Altcoins

Buckle Up, Injective (INJ) Primed For Takeoff Towards $50

Published

2 weeks agoon

By

admin

Injective Protocol, a blockchain platform dedicated to decentralized finance (DeFi) and derivatives trading, is currently at the center of attention. The platform’s proposed upgrade, Injective 3.0, aims to revolutionize its tokenomics by introducing deflationary measures for INJ.

This upgrade seeks to address the issue of token inflation, a common challenge faced by many DeFi tokens, by implementing mechanisms to control the creation of new tokens and incentivizing users to stake their existing INJ holdings.

Injective: Creating Token Scarcity

One of the key objectives of Injective 3.0 is to increase the scarcity of the INJ token. By reducing the rate of token creation and encouraging staking activity, the upgrade aims to create a supply-demand dynamic that could drive up the token’s price.

This strategy reflects a broader trend within the cryptocurrency space, where projects are exploring innovative ways to enhance token utility and value proposition.

INJ is now trading at $27.62. Chart: TradingView

Meanwhile, Injective (INJ) has seen a remarkable surge in value. Over the past week, INJ has soared by an impressive 12%, building upon a substantial 24% gain over the last month.

This surge in price has prompted speculation about the token’s future trajectory and the factors driving its bullish momentum.

INJ weekly price action. Source: Coingecko

Analyst Optimism And Price Predictions

Amidst the excitement surrounding Injective’s upgrade proposal, crypto analyst World Of Charts has issued a bullish prediction for INJ. The analyst’s analysis points to a bullish flag pattern emerging in INJ’s price chart, a technical indicator often associated with significant price breakouts.

$Inj#Inj In Strong Uptrend And Now Consolidating In Bullish Flag Incase Of Breakout Expecting Move Towards 50$ Expecting Almost 80-90% In Coming Weeks#Crypto pic.twitter.com/wsiID0YaTl

— World Of Charts (@WorldOfCharts1) April 18, 2024

According to World Of Charts, if INJ breaks out of this pattern, it could potentially reach the $50 mark, representing a substantial increase from its current price and signaling further upside potential for the token.

Positive Prospects

While the prospects of INJ’s price surge are enticing, investors are advised to tread cautiously. The cryptocurrency market is inherently volatile, and factors beyond the upgrade proposal could influence INJ’s performance.

Injective Protocol just took a big step forward with their upgrade to Injective 3.0. This update brings new features to the platform, and the INJ token is looking attractive as a result.

The changes could be a draw for both experienced investors who understand the DeFi space and those who are just starting out and looking for exciting new opportunities.

Featured image from Pixabay, chart from TradingView

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Source link

You may like

$120 Million Futures Liquidated As Price Takes A Beating

Dogecoin Mirroring Price Action That Preceded Massive Bull Runs in the Past, Says Trader – Here’s His Outlook

Is Ethereum Back? Record 267,000 New Users Spark Speculation

Economist Alex Krüger Goes ‘Max Long’ on Crypto Positions – Here Are His Altcoin Picks

Crypto Investors Bet Big On ETFSwap (ETFS) Presale To Leverage Spot Bitcoin ETFs Popularity – Blockchain News, Opinion, TV and Jobs

Bitbot’s Presale Passes $3M After AI Development Update – Blockchain News, Opinion, TV and Jobs

Altcoins

Dogecoin Mirroring Price Action That Preceded Massive Bull Runs in the Past, Says Trader – Here’s His Outlook

Published

5 hours agoon

May 3, 2024By

admin

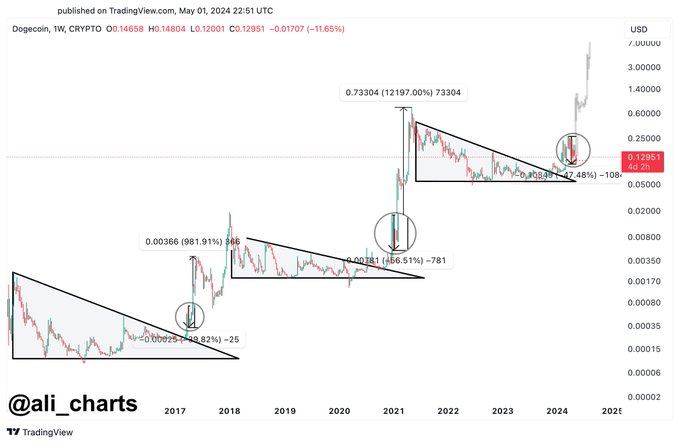

Cryptocurrency analyst and trader Ali Martinez is saying that the price of Dogecoin (DOGE) is exhibiting behavior it has previously displayed before embarking on massive rallies.

