Bitcoin

Analyst Reveals Bitcoin’s Bull Market Breakthrough: Here’s What You Need To Know

Published

2 weeks agoon

By

admin

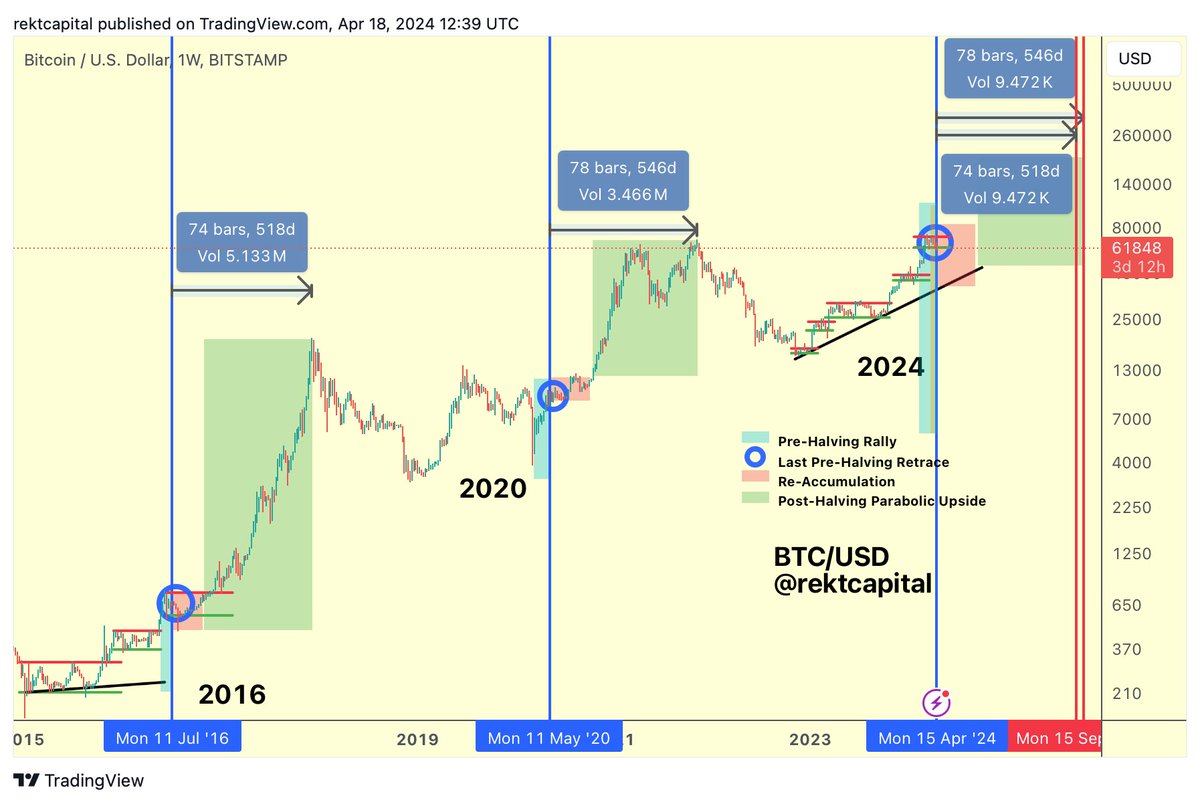

In a recent tweet, well-known crypto analyst Rekt Capital delved into the potential timeline for the next Bitcoin market peak, emphasizing the Halving cycle’s significant impact on building BTC’s market path.

As the Bitcoin Halving is set to occur between today and tomorrow, April 20, Bitcoin has shown less significant market movement. At the time of writing, the asset has a market price of $64,578.

Analyst: ‘When Could Bitcoin Peak In This Bull Market?’

According to Rekt Capital’s analysis, Bitcoin typically reaches its bull market peak between 518 and 546 days following a Halving event. Applying this historical timeline, the next anticipated bull market peak could fall between mid-September and mid-October 2025.

However, as disclosed by Rekt Capital, recent market trends suggest a possible acceleration in Bitcoin’s ongoing cycle compared to historical patterns, demonstrated by the cryptocurrency achieving new record levels approximately 260 days ahead of the typical schedule.

Despite this apparent acceleration, Rekt Capital noted:

Bitcoin has been experiencing a Pre-Halving Retrace for the past month or so As a result, Bitcoin has been slowing down and decelerating the cycle by 30 days thus far and counting So while Bitcoin may have been accelerating by ~260 days last month… Today this acceleration is now more close to ~230 days due to the current Pre-Halving Retrace.

Additionally, Rekt Capital introduced an alternative viewpoint termed the “Accelerated Perspective,” which factors in the duration from when Bitcoin exceeds its previous peak to the projected culmination of the bull market.

