Bitcoin

Bitcoin Price Approaches Breakout, Can BTC Pump Above $66K?

Published

2 weeks agoon

By

admin

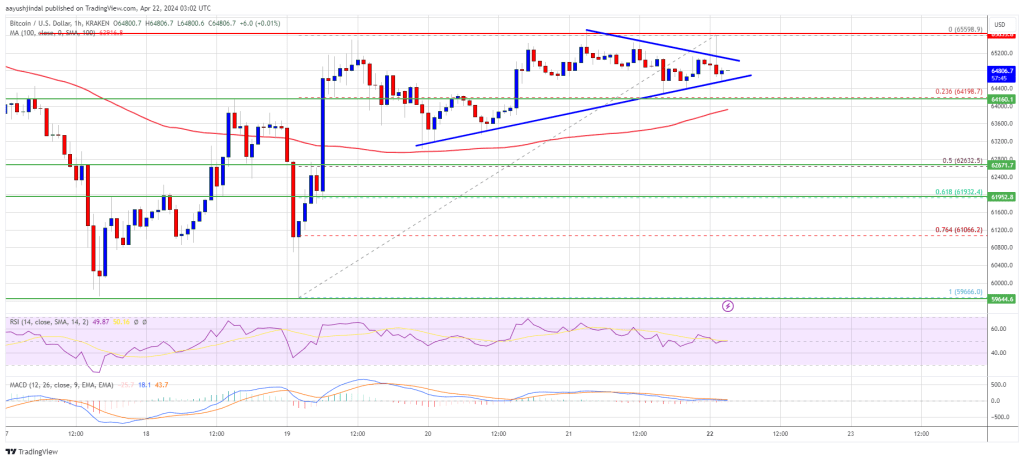

Bitcoin price recovered and climbed above the $64,000 resistance zone. BTC is now facing hurdles near the $65,500 and $66,000 levels.

- Bitcoin is now struggling to gain pace for a move above the $65,500 resistance zone.

- The price is trading above $64,000 and the 100 hourly Simple moving average.

- There is a key contracting triangle forming with resistance at $65,100 on the hourly chart of the BTC/USD pair (data feed from Kraken).

- The pair could start a fresh surge if it clears the $65,500 resistance zone.

Bitcoin Price Starts Increase

Bitcoin price found support above $60,000 and started a fresh increase. BTC climbed above the $62,500 and $63,500 resistance levels. The bulls even pushed the price above the $65,000 level.

However, the bears seem to be active near the $65,500 zone. The recent high was formed at $65,598 and the price is now consolidating gains. There was a drop below the $65,000 level, but the price is still above the 23.6% Fib retracement level of the upward move from the $59,666 swing low to the $65,598 low.

Bitcoin price is trading above $64,000 and the 100 hourly Simple moving average. Immediate resistance is near the $65,100 level. There is also a key contracting triangle forming with resistance at $65,100 on the hourly chart of the BTC/USD pair.

The first major resistance could be $65,500. The next resistance now sits at $66,000. If there is a clear move above the $66,000 resistance zone, the price could continue to move up. In the stated case, the price could rise toward $67,500.

Source: BTCUSD on TradingView.com

The next major resistance is near the $68,500 zone. Any more gains might send Bitcoin toward the $70,000 resistance zone in the near term.

Downside Correction In BTC?

If Bitcoin fails to rise above the $65,500 resistance zone, it could start a downside correction. Immediate support on the downside is near the $64,500 level.

The first major support is $64,000. If there is a close below $64,000, the price could start to drop toward the 50% Fib retracement level of the upward move from the $59,666 swing low to the $65,598 low at $62,500. Any more losses might send the price toward the $61,200 support zone in the near term.

Technical indicators:

Hourly MACD – The MACD is now losing pace in the bullish zone.

Hourly RSI (Relative Strength Index) – The RSI for BTC/USD is now near the 50 level.

Major Support Levels – $64,500, followed by $64,000.

Major Resistance Levels – $65,100, $65,500, and $66,000.