Martinez tells his 61,200 followers on the social media platform X that the largest memecoin by market cap earlier this year broke out of a descending triangle, which is considered bullish if the price breaks out above the upper trend line, on the weekly chart.

“It is currently undergoing a 47% price correction, very similar to previous cycles, which could ignite the next DOGE bull run!”

According to Martinez, Dogecoin exhibited similar price behavior in 2017 and 2021.

“In 2017, DOGE broke out of a descending triangle. Then, DOGE retraced by 40% before entering a 982% bull run!”

“In 2021, DOGE broke out of a descending triangle again. Then, DOGE retraced by 56% before skyrocketing by 12,197%!”

“Over the years, Dogecoin appears to mirror its previous bull cycles! All you need is a little bit of patience.”

Dogecoin is trading at $0.13 at time of writing.

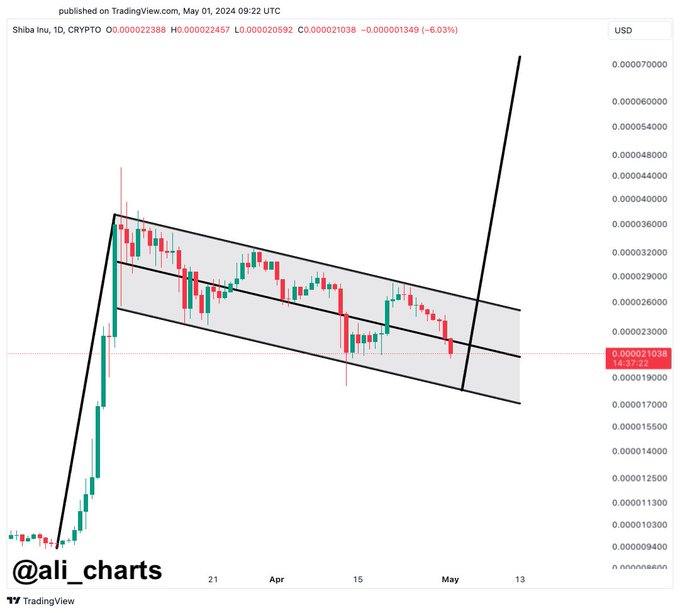

Next up is the second-largest memecoin by market cap, Shiba Inu (SHIB). Martinez says that he entered a long position nearly 20% below the current level and is targeting a gain of close to 4x.

“Shiba Inu appears to be forming a bull flag on the daily chart! I’m placing buy orders around $0.000018343, aiming for a bullish breakout that sends SHIB to $0.000072323.”

SHIB is trading at $0.0000225 at time of writing.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: DALLE3

