crypto

Ripple CEO Responds To SEC’s Shocking $2 Billion Demand

Published

1 month agoon

By

admin

In a rather shocking development, the United States Securities and Exchange Commission (SEC) has demanded a $2 billion sanction against Ripple. Responding to the startling demands, Ripple’s Chief Executive Officer (CEO), Brad Garlinghouse has taken a firm stance against the agency’s demands, determined to expose the true nature of the SEC.

Ripple CEO Criticizes SEC’s Demands

Stuart Alderoty, the Chief Legal Officer (CLO) of Ripple recently disclosed in a post on X (formerly Twitter) that the US SEC has petitioned a Judge for $2 billion in fines and penalties against Ripple. According to the Ripple CLO, the SEC is in a relentless pursuit to “punish and intimidate Ripple,” rather than faithfully applying the law.

Challenging the SEC’s $2 billion penalty, Garlinghouse emphasized that the agency has consistently operated beyond the bounds of law in various enforcement actions. He disclosed that Judges have also taken note of the SEC’s actions, previously admonishing the agency for its extensive abuse of power entrusted to it by Congress.

The Ripple CEO also criticized the SEC’s penalty demand, arguing that it lacks precedent and justification, particularly given the absence of any allegations, findings of fraud or recklessness in the case. As a result, Garlinghouse has vowed to expose the SEC for its conduct, emphasizing that Ripple will vigorously respond to the SEC’s action.

Notably, Alderoty has disclosed that the company’s legal team will be addressing the SEC’s demands in a filing scheduled for next month. Offering his perspective on the SEC, the Ripple CLO characterized the agency as one “that trades in statements that are false, mischaracterized and designed to mislead.”

SEC Actions Hurt XRP Holders The Most

In its lawsuit against Ripple, the US SEC accused the payment company of violating securities laws by selling XRP in unregistered securities offering to investors in the US. According to the agency, the company and its executives had allegedly failed to protect its investors, depriving them of adequate disclosures of XRP.

However, members of the Ripple community argue that the SEC’s enforcement actions against Ripple have not protected investors but caused even deeper challenges and financial losses for XRP holders.

A popular XRP enthusiast, identified as XRPCryptoWolf has asserted that it should be the SEC, not Ripple, paying billions to XRP holders.

“The SEC asking for $2 billion in fines and penalties is ridiculous when they’re the ones who financially hurt XRP holders the most. The SEC owes XRP holders tens of billions of dollars,” he stated.

The XRP community member disclosed that after the SEC announced its lawsuit against Ripple, approximately $15 billion was wiped out from XRP’s market capitalization, and the token was also delisted from major exchanges. As a result of the lawsuit’s significant impact on XRP’s value, millions of XRP holders experienced financial losses.

XRP price at $0.644 | Source: XRPUSDT on Tradingview.com

Featured image from Inside Bitcoins, chart from Tradingview.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Source link

You may like

Bitcoin Just Entered a ‘Second Danger Zone,’ Warns Crypto Analyst – Here Are His Targets

Forbes Unveils 20 Crypto ‘Zombies,’ Declares Ripple And XRP Among The Undead

Crypto Trader Issues Bitcoin Warning, Says Ethereum Liquid Staking Project Flashing Short-Term Bullish Signal

Crypto Analyst Predicts Massive Move For Bitcoin, What’s The Target?

Analyst Warns One Crypto Asset Category About To Face a Reckoning, Maps Path Forward for Bitcoin and Hedera

