Inu’s future remains uncertain. While the recent developments paint a cautiously optimistic picture, the meme coin market is notoriously volatile. The success of SHIB hinges on several factors beyond its current holder base and support structure.

Continued positive developments in the broader cryptocurrency market, increased utility for the SHIB token itself, and a potential reduction in sell pressure are all crucial for a sustained price increase.

Featured image from Pexels, chart from TradingView

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Source link

Bitcoin

Everything You Need to Know When Using a Digital Currency Exchange – Blockchain News, Opinion, TV and Jobs

Published

1 week agoon

April 20, 2024By

admin

The crypto market is currently in another bull cycle. Bitcoin recently hit an all-time high price of $73,800. There are also hundreds of meme coins booming and busting in quick succession. Of course, you very likely already know this. And this is a testament to how much cryptocurrencies have permeated society and changed how we perceive and manage financial assets.

Much of this has been made possible by digital currency exchanges that provide platforms for billions of people worldwide to trade and invest in cryptocurrencies—at transaction speeds that even the traditional financial system is still only catching up to. Here’s an example of such an exchange: https://www.independentreserve.com/au.

However, as it is with any financial venture, these exchanges come with a unique set of risks and challenges. For anyone looking to navigate the crypto market, and hopefully participate in the bull season, it is crucial to understand these intricacies.

Why are Digital Currency Exchanges Necessary?

Crypto exchanges act as intermediaries and facilitate the trade of digital assets like Bitcoin and other cryptocurrencies. They provide a structured marketplace that is usually intuitive enough to be navigated by both seasoned traders and newcomers alike.

Additionally, these also typically offer analytical tools, and real-time market data and sometimes even help provide educational resources to assist users in making informed decisions in trading their cryptocurrencies.

What Are These Risks And Challenges?

However, the purpose of this article is to get into the risks and challenges that are associated with these exchanges. So, let us get into them:

The Markets are Quite Volatile

Volatility risk is not exactly directly tied to crypto exchanges. However, it bears mentioning, as these exchanges are the main arenas where crypto transactions take place. These fluctuations typically occur in mere seconds, leading to either high gains or heavy losses. This volatility is usually caused by a variety of factors including announcements from regulatory bodies or government leaders or random shifts in market sentiments.

As an investor, you need to learn how to navigate these turbulent waters with the care of an expert captain; developing a system that allows you to make quick movements in your portfolio, in adapting to market changes. Essentially, the markets are unpredictable, so you have to keep your ear to the ground. To do this, you need to switch on news alerts for the keywords that are often included in the news headlines that typically move the markets.

Many crypto exchanges come with features like this that alert you to market-moving events; so it may be wise to consider that as a factor in selecting which exchange to use. However, you also need to develop your independent systems for monitoring these trends.

There are Legal and Regulatory Risks

Another area with a lot of risks is the legal and regulatory aspects of things. The crypto market is relatively new, and hence the legal frameworks are largely nascent and evolving or even non-existent. From countries like el-Salvador where crypto adoption is encouraged by the government to countries like China, where it is permanently banned; regulatory attitudes vary widely. And sometimes, even within the same country, attitudes can shift, depending on internal political cycles.

This inconsistency can make compliance a complex affair. For example, in Nigeria, Binance suddenly got banned by the government, even after several government figures had indicated an interest in encouraging the growth of crypto in the country. This inconsistency also introduces a layer of uncertainty that can influence market behavior and price movement.

So, as an investor, it is quite important that you also keep an eye out for regulatory changes in the jurisdiction that you operate in. But, it is even more imperative that you find measures to insulate yourself and your assets from the reach of the regulatory agencies in your country.

There are Always Security Concerns

As it is with anything else in this digital era, the threat of security breaches looms large over crypto exchanges. While most exchanges typically have an array of innovative protective measures, hackers and their tactics are also always evolving and getting more sophisticated.

Unfortunately, the consequences of one successful breach are usually enough to cause significant damage to both exchanges and individual investors; and make insignificant the efforts of the security systems in place in stopping a thousand earlier threats.

Anyway, it is important for you as an investor to research the security measures employed by the various exchanges before choosing one. We have said that security threats are ever-evolving, but it is still always best to be on the side that is always on top of its game when it comes to security. You want to look out for encryption protocols, cold storage solutions, and rigorous security audits.

However, the role of personal vigilance cannot be overemphasized. While it is great to trade with an exchange with cutting-edge security measures, you can also personally deploy strategies like using complex, unique passwords and employing two-factor authentication.

Liquidity is Paramount

This is particularly important if you’re one of those who like to take advantage of meme coins that can see growths in thousands of percentages. Whether your coin gains 180% or 18,000%, it only matters if there are enough other traders in the market who are willing to buy it from you in exchange for other crypto coins or fiat. That is what liquidity is — your avenue to exit and take profit from a trade.

Exchanges that have low liquidity may expose you to the risk of slippage, which is when the final executed price of a trade diverges significantly from the expected price at the time the order was placed. These discrepancies can erode trading margins, and impact your profitability. So, you need to opt for exchanges that are known for substantial trading volumes to mitigate against possible liquidity problems.

