Bitcoin

Bitcoin Users Spend Record $2.4 Million On Block 840,000

Published

2 weeks agoon

By

admin

With Bitcoin finally completing its fourth-year halving cycle, many users are aggressively competing for halving blocks, paying exorbitant amounts of fees to mine a single block.

Bitcoin Mining Pool Pays Over $2.4 Million In Block Fees

Earlier today, the 840,000th block was added to the Bitcoin blockchain, triggering the onslaught of the highly anticipated halving event. While the price of BTC did not witness a dramatic change following the halving, transaction fees spiked to unprecedented highs.

Amidst the massive competition, a mining pool identified as ViaBTC had successfully mined the 840,000th Bitcoin block. Cumulatively, BTC users had spent a staggering $37.7 BTC in mining fees, equivalent to $2.4 million, recording the highest fee ever paid for a Bitcoin block.

According to reports from mempool, after ViaBTC had produced the 840,000th block, the protocol had initiated an automated reduction of miners’ reward by half, from 6.25 BTC to 3.125 BTC per block. In addition to the fees, ViaBTC had received a total payout of 40.7 BTC, valued at approximately $2.6 million, for mining the historic block.

While it may seem that Bitcoin miners had thrown caution to the wind by spending over $2.4 million on a single block, the 840,000th block had a major significance within the cryptocurrency space. The historic Bitcoin block is said to hold the first Satoshis, ‘sats,’ the smallest units of BTC following the halving.

There are several of these “epic sats,” that appear after the halving event, coveted as a rare collector’s item among cryptocurrency enthusiasts. Some even speculate that these Bitcoin fragments could be potentially worth millions of dollars.

Including the hype surrounding these fragmented BTC, much of the competition for the Bitcoin blocks, following the halving has been attributed to the new Runes Protocol which launched at the same time as the Bitcoin halving.

Degens Rush To Secure Infamous Rune Tokens

The Runes Protocol, created by Casey Rodamor, a Bitcoin developer, has sent shockwaves through the cryptocurrency community, as degens are avidly competing to etch and mint tokens directly on the Bitcoin network.

While mining pools were mining new Bitcoin blocks, degens had paid over 78.6 BTC valued at $4.95 million to mint the rarest Runes. This exponential surge in fees has been an unprecedented event, highlighting the increased adoption and participation of the Bitcoin network.

According to reports from Ord.io, a Rune labeled as ‘Decentralized’ was acquired for a fee of 7.99 BTC, equivalent to $510,760. While another titled ‘Dog-Go-To-The-Moon’ was obtained for a fee of 6.73 BTC, worth approximately $429,831.

Leonidas, protocol developer and host of the groundbreaking Ordinals, a system for numbering “epic sats,” has declared the Runes Protocol a remarkable success as degens have “single-handedly offset the drop in miner rewards from the halving.” He concluded that Runes have significantly impacted Bitcoin’s security budget, potentially playing a major role in ensuring the network’s sustainability.

BTC price sitting at $63,700 after halving | Source: BTCUSD on Tradingview.com

Featured image from Watcher Guru, chart from Tradingview.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Source link

You may like

$120 Million Futures Liquidated As Price Takes A Beating

Dogecoin Mirroring Price Action That Preceded Massive Bull Runs in the Past, Says Trader – Here’s His Outlook

Is Ethereum Back? Record 267,000 New Users Spark Speculation

Economist Alex Krüger Goes ‘Max Long’ on Crypto Positions – Here Are His Altcoin Picks

Crypto Investors Bet Big On ETFSwap (ETFS) Presale To Leverage Spot Bitcoin ETFs Popularity – Blockchain News, Opinion, TV and Jobs

Bitbot’s Presale Passes $3M After AI Development Update – Blockchain News, Opinion, TV and Jobs