DOGE Price Prediction – Dogecoin Below $0.14 Could Spark Larger Degree Drop

Bitcoin

Forbes Unveils 20 Crypto ‘Zombies,’ Declares Ripple And XRP Among The Undead

Published

4 hours agoon

April 27, 2024By

admin

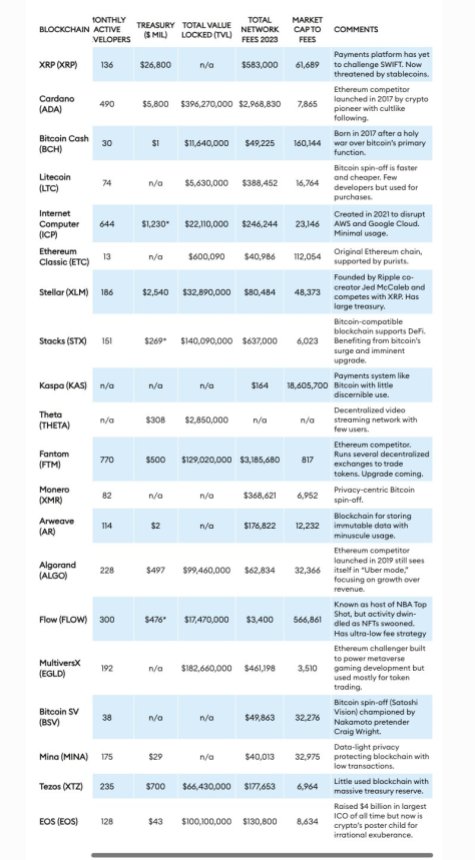

In a controversial report, Forbes unveiled a list of 20 “crypto billion-dollar zombies,” Layer 1 (L1) tokens, which the news outlet defines as crypto assets with substantial valuations but “limited utility beyond speculative trading.”

These cryptocurrencies and projects include Ripple, XRP, Ethereum Classic (ETC), Tezos (XTZ), Algorand (ALGO), and Cardano (ADA), among others.

XRP And Ethereum Classic In The Spotlight

Ripple Labs, the company behind XRP, was highlighted as a prominent crypto zombie. Despite XRP’s active trading volume of around $2 billion daily, Forbes asserts that the token’s primary purpose remains “speculative” and “lacking meaningful utility.”

However, Ripple Labs and XRP are not alone in this regard. Forbes reveals that 50 blockchains, excluding Bitcoin (BTC) and Ethereum (ETH), currently trade at values surpassing $1 billion, with at least 20 of them classified as “functional zombies.” Collectively, these 20 blockchains hold a market value of $116 billion, despite having “limited user bases.”

According to Forbes, an example of a “functional zombie” is Ethereum Classic, which maintains the distinction of being the original Ethereum chain.

While ETC has a market value of $4.6 billion, its fee generation in 2023 was less than $41,000, raising questions about the blockchain’s viability for the news organization.

Another crypto project in Forbes’ report is Tezos, which raised $230 million through an initial coin offering (ICO) in 2017.

Tezos’ XTZ token currently holds a market capitalization of $1.2 billion. However, the blockchain’s fee earnings were meager, with $5,640 in February 2024 and a total of $177,653 for all of 2023.

Algorand, once hailed as an “Ethereum killer” due to its capability of processing 7,500 transactions per second, faces similar challenges.

Despite a market cap of $2 billion and a treasury holding of $500 million, Algorand earned $63,000 in blockchain transaction fees throughout 2023. For Forbes, this casts doubt on its actual adoption and utility.

Crypto ‘Zombie’ Blockchains

The zombie blockchains are categorized into two groups by Forbes: spin-offs and direct competitors to established blockchains like Bitcoin and Ethereum.

Spin-off zombies include Bitcoin Cash (BCH), Litecoin (LTC), Monero (XMR), Bitcoin SV (BSV), and Ethereum Classic.

These blockchains, collectively valued at $23 billion, reportedly emerged from “disagreements” among programmers regarding the governance and direction of the original chains.

Forbes notes that when such conflicts arise, hard forks occur, resulting in new networks that share the same transaction history as their predecessors. The agency claims that their market value “often exceeds” their real-world usage.

Overall, The report highlights a growing disparity between the valuations of certain projects in the cryptocurrency industry and their actual utility and usage. Consequently, Forbes refers to these projects as “zombies.”

Featured image from Shutterstock, chart from TradingView.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Source link

Analyst

Crypto Analyst Predicts Massive Move For Bitcoin, What’s The Target?

Published

12 hours agoon

April 26, 2024By

admin

Despite BTC’s recent unimpressive price action, crypto analyst Doctor Profit has shared his bullish sentiment for Bitcoin and the broader crypto market. The analyst further suggested that a parabolic move was imminent and that crypto investors should position themselves accordingly.