Source link

Altcoins

Is Ethereum Back? Record 267,000 New Users Spark Speculation

Published

9 hours agoon

May 3, 2024By

admin

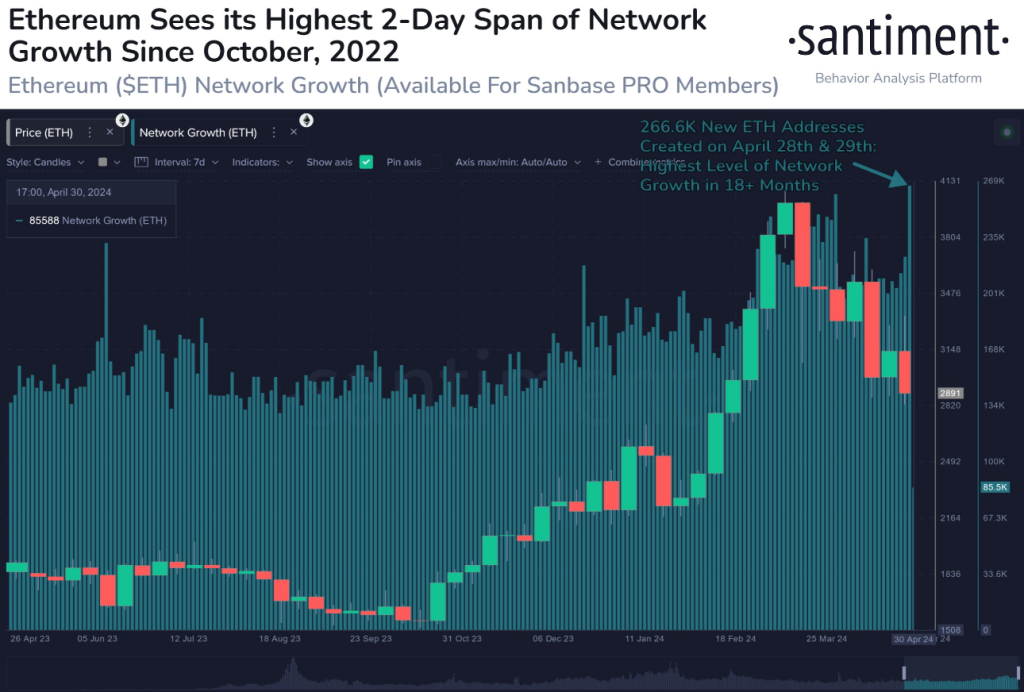

The winds of change are swirling around Ethereum, the world’s second-largest cryptocurrency. Despite a recent price dip, the network has witnessed a surge in new user activity, sparking a wave of optimism. However, the outsized influence of large holders, known as whales, continues to cast a long shadow.

New Wallets Open For Business

Data from blockchain analytics firm Santiment reveals a surge in new Ethereum wallets, with a record-breaking 267,000 created on April 28th and 29th. This influx marks the highest two-day increase since October 2022 and suggests a potential resurgence of interest in the Ethereum network.

📈 #Ethereum saw a milestone as April came to an end. 266.6K new wallets were created on April 28th and 29th, the highest 2-day stretch of network growth since October 8th and 9th, 2022. It is a strong that $ETH continues expanding despite dipping prices. https://t.co/SN6xqc3JXV pic.twitter.com/KDcjhY30y5

— Santiment (@santimentfeed) May 1, 2024

This trend defies the current market downturn, with many cryptocurrencies experiencing significant price drops. Analysts speculate that the rise in new wallets could be fueled by several factors, including:

- Anticipation of future growth: Investors may be looking towards upcoming Ethereum upgrades that promise improved scalability and security, betting on the network’s long-term potential.

- Bargain hunters: The recent price dip might be seen as an attractive entry point for new investors seeking a discount on Ethereum.

On Minnows And Whales

While the number of new users is encouraging, a closer look at Ethereum’s address distribution reveals a stark disparity in holdings. According to CoinMarketCap, a staggering 97% of Ethereum addresses hold between $0 and $1,000 worth of the cryptocurrency. This signifies a large pool of small-scale investors, often referred to as “minnows.”

However, the real power lies with a select few. Whale tracking platform Clank estimates that whales, representing only 0.10% of all Ethereum addresses, control a whopping 41% of the total circulating supply. This translates to an average holding of nearly 10 million ETH per whale, valued at a staggering $3.7 million.

Ether market cap currently at $362 billion. Chart: TradingView.com

Holding Steady: A Vote Of Confidence?

Despite the recent price decline, Ethereum appears to be weathering the storm better than the broader crypto market. In fact, Ether is up more than 30% year-to-date (YTD) from an opening price of about $2,282.

As of today, Ethereum sits at $3,014, with a total market capitalization of $362 billion. Notably, the market experienced an average decline of 8.75% over the last week, highlighting Ethereum’s relative resilience.

Source: CoinMarketCap

Furthermore, data suggests that a majority of Ethereum investors (74%) are long-term holders, demonstrating a strong belief in the project’s future. This “hodling” mentality indicates a commitment to maintaining their Ethereum positions for the long haul, even in the face of short-term market fluctuations.

Featured image from Pixabay, chart from TradingView

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Source link

Altcoins

Economist Alex Krüger Goes ‘Max Long’ on Crypto Positions – Here Are His Altcoin Picks

Published

13 hours agoon

May 3, 2024By

admin

Popular trader and economist Alex Krüger says he’s currently “max long” on the crypto market.

Krüger tells his 173,800 followers on the social media platform X that he’s hedged and unhedged multiple times but he’s now max long in “very concentrated positions.”

The economist notes that he’s looking to “de-risk” soon. However, he acknowledges that Bitcoin (BTC) could drop as low as $52,000 after plunging below $59,000. BTC is trading at $57,093 at time of writing and is down more than 4.5% in the past 24 hours.

Explains Krüger,

“I’m not immune to bear raids. My bigger picture view has not changed: new ATHs later in the year (for Bitcoin). End-of-cycle views make little sense to me. A correction was to be expected.”

The economist also notes that he has positions in the layer-1 blockchains Solana (SOL), Toncoin (TON), Aptos (APT) and Core (CORE), as well as the decentralized data storage protocol Arweave (AR) and Bittensor (TAO), a decentralized blockchain platform that focuses on machine learning and AI.

