Bitcoin

Successful Beta Service launch of SOMESING, ‘My Hand-Carry Studio Karaoke App’

Published

2 years agoon

By

adminSep 7, 2022 12:14 UTC

| Updated:

Sep 7, 2022 at 12:14 UTC

By Clark

India’s RBI, the Reserve Bank of India (RBI), has reportedly asked four banks to pilot the country’s Central Bank digital currency (CBDC) previous its public launch.

RBI to Pilot India’s CBDC With Public-Sector Banks

The Reserve Bank of India (RBI), the country’s Central Bank, has reportedly asked four public-sector banks to trial India’s Central Bank digital currency (CBDC), Moneycontrol Monday, citing 2 nameless bank officers.

One of the officers was quoted as saying:

The RBI has asked India, Punjab commercial bank, Union Bank of India, and Bank of Baroda to run the pilot internally.

“There could be a pilot on CBDCs,” another senior public-sector bank official confirmed to the publication. “The tally could accompany the launch this year. once it’ll specifically roll out the merchandise and specifications is to be seen.”

The Reserve Bank of India is additionally reportedly consulting with many fintech corporations on the digital rupee. Among them is the U.S.-based firm FIS, that has been advising central banks on CBDC problems, like offline and programmable payments, money inclusion, and cross-border CBDC payments.

FIS senior director Julia Demidova told the news outlet last week:

FIS has had numerous engagements with the tally … Our connected scheme might be extended to the RBI to experiment with numerous CBDC choices.

“Whether it’s a wholesale or retail CBDC dealing, our technology may also be extended to business banks wherever they will check and tokenize Central Bank cash within the kind of digital regulated cash,” she said.

India’s minister of finance, Nirmala Sitharaman, declared while presenting the federal budget 2022 in Feb that the RBI can issue a CBDC during this year. In May, the Central Bank mentioned that it’ll adopt a “graded approach” to launching the digital rupee.

“The digital rupee is going to be the digital kind of our physical rupee and can be regulated by the tally. This can be such a system that may alter associate degree exchange of physical currency with digital currency,” Indian Prime Minister Narendra Modi antecedently explained.

Meanwhile, the tally is advocating for a ban on all cryptocurrencies like bitcoin and ether. RBI Deputy Governor T. Rabi Sankar aforementioned earlier this year that cryptocurrencies have “no underlying money flows” and “no intrinsic price,” adding that “they square measure love Ponzi schemes, and will even be worse.” The central banker stressed, “Banning cryptocurrency is maybe the foremost wise selection in India.”

Clark

Head of the technology.

Source link

You may like

Altcoins in ‘Last Exit Pump’ Against Bitcoin Before Final Capitulation, Warns Top Analyst – Here’s the Timeline

Bitcoin Raises Bull Flag, Formation Triggers Calls For $100,000

Bitcoin Just Entered a ‘Second Danger Zone,’ Warns Crypto Analyst – Here Are His Targets

Forbes Unveils 20 Crypto ‘Zombies,’ Declares Ripple And XRP Among The Undead

Crypto Trader Issues Bitcoin Warning, Says Ethereum Liquid Staking Project Flashing Short-Term Bullish Signal

Crypto Analyst Predicts Massive Move For Bitcoin, What’s The Target?

Altcoins

Altcoins in ‘Last Exit Pump’ Against Bitcoin Before Final Capitulation, Warns Top Analyst – Here’s the Timeline

Published

1 hour agoon

April 27, 2024By

admin

A widely followed crypto analyst is issuing a warning that the altcoin market is about to implode against Bitcoin (BTC).

In a new video update, crypto strategist Benjamin Cowen tells his 800,000 YouTube subscribers that the TOTAL3 chart, which tracks the market capitalization of all altcoins minus Ethereum (ETH) and stablecoins, looks bearish against Bitcoin.

According to Cowen, the weakness of altcoins against Bitcoin suggests that alts may witness a collapse in the coming weeks.

“A majority of the altcoins are still putting in new lows on their Bitcoin pairs and to find ones that are not, you’d have to cherry-pick ones in the top 20 that are not or they’re on their way to new lows right now or you’d have to find a micro-cap that was created recently and show that one that’s not putting in new lows.

But a lot of them are and you can see that by looking at TOTAL3 minus USDT divided by Bitcoin. I think what you’re witnessing right now is the last exit pump of alt/Bitcoin pairs before we see final capitulation of alt/Bitcoin pairs as we go into May and June. That is what I think.”

The analyst says a TOTAL3/Bitcoin pattern that played out in 2019 may be repeating itself in the current cycle.

“This is a very similar pattern we saw last cycle where after setting a low here [in May 2019], we then had one final bounce [in June 2019] that ultimately faded just below the bull market support band and then it rolled over into the summer.

And a lot of times you will see alt/Bitcoin pairs capitulate in the summertime because a lot of people aren’t as glued to their computers as they are during the fall and the spring and the winter. During the summertime, people focus on other things a lot of times, and so the collective bid for the altcoin market can often dry up.