Bitcoin

$120 Million Futures Liquidated As Price Takes A Beating

Published

2 hours agoon

May 3, 2024By

admin

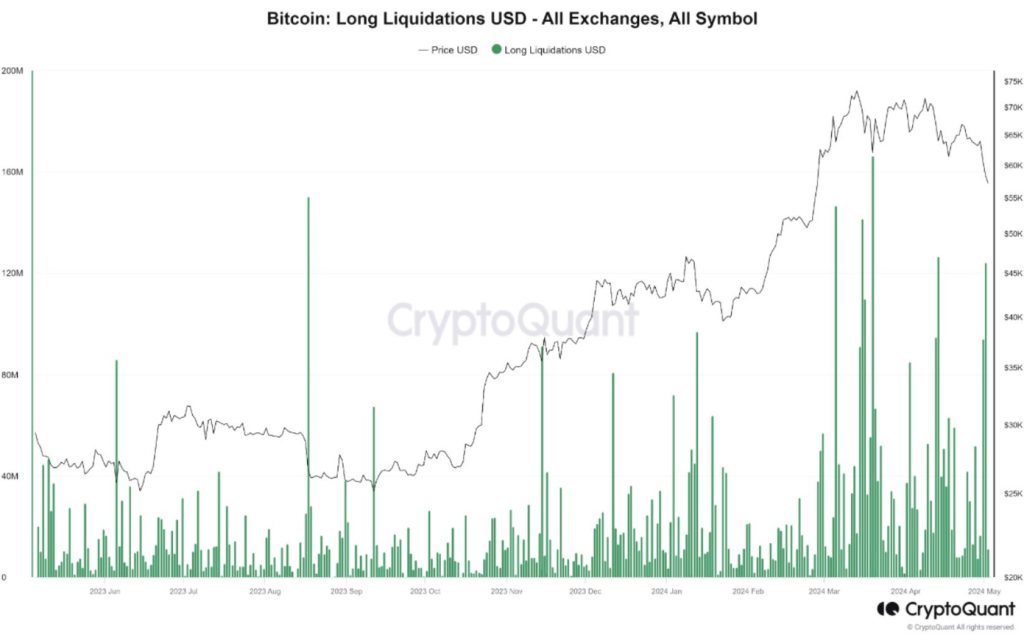

The recent dip in the price of Bitcoin below the $59,000 support level has sent jitters through the cryptocurrency market. While the price drop triggered liquidations in futures markets, analysts warn that a more significant decline could be on the horizon in the absence of a full-blown market capitulation.

Measured Retreat, Not Mass Exodus

Following the price drop, CryptoQuant, a cryptocurrency analysis platform, reported roughly $120 million in liquidated long positions (bets that the price would go up). This liquidation is noteworthy, but unlike previous selloffs at the same support level, it doesn’t signal a panicked exodus from investors. Investors seem to be taking a more measured approach, suggesting a possible short-term correction rather than a long-term bear market.

$BTC Futures Market Not Yet Signaling Capitulation

“Given the relatively small amount of long position liquidation and the lack of dramatic negative funding ratios, we believe that a ‘capitulation’ has not yet occurred in the futures market.” – By @MAC_D46035

Link 👇… pic.twitter.com/xqArLQiITf

— CryptoQuant.com (@cryptoquant_com) May 2, 2024

A Glimmer Of Hope For Long-Term Investors

While the short-term outlook appears cautious, there are reasons for long-term investors to remain optimistic. On-chain metrics, which analyze data directly on the Bitcoin blockchain, offer hints of a potential future upswing.

Metrics like MVRV (Market Value to Realized Value) suggest there’s a chance for an upward move in the larger market cycle. This information empowers strategic investors to view the current situation as a potential buying opportunity, particularly if a significant capitulation event unfolds in the futures market.

Bitcoin price action in the last week. Source: Coingecko

Navigating The Bitcoin Maze: Data-Driven Decisions Are Key

The current market volatility presents a complex challenge for investors. Understanding market sentiment is crucial for making informed decisions. The funding rate, an indicator of sentiment in futures contracts, has dipped into negative territory at times.

BTCUSD trading at $59,167 on the daily chart: TradingView.com

Traditionally, this suggests a stronger presence of bears (investors betting on a price decline) than bulls. However, the negativity hasn’t reached the extremes witnessed during past significant downturns, leaving the overall sentiment somewhat unclear.

Bitcoin’s Long-Term Narrative Remains Unwritten

Closely monitoring futures markets for signs of capitulation, along with analyzing other market indicators like the funding rate, is essential for success in this dynamic environment. Sharp investors armed with a strategic understanding of market dynamics are likely to profit from any future moves.

Bitcoin’s recent price drop has caused short-term volatility, but the long-term story remains unwritten. While the coming weeks might test investor resolve, those who can analyze market data and make strategic decisions could be well-positioned to capitalize on future opportunities.

Featured image from Pixabay, chart from TradingView

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Source link

Altcoins

Economist Alex Krüger Goes ‘Max Long’ on Crypto Positions – Here Are His Altcoin Picks

Published

14 hours agoon

May 3, 2024By

admin

Popular trader and economist Alex Krüger says he’s currently “max long” on the crypto market.

Krüger tells his 173,800 followers on the social media platform X that he’s hedged and unhedged multiple times but he’s now max long in “very concentrated positions.”

The economist notes that he’s looking to “de-risk” soon. However, he acknowledges that Bitcoin (BTC) could drop as low as $52,000 after plunging below $59,000. BTC is trading at $57,093 at time of writing and is down more than 4.5% in the past 24 hours.

