Altcoins

Analyst Says Next Leg up Incoming for Altcoins, Updates Outlook on Solana and Two Other Crypto Assets

Published

1 month agoon

By

admin

A popular crypto trader believes altcoins are on the verge of big rallies after a pullback in the digital assets market.

The pseudonymous analyst known as Altcoin Sherpa tells his 212,400 followers on the social media platform X that Render (RNDR), a project related to Graphics Processing Units (GPUs), seems to be consolidating in preparation for a breakout.

He says many altcoins are forming similar bullish price patterns with consolidation in a broader uptrend as shown in Render’s chart.

“RNDR: you know, a lot of good charts have this same type of price action. I think now is a great time to scale into many altcoins that you like and just sit on them. The next leg seems like it’s going to come in the next few weeks.”

Render is trading for $11.18 at time of writing, up nearly 2% in the last 24 hours.

Next up, the trader predicts that Ethereum (ETH) competitor Solana (SOL) could dip to the 0.382 Fibonacci retracement level before rallying.

“SOL: I think this remains a good area to buy and scale in. Would DCA (dollar cost average) from here to $140 personally.”

Solana is trading for $189.84 at time of writing, up more than 4% in the last 24 hours.

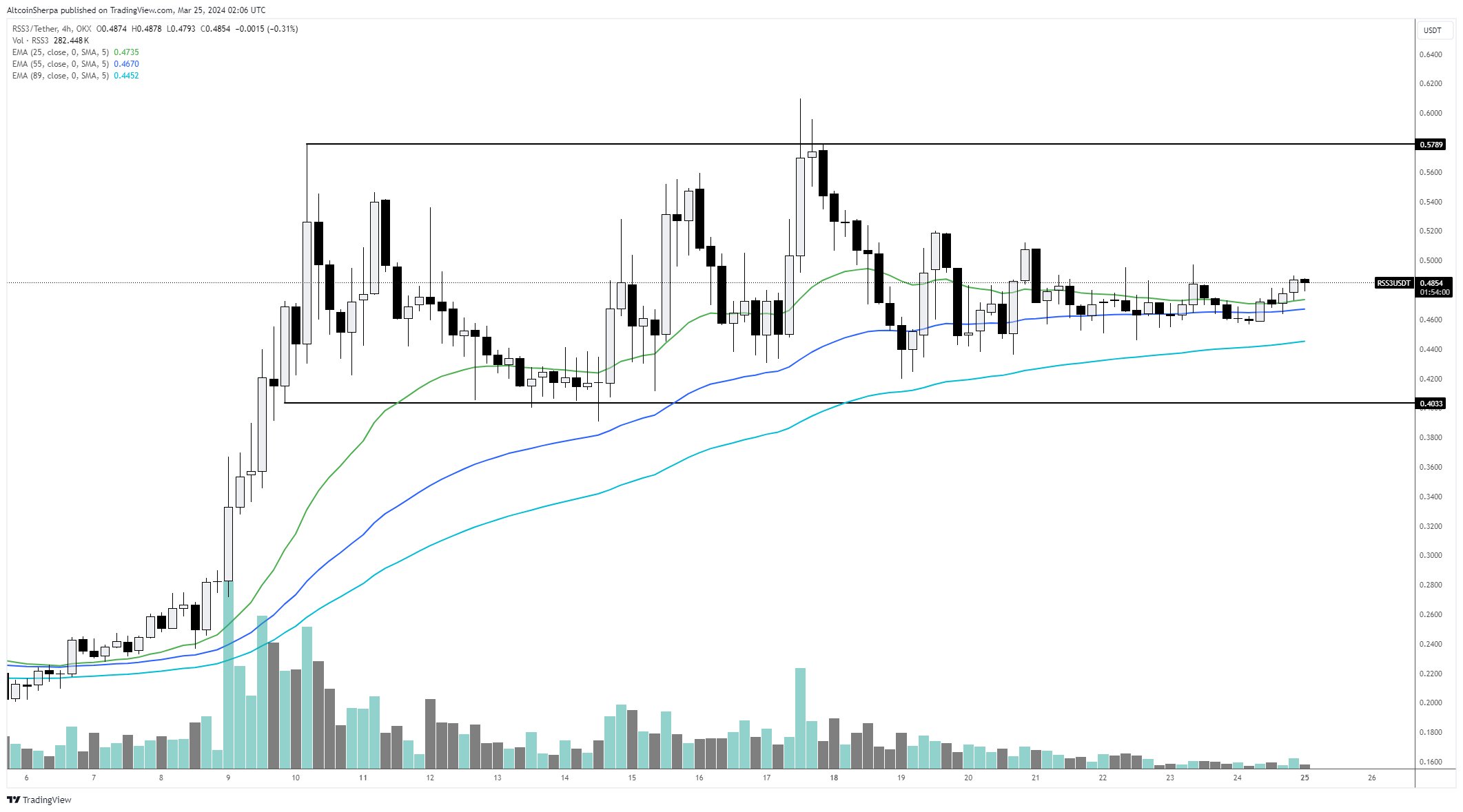

The trader is also bullish on RSS3 (RSS3), a decentralized information processing protocol.

“RSS3 is consolidating here in my opinion. I think the next leg is coming. In this one personally and have a node. Bullish.”

RSS3 is trading for $0.523 at time of writing, up over 8% in the last 24 hours.

Lastly, the trader says that the layer-1 blockchain project Vanar Chain (VANRY) seems to be in a consolidation phase and could break out within weeks.

“VANRY: fibbed the entire move and it’s consolidating right at the .382 fib. I would like to see this continue chopping around here another few weeks to be honest; the longer the break, the stronger the next move. I’ve got a bag.”

