Ethereum

Giant Whale With $405,190,000 in Ethereum Starts Withdrawing ETH From Binance: On-Chain Data

Published

2 weeks agoon

By

admin

Crypto whales are currently on the move as one large entity with nearly half a billion dollars worth of Ethereum (ETH) was spotted withdrawing coins from crypto exchanges.

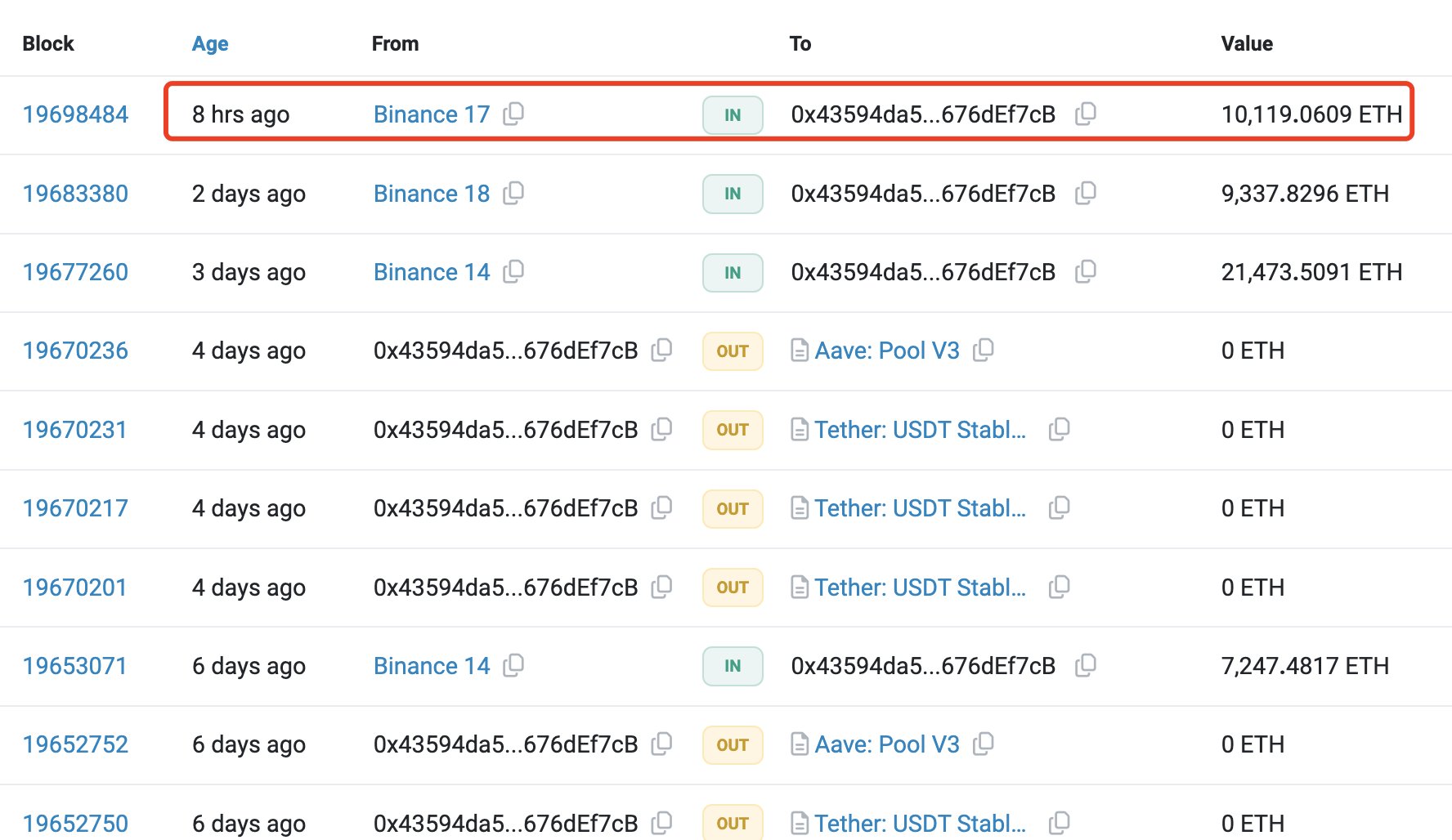

First seen by blockchain tracking firm Lookonchain, an address beginning with “0x4359” was spotted taking their ETH out of Binance and decentralized exchanges (DEXes).