Explains Krüger,

“I’m not immune to bear raids. My bigger picture view has not changed: new ATHs later in the year (for Bitcoin). End-of-cycle views make little sense to me. A correction was to be expected.”

The economist also notes that he has positions in the layer-1 blockchains Solana (SOL), Toncoin (TON), Aptos (APT) and Core (CORE), as well as the decentralized data storage protocol Arweave (AR) and Bittensor (TAO), a decentralized blockchain platform that focuses on machine learning and AI.

Krüger adds that APT, CORE, AR and TAO are “much higher risk” than SOL and TON.

The economist also notes that Bitcoin had a bearish response to Wednesday’s U.S. Federal Open Market Committee (FOMC) statement.

“Very rare for price to reverse in full right after the press conference is over. And bearish, as the FOMC was dovish. And now you have trapped intraday longs. The one silver lining is BTC is trading in line with equities.”

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney

Source link

AI crypto

Crypto Investors Bet Big On ETFSwap (ETFS) Presale To Leverage Spot Bitcoin ETFs Popularity – Blockchain News, Opinion, TV and Jobs

Published

17 hours agoon

May 2, 2024By

admin

Crypto investors are now moving to the ongoing ETFSwap (ETFS) presale as Spot Bitcoin ETFs surge in popularity.

Crypto investors are now looking into ETFSwap (ETFS) amidst surging interest in Spot Bitcoin ETFs. With ETFSwap (ETFS), users can access both decentralized finance (DeFi) and the conventional exchange-traded fund (ETF) market without having to purchase any assets directly.

Investors can profit from a closer integration between these two markets by trading and using particular platform features with different tokenized ETFs. These tokenized exchange-traded funds (ETFs) replicate the performance of significant institutional cryptocurrency ETFs, such as Blackrock’s IBIT, which oversees $17.6 billion in assets.

Increasing Crypto Investor Confidence In Spot Bitcoin ETFs

The emergence of numerous cryptocurrency exchange-traded funds (ETFs) has been a notable development in the market thus far. Spot Bitcoin ETFs in particular, have now taken a majority of the market share of crypto ETFs. The ETFs went live immediately after they gained approval from the US Securities and Exchange Commission (SEC) in January and now represent 90% of the market share of daily trading activity for ETFs that provide price exposure to bitcoin.

In this regard, ETFSwap (ETFS) has distinguished itself as a top-notch DeFi platform, breaking into the ETF investing world. At the core of its model, ETFSwap (ETFS) is a DeFi platform that is revolutionizing the world of ETF investments. ETFSwap (ETFS) is built on blockchain technology, allowing it to provide a seamless ETF investing experience for both institutional and retail investors.

The ETFSwap (ETFS) platform is equipped with many tokenized ETFs of precious metals, cryptocurrencies, commodities, and ETFs tracking fixed-income investment vehicles. These tokenized ETFs can be easily bought and sold like conventional ETFs, albeit with cryptocurrencies on the ETFSwap (ETFS) platform.

Notably, ETFSwap’s (ETFS) use of blockchain technology buffed the platform’s security and transparency, making it impossible for third parties and middlemen to interfere. As a result, investors can start trading easily without having to undergo KYC registrations. Investors only need to connect their digital wallets to the platform and start trading tokenized ETFs 24/7.

Another key perk of the ETFSwap (ETFS) platform is the ability of users to trade fractionalized ETF shares with up to 10X leverage, a feature extremely appealing to retail investors.

Taking into account these impressive features and the long-term objective of ETFSwap (ETFS) within the surging popularity of Spot Bitcoin ETFs, crypto investors are now looking to position themselves on the platform. This interesting potential and bullish sentiment has allowed ETFSwap (ETFS) to easily raise $750,000 within 72 hours of its private funding round, which has also flowed into its ongoing presale.

Expectations And Investor Sentiment Toward ETFSwap

ETFSwap (ETFS) is currently in its presale round, where 4almost 0% of the total circulating supply of its utility token ETFS has already been sold to early investors. As a utility token, ETFS unlocks many utilities and benefits within the ETFSwap (ETFS) ecosystem and, consequently within the world of ETF investments.

Some of these benefits include staking rewards, lower fees, trading discounts, and an APR of up to 87%. Interestingly, presale data shows crypto investors are maneuvering to get their hands on ETFS. The demand for the ETFSwap (ETFS) token has been exceptional, with over 30 million tokens sold already.

The first presale round initial presale is still selling for $0.00854 per token, and participants can get an 18% bonus on their purchase. On the other hand, it is anticipated that the next presale stage will sell for $0.01831 per ETFS, and reaching the $1 mark is expected once it lists on major exchanges, which is an 100x increase.