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Source link

You may like

JPMorgan Chase, Bank of America and Citibank Holding $7,427,000,000,000 Off-Balance Sheet in Potentially Dangerous Cocktail of Unknown Assets: Report

Crypto Expert Turns Bullish On Bitcoin, Predicts Quantitative Easing Will Begin Soon

US DOJ Indicts Manhattan Man on Fraud Charges Related to $43,000,000 Fake Crypto Ponzi Scheme

$120 Million Futures Liquidated As Price Takes A Beating

Dogecoin Mirroring Price Action That Preceded Massive Bull Runs in the Past, Says Trader – Here’s His Outlook

Is Ethereum Back? Record 267,000 New Users Spark Speculation

Bitcoin

Crypto Expert Turns Bullish On Bitcoin, Predicts Quantitative Easing Will Begin Soon

Published

7 hours agoon

May 3, 2024By

admin

Crypto expert Michaël van de Poppe has made a bullish case for Bitcoin as he alluded to macroeconomic factors that could soon play out in the flagship crypto’s favor. In line with this, he urged Bitcoin investors to take action with a parabolic surge on the horizon.

An Imminent Quantitative Easing Would Be Good For Bitcoin

Van de Poppe suggested in an X (formerly Twitter) post that Bitcoin will rise on the back of a Quantitative Easing (QE), which he anticipates is “close.” He noted that the Fed has already started to “unwind Treasury buybacks and is reducing QT [Quantitative Tightening].” He claims this is happening because the economic data has worsened, which puts the US at risk of a recession.

Therefore, the Fed seeks to avoid this recession by buying back long-term government bonds and injecting liquidity into the financial system. As the crypto expert predicts, this could be good since it will force the Fed to take a more dovish stance and possibly lower interest rates, boosting investors’ confidence to go all in on risk assets like Bitcoin.

Van de Popper further predicts that this Quantitative Easing will become evident in the data released in the coming months. In line with this, he advised investors to long Bitcoin. It is worth noting that Bitcoin dropped to as low as $57,000 ahead of the latest FOMC meeting, with many investors seeming to have anticipated a hawkish stance from the Fed.

However, as the crypto expert noted, the rates remain unchanged, and Fed Chair Jerome Powell raised the possibility of a rate cut as early as June. Given Bitcoin’s price recovery since then, this development looks to have already revived a bullish sentiment among investors.

What To Expect Going Forward

In another X post, Van de Popper revealed his expectations for the crypto market going forward. He stated that Bitcoin will consolidate and go sideways (possibly ahead of the QE which will boost its price in the coming months. Meanwhile, he also expects Altcoins to “heavily outperform and rotation kicks in.”

The crypto expert had previously echoed a similar sentiment when he stated that he expects altcoins to bounce in their Bitcoin pairs while Bitcoin faces a period of consolidation that he doesn’t expect to change in the “coming months.”

Back then, he also mentioned that there would be a narrative shift to Ethereum, and he reaffirmed this belief in a more recent X post, stating that he expects a lot from the second-largest crypto token by market cap.

At the time of writing, Bitcoin is trading at around $59,100, up over 2% in the last 24 hours, according to data from CoinMarketCap.

BTC bulls reclaim control of price | Source: BTCUSD on Tradingview.com

Featured image from Seu Dinheiro, chart from Tradingview.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Source link