Lookonchain says the whale has accumulated about $405.19 million worth of ETH in less than two weeks.

“This giant whale withdrew 10,119 ETH ($31.85 million) from Binance…

He has bought 127,388 ETH ($405.19 million) from DEX and Binance since Apr 8th, with an average buying price of ~$3,172.”

On the same day, another unknown entity was spotted by whale tracking service Whale Alert sending 14,408 ETH worth over $45.745 million to crypto exchange OKX.

Whale Alert also tracked down a wallet that was involved in the initial coin offering (ICO) of Ethereum move 197 ETH worth $622,685. The wallet had been dormant for nearly nine years prior to the latest transfer, according to Whale Alert.

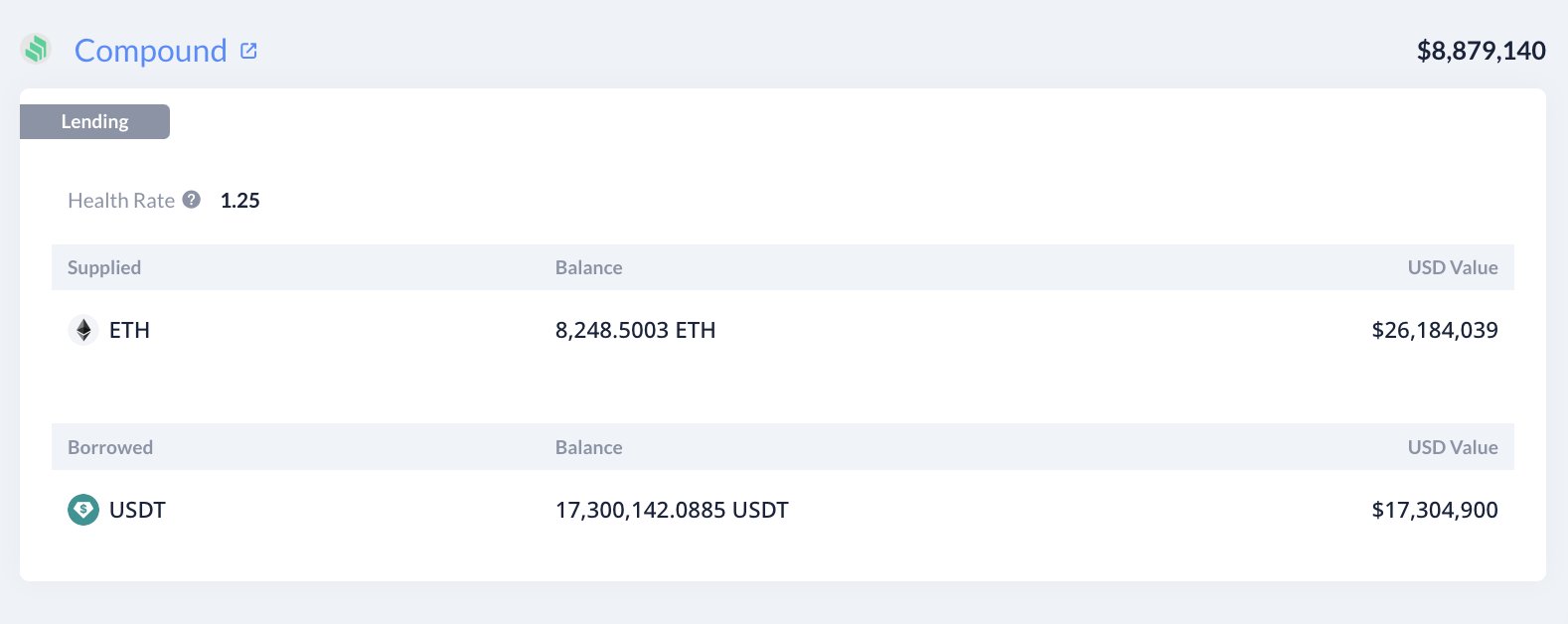

Another whale was seen attempting to leverage-long Ethereum, after previously losing millions trying to do the same move. Lookonchain identified the entity borrowing USDT from the lending platform Compound (COMP) to long ETH.

“This whale went long ETH again.

He lost two times while long ETH, for a total loss of $4.5 million!

[On Sunday], he withdrew 8,249 ETH ($26.18 million) from Binance and deposited it into Compound, then borrowed 17.3 million USDT from Compound.”

At time of writing, Ethereum is trading at $3,222.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any loses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney

Source link

You may like

Crypto Expert Turns Bullish On Bitcoin, Predicts Quantitative Easing Will Begin Soon

US DOJ Indicts Manhattan Man on Fraud Charges Related to $43,000,000 Fake Crypto Ponzi Scheme

$120 Million Futures Liquidated As Price Takes A Beating

Dogecoin Mirroring Price Action That Preceded Massive Bull Runs in the Past, Says Trader – Here’s His Outlook

Is Ethereum Back? Record 267,000 New Users Spark Speculation

Economist Alex Krüger Goes ‘Max Long’ on Crypto Positions – Here Are His Altcoin Picks

Altcoins

Is Ethereum Back? Record 267,000 New Users Spark Speculation

Published

18 hours agoon

May 3, 2024By

admin

The winds of change are swirling around Ethereum, the world’s second-largest cryptocurrency. Despite a recent price dip, the network has witnessed a surge in new user activity, sparking a wave of optimism. However, the outsized influence of large holders, known as whales, continues to cast a long shadow.

New Wallets Open For Business

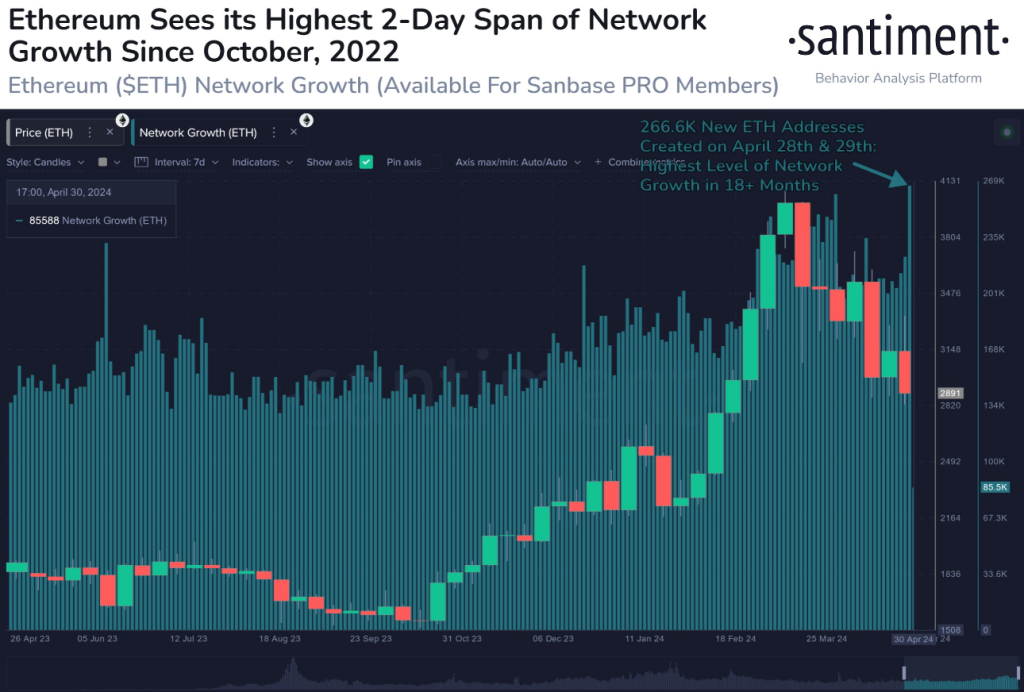

Data from blockchain analytics firm Santiment reveals a surge in new Ethereum wallets, with a record-breaking 267,000 created on April 28th and 29th. This influx marks the highest two-day increase since October 2022 and suggests a potential resurgence of interest in the Ethereum network.

📈 #Ethereum saw a milestone as April came to an end. 266.6K new wallets were created on April 28th and 29th, the highest 2-day stretch of network growth since October 8th and 9th, 2022. It is a strong that $ETH continues expanding despite dipping prices. https://t.co/SN6xqc3JXV pic.twitter.com/KDcjhY30y5

— Santiment (@santimentfeed) May 1, 2024

This trend defies the current market downturn, with many cryptocurrencies experiencing significant price drops. Analysts speculate that the rise in new wallets could be fueled by several factors, including:

- Anticipation of future growth: Investors may be looking towards upcoming Ethereum upgrades that promise improved scalability and security, betting on the network’s long-term potential.

- Bargain hunters: The recent price dip might be seen as an attractive entry point for new investors seeking a discount on Ethereum.

On Minnows And Whales

While the number of new users is encouraging, a closer look at Ethereum’s address distribution reveals a stark disparity in holdings. According to CoinMarketCap, a staggering 97% of Ethereum addresses hold between $0 and $1,000 worth of the cryptocurrency. This signifies a large pool of small-scale investors, often referred to as “minnows.”

However, the real power lies with a select few. Whale tracking platform Clank estimates that whales, representing only 0.10% of all Ethereum addresses, control a whopping 41% of the total circulating supply. This translates to an average holding of nearly 10 million ETH per whale, valued at a staggering $3.7 million.

Ether market cap currently at $362 billion. Chart: TradingView.com

Holding Steady: A Vote Of Confidence?

Despite the recent price decline, Ethereum appears to be weathering the storm better than the broader crypto market. In fact, Ether is up more than 30% year-to-date (YTD) from an opening price of about $2,282.

As of today, Ethereum sits at $3,014, with a total market capitalization of $362 billion. Notably, the market experienced an average decline of 8.75% over the last week, highlighting Ethereum’s relative resilience.

Source: CoinMarketCap

Furthermore, data suggests that a majority of Ethereum investors (74%) are long-term holders, demonstrating a strong belief in the project’s future. This “hodling” mentality indicates a commitment to maintaining their Ethereum positions for the long haul, even in the face of short-term market fluctuations.

Featured image from Pixabay, chart from TradingView

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Source link

ETH

Ethereum Price Revisits Key Support, Can Bears Take Over?

Published

2 days agoon

May 2, 2024By

admin

Ethereum price started another decline and traded below $2,920. ETH could gain bearish momentum if there is a close below the $2,800 support zone.

- Ethereum remained in a bearish zone and traded below the $2,900 zone.

- The price is trading below $2,950 and the 100-hourly Simple Moving Average.

- There is a connecting bearish trend line forming with resistance at $3,050 on the hourly chart of ETH/USD (data feed via Kraken).

- The pair could continue to move down if it stays below the $3,050 resistance.

Ethereum Price Extends Losses

Ethereum price remained in a bearish zone below the $3,120 level, like Bitcoin. ETH traded below the $3,000 level. The bears even pushed the price below the $2,920 level.

A low was formed at $2,813 and the price is now consolidating. There was a minor increase above the $2,900 level. The price tested the 23.6% Fib retracement level of the downward wave from the $3,355 swing high to the $2,813 low. However, the bears were active near the $2,950 and $2,965 levels.

Ethereum is now trading below $3,000 and the 100-hourly Simple Moving Average. Immediate resistance is near the $2,965 level. The first major resistance is near the $3,050 level and the 100-hourly Simple Moving Average.

There is also a connecting bearish trend line forming with resistance at $3,050 on the hourly chart of ETH/USD. The trend line is close to the 50% Fib retracement level of the downward wave from the $3,355 swing high to the $2,813 low.

Source: ETHUSD on TradingView.com

The next key resistance sits at $3,085, above which the price might gain traction and rise toward the $3,150 level. A close above the $3,150 resistance could send the price toward the $3,250 resistance. If there is a move above the $3,250 resistance, Ethereum could even test the $3,350 resistance. Any more gains could send Ether toward the $3,500 resistance zone.

More Downsides In ETH?

If Ethereum fails to clear the $3,050 resistance, it could continue to move down. Initial support on the downside is near the $2,850 level. The first major support is near the $2,820 zone.

The main support is near the $2,820 level. A clear move below the $2,820 support might push the price toward $2,650. Any more losses might send the price toward the $2,540 level in the near term.

Technical Indicators

Hourly MACD – The MACD for ETH/USD is gaining momentum in the bearish zone.

Hourly RSI – The RSI for ETH/USD is now below the 50 level.

Major Support Level – $2,820

Major Resistance Level – $3,050

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Source link

Altcoins

Ethereum and Altcoins Associated With ETH May Witness Rallies Sooner Than Expected, According to Santiment

Published

3 days agoon

May 1, 2024By

admin

Crypto analytics firm Santiment thinks that Ethereum (ETH) and altcoins related to the top smart contract platform will leave many traders on the sidelines.

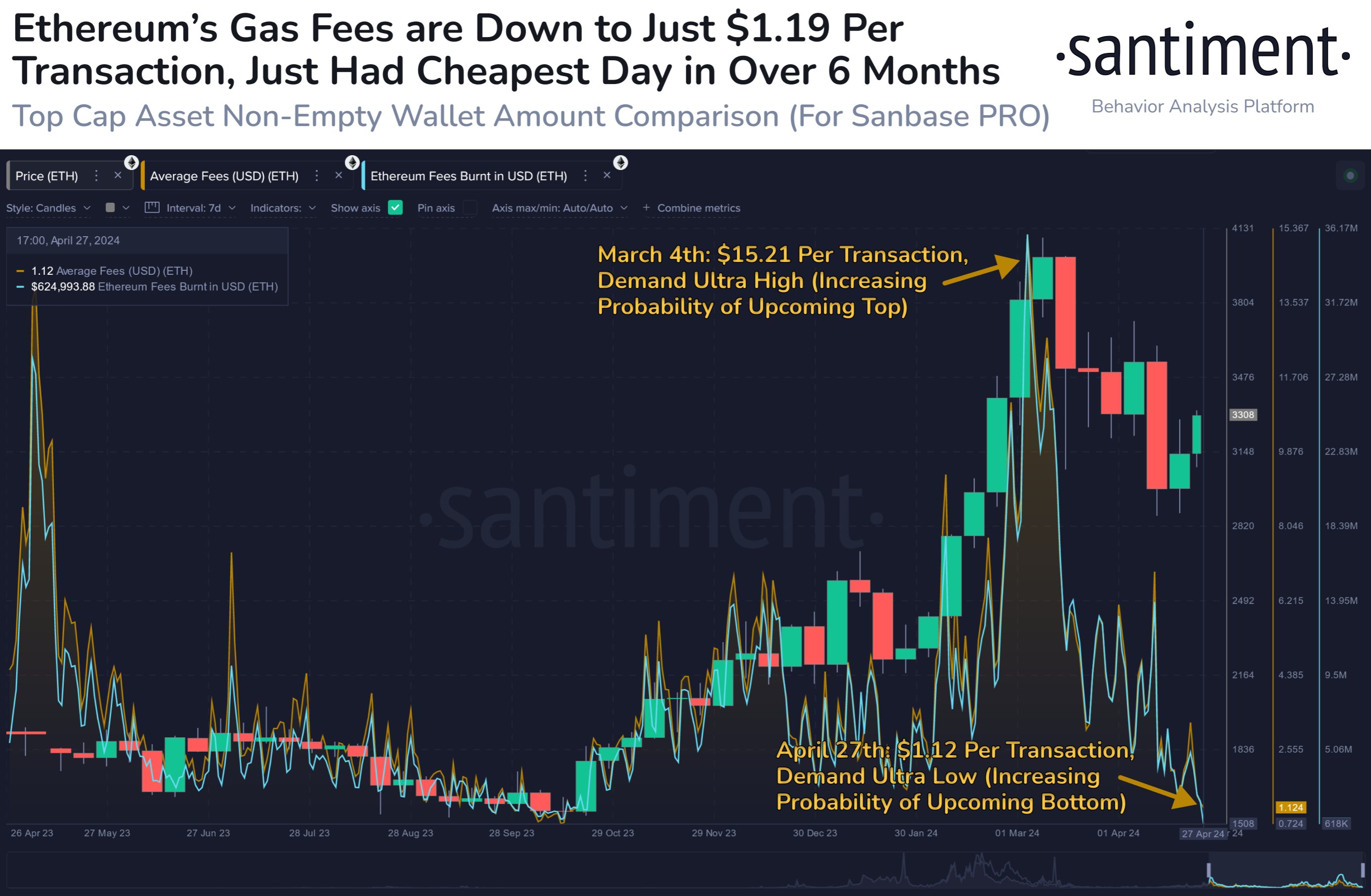

Santiment says it is keeping a close eye on Ethereum’s average transaction fee, which nosedived to its lowest level since October 18th, 2023.

According to the analytics firm, the slumping gas fee is a solid signal that Ethereum is in the midst of carving a local bottom.

“Ethereum’s average fee level has dipped to just $1.12 per network transaction, the lowest average cost in a day since October 18th.

Traders historically move between sentimental cycles of feeling that crypto is going ‘To the Moon’ or feeling that ‘It Is Dead,’ which can be observed through transaction fees. These fees will tend to peak (and sometimes diverge) around price tops, and go back to its resting state around price bottoms.

With markets mainly retracing over the past six weeks, the lack of demand and strain on the network may help turn ETH and associated altcoins around sooner than many may expect.”

At time of writing, Ethereum is trading for $3,218, up over 13% from its April low of $2,832.

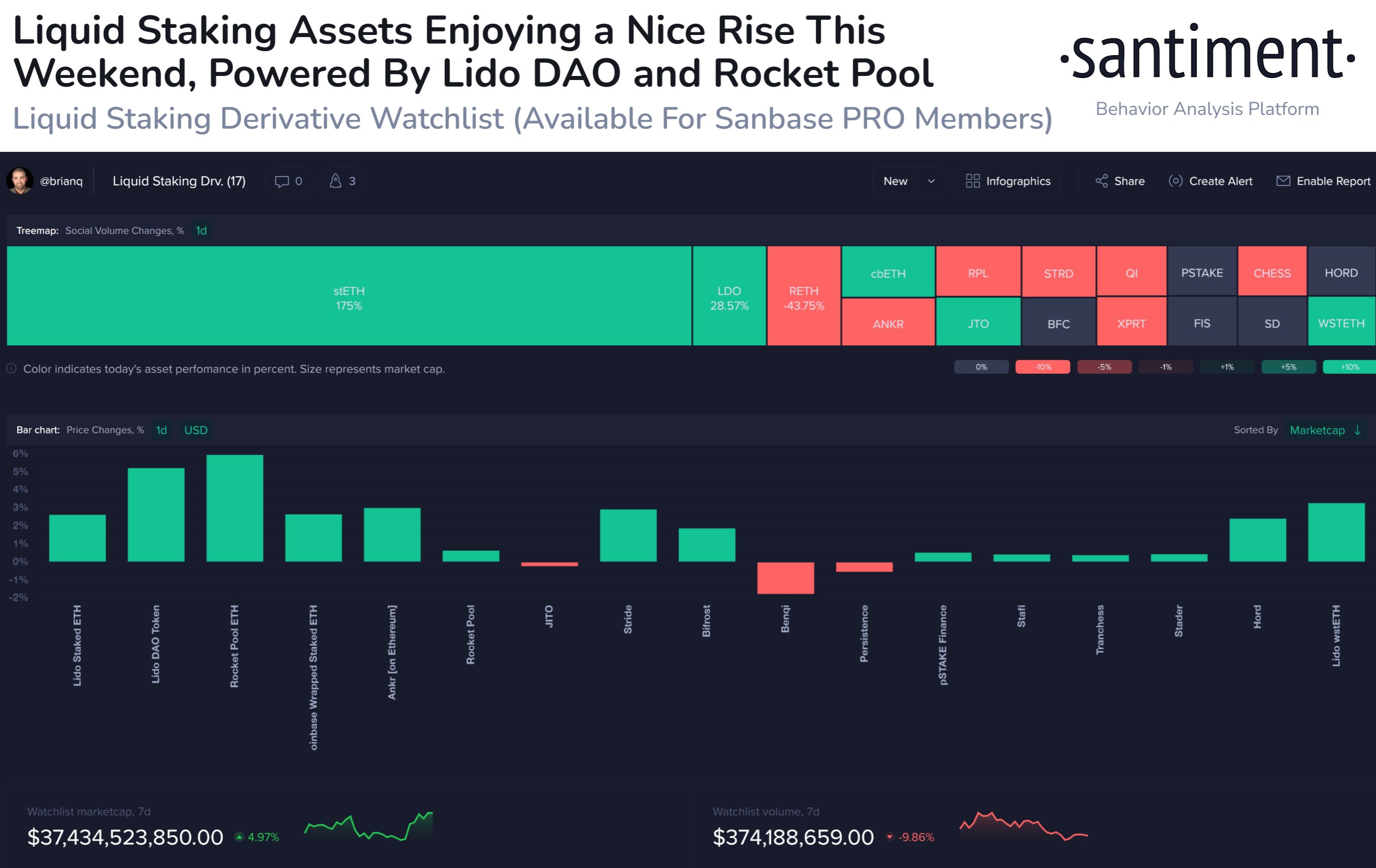

Looking at altcoins operating in the Ethereum ecosystem, Santiment notes that a couple of coins are already showing signs of strength.