Vanar Chain is trading for $0.28 at time of writing, up more than 4% in the last 24 hours.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any loses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney

Source link

You may like

Bitcoin Just Entered a ‘Second Danger Zone,’ Warns Crypto Analyst – Here Are His Targets

Forbes Unveils 20 Crypto ‘Zombies,’ Declares Ripple And XRP Among The Undead

Crypto Trader Issues Bitcoin Warning, Says Ethereum Liquid Staking Project Flashing Short-Term Bullish Signal

Crypto Analyst Predicts Massive Move For Bitcoin, What’s The Target?

Analyst Warns One Crypto Asset Category About To Face a Reckoning, Maps Path Forward for Bitcoin and Hedera

DOGE Price Prediction – Dogecoin Below $0.14 Could Spark Larger Degree Drop

Altcoins

Crypto Trader Issues Bitcoin Warning, Says Ethereum Liquid Staking Project Flashing Short-Term Bullish Signal

Published

10 hours agoon

April 27, 2024By

admin

A popular crypto trader says a liquid staking service for the Ethereum (ETH) blockchain is flashing a short-term bullish signal.

The analyst Ali Martinez tells his 60,600 followers on the social media platform X that the Tom DeMark (TD) Sequential indicator recently presented a buy signal on Lido DAO’s (LDO) 3-day chart.

“If LDO can hold above $1.85, we could see it rebound toward $3!”

Traders use the TD Sequential Indicator to predict potential trend reversals for tokens based on the closing prices of their 13 previous bars or candles.

LDO is trading at $2.05 at time of writing. The 63rd-ranked crypto asset by market cap is up 2.5% in the past week.

Martinez also updates his outlook on Bitcoin (BTC), noting that the top crypto asset presented two sell signals on the 12-hour chart.

“A death cross between the 50 and 100 SMA (simple moving average) and a red 9 candlestick from the TD Sequential.

If BTC falls below $63,300, brace for possible dives to $61,000 or even $59,000.”

A death cross occurs when the 50-day moving average crosses below the 200-day moving average, a sign that the asset could enter a more pronounced bear phase.