Crypto Market Preparing For A “Third Industrial Revolution”

Doctor Profit mentioned in an X (formerly Twitter) post that the crypto market “is preparing itself for the third Industrial Revolution,” thereby hinting at a trend reversal for Bitcoin and altcoins soon enough. “Be part of it, or regret for [a] lifetime,” the crypto analyst added as he warned crypto investors of missing this market rally.

Related Reading: HBAR Prices Crashes 35% As BlackRock Denies Any Ties To Hedera

In a previous X post, Doctor Profit gave an idea of what to expect from the crypto market (Bitcoin in particular) when it makes its next leg up. He stated that the flagship crypto will rise to $84,000 after it is done trading the sideway range between $60,000 and $72,000. In another X post, he claimed that the super cycle will start after Bitcoin hits $72,000.

Meanwhile, Doctor Profit suggested that the price corrections experienced were normal and usually occur in each crypto cycle. He further remarked that the 10 to 20% price fluctuations weren’t big moves. His statement echoes the sentiment of Alex Thorn, Head of Research at Galaxy Digital, who previously warned that bull markets weren’t “straight lines up.”

Bitcoin Is In The Re-Accumulation Period

In a recent X (formerly Twitter) post, crypto analyst Rekt Capital confirmed that Bitcoin is currently in the Re-Accumulation phase, which occurs after the Bitcoin Halving. He further noted that the goal now “is for Bitcoin to move sideways to catch a breather, for the market to cool off after [a] fantastic Pre-Halving price performance.

According to Rekt Capital, this Re-Accumulation period can last for multiple weeks “and even up to 150 days.” The analyst revealed that once this period is over, Bitcoin will experience a breakout from this sideways range, followed by a parabolic uptrend.

This uptrend phase is said to last for over a year. However, with the probability of this being an accelerated market cycle, Rekt Capital remarked that the duration for this uptrend could be cut in half. Crypto analysts like Tom Dunleavy, Partner and Chief Investment Officer (CIO) at MV Capital, predict that the flagship crypto will rise as high as $100,000 when that time comes.

At the time of writing, Bitcoin is trading at around $64,360, up in the last 24 hours according to data from CoinMarketCap.

BTC bears pull down price | Source: BTCUSD on Tradingview.com

Featured image from Kapersky, chart from Tradingview.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Source link