Bitcoin

$120 Million Futures Liquidated As Price Takes A Beating

Published

15 hours agoon

May 3, 2024By

admin

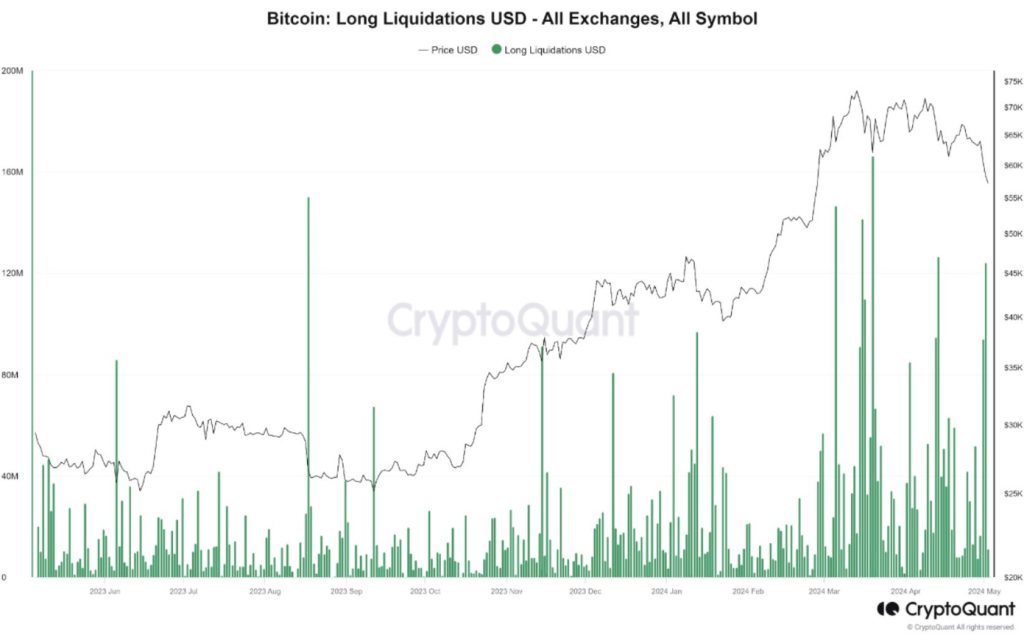

The recent dip in the price of Bitcoin below the $59,000 support level has sent jitters through the cryptocurrency market. While the price drop triggered liquidations in futures markets, analysts warn that a more significant decline could be on the horizon in the absence of a full-blown market capitulation.

Measured Retreat, Not Mass Exodus

Following the price drop, CryptoQuant, a cryptocurrency analysis platform, reported roughly $120 million in liquidated long positions (bets that the price would go up). This liquidation is noteworthy, but unlike previous selloffs at the same support level, it doesn’t signal a panicked exodus from investors. Investors seem to be taking a more measured approach, suggesting a possible short-term correction rather than a long-term bear market.

$BTC Futures Market Not Yet Signaling Capitulation

“Given the relatively small amount of long position liquidation and the lack of dramatic negative funding ratios, we believe that a ‘capitulation’ has not yet occurred in the futures market.” – By @MAC_D46035

Link 👇… pic.twitter.com/xqArLQiITf

— CryptoQuant.com (@cryptoquant_com) May 2, 2024

A Glimmer Of Hope For Long-Term Investors

While the short-term outlook appears cautious, there are reasons for long-term investors to remain optimistic. On-chain metrics, which analyze data directly on the Bitcoin blockchain, offer hints of a potential future upswing.

Metrics like MVRV (Market Value to Realized Value) suggest there’s a chance for an upward move in the larger market cycle. This information empowers strategic investors to view the current situation as a potential buying opportunity, particularly if a significant capitulation event unfolds in the futures market.

Bitcoin price action in the last week. Source: Coingecko

Navigating The Bitcoin Maze: Data-Driven Decisions Are Key

The current market volatility presents a complex challenge for investors. Understanding market sentiment is crucial for making informed decisions. The funding rate, an indicator of sentiment in futures contracts, has dipped into negative territory at times.

BTCUSD trading at $59,167 on the daily chart: TradingView.com

Traditionally, this suggests a stronger presence of bears (investors betting on a price decline) than bulls. However, the negativity hasn’t reached the extremes witnessed during past significant downturns, leaving the overall sentiment somewhat unclear.

Bitcoin’s Long-Term Narrative Remains Unwritten

Closely monitoring futures markets for signs of capitulation, along with analyzing other market indicators like the funding rate, is essential for success in this dynamic environment. Sharp investors armed with a strategic understanding of market dynamics are likely to profit from any future moves.

Bitcoin’s recent price drop has caused short-term volatility, but the long-term story remains unwritten. While the coming weeks might test investor resolve, those who can analyze market data and make strategic decisions could be well-positioned to capitalize on future opportunities.

Featured image from Pixabay, chart from TradingView

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Source link

Altcoins

Economist Alex Krüger Goes ‘Max Long’ on Crypto Positions – Here Are His Altcoin Picks

Published

1 day agoon

May 3, 2024By

admin

Popular trader and economist Alex Krüger says he’s currently “max long” on the crypto market.

Krüger tells his 173,800 followers on the social media platform X that he’s hedged and unhedged multiple times but he’s now max long in “very concentrated positions.”

The economist notes that he’s looking to “de-risk” soon. However, he acknowledges that Bitcoin (BTC) could drop as low as $52,000 after plunging below $59,000. BTC is trading at $57,093 at time of writing and is down more than 4.5% in the past 24 hours.

Explains Krüger,

“I’m not immune to bear raids. My bigger picture view has not changed: new ATHs later in the year (for Bitcoin). End-of-cycle views make little sense to me. A correction was to be expected.”

The economist also notes that he has positions in the layer-1 blockchains Solana (SOL), Toncoin (TON), Aptos (APT) and Core (CORE), as well as the decentralized data storage protocol Arweave (AR) and Bittensor (TAO), a decentralized blockchain platform that focuses on machine learning and AI.

Krüger adds that APT, CORE, AR and TAO are “much higher risk” than SOL and TON.