Bitcoin is trading at $64,676 at time of writing. The top-ranked crypto asset by market cap is up nearly 2% in the past week.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney

Source link

Altcoins

Analyst Warns One Crypto Asset Category About To Face a Reckoning, Maps Path Forward for Bitcoin and Hedera

Published

18 hours agoon

April 26, 2024By

admin

A widely followed cryptocurrency analyst and trader believes one type of crypto asset is about to implode.

The analyst pseudonymously known as Credible Crypto tells his 391,500 followers on the social media platform X that memecoins could suddenly collapse in value.

“Still a lot of salt in this space despite us being at new all-time high for BTC. Mainly because memes are the ‘only’ alts that have been pumping the last few months. Hearing lots of ‘this cycle is clearly different, it’s a meme supercycle’ etc. and ‘fundamentals don’t matter.’ Lots of people have lost hope on their non-meme alt holdings and the meme reply guys couldn’t be louder.

Three things:

1. We’re going so much higher with this market as a whole.

2. There’s a meme reckoning coming.

3. Other alts will get their turn, in time.”

Next up, the analyst says Bitcoin (BTC) could retest the lower $60,000 range before breaking through the upper trendline resistance.

“And there is our drop. Would like to see us go a bit lower here though before the reversal so ideally we aren’t done just yet. Watching to see how things develop.”

Bitcoin is trading for $64,496 at time of writing, up slightly in the last 24 hours.

Lastly, the analyst says Ethereum (ETH) competitor Hedera (HBAR) could increase more than 90% from the current value.

“Looking for something like this after completing a nice five wave impulse off the lows. Note the first step is a break in lower timeframe market structure to kick things into gear. After that if we can print a higher low we should be able to run it back to the highs.”

Hedera is trading for $0.11 at time of writing, down more than 2% in the last 24 hours.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: DALLE3