Altcoin

85% Of Altcoins In “Opportunity Zone,” Santiment Reveals

Published

1 day agoon

April 26, 2024By

admin

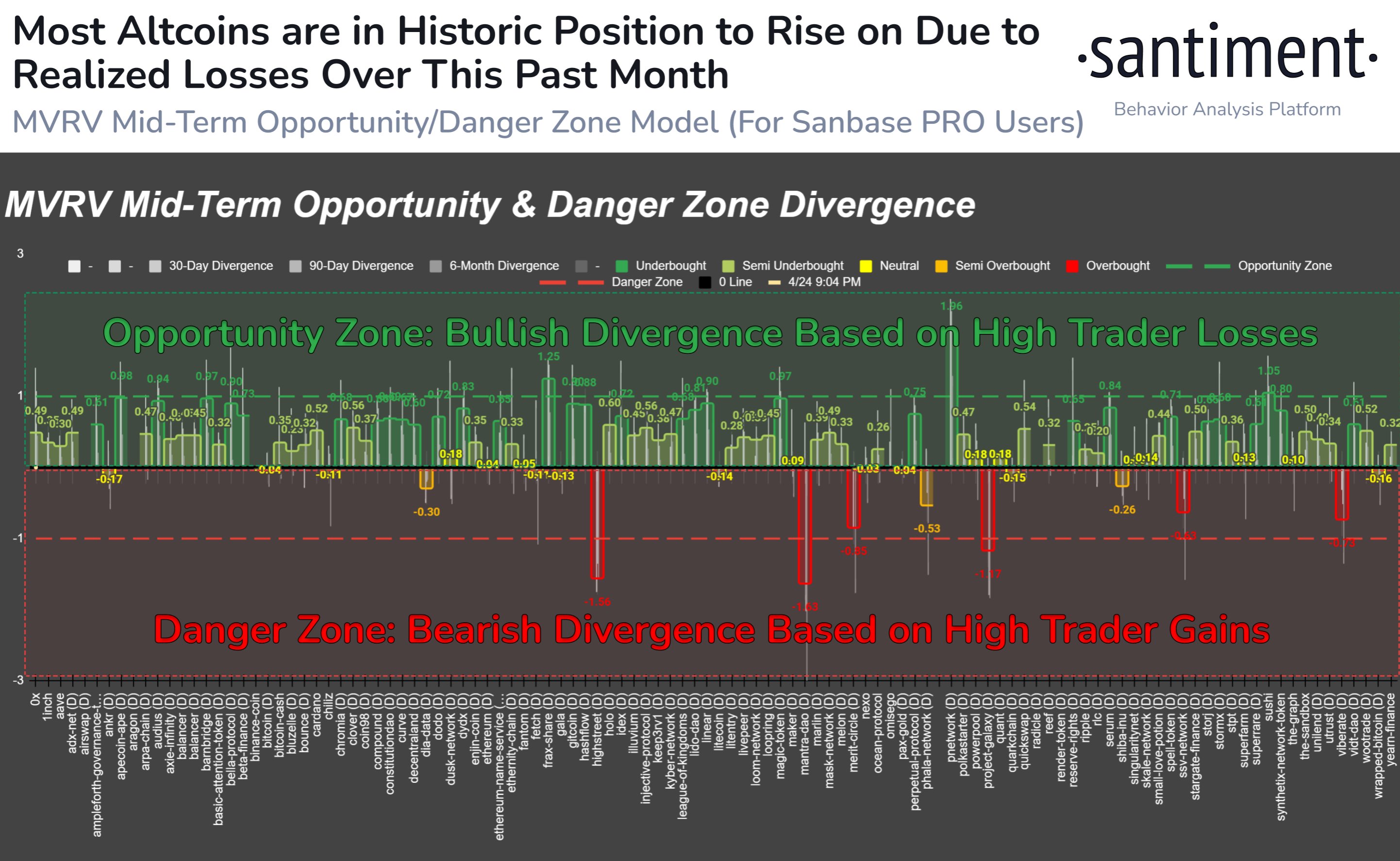

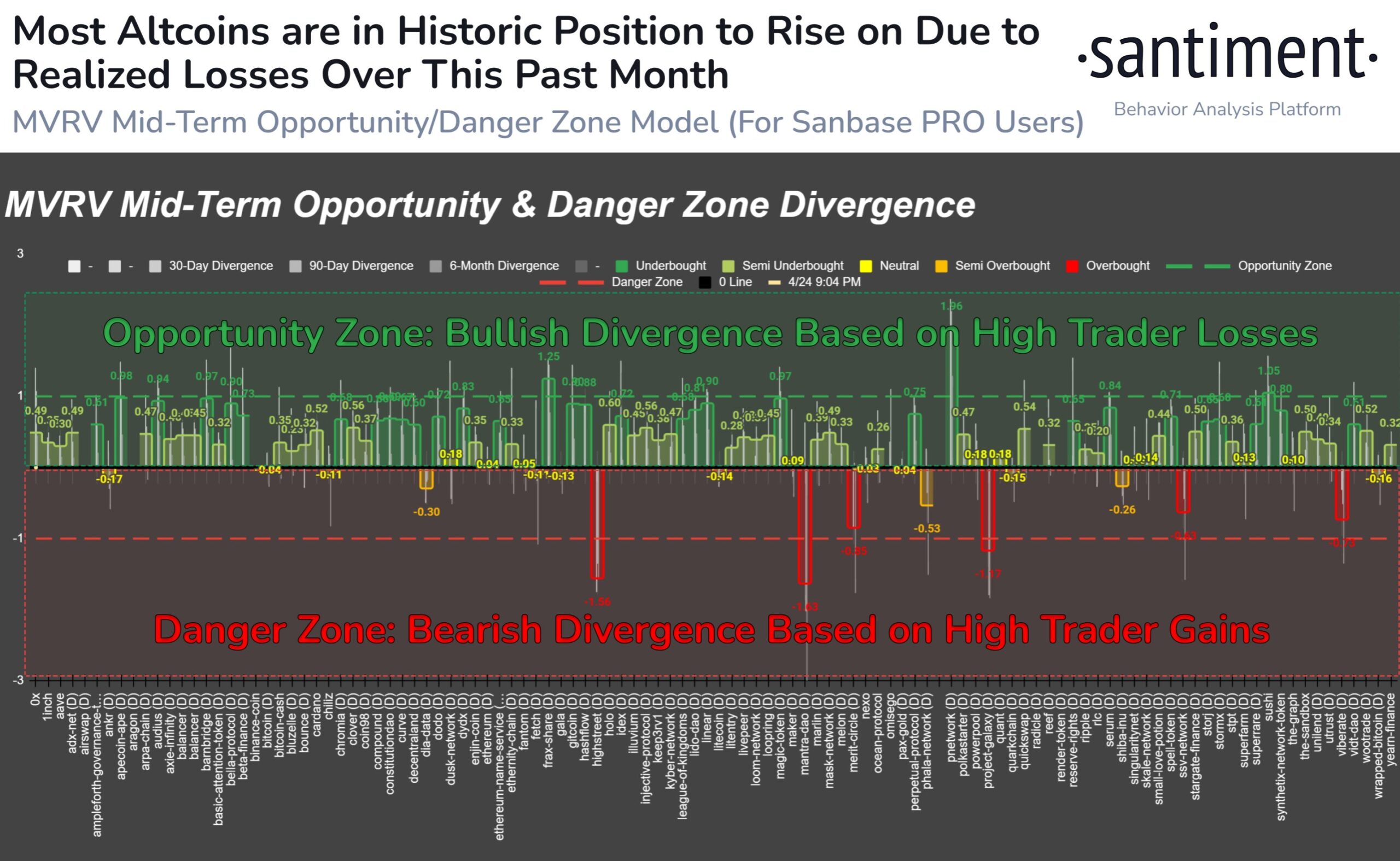

The on-chain analytics firm Santiment has revealed that over 85% of all altcoins in the sector are currently in the historical “opportunity zone.”

MVRV Would Suggest Most Altcoins Are Ready For A Bounce

In a new post on X, Santiment discussed how the altcoin market looks based on their MVRV ratio model. The “Market Value to Realized Value (MVRV) ratio” is a popular on-chain indicator that compares the market cap of Bitcoin against its realized cap.

The market cap here is the usual total valuation of the asset’s circulating supply based on the current spot price. At the same time, the latter is an on-chain capitalization model that calculates the asset’s value by assuming the “true” value of any coin in circulation is the last price at which it is transferred on the blockchain.

Given that the last transaction of any coin would have likely been the last time it changed hands, the price at its time would act as its current cost basis. As such, the realized cap essentially sums up the cost basis of every token in the circulating supply.

Therefore, one way to view the model is as a measure of the total amount of capital the investors have put into the asset. In contrast, the market cap measures the value holders are carrying.

Since the MVRV ratio compares these two models, its value can tell whether Bitcoin investors hold more or less than their total initial investment.

Historically, when investors have been in high profits, tops have become probable to form, as the risk of profit-taking can spike in such periods. On the other hand, a dominance of losses could lead to bottom formations as selling pressure runs out in the market.

Based on these facts, Santiment has defined an “opportunity” and “danger” zone model for altcoins. The chart below shows how the market currently looks from the perspective of this MVRV model.

The data for the MVRV divergence for the various altcoins | Source: Santiment on X

Under this model, when the MVRV divergence for any asset on some timeframe is higher than 1, the coin is considered to be inside the bullish opportunity zone. Similarly, if it is less than -1, it suggests it’s in the bearish danger zone.

The chart shows that MVRV divergence for a large part of the market is in the opportunity zone right now. As the analytics firm explains,

Over 85% of assets we track are in a historic opportunity zone when calculating the market value to realized value (MVRV) of wallets’ collective returns over 1-month, 3-month, and 6-month cycles.

Thus, if the model is to go by, now may be the time to go around altcoin shopping.

ETH Price

Ethereum, the largest among the altcoins, has observed a 3% surge over the past week, which has taken its price to $3,150.