Given Bitcoin’s recent attainment of new all-time highs in March, this perspective implies that the subsequent bull market peak could happen between December 2024 and February 2025.

When Could Bitcoin Peak In This Bull Market?

Historically, Bitcoin has peaked in its Bull Market 518-546 days after the Halving (Chart 1)

This is how typical Bitcoin Halving Cycles have progressed

So if history repeats…

Next Bull Market peak may occur 518-546 days… pic.twitter.com/QXZUS7ZyjU

— Rekt Capital (@rektcapital) April 19, 2024

BTC Price Dynamics Amidst Market Fluctuations

Meanwhile, amidst recent market fluctuations, BTC is undergoing a slight recovery. At the time of writing, it had increased marginally by 1.4%, bringing its market price to above $64,000. This recovery follows a week-long decline during which Bitcoin experienced nearly a 10% downturn.

In light of these developments, crypto expert Michaël van de Poppe has shared insights into the potential implications of the impending BTC Halving event. Van de Poppe suggests a shift in focus away from Bitcoin once the halving occurs, speculating on potential changes in market narratives.

While he did not specify the exact narrative shift, Van de Poppe previously outlined expectations for the crypto market, including an anticipated emphasis on Ethereum (ETH) and projects focused on Decentralized Physical Infrastructure Networks (DePIN) and Real World Assets (RWA) post-Halving.

Expectance:

– #Bitcoin to consolidate.

– #Altcoins bouncing in their Bitcoin pairs.

– Narrative to shift to ETH and DePIN/RWA.

– Altcoin strength from in Q2/Summer.

– Corrections in Q3.It’s going to be great, just buy the dip.

— Michaël van de Poppe (@CryptoMichNL) April 17, 2024

Featured image from Unsplash, Chart from TradingView

Source link

You may like

Is Ethereum Back? Record 267,000 New Users Spark Speculation

Economist Alex Krüger Goes ‘Max Long’ on Crypto Positions – Here Are His Altcoin Picks

Crypto Investors Bet Big On ETFSwap (ETFS) Presale To Leverage Spot Bitcoin ETFs Popularity – Blockchain News, Opinion, TV and Jobs

Bitbot’s Presale Passes $3M After AI Development Update – Blockchain News, Opinion, TV and Jobs

Dogecoin Breaks Out Of Descending Triangle Like It Did In 2021, Analyst Sets $6 Target

Bitcoin Cash (BCH) Backer Roger Ver Arrested and Charged With Evading Nearly $50,000,000 in Taxes

Altcoins

Economist Alex Krüger Goes ‘Max Long’ on Crypto Positions – Here Are His Altcoin Picks

Published

8 hours agoon

May 3, 2024By

admin

Popular trader and economist Alex Krüger says he’s currently “max long” on the crypto market.

Krüger tells his 173,800 followers on the social media platform X that he’s hedged and unhedged multiple times but he’s now max long in “very concentrated positions.”

The economist notes that he’s looking to “de-risk” soon. However, he acknowledges that Bitcoin (BTC) could drop as low as $52,000 after plunging below $59,000. BTC is trading at $57,093 at time of writing and is down more than 4.5% in the past 24 hours.

Explains Krüger,

“I’m not immune to bear raids. My bigger picture view has not changed: new ATHs later in the year (for Bitcoin). End-of-cycle views make little sense to me. A correction was to be expected.”

The economist also notes that he has positions in the layer-1 blockchains Solana (SOL), Toncoin (TON), Aptos (APT) and Core (CORE), as well as the decentralized data storage protocol Arweave (AR) and Bittensor (TAO), a decentralized blockchain platform that focuses on machine learning and AI.

Krüger adds that APT, CORE, AR and TAO are “much higher risk” than SOL and TON.

The economist also notes that Bitcoin had a bearish response to Wednesday’s U.S. Federal Open Market Committee (FOMC) statement.

“Very rare for price to reverse in full right after the press conference is over. And bearish, as the FOMC was dovish. And now you have trapped intraday longs. The one silver lining is BTC is trading in line with equities.”

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney

Source link

AI crypto

Crypto Investors Bet Big On ETFSwap (ETFS) Presale To Leverage Spot Bitcoin ETFs Popularity – Blockchain News, Opinion, TV and Jobs

Published

11 hours agoon

May 2, 2024By

admin

Crypto investors are now moving to the ongoing ETFSwap (ETFS) presale as Spot Bitcoin ETFs surge in popularity.

Crypto investors are now looking into ETFSwap (ETFS) amidst surging interest in Spot Bitcoin ETFs. With ETFSwap (ETFS), users can access both decentralized finance (DeFi) and the conventional exchange-traded fund (ETF) market without having to purchase any assets directly.

Investors can profit from a closer integration between these two markets by trading and using particular platform features with different tokenized ETFs. These tokenized exchange-traded funds (ETFs) replicate the performance of significant institutional cryptocurrency ETFs, such as Blackrock’s IBIT, which oversees $17.6 billion in assets.