Why you need Diversification to Mitigate Risks

There are many strategies that you can employ to mitigate risks, but like anyone will tell you, your top option is to diversify your holdings. Diversification can take varying forms. It can mean holding a varied range of cryptocurrencies across the industry—rather than focusing on only one token, as a way to shield yourself from the extreme volatility of the markets. It can also mean holding your assets in a variety of wallets and other storage options, to protect them from cyber-attacks.

Either way, diversification enables the spreading of potential risks, ensuring that the impact of one negative event does not necessarily wipe out your portfolio.

Conclusion

The global crypto markets are very volatile and can be fraught with a lot of security threats and other dangerous problems. However, it has also emerged as the greatest financial invention of the current century; as it has made more millionaires than any system before it.

However, it is always important for you as an investor to keep an eye on the market, and to arm yourself with the knowledge of various strategies to protect yourself from the pitfalls that abound in the ecosystem.

Do your own research, thoroughly, remain adaptable, and practice enhanced cybersecurity measures.

Source link

Russian Authorities Introduce New Restrictions on Cryptocurrency To Prevent Ruble From Being Replaced: Report

CARV Announces Decentralized Node Sale to Revolutionize Data Ownership in Gaming and AI – Blockchain News, Opinion, TV and Jobs

Yue Minjun Revolutionizes Bitcoin Art Scene with Pioneering Ordinals Collection on LiveArt – Blockchain News, Opinion, TV and Jobs

Sui Teams Up with Google Cloud to Drive Web3 Innovation with Enhanced Security, Scalability and AI Capabilities

Fantasy Metaverse Darklume – Presale is LIVE – Blockchain News, Opinion, TV and Jobs

XRP Can This 23 Million Token Purchase Spark A Rally?

Legendary Trader Peter Brandt Says Bitcoin Has 25% Chance of Hitting $160,000 – Here’s His Timeline

Ethereum Price Topside Bias Vulnerable If It Continues To Struggle Below $3.5K

Ethereum Showing Serious Strength as One Low-Cap Altcoin Flashes Bullish Signal for First Time Since 2022: Analyst

Ethereum Flashes Bullish Signals, Can It Rally 50% From Here?

Consensys Takes Legal Action Against SEC to Safeguard U.S. Ethereum Community – Blockchain News, Opinion, TV and Jobs

Billion-Dollar Bank Paying $700,000 Penalty for Illegally Freezing Accounts, Transferring Customers’ Cash to Debt Collectors

MetaWin Founder Launches $ROCKY Meme Coin on Base Network – Blockchain News, Opinion, TV and Jobs

Forget Meme Coins And NFTs, RWA And DePin Are The Next Big Things – Blockchain News, Opinion, TV and Jobs

Successful Beta Service launch of SOMESING, ‘My Hand-Carry Studio Karaoke App’

Bitcoin Dropped Below 2017 All-Time-High but Could Sellers be Getting Exhausted? – Blockchain News, Opinion, TV and Jobs

What does the Coinbase Premium Gap Tell us about Investor Activity? – Blockchain News, Opinion, TV and Jobs

BNM DAO Token Airdrop

NFT Sector Keeps Developing – Number of Unique Ethereum NFT Traders Surged 276% in 2022 – Blockchain News, Opinion, TV and Jobs

New Minting Services

Block News Media Live Stream

A String of 200 ‘Sleeping Bitcoins’ From 2010 Worth $4.27 Million Moved on Friday

SEC’s Chairman Gensler Takes Aggressive Stance on Tokens – Blockchain News, Opinion, TV and Jobs

Friends or Enemies? – Blockchain News, Opinion, TV and Jobs

Enjoy frictionless crypto purchases with Apple Pay and Google Pay | by Jim | @blockchain | Jun, 2022

Block News Media Live Stream

Block News Media Live Stream

How Web3 can prevent Hollywood strikes

XRP Explodes With 1,300% Surge In Trading Volume As crypto Exchanges Jump On Board

Block News Media Live Stream

Trending

Altcoins2 years ago

Altcoins2 years agoBitcoin Dropped Below 2017 All-Time-High but Could Sellers be Getting Exhausted? – Blockchain News, Opinion, TV and Jobs

Binance2 years ago

Binance2 years agoWhat does the Coinbase Premium Gap Tell us about Investor Activity? – Blockchain News, Opinion, TV and Jobs

- Uncategorized2 years ago

BNM DAO Token Airdrop

BTC1 year ago

BTC1 year agoNFT Sector Keeps Developing – Number of Unique Ethereum NFT Traders Surged 276% in 2022 – Blockchain News, Opinion, TV and Jobs

- Uncategorized2 years ago

New Minting Services

Video2 years ago

Video2 years agoBlock News Media Live Stream

Bitcoin miners2 years ago

Bitcoin miners2 years agoA String of 200 ‘Sleeping Bitcoins’ From 2010 Worth $4.27 Million Moved on Friday

Bitcoin1 year ago

Bitcoin1 year agoSEC’s Chairman Gensler Takes Aggressive Stance on Tokens – Blockchain News, Opinion, TV and Jobs