The economist also notes that Bitcoin had a bearish response to Wednesday’s U.S. Federal Open Market Committee (FOMC) statement.

“Very rare for price to reverse in full right after the press conference is over. And bearish, as the FOMC was dovish. And now you have trapped intraday longs. The one silver lining is BTC is trading in line with equities.”

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney

Source link

JPMorgan Chase, Bank of America and Citibank Holding $7,427,000,000,000 Off-Balance Sheet in Potentially Dangerous Cocktail of Unknown Assets: Report

Crypto Expert Turns Bullish On Bitcoin, Predicts Quantitative Easing Will Begin Soon

US DOJ Indicts Manhattan Man on Fraud Charges Related to $43,000,000 Fake Crypto Ponzi Scheme

$120 Million Futures Liquidated As Price Takes A Beating

Dogecoin Mirroring Price Action That Preceded Massive Bull Runs in the Past, Says Trader – Here’s His Outlook

Is Ethereum Back? Record 267,000 New Users Spark Speculation

Economist Alex Krüger Goes ‘Max Long’ on Crypto Positions – Here Are His Altcoin Picks

Crypto Investors Bet Big On ETFSwap (ETFS) Presale To Leverage Spot Bitcoin ETFs Popularity – Blockchain News, Opinion, TV and Jobs

Bitbot’s Presale Passes $3M After AI Development Update – Blockchain News, Opinion, TV and Jobs

Dogecoin Breaks Out Of Descending Triangle Like It Did In 2021, Analyst Sets $6 Target

Bitcoin Cash (BCH) Backer Roger Ver Arrested and Charged With Evading Nearly $50,000,000 in Taxes

AppLayer Unveils Fastest EVM Network and $1.5M Network Incentive Program – Blockchain News, Opinion, TV and Jobs

Whales Dive In, But Dogecoin Price Sinks 20%: What’s Going On?

Humanode, a blockchain built with Polkadot SDK, becomes the most decentralized by Nakamoto Coefficient – Blockchain News, Opinion, TV and Jobs

Here’s When Bitcoin Could Halt the ‘Slide’ and Start To Pump, According to On-Chain Analytics Firm Santiment

Bitcoin Dropped Below 2017 All-Time-High but Could Sellers be Getting Exhausted? – Blockchain News, Opinion, TV and Jobs

What does the Coinbase Premium Gap Tell us about Investor Activity? – Blockchain News, Opinion, TV and Jobs

BNM DAO Token Airdrop

NFT Sector Keeps Developing – Number of Unique Ethereum NFT Traders Surged 276% in 2022 – Blockchain News, Opinion, TV and Jobs

New Minting Services

Block News Media Live Stream

A String of 200 ‘Sleeping Bitcoins’ From 2010 Worth $4.27 Million Moved on Friday

SEC’s Chairman Gensler Takes Aggressive Stance on Tokens – Blockchain News, Opinion, TV and Jobs

Friends or Enemies? – Blockchain News, Opinion, TV and Jobs

Enjoy frictionless crypto purchases with Apple Pay and Google Pay | by Jim | @blockchain | Jun, 2022

Block News Media Live Stream

How Web3 can prevent Hollywood strikes

Block News Media Live Stream

XRP Explodes With 1,300% Surge In Trading Volume As crypto Exchanges Jump On Board

Block News Media Live Stream

Trending

Altcoins2 years ago

Altcoins2 years agoBitcoin Dropped Below 2017 All-Time-High but Could Sellers be Getting Exhausted? – Blockchain News, Opinion, TV and Jobs

Binance2 years ago

Binance2 years agoWhat does the Coinbase Premium Gap Tell us about Investor Activity? – Blockchain News, Opinion, TV and Jobs

- Uncategorized2 years ago

BNM DAO Token Airdrop

BTC1 year ago

BTC1 year agoNFT Sector Keeps Developing – Number of Unique Ethereum NFT Traders Surged 276% in 2022 – Blockchain News, Opinion, TV and Jobs

- Uncategorized2 years ago

New Minting Services

Video2 years ago

Video2 years agoBlock News Media Live Stream

Bitcoin miners2 years ago

Bitcoin miners2 years agoA String of 200 ‘Sleeping Bitcoins’ From 2010 Worth $4.27 Million Moved on Friday

Bitcoin1 year ago

Bitcoin1 year agoSEC’s Chairman Gensler Takes Aggressive Stance on Tokens – Blockchain News, Opinion, TV and Jobs