Increasing Crypto Investor Confidence In Spot Bitcoin ETFs

The emergence of numerous cryptocurrency exchange-traded funds (ETFs) has been a notable development in the market thus far. Spot Bitcoin ETFs in particular, have now taken a majority of the market share of crypto ETFs. The ETFs went live immediately after they gained approval from the US Securities and Exchange Commission (SEC) in January and now represent 90% of the market share of daily trading activity for ETFs that provide price exposure to bitcoin.

In this regard, ETFSwap (ETFS) has distinguished itself as a top-notch DeFi platform, breaking into the ETF investing world. At the core of its model, ETFSwap (ETFS) is a DeFi platform that is revolutionizing the world of ETF investments. ETFSwap (ETFS) is built on blockchain technology, allowing it to provide a seamless ETF investing experience for both institutional and retail investors.

The ETFSwap (ETFS) platform is equipped with many tokenized ETFs of precious metals, cryptocurrencies, commodities, and ETFs tracking fixed-income investment vehicles. These tokenized ETFs can be easily bought and sold like conventional ETFs, albeit with cryptocurrencies on the ETFSwap (ETFS) platform.

Notably, ETFSwap’s (ETFS) use of blockchain technology buffed the platform’s security and transparency, making it impossible for third parties and middlemen to interfere. As a result, investors can start trading easily without having to undergo KYC registrations. Investors only need to connect their digital wallets to the platform and start trading tokenized ETFs 24/7.

Another key perk of the ETFSwap (ETFS) platform is the ability of users to trade fractionalized ETF shares with up to 10X leverage, a feature extremely appealing to retail investors.

Taking into account these impressive features and the long-term objective of ETFSwap (ETFS) within the surging popularity of Spot Bitcoin ETFs, crypto investors are now looking to position themselves on the platform. This interesting potential and bullish sentiment has allowed ETFSwap (ETFS) to easily raise $750,000 within 72 hours of its private funding round, which has also flowed into its ongoing presale.

Expectations And Investor Sentiment Toward ETFSwap

ETFSwap (ETFS) is currently in its presale round, where 4almost 0% of the total circulating supply of its utility token ETFS has already been sold to early investors. As a utility token, ETFS unlocks many utilities and benefits within the ETFSwap (ETFS) ecosystem and, consequently within the world of ETF investments.

Some of these benefits include staking rewards, lower fees, trading discounts, and an APR of up to 87%. Interestingly, presale data shows crypto investors are maneuvering to get their hands on ETFS. The demand for the ETFSwap (ETFS) token has been exceptional, with over 30 million tokens sold already.

The first presale round initial presale is still selling for $0.00854 per token, and participants can get an 18% bonus on their purchase. On the other hand, it is anticipated that the next presale stage will sell for $0.01831 per ETFS, and reaching the $1 mark is expected once it lists on major exchanges, which is an 100x increase.

Conclusion: Take Action In ETFS Presale

The crypto industry is home to different calibers of investors who are searching for potential projects to invest in and places to increase their portfolios. As a result, the recent immense popularity of Spot Bitcoin ETFs’ has placed ETFSwap (ETFS) in the limelight for investors looking to invest in ETFs. The ongoing ETFS presale is a great place to start as it offers investors a calculated way to enter the expanding cryptocurrency sector, and presale data suggests the earlier, the better. Due to the urgency created by limited availability, investors are encouraged to lock up their positions before allocations run out.

For more information about the ETFS Presale:

Source link

Altcoins

Bitcoin Cash (BCH) Backer Roger Ver Arrested and Charged With Evading Nearly $50,000,000 in Taxes

Published

16 hours agoon

May 2, 2024By

admin

A prominent early Bitcoin (BTC) investor was arrested in Spain over the weekend for allegedly evading $50 million worth of US taxes.

Roger Ver, a noted supporter of Bitcoin Cash (BCH), faces charges including mail fraud, tax evasion and filing false tax returns, according to a new announcement from the U.S. Department of Justice (DOJ).

US authorities hope to extradite the crypto veteran, who has faced multiple lawsuits from other businesses in the crypto space in the past.

Ver, who’s nicknamed “Bitcoin Jesus” for his outspoken early praise of BTC, allegedly obtained citizenship in St. Kitts and Nevis in February 2014 and renounced his US citizenship shortly afterward.

The DOJ’s indictment indicates Ver owned two companies, MemoryDealers.com Inc. and Agilestar.com Inc. Between his personal portfolio and the two companies’ holdings, the crypto veteran in February 2014 owned approximately 131,000 Bitcoin at an average price of $871 per BTC.

Explains the DOJ,

“As a result of his expatriation, Ver allegedly was required under US law to file tax returns that reported capital gains from the constructive sale of his worldwide assets, including the Bitcoins, and to report the fair market value of his assets. He was also allegedly required to pay a tax – referred to as an “exit tax” – on those capital gains.”