Krüger adds that APT, CORE, AR and TAO are “much higher risk” than SOL and TON.

The economist also notes that Bitcoin had a bearish response to Wednesday’s U.S. Federal Open Market Committee (FOMC) statement.

“Very rare for price to reverse in full right after the press conference is over. And bearish, as the FOMC was dovish. And now you have trapped intraday longs. The one silver lining is BTC is trading in line with equities.”

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney

Source link

$120 Million Futures Liquidated As Price Takes A Beating

Dogecoin Mirroring Price Action That Preceded Massive Bull Runs in the Past, Says Trader – Here’s His Outlook

Is Ethereum Back? Record 267,000 New Users Spark Speculation

Economist Alex Krüger Goes ‘Max Long’ on Crypto Positions – Here Are His Altcoin Picks

Crypto Investors Bet Big On ETFSwap (ETFS) Presale To Leverage Spot Bitcoin ETFs Popularity – Blockchain News, Opinion, TV and Jobs

Bitbot’s Presale Passes $3M After AI Development Update – Blockchain News, Opinion, TV and Jobs

Dogecoin Breaks Out Of Descending Triangle Like It Did In 2021, Analyst Sets $6 Target

Bitcoin Cash (BCH) Backer Roger Ver Arrested and Charged With Evading Nearly $50,000,000 in Taxes

AppLayer Unveils Fastest EVM Network and $1.5M Network Incentive Program – Blockchain News, Opinion, TV and Jobs

Whales Dive In, But Dogecoin Price Sinks 20%: What’s Going On?

Humanode, a blockchain built with Polkadot SDK, becomes the most decentralized by Nakamoto Coefficient – Blockchain News, Opinion, TV and Jobs

Here’s When Bitcoin Could Halt the ‘Slide’ and Start To Pump, According to On-Chain Analytics Firm Santiment

Ethereum Price Revisits Key Support, Can Bears Take Over?

Solana Co-Founder Says Cosmos and One SOL Rival Are Clear Winners in Building Sovereign Blockchains

Achieves Record Net Profit Of $4.5 Billion In Q1

Bitcoin Dropped Below 2017 All-Time-High but Could Sellers be Getting Exhausted? – Blockchain News, Opinion, TV and Jobs

What does the Coinbase Premium Gap Tell us about Investor Activity? – Blockchain News, Opinion, TV and Jobs

BNM DAO Token Airdrop

NFT Sector Keeps Developing – Number of Unique Ethereum NFT Traders Surged 276% in 2022 – Blockchain News, Opinion, TV and Jobs

New Minting Services

Block News Media Live Stream

A String of 200 ‘Sleeping Bitcoins’ From 2010 Worth $4.27 Million Moved on Friday

SEC’s Chairman Gensler Takes Aggressive Stance on Tokens – Blockchain News, Opinion, TV and Jobs

Friends or Enemies? – Blockchain News, Opinion, TV and Jobs

Enjoy frictionless crypto purchases with Apple Pay and Google Pay | by Jim | @blockchain | Jun, 2022

Block News Media Live Stream

How Web3 can prevent Hollywood strikes

Block News Media Live Stream

XRP Explodes With 1,300% Surge In Trading Volume As crypto Exchanges Jump On Board

Block News Media Live Stream

Trending

Altcoins2 years ago

Altcoins2 years agoBitcoin Dropped Below 2017 All-Time-High but Could Sellers be Getting Exhausted? – Blockchain News, Opinion, TV and Jobs

Binance2 years ago

Binance2 years agoWhat does the Coinbase Premium Gap Tell us about Investor Activity? – Blockchain News, Opinion, TV and Jobs

- Uncategorized2 years ago

BNM DAO Token Airdrop

BTC1 year ago

BTC1 year agoNFT Sector Keeps Developing – Number of Unique Ethereum NFT Traders Surged 276% in 2022 – Blockchain News, Opinion, TV and Jobs

- Uncategorized2 years ago

New Minting Services

Video2 years ago

Video2 years agoBlock News Media Live Stream

Bitcoin miners2 years ago

Bitcoin miners2 years agoA String of 200 ‘Sleeping Bitcoins’ From 2010 Worth $4.27 Million Moved on Friday

Bitcoin1 year ago

Bitcoin1 year agoSEC’s Chairman Gensler Takes Aggressive Stance on Tokens – Blockchain News, Opinion, TV and Jobs