Source link

Altcoin

85% Of Altcoins In “Opportunity Zone,” Santiment Reveals

Published

1 day agoon

April 26, 2024By

admin

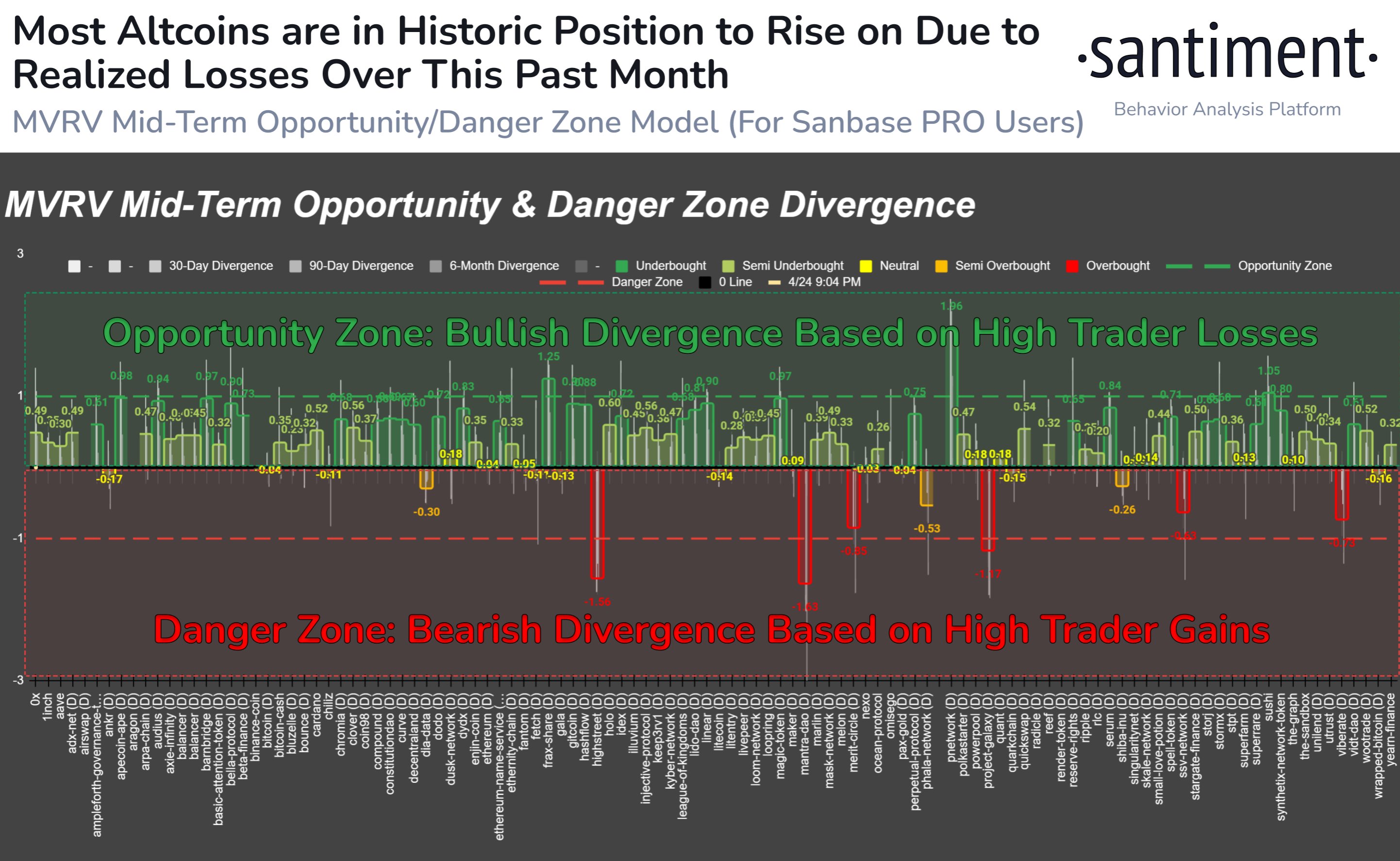

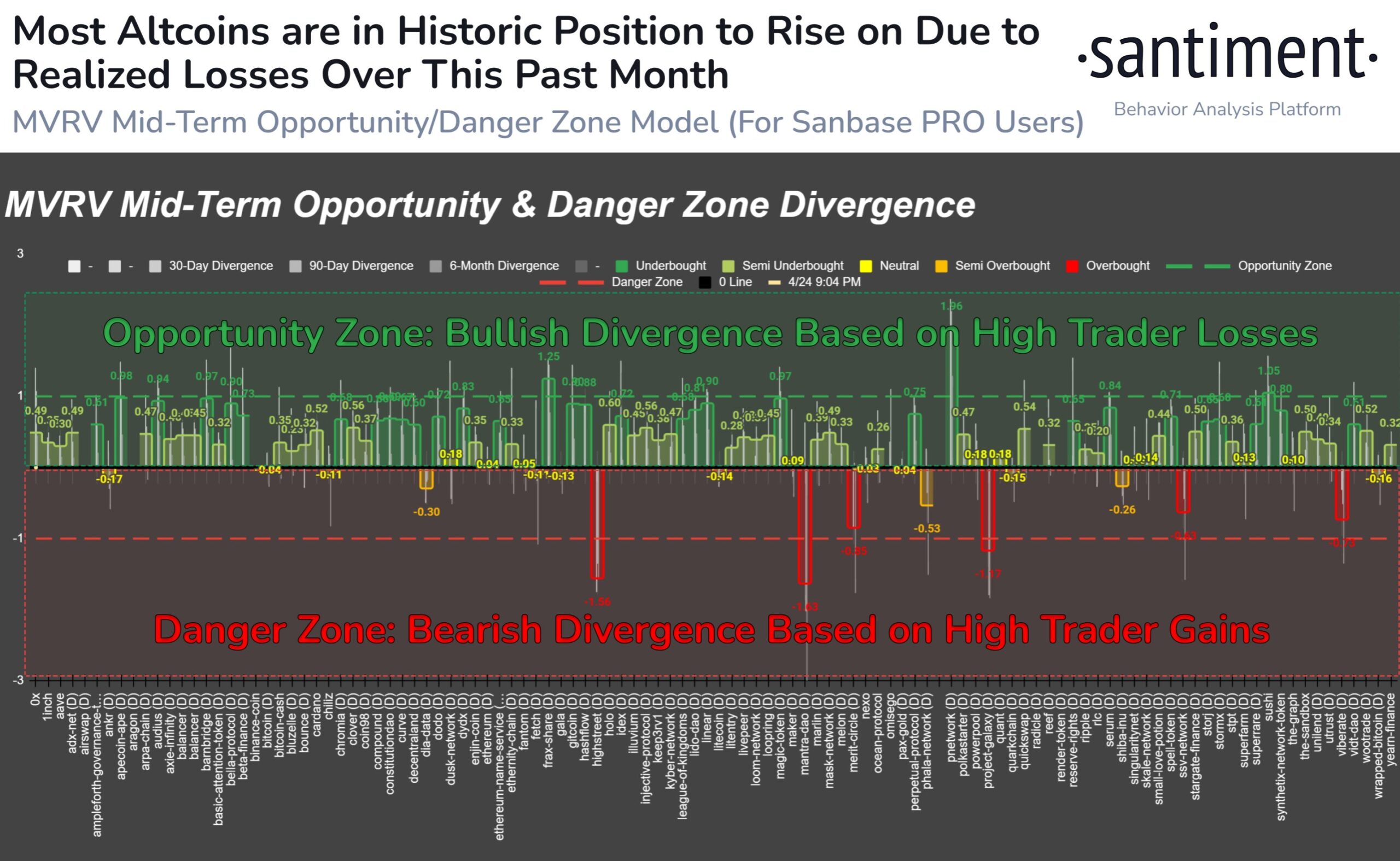

The on-chain analytics firm Santiment has revealed that over 85% of all altcoins in the sector are currently in the historical “opportunity zone.”

MVRV Would Suggest Most Altcoins Are Ready For A Bounce

In a new post on X, Santiment discussed how the altcoin market looks based on their MVRV ratio model. The “Market Value to Realized Value (MVRV) ratio” is a popular on-chain indicator that compares the market cap of Bitcoin against its realized cap.

The market cap here is the usual total valuation of the asset’s circulating supply based on the current spot price. At the same time, the latter is an on-chain capitalization model that calculates the asset’s value by assuming the “true” value of any coin in circulation is the last price at which it is transferred on the blockchain.

Given that the last transaction of any coin would have likely been the last time it changed hands, the price at its time would act as its current cost basis. As such, the realized cap essentially sums up the cost basis of every token in the circulating supply.

Therefore, one way to view the model is as a measure of the total amount of capital the investors have put into the asset. In contrast, the market cap measures the value holders are carrying.

Since the MVRV ratio compares these two models, its value can tell whether Bitcoin investors hold more or less than their total initial investment.

Historically, when investors have been in high profits, tops have become probable to form, as the risk of profit-taking can spike in such periods. On the other hand, a dominance of losses could lead to bottom formations as selling pressure runs out in the market.

Based on these facts, Santiment has defined an “opportunity” and “danger” zone model for altcoins. The chart below shows how the market currently looks from the perspective of this MVRV model.

The data for the MVRV divergence for the various altcoins | Source: Santiment on X

Under this model, when the MVRV divergence for any asset on some timeframe is higher than 1, the coin is considered to be inside the bullish opportunity zone. Similarly, if it is less than -1, it suggests it’s in the bearish danger zone.

The chart shows that MVRV divergence for a large part of the market is in the opportunity zone right now. As the analytics firm explains,

Over 85% of assets we track are in a historic opportunity zone when calculating the market value to realized value (MVRV) of wallets’ collective returns over 1-month, 3-month, and 6-month cycles.

Thus, if the model is to go by, now may be the time to go around altcoin shopping.

ETH Price

Ethereum, the largest among the altcoins, has observed a 3% surge over the past week, which has taken its price to $3,150.