And so I think that that’s what you’re looking at right now. I think we’re seeing alt/Bitcoin pairs get this final bounce up, but I think they’re going to ultimately fail here and go back down to the range lows but this time when they break, I don’t think there’s going to be any mercy in another rally. I think it’ll just lead you into the final capitulation, going back to 25% of Bitcoin’s market cap.”

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: DALLE3

Source link

Bitcoin

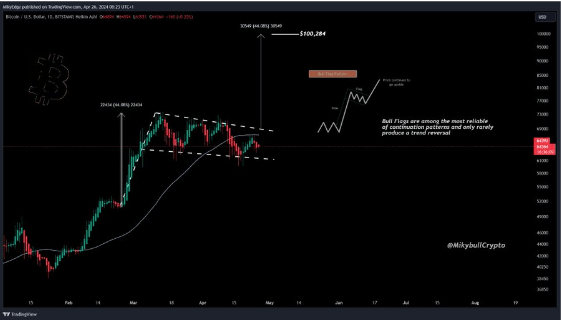

Bitcoin Raises Bull Flag, Formation Triggers Calls For $100,000

Published

5 hours agoon

April 27, 2024By

admin

A bull flag recently formed on the Bitcoin chart, raising the possibility of a trend reversal soon enough as the flagship crypto makes significant moves to the upside. This crypto analyst suggests that the crypto could rise to as high as $100,000 when it makes that move.

Bitcoin’s Bull Flag Suggests More Upside

Denis Baca, Head of Product at Zivoe Finance, noted that the bull flag formation on Bitcoin’s daily chart historically suggests that the crypto token is primed for more upsides. He added that the bullish pattern is “shaping up nicely” and that Bitcoin could potentially shoot up towards $100,000 once the declining volume picks up.

However, Baca further suggested that Bitcoin could drop below $60,000 before it makes such a parabolic move. He alluded to how the crypto token historically retests the support level of the 20-week SMA (small moving average) in May. This could cause Bitcoin to drop to $56,000, he claimed.

Total crypto market cap currently at $2.2 trillion. Chart: TradingView

Baca opined that such price dips could be “healthy” for Bitcoin before it experiences a reversal. He elaborated that these dips “offer solid buying opportunities,” which could help spark Bitcoin’s move to record highs.

Crypto analyst Mikybull Crypto also shared his thoughts on what this bullish pattern could mean for Bitcoin. On his part, he suggested that the formation further proves the continuation of Bitcoin’s bull run and that a bearish reversal was unlikely.

#Bitcoin on a daily chart forming a bull continuation pattern.

According to Wyckoff’s law of cause and effect “the longer the consolidation, the more explosive the markup will be” pic.twitter.com/ArH0lNnyc2

— Mikybull 🐂Crypto (@MikybullCrypto) April 26, 2024

He also hinted that the next leg up could be massive as he alluded to Wyckoff’s law of cause and effect, which states that “the longer the consolidation, the more explosive the markup will be.”

Bitcoin Needs A Catalyst To Spark This Upward Trend

Andrey Stoychev, Head of prime brokerage at Nexo, remarked that any potential price rise for Bitcoin is unlikely to be realized without a catalyst. He noted that the flagship crypto token has managed to build resilient support at $64,000, but without any catalyst, it will merely continue to trade around the $67,000 range.

It is worth noting that the Spot Bitcoin ETFs, which previously served as a major catalyst to Bitcoin’s price surges, have recently suffered from declining demand. They have also experienced significant net outflows this month, leading to a wave of Bitcoin sell-offs from the fund issuers to fulfill redemptions.

Despite this, Stoychev is positive that Bitcoin won’t drop below $60,000. He predicts that the only thing that can cause Bitcoin to retrace to such a level is if high interest rates are maintained longer than expected, as this can affect sentiment toward crypto assets.

At the time of writing, Bitcoin is trading at around $62,900, down over 2% in the last 24 hours, according to data from CoinMarketCap.

Featured image from Pixabay, chart from TradingView

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Source link

Bitcoin

Bitcoin Just Entered a ‘Second Danger Zone,’ Warns Crypto Analyst – Here Are His Targets

Published

9 hours agoon

April 27, 2024By

admin

A cryptocurrency analyst and trader is warning that Bitcoin (BTC) may see another move to the downside in the next two weeks.