Ver hired a lawyer and appraiser to help him prepare tax returns for his expatriation but allegedly provided both with false information designed to conceal the true amount of Bitcoin he owned.

He allegedly took possession of 70,000 BTC from his two companies in 2017 and sold tens of thousands of them for approximately $240 million in cash. The DOJ says Ver was required to pay tax on certain distributions from his companies, like dividends, even though he was no longer a US citizen.

The crypto veteran allegedly owes the U.S. Internal Revenue Service (IRS) at least $48 million.

Despite the “Bitcoin Jesus” moniker, Ver eventually soured on BTC and switched his allegiance to Bitcoin Cash, referring to the top crypto asset in 2020 as “just basically a pyramid scheme.”

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney

Source link

Is Ethereum Back? Record 267,000 New Users Spark Speculation

Economist Alex Krüger Goes ‘Max Long’ on Crypto Positions – Here Are His Altcoin Picks

Crypto Investors Bet Big On ETFSwap (ETFS) Presale To Leverage Spot Bitcoin ETFs Popularity – Blockchain News, Opinion, TV and Jobs

Bitbot’s Presale Passes $3M After AI Development Update – Blockchain News, Opinion, TV and Jobs

Dogecoin Breaks Out Of Descending Triangle Like It Did In 2021, Analyst Sets $6 Target

Bitcoin Cash (BCH) Backer Roger Ver Arrested and Charged With Evading Nearly $50,000,000 in Taxes

AppLayer Unveils Fastest EVM Network and $1.5M Network Incentive Program – Blockchain News, Opinion, TV and Jobs

Whales Dive In, But Dogecoin Price Sinks 20%: What’s Going On?

Humanode, a blockchain built with Polkadot SDK, becomes the most decentralized by Nakamoto Coefficient – Blockchain News, Opinion, TV and Jobs

Here’s When Bitcoin Could Halt the ‘Slide’ and Start To Pump, According to On-Chain Analytics Firm Santiment

Ethereum Price Revisits Key Support, Can Bears Take Over?

Solana Co-Founder Says Cosmos and One SOL Rival Are Clear Winners in Building Sovereign Blockchains

Achieves Record Net Profit Of $4.5 Billion In Q1

Ripple Forms Partnership With Tokyo Unit of $1,200,000,000 Firm To Push for XRPL-Powered Solutions in Japan

Nektar Network begins Epoch 1 of Nektar Drops

Bitcoin Dropped Below 2017 All-Time-High but Could Sellers be Getting Exhausted? – Blockchain News, Opinion, TV and Jobs

What does the Coinbase Premium Gap Tell us about Investor Activity? – Blockchain News, Opinion, TV and Jobs

BNM DAO Token Airdrop

NFT Sector Keeps Developing – Number of Unique Ethereum NFT Traders Surged 276% in 2022 – Blockchain News, Opinion, TV and Jobs

New Minting Services

Block News Media Live Stream

A String of 200 ‘Sleeping Bitcoins’ From 2010 Worth $4.27 Million Moved on Friday

SEC’s Chairman Gensler Takes Aggressive Stance on Tokens – Blockchain News, Opinion, TV and Jobs

Friends or Enemies? – Blockchain News, Opinion, TV and Jobs

Enjoy frictionless crypto purchases with Apple Pay and Google Pay | by Jim | @blockchain | Jun, 2022

Block News Media Live Stream

How Web3 can prevent Hollywood strikes

Block News Media Live Stream

XRP Explodes With 1,300% Surge In Trading Volume As crypto Exchanges Jump On Board

Block News Media Live Stream

Trending

Altcoins2 years ago

Altcoins2 years agoBitcoin Dropped Below 2017 All-Time-High but Could Sellers be Getting Exhausted? – Blockchain News, Opinion, TV and Jobs

Binance2 years ago

Binance2 years agoWhat does the Coinbase Premium Gap Tell us about Investor Activity? – Blockchain News, Opinion, TV and Jobs

- Uncategorized2 years ago

BNM DAO Token Airdrop

BTC1 year ago

BTC1 year agoNFT Sector Keeps Developing – Number of Unique Ethereum NFT Traders Surged 276% in 2022 – Blockchain News, Opinion, TV and Jobs

- Uncategorized2 years ago

New Minting Services

Video2 years ago

Video2 years agoBlock News Media Live Stream

Bitcoin miners2 years ago

Bitcoin miners2 years agoA String of 200 ‘Sleeping Bitcoins’ From 2010 Worth $4.27 Million Moved on Friday

Bitcoin1 year ago

Bitcoin1 year agoSEC’s Chairman Gensler Takes Aggressive Stance on Tokens – Blockchain News, Opinion, TV and Jobs