Looks like the price of the asset has gone up over the last few days | Source: ETHUSD on TradingView

Featured image from Shutterstock.com, Santiment.net, chart from TradingView.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Source link

Bitcoin Just Entered a ‘Second Danger Zone,’ Warns Crypto Analyst – Here Are His Targets

Forbes Unveils 20 Crypto ‘Zombies,’ Declares Ripple And XRP Among The Undead

Crypto Trader Issues Bitcoin Warning, Says Ethereum Liquid Staking Project Flashing Short-Term Bullish Signal

Crypto Analyst Predicts Massive Move For Bitcoin, What’s The Target?

Analyst Warns One Crypto Asset Category About To Face a Reckoning, Maps Path Forward for Bitcoin and Hedera

DOGE Price Prediction – Dogecoin Below $0.14 Could Spark Larger Degree Drop

WhalesNight AfterParty 2024 – Blockchain News, Opinion, TV and Jobs

‘Violent to the Upside’: This Catalyst Could See Bitcoin Explode by up to 1,486%, Says Strike CEO Jack Mallers

85% Of Altcoins In “Opportunity Zone,” Santiment Reveals

Ethereum, Solana and Altcoins Approaching ‘Banana Zone,’ According to Macro Guru Raoul Pal – Here’s His Outlook

Bullish March Marks Record for Bitcoin – Blockchain News, Opinion, TV and Jobs

Why Is The Dogecoin Price Down Today?

The AI-Based Smart Contract Audit Firm “Bunzz Audit” Has Officially Launched – Blockchain News, Opinion, TV and Jobs

Successful Beta Service launch of SOMESING, ‘My Hand-Carry Studio Karaoke App’

dWallet Network brings multi-chain DeFi to Sui, featuring native Bitcoin and Ethereum – Blockchain News, Opinion, TV and Jobs

Bitcoin Dropped Below 2017 All-Time-High but Could Sellers be Getting Exhausted? – Blockchain News, Opinion, TV and Jobs

What does the Coinbase Premium Gap Tell us about Investor Activity? – Blockchain News, Opinion, TV and Jobs

BNM DAO Token Airdrop

NFT Sector Keeps Developing – Number of Unique Ethereum NFT Traders Surged 276% in 2022 – Blockchain News, Opinion, TV and Jobs

New Minting Services

Block News Media Live Stream

A String of 200 ‘Sleeping Bitcoins’ From 2010 Worth $4.27 Million Moved on Friday

SEC’s Chairman Gensler Takes Aggressive Stance on Tokens – Blockchain News, Opinion, TV and Jobs

Friends or Enemies? – Blockchain News, Opinion, TV and Jobs

Enjoy frictionless crypto purchases with Apple Pay and Google Pay | by Jim | @blockchain | Jun, 2022

Block News Media Live Stream

Block News Media Live Stream

How Web3 can prevent Hollywood strikes

XRP Explodes With 1,300% Surge In Trading Volume As crypto Exchanges Jump On Board

Block News Media Live Stream

Trending

Altcoins2 years ago

Altcoins2 years agoBitcoin Dropped Below 2017 All-Time-High but Could Sellers be Getting Exhausted? – Blockchain News, Opinion, TV and Jobs

Binance2 years ago

Binance2 years agoWhat does the Coinbase Premium Gap Tell us about Investor Activity? – Blockchain News, Opinion, TV and Jobs

- Uncategorized2 years ago

BNM DAO Token Airdrop

BTC1 year ago

BTC1 year agoNFT Sector Keeps Developing – Number of Unique Ethereum NFT Traders Surged 276% in 2022 – Blockchain News, Opinion, TV and Jobs

- Uncategorized2 years ago

New Minting Services

Video1 year ago

Video1 year agoBlock News Media Live Stream

Bitcoin miners2 years ago

Bitcoin miners2 years agoA String of 200 ‘Sleeping Bitcoins’ From 2010 Worth $4.27 Million Moved on Friday

Bitcoin1 year ago

Bitcoin1 year agoSEC’s Chairman Gensler Takes Aggressive Stance on Tokens – Blockchain News, Opinion, TV and Jobs