Looks like the price of the asset has gone up over the last few days | Source: ETHUSD on TradingView

Featured image from Shutterstock.com, Santiment.net, chart from TradingView.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Source link

Bitcoin Just Entered a ‘Second Danger Zone,’ Warns Crypto Analyst – Here Are His Targets

Forbes Unveils 20 Crypto ‘Zombies,’ Declares Ripple And XRP Among The Undead

Crypto Trader Issues Bitcoin Warning, Says Ethereum Liquid Staking Project Flashing Short-Term Bullish Signal

Crypto Analyst Predicts Massive Move For Bitcoin, What’s The Target?

Analyst Warns One Crypto Asset Category About To Face a Reckoning, Maps Path Forward for Bitcoin and Hedera

DOGE Price Prediction – Dogecoin Below $0.14 Could Spark Larger Degree Drop

WhalesNight AfterParty 2024 – Blockchain News, Opinion, TV and Jobs

‘Violent to the Upside’: This Catalyst Could See Bitcoin Explode by up to 1,486%, Says Strike CEO Jack Mallers

85% Of Altcoins In “Opportunity Zone,” Santiment Reveals

Ethereum, Solana and Altcoins Approaching ‘Banana Zone,’ According to Macro Guru Raoul Pal – Here’s His Outlook

Bullish March Marks Record for Bitcoin – Blockchain News, Opinion, TV and Jobs

Why Is The Dogecoin Price Down Today?

The AI-Based Smart Contract Audit Firm “Bunzz Audit” Has Officially Launched – Blockchain News, Opinion, TV and Jobs

Successful Beta Service launch of SOMESING, ‘My Hand-Carry Studio Karaoke App’

dWallet Network brings multi-chain DeFi to Sui, featuring native Bitcoin and Ethereum – Blockchain News, Opinion, TV and Jobs

Bitcoin Dropped Below 2017 All-Time-High but Could Sellers be Getting Exhausted? – Blockchain News, Opinion, TV and Jobs

What does the Coinbase Premium Gap Tell us about Investor Activity? – Blockchain News, Opinion, TV and Jobs

BNM DAO Token Airdrop

NFT Sector Keeps Developing – Number of Unique Ethereum NFT Traders Surged 276% in 2022 – Blockchain News, Opinion, TV and Jobs

New Minting Services

Block News Media Live Stream

A String of 200 ‘Sleeping Bitcoins’ From 2010 Worth $4.27 Million Moved on Friday

SEC’s Chairman Gensler Takes Aggressive Stance on Tokens – Blockchain News, Opinion, TV and Jobs

Friends or Enemies? – Blockchain News, Opinion, TV and Jobs

Enjoy frictionless crypto purchases with Apple Pay and Google Pay | by Jim | @blockchain | Jun, 2022

Block News Media Live Stream

Block News Media Live Stream

How Web3 can prevent Hollywood strikes

XRP Explodes With 1,300% Surge In Trading Volume As crypto Exchanges Jump On Board

Block News Media Live Stream

Trending

Altcoins2 years ago

Altcoins2 years agoBitcoin Dropped Below 2017 All-Time-High but Could Sellers be Getting Exhausted? – Blockchain News, Opinion, TV and Jobs

Binance2 years ago

Binance2 years agoWhat does the Coinbase Premium Gap Tell us about Investor Activity? – Blockchain News, Opinion, TV and Jobs

- Uncategorized2 years ago

BNM DAO Token Airdrop

BTC1 year ago

BTC1 year agoNFT Sector Keeps Developing – Number of Unique Ethereum NFT Traders Surged 276% in 2022 – Blockchain News, Opinion, TV and Jobs

- Uncategorized2 years ago

New Minting Services

Video1 year ago

Video1 year agoBlock News Media Live Stream

Bitcoin miners2 years ago

Bitcoin miners2 years agoA String of 200 ‘Sleeping Bitcoins’ From 2010 Worth $4.27 Million Moved on Friday

Bitcoin1 year ago

Bitcoin1 year agoSEC’s Chairman Gensler Takes Aggressive Stance on Tokens – Blockchain News, Opinion, TV and Jobs