Conclusion: Take Action In ETFS Presale

The crypto industry is home to different calibers of investors who are searching for potential projects to invest in and places to increase their portfolios. As a result, the recent immense popularity of Spot Bitcoin ETFs’ has placed ETFSwap (ETFS) in the limelight for investors looking to invest in ETFs. The ongoing ETFS presale is a great place to start as it offers investors a calculated way to enter the expanding cryptocurrency sector, and presale data suggests the earlier, the better. Due to the urgency created by limited availability, investors are encouraged to lock up their positions before allocations run out.

For more information about the ETFS Presale:

Source link

$120 Million Futures Liquidated As Price Takes A Beating

Dogecoin Mirroring Price Action That Preceded Massive Bull Runs in the Past, Says Trader – Here’s His Outlook

Is Ethereum Back? Record 267,000 New Users Spark Speculation

Economist Alex Krüger Goes ‘Max Long’ on Crypto Positions – Here Are His Altcoin Picks

Crypto Investors Bet Big On ETFSwap (ETFS) Presale To Leverage Spot Bitcoin ETFs Popularity – Blockchain News, Opinion, TV and Jobs

Bitbot’s Presale Passes $3M After AI Development Update – Blockchain News, Opinion, TV and Jobs

Dogecoin Breaks Out Of Descending Triangle Like It Did In 2021, Analyst Sets $6 Target

Bitcoin Cash (BCH) Backer Roger Ver Arrested and Charged With Evading Nearly $50,000,000 in Taxes

AppLayer Unveils Fastest EVM Network and $1.5M Network Incentive Program – Blockchain News, Opinion, TV and Jobs

Whales Dive In, But Dogecoin Price Sinks 20%: What’s Going On?

Humanode, a blockchain built with Polkadot SDK, becomes the most decentralized by Nakamoto Coefficient – Blockchain News, Opinion, TV and Jobs

Here’s When Bitcoin Could Halt the ‘Slide’ and Start To Pump, According to On-Chain Analytics Firm Santiment

Ethereum Price Revisits Key Support, Can Bears Take Over?

Solana Co-Founder Says Cosmos and One SOL Rival Are Clear Winners in Building Sovereign Blockchains

Achieves Record Net Profit Of $4.5 Billion In Q1

Bitcoin Dropped Below 2017 All-Time-High but Could Sellers be Getting Exhausted? – Blockchain News, Opinion, TV and Jobs

What does the Coinbase Premium Gap Tell us about Investor Activity? – Blockchain News, Opinion, TV and Jobs

BNM DAO Token Airdrop

NFT Sector Keeps Developing – Number of Unique Ethereum NFT Traders Surged 276% in 2022 – Blockchain News, Opinion, TV and Jobs

New Minting Services

Block News Media Live Stream

A String of 200 ‘Sleeping Bitcoins’ From 2010 Worth $4.27 Million Moved on Friday

SEC’s Chairman Gensler Takes Aggressive Stance on Tokens – Blockchain News, Opinion, TV and Jobs

Friends or Enemies? – Blockchain News, Opinion, TV and Jobs

Enjoy frictionless crypto purchases with Apple Pay and Google Pay | by Jim | @blockchain | Jun, 2022

Block News Media Live Stream

How Web3 can prevent Hollywood strikes

Block News Media Live Stream

XRP Explodes With 1,300% Surge In Trading Volume As crypto Exchanges Jump On Board

Block News Media Live Stream

Trending

Altcoins2 years ago

Altcoins2 years agoBitcoin Dropped Below 2017 All-Time-High but Could Sellers be Getting Exhausted? – Blockchain News, Opinion, TV and Jobs

Binance2 years ago

Binance2 years agoWhat does the Coinbase Premium Gap Tell us about Investor Activity? – Blockchain News, Opinion, TV and Jobs

- Uncategorized2 years ago

BNM DAO Token Airdrop

BTC1 year ago

BTC1 year agoNFT Sector Keeps Developing – Number of Unique Ethereum NFT Traders Surged 276% in 2022 – Blockchain News, Opinion, TV and Jobs

- Uncategorized2 years ago

New Minting Services

Video2 years ago

Video2 years agoBlock News Media Live Stream

Bitcoin miners2 years ago

Bitcoin miners2 years agoA String of 200 ‘Sleeping Bitcoins’ From 2010 Worth $4.27 Million Moved on Friday

Bitcoin1 year ago

Bitcoin1 year agoSEC’s Chairman Gensler Takes Aggressive Stance on Tokens – Blockchain News, Opinion, TV and Jobs