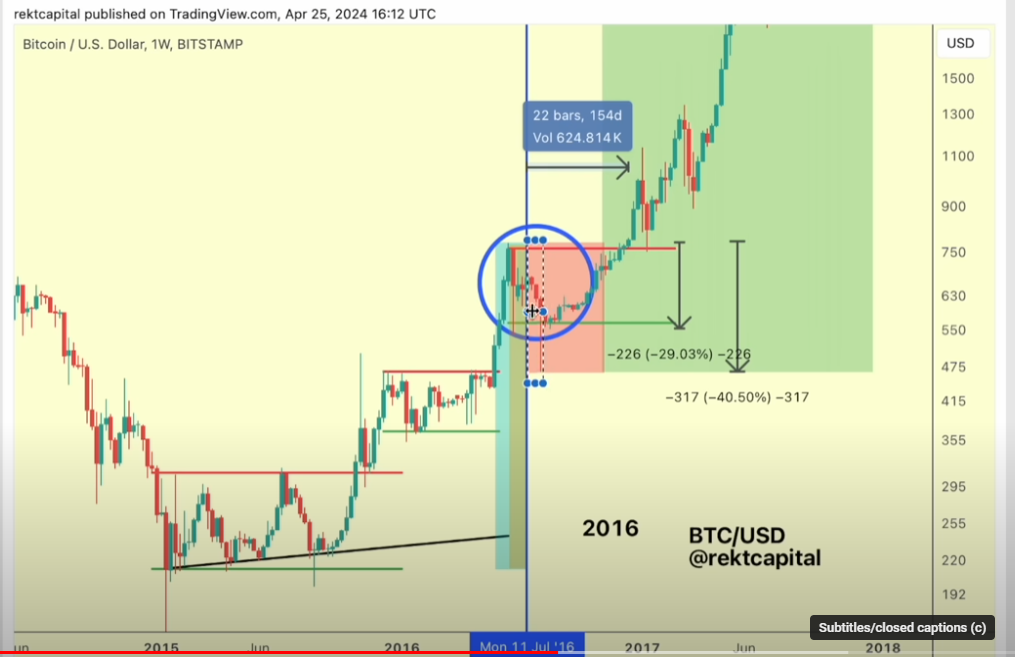

The analyst pseudonymously known as Rekt Capital tells his 74,300 YouTube subscribers that the current Bitcoin correction may be mirroring its 2016 halving price action when BTC witnessed two corrective waves: one before the halving and another after the halving.

According to the analyst, the historical precedent suggests that it is within the realm of possibility for BTC to witness another pullback within weeks after the most recent halving.

“If you look at these halving retraces, a small portion of them occur before the halving. But the majority of these pullbacks and consolidation periods occur after the halving…

In 2016, we had a slightly different scenario where 28 days before the halving, we saw this pre-halving retrace kick start… Pre-halving we already saw that initial downside wick that crashed. But after the halving, we saw additional downside so in effect, this danger zone did not just end before the halving. It extended a few more weeks after the halving…

If we think about the pre-halving danger zone 1714206893, we need to also potentially factor in or at least consider a potential danger zone after the halving – so, a second danger zone.”

The pseudonymous analyst says that based on historical price action, Bitcoin could trade within the post-halving danger zone until next month.

“So if the halving was last week then technically we have a three-week window of 21 days… Maybe even less than that right now because it’s the [27th] of April…

So just over two weeks left for this post-halving danger zone based on historical tendencies in 2016 for this post-halving danger zone to come to full fruition.”

According to Rekt Capital, Bitcoin’s current support zone at around the $60,000 price could prove to be enduring if it holds over the next couple of weeks.

“It’s about these next two weeks, these two pivotal weeks. Can we continue to hold on at the range low here [around $60,000]? And if we do within the next two weeks, then that gives us a fair degree of confidence that maybe, just maybe, this re-accumulation range low is going to continue to hold.”

At time of writing, Bitcoin is trading for $62,871, down over 3% in the past day.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: DALLE3

Source link

Altcoins in ‘Last Exit Pump’ Against Bitcoin Before Final Capitulation, Warns Top Analyst – Here’s the Timeline

Bitcoin Raises Bull Flag, Formation Triggers Calls For $100,000

Bitcoin Just Entered a ‘Second Danger Zone,’ Warns Crypto Analyst – Here Are His Targets

Forbes Unveils 20 Crypto ‘Zombies,’ Declares Ripple And XRP Among The Undead

Crypto Trader Issues Bitcoin Warning, Says Ethereum Liquid Staking Project Flashing Short-Term Bullish Signal

Crypto Analyst Predicts Massive Move For Bitcoin, What’s The Target?

Analyst Warns One Crypto Asset Category About To Face a Reckoning, Maps Path Forward for Bitcoin and Hedera

DOGE Price Prediction – Dogecoin Below $0.14 Could Spark Larger Degree Drop

WhalesNight AfterParty 2024 – Blockchain News, Opinion, TV and Jobs

‘Violent to the Upside’: This Catalyst Could See Bitcoin Explode by up to 1,486%, Says Strike CEO Jack Mallers

85% Of Altcoins In “Opportunity Zone,” Santiment Reveals

Ethereum, Solana and Altcoins Approaching ‘Banana Zone,’ According to Macro Guru Raoul Pal – Here’s His Outlook

Bullish March Marks Record for Bitcoin – Blockchain News, Opinion, TV and Jobs

Why Is The Dogecoin Price Down Today?

The AI-Based Smart Contract Audit Firm “Bunzