cryptocurrency

How To Become A Crypto Millionaire With Dogecoin (DOGE), ETFSwap (ETFS), And Ondo Finance (ONDO) – Blockchain News, Opinion, TV and Jobs

Published

1 week agoon

By

admin

Dogecoin (DOGE), ETFSwap (ETFS), and Ondo Finance (ONDO) have been touted as three tokens that could make crypto investors millions of dollars in this bull run. Dogecoin (DOGE), on its part, has a proven track record since it made many crypto millionaires in the last bull run.

Meanwhile, as relative newcomers, ETFSwap (ETFS) and Ondo Finance (ONDO) have shown enough bullish momentum to convince investors they are the future of the crypto market. Besides, the infrastructure that they provide in the crypto industry is second to none.

Expect More Dogecoin (DOGE) Millionaires This Market Cycle

More Dogecoin (DOGE) millionaires are expected to be made in this bull cycle, with analysts projecting that the meme coin can still mount a significant run this year. Specifically, a host of these crypto analysts predicts that Dogecoin (DOGE) will rise to as high as $1 this time around. A rise to $1 represents over a 3x increase for the foremost meme coin from its current price of $0.15.

Factors like Elon Musk’s support for the meme coin are expected to contribute to Dogecoin’s (DOGE) rise to the $1 mark. Musk already confirmed that Tesla customers will be able to use the meme coin to make payments “at some point.” Meanwhile, there continues to be speculation that Dogecoin (DOGE) payments will be enabled once X (formerly Twitter) launches its payment service.

Institutional interest in the meme coin is also set to pick up, with the foremost US crypto exchange, Coinbase, launching a regulated Dogecoin (DOGE) futures for its institutional clients on April 29.

Given such developments, Dogecoin (DOGE) rising to $1 is possible. However, crypto investors who are likely to make millions of dollars from such a price increase are those who can invest a significant sum in the meme coin, simply put, crypto whales. That is why crypto investors with lesser liquidity are turning their attention to other crypto tokens like ETFSwap (ETFS).

ETFSwap (ETFS) To Lead The Tokenization Wave

ETFSwap (ETFS) is a decentralized finance (DeFi) platform that enables users to trade exchange-traded funds (ETFs) on-chain. These ETFs will cut across various sectors, including technology, health, transportation, oil, and gas, giving investors an array of choices to pick from.

ETFSwap (ETFS) provides instant settlement of these tokenized ETFs, meaning that investors can redeem their investments at any time without waiting for the traditional trading hours they are accustomed to under centralized entities.

Unlike these centralized entities and even Ondo Finance (ONDO), ETFSwap (ETFS) will operate a permissionless access framework. This means that users do not have to worry about the overwhelming Know-Your-Customers (KYC) requirements they usually have to fulfill when investing in these RWAs.

BlackRock’s CEO Larry Fink once mentioned that tokenization will be the “next generation for markets,” which makes ETFSwap’s (ETFS) offering more exciting. Fink even suggested that tokenized real-world assets could even end up bigger than Bitcoin (BTC), meaning that ETFSwap (ETFS) is set to gain more prominence when that time comes.

Ondo Finance (ONDO) Is Also Doing Something Special

Like ETFSwap (ETFS), Ondo Finance (ONDO) bridges the gap between traditional finance (TradFi) and DeFi as it also enables on-chain access to real-world assets (RWA). Specifically, the decentralized finance (DeFi) platform focuses on bringing US treasury yields on-chain, allowing crypto natives to benefit from these traditional assets.

Ondo Finance (ONDO) continues to make great strides in the crypto industry. The DeFi platform recently expanded its offerings to the Cosmos ecosystem. This exposes Ondo Finance’s (ONDO) tokenized treasuries to users of the numerous blockchains in the Cosmos ecosystem.

Meanwhile, thanks to Ondo Finance (ONDO) backing its US-treasury-backed tokens (OUSG) with BlackRock’s first tokenized fund, BUIDL, investors can now get an instant settlement and redemption of their investments. Given such offerings, Ondo Finance’s native token, Ondo (ONDO), currently trading at around $0.7, looks like a good bargain and could still make more parabolic moves to the upside.

Crypto Investors Are Choosing ETFSwap (ETFS)

With over 22 million ETFSwap (ETFS) tokens sold in stage 1 of its ongoing presale round, crypto investors have shown where they have decided to pitch their tent. These investors are believed to have chosen the ETFSwap (ETFS) token over Ondo (ONDO) and Dogecoin (DOGE) because it looks like the one with the most bullish momentum.

Moreover, ETFSwap (ETFS), currently selling at $0.00854, looks more undervalued than the others and could eventually provide crypto investors with the most gains. Crypto experts have also identified ETFSwap as the crypto token that could rise as Shiba Inu (SHIB) did in 2021, which means that ETFSwap’s (ETFS) price gains are likely to be unmatched by either Dogecoin (DOGE) or Ondo Finance (ONDO).

Stage 1 of the token presale is still ongoing, and crypto investors still have a chance to invest in this once-in-a-lifetime opportunity. ETFSwap’s (ETFS) price is expected to double in stage 2 of the presale, meaning that those who will make maximum gains from the token are those who invest now.

For more information about the ETFS Presale:

Source link

You may like

$120 Million Futures Liquidated As Price Takes A Beating

Dogecoin Mirroring Price Action That Preceded Massive Bull Runs in the Past, Says Trader – Here’s His Outlook

Is Ethereum Back? Record 267,000 New Users Spark Speculation

Economist Alex Krüger Goes ‘Max Long’ on Crypto Positions – Here Are His Altcoin Picks

Crypto Investors Bet Big On ETFSwap (ETFS) Presale To Leverage Spot Bitcoin ETFs Popularity – Blockchain News, Opinion, TV and Jobs

Bitbot’s Presale Passes $3M After AI Development Update – Blockchain News, Opinion, TV and Jobs

AI crypto

Crypto Investors Bet Big On ETFSwap (ETFS) Presale To Leverage Spot Bitcoin ETFs Popularity – Blockchain News, Opinion, TV and Jobs

Published

18 hours agoon

May 2, 2024By

admin

Crypto investors are now moving to the ongoing ETFSwap (ETFS) presale as Spot Bitcoin ETFs surge in popularity.

Crypto investors are now looking into ETFSwap (ETFS) amidst surging interest in Spot Bitcoin ETFs. With ETFSwap (ETFS), users can access both decentralized finance (DeFi) and the conventional exchange-traded fund (ETF) market without having to purchase any assets directly.

Investors can profit from a closer integration between these two markets by trading and using particular platform features with different tokenized ETFs. These tokenized exchange-traded funds (ETFs) replicate the performance of significant institutional cryptocurrency ETFs, such as Blackrock’s IBIT, which oversees $17.6 billion in assets.

Increasing Crypto Investor Confidence In Spot Bitcoin ETFs

The emergence of numerous cryptocurrency exchange-traded funds (ETFs) has been a notable development in the market thus far. Spot Bitcoin ETFs in particular, have now taken a majority of the market share of crypto ETFs. The ETFs went live immediately after they gained approval from the US Securities and Exchange Commission (SEC) in January and now represent 90% of the market share of daily trading activity for ETFs that provide price exposure to bitcoin.

In this regard, ETFSwap (ETFS) has distinguished itself as a top-notch DeFi platform, breaking into the ETF investing world. At the core of its model, ETFSwap (ETFS) is a DeFi platform that is revolutionizing the world of ETF investments. ETFSwap (ETFS) is built on blockchain technology, allowing it to provide a seamless ETF investing experience for both institutional and retail investors.

The ETFSwap (ETFS) platform is equipped with many tokenized ETFs of precious metals, cryptocurrencies, commodities, and ETFs tracking fixed-income investment vehicles. These tokenized ETFs can be easily bought and sold like conventional ETFs, albeit with cryptocurrencies on the ETFSwap (ETFS) platform.

Notably, ETFSwap’s (ETFS) use of blockchain technology buffed the platform’s security and transparency, making it impossible for third parties and middlemen to interfere. As a result, investors can start trading easily without having to undergo KYC registrations. Investors only need to connect their digital wallets to the platform and start trading tokenized ETFs 24/7.

Another key perk of the ETFSwap (ETFS) platform is the ability of users to trade fractionalized ETF shares with up to 10X leverage, a feature extremely appealing to retail investors.

Taking into account these impressive features and the long-term objective of ETFSwap (ETFS) within the surging popularity of Spot Bitcoin ETFs, crypto investors are now looking to position themselves on the platform. This interesting potential and bullish sentiment has allowed ETFSwap (ETFS) to easily raise $750,000 within 72 hours of its private funding round, which has also flowed into its ongoing presale.

Expectations And Investor Sentiment Toward ETFSwap

ETFSwap (ETFS) is currently in its presale round, where 4almost 0% of the total circulating supply of its utility token ETFS has already been sold to early investors. As a utility token, ETFS unlocks many utilities and benefits within the ETFSwap (ETFS) ecosystem and, consequently within the world of ETF investments.

Some of these benefits include staking rewards, lower fees, trading discounts, and an APR of up to 87%. Interestingly, presale data shows crypto investors are maneuvering to get their hands on ETFS. The demand for the ETFSwap (ETFS) token has been exceptional, with over 30 million tokens sold already.

The first presale round initial presale is still selling for $0.00854 per token, and participants can get an 18% bonus on their purchase. On the other hand, it is anticipated that the next presale stage will sell for $0.01831 per ETFS, and reaching the $1 mark is expected once it lists on major exchanges, which is an 100x increase.

Conclusion: Take Action In ETFS Presale

The crypto industry is home to different calibers of investors who are searching for potential projects to invest in and places to increase their portfolios. As a result, the recent immense popularity of Spot Bitcoin ETFs’ has placed ETFSwap (ETFS) in the limelight for investors looking to invest in ETFs. The ongoing ETFS presale is a great place to start as it offers investors a calculated way to enter the expanding cryptocurrency sector, and presale data suggests the earlier, the better. Due to the urgency created by limited availability, investors are encouraged to lock up their positions before allocations run out.

For more information about the ETFS Presale:

Source link

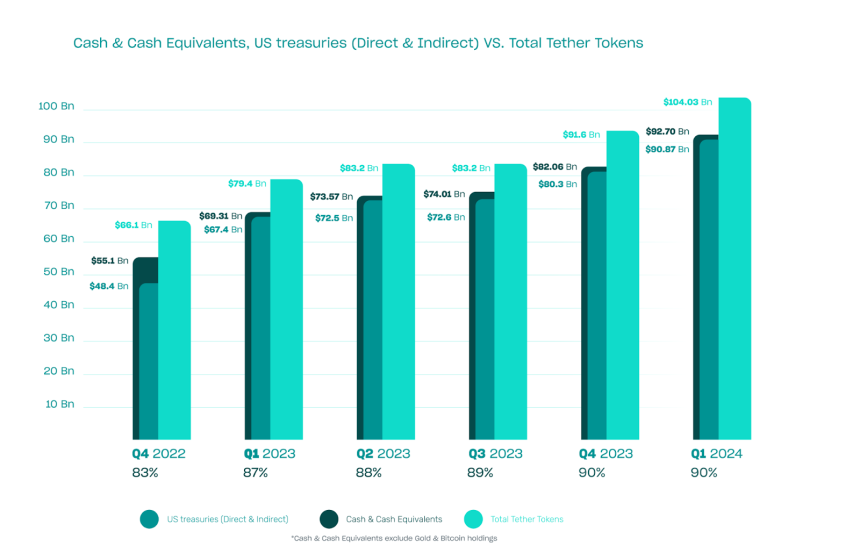

Stablecoin issuer Tether, a prominent player in the cryptocurrency market behind the widely used USDT stablecoin, has released its audit statement for the first quarter of 2024, accompanied by a report conducted by independent accounting firm BDO.

The report, which provides additional financial information beyond the reserves backing Tether’s fiat-denominated stablecoins, shows the company’s profit for the first quarter of the year, which saw an increased influx of capital into the market.

Tether Q1 2024 Financials Soar

Digging into the numbers, the first quarter of 2024 proved highly profitable for Tether, with a net profit of $4.52 billion.

The main contributors, the entities responsible for issuing stablecoins and managing reserves, reportedly generated approximately $1 billion of this profit from net operating gains, primarily from US Treasury holdings. The remaining profits were attributable to mark-to-market gains on Bitcoin (BTC) and gold positions.

The report also highlighted Tether’s success in increasing its direct and indirect holdings of US Treasuries to over $90 billion. This includes indirect exposure through overnight reverse repurchase agreements collateralized by US Treasuries and investments in US Treasuries through money market funds.

In a sign of significant growth, Tether also disclosed its net equity for the first time, revealing a figure of $11.37 billion as of March 31, 2024. This is an increase from the $7.01 billion equity reported as of December 31, 2023.

The report also highlighted a $1 billion increase in excess reserves, which support the company’s stablecoin offerings, bringing the total to nearly $6.3 billion.

CEO Emphasizes Transparency And Stability

The BDO confirmation reiterated that Tether-issued tokens are 90% backed by cash and cash equivalents, underscoring the company’s stance on maintaining liquidity within the stablecoin ecosystem. Furthermore, the report revealed that over $12.5 billion worth of USDT was issued in the first quarter alone.

Tether Group’s strategic investments, which exceed $5 billion as of the report date, span various sectors, including artificial intelligence (AI) and data, renewable energy, person-to-person (P2P) communication, and Bitcoin Mining.

In response to the latest report, Paolo Ardoino, CEO of Tether, expressed the company’s commitment to transparency, stability, liquidity, and responsible risk management.

Ardoino highlighted Tether’s record-breaking profit benchmark of $4.52 billion and the company’s efforts to increase transparency and trust within the cryptocurrency industry. Ardoino further claimed:

In reporting not just the composition of our reserves, but now the Group’s net equity of $11.37 billion, Tether is again raising the bar in the cryptocurrency industry in the realms of transparency and trust.

Featured image from Shutterstock, chart from TradingView.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Source link

cryptocurrency

Forget Meme Coins And NFTs, RWA And DePin Are The Next Big Things – Blockchain News, Opinion, TV and Jobs

Published

4 days agoon

April 29, 2024By

admin

Meme coins and NFTs have outlived their relevance, and it is now time for crypto investors to focus on DePin and RWA projects like ETFSwap (ETFS).

Over the last three years, meme coins and non-fungible tokens (NFTs) have been among the leading narratives in the crypto space. Thanks to the hype around these meme coins and NFTs, crypto investors have made insane returns on their investments,

However, there is a change in the tide that the time has come to pivot from these meme coins and NFT projects and focus on new narratives such as RWA and DePin.

Real World Assets (RWA) and Decentralized Physical Infrastructure (DePin) are two sectors that are gaining traction and could become the center of attraction soon enough.

RWA And DePin Take Over From Meme Coins And NFTs

Asset tokenization continues to be widely discussed, with BlackRock’s CEO Larry Fink even referring to it as the “next generation for markets.” This has put more focus on RWA projects, which are bringing this concept to life. Basically, these projects are tokenizing real-world assets like real estate, royalties, securities, contracts, ETFs, and art with the aid of blockchain technology.

This changes how investors interact with these assets since they will become more accessible and easier to trade. On accessibility, asset tokenization further promotes fractional ownership, which means that individuals can now own a share of assets they wouldn’t otherwise have the means to access.

With these assets being easier to trade, previously illiquid assets will become more liquid. Generally, all asset classes will become more liquid since there is expected to be an inflow of new money into all of them. That is why the RWA industry is projected to become a trillion-dollar market by 2030.

Meanwhile, it is worth noting that RWA projects will be the tunnel through which this liquidity will pass through. That is why crypto investors should pay more attention to them and look to position themselves accordingly.

Like the RWA industry, the DePin market also boasts great potential. As the name suggests, these projects, with the aid of blockchain technology and tokenization, manage their physical infrastructure in a decentralized manner. These physical infrastructures include telecommunications, health systems, power grids, and road networks.

Unlike traditional companies, these projects’ decentralized mode of operation helps simplify their operations and reduce their operating costs. Meanwhile, this business model is also a win for their users, as they are incentivized (with tokens) to contribute to the services these projects provide.

Given such massive potential, the narrative shift from meme coins and NFTs to these RWA and DePin projects is expected to happen sooner rather than later. In fact, these projects could already be the leading narratives, seeing how they have recently achieved more success than meme coins and NFT projects in this cycle.

Crypto expert Michaël van de Poppe called this correctly, as before the Bitcoin Halving took place, he mentioned that there would be a narrative shift to RWA and DePin projects after the Halving.

ETFSwap (ETFS) Presale Sees Increased Demand

The ETFSwap (ETFS) token presale is already seeing increased demand, with crypto investors turning their attention to RWA and DePin projects. ETFS is the native token of ETFSwap, a decentralized finance (DeFi) platform that enables on-chain trading of exchange-traded funds (ETFs).

That explains why investors are rushing to accumulate as many ETFSwap (ETFS) tokens as possible since the platform is already ranked as one of the most promising RWA projects.

Meanwhile, with RWA and DePin projected as the next big things in the crypto space, the ETFSwap (ETFS) is an instant pick as one of the tokens likely to run hard in this market cycle. Experts have also predicted impressive price gains for the crypto token in particular, saying it could rise as Shiba Inu (SHIB) did in 2021.

They say this is possible because ETFSwap (ETFS) has many bullish narratives working in its favor. Besides the RWA narrative, ETFSwap will offer ETFs like the Spot Bitcoin ETF, which has already gained a lot of attention in the crypto space since launching.

Furthermore, staking rewards have recently become more attractive to investors looking for passive income. ETFSwap (ETFS) is set to stand out in this regard since it provides attractive yields that are second to none.