“Liquid staking assets have benefited from a nice mini-run this weekend. Of the 17 key assets that we track for this sector, the market caps have increased by a combined +5.0% despite choppy market conditions: LDO (+5.2%) and RETH (+5.9%) lead the way.”

At time of writing, Lido DAO (LDO) is trading for $2.15 while Rocket Pool ETH (RETH) is worth $3,547.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney

Source link

Crypto Expert Turns Bullish On Bitcoin, Predicts Quantitative Easing Will Begin Soon

US DOJ Indicts Manhattan Man on Fraud Charges Related to $43,000,000 Fake Crypto Ponzi Scheme

$120 Million Futures Liquidated As Price Takes A Beating

Dogecoin Mirroring Price Action That Preceded Massive Bull Runs in the Past, Says Trader – Here’s His Outlook

Is Ethereum Back? Record 267,000 New Users Spark Speculation

Economist Alex Krüger Goes ‘Max Long’ on Crypto Positions – Here Are His Altcoin Picks

Crypto Investors Bet Big On ETFSwap (ETFS) Presale To Leverage Spot Bitcoin ETFs Popularity – Blockchain News, Opinion, TV and Jobs

Bitbot’s Presale Passes $3M After AI Development Update – Blockchain News, Opinion, TV and Jobs

Dogecoin Breaks Out Of Descending Triangle Like It Did In 2021, Analyst Sets $6 Target

Bitcoin Cash (BCH) Backer Roger Ver Arrested and Charged With Evading Nearly $50,000,000 in Taxes

AppLayer Unveils Fastest EVM Network and $1.5M Network Incentive Program – Blockchain News, Opinion, TV and Jobs

Whales Dive In, But Dogecoin Price Sinks 20%: What’s Going On?

Humanode, a blockchain built with Polkadot SDK, becomes the most decentralized by Nakamoto Coefficient – Blockchain News, Opinion, TV and Jobs

Here’s When Bitcoin Could Halt the ‘Slide’ and Start To Pump, According to On-Chain Analytics Firm Santiment

Ethereum Price Revisits Key Support, Can Bears Take Over?

Bitcoin Dropped Below 2017 All-Time-High but Could Sellers be Getting Exhausted? – Blockchain News, Opinion, TV and Jobs

What does the Coinbase Premium Gap Tell us about Investor Activity? – Blockchain News, Opinion, TV and Jobs

BNM DAO Token Airdrop

NFT Sector Keeps Developing – Number of Unique Ethereum NFT Traders Surged 276% in 2022 – Blockchain News, Opinion, TV and Jobs

New Minting Services

Block News Media Live Stream

A String of 200 ‘Sleeping Bitcoins’ From 2010 Worth $4.27 Million Moved on Friday

SEC’s Chairman Gensler Takes Aggressive Stance on Tokens – Blockchain News, Opinion, TV and Jobs

Friends or Enemies? – Blockchain News, Opinion, TV and Jobs

Enjoy frictionless crypto purchases with Apple Pay and Google Pay | by Jim | @blockchain | Jun, 2022

Block News Media Live Stream

How Web3 can prevent Hollywood strikes

Block News Media Live Stream

XRP Explodes With 1,300% Surge In Trading Volume As crypto Exchanges Jump On Board

Block News Media Live Stream

Trending

Altcoins2 years ago

Altcoins2 years agoBitcoin Dropped Below 2017 All-Time-High but Could Sellers be Getting Exhausted? – Blockchain News, Opinion, TV and Jobs

Binance2 years ago

Binance2 years agoWhat does the Coinbase Premium Gap Tell us about Investor Activity? – Blockchain News, Opinion, TV and Jobs

- Uncategorized2 years ago

BNM DAO Token Airdrop

BTC1 year ago

BTC1 year agoNFT Sector Keeps Developing – Number of Unique Ethereum NFT Traders Surged 276% in 2022 – Blockchain News, Opinion, TV and Jobs

- Uncategorized2 years ago

New Minting Services

Video2 years ago

Video2 years agoBlock News Media Live Stream

Bitcoin miners2 years ago

Bitcoin miners2 years agoA String of 200 ‘Sleeping Bitcoins’ From 2010 Worth $4.27 Million Moved on Friday

Bitcoin1 year ago

Bitcoin1 year agoSEC’s Chairman Gensler Takes Aggressive Stance on Tokens – Blockchain News, Opinion, TV and Jobs