Privacy concerns also continue to be raised in the crypto space, with users complaining that many projects are not truly decentralized and do not protect users’ data. This plays out in ETFSwap’s (ETFS) favor since the platform prioritizes its users’ privacy above anything else. For instance, Know-Your-Customer (KYC) requirements are non-mandatory on the platform, so users do not have to worry about sharing sensitive data or their information being tracked and leaked.

So far, over 30 million ETFSwap (ETFS) tokens have been sold in stage 1 of the ongoing presale. This presale stage is still ongoing, and each token costs $0.00854. However, with the increased demand for these tokens, they are expected to sell out even before the scheduled end date.

For more information about the ETFS Presale:

Source link

$120 Million Futures Liquidated As Price Takes A Beating

Dogecoin Mirroring Price Action That Preceded Massive Bull Runs in the Past, Says Trader – Here’s His Outlook

Is Ethereum Back? Record 267,000 New Users Spark Speculation

Economist Alex Krüger Goes ‘Max Long’ on Crypto Positions – Here Are His Altcoin Picks

Crypto Investors Bet Big On ETFSwap (ETFS) Presale To Leverage Spot Bitcoin ETFs Popularity – Blockchain News, Opinion, TV and Jobs

Bitbot’s Presale Passes $3M After AI Development Update – Blockchain News, Opinion, TV and Jobs

Dogecoin Breaks Out Of Descending Triangle Like It Did In 2021, Analyst Sets $6 Target

Bitcoin Cash (BCH) Backer Roger Ver Arrested and Charged With Evading Nearly $50,000,000 in Taxes

AppLayer Unveils Fastest EVM Network and $1.5M Network Incentive Program – Blockchain News, Opinion, TV and Jobs

Whales Dive In, But Dogecoin Price Sinks 20%: What’s Going On?

Humanode, a blockchain built with Polkadot SDK, becomes the most decentralized by Nakamoto Coefficient – Blockchain News, Opinion, TV and Jobs

Here’s When Bitcoin Could Halt the ‘Slide’ and Start To Pump, According to On-Chain Analytics Firm Santiment

Ethereum Price Revisits Key Support, Can Bears Take Over?

Solana Co-Founder Says Cosmos and One SOL Rival Are Clear Winners in Building Sovereign Blockchains

Achieves Record Net Profit Of $4.5 Billion In Q1

Bitcoin Dropped Below 2017 All-Time-High but Could Sellers be Getting Exhausted? – Blockchain News, Opinion, TV and Jobs

What does the Coinbase Premium Gap Tell us about Investor Activity? – Blockchain News, Opinion, TV and Jobs

BNM DAO Token Airdrop

NFT Sector Keeps Developing – Number of Unique Ethereum NFT Traders Surged 276% in 2022 – Blockchain News, Opinion, TV and Jobs

New Minting Services

Block News Media Live Stream

A String of 200 ‘Sleeping Bitcoins’ From 2010 Worth $4.27 Million Moved on Friday

SEC’s Chairman Gensler Takes Aggressive Stance on Tokens – Blockchain News, Opinion, TV and Jobs

Friends or Enemies? – Blockchain News, Opinion, TV and Jobs

Enjoy frictionless crypto purchases with Apple Pay and Google Pay | by Jim | @blockchain | Jun, 2022

Block News Media Live Stream

How Web3 can prevent Hollywood strikes

Block News Media Live Stream

XRP Explodes With 1,300% Surge In Trading Volume As crypto Exchanges Jump On Board

Block News Media Live Stream

Trending

Altcoins2 years ago

Altcoins2 years agoBitcoin Dropped Below 2017 All-Time-High but Could Sellers be Getting Exhausted? – Blockchain News, Opinion, TV and Jobs

Binance2 years ago

Binance2 years agoWhat does the Coinbase Premium Gap Tell us about Investor Activity? – Blockchain News, Opinion, TV and Jobs

- Uncategorized2 years ago

BNM DAO Token Airdrop

BTC1 year ago

BTC1 year agoNFT Sector Keeps Developing – Number of Unique Ethereum NFT Traders Surged 276% in 2022 – Blockchain News, Opinion, TV and Jobs

- Uncategorized2 years ago

New Minting Services

Video2 years ago

Video2 years agoBlock News Media Live Stream

Bitcoin miners2 years ago

Bitcoin miners2 years agoA String of 200 ‘Sleeping Bitcoins’ From 2010 Worth $4.27 Million Moved on Friday

Bitcoin1 year ago

Bitcoin1 year agoSEC’s Chairman Gensler Takes Aggressive Stance on Tokens – Blockchain News, Opinion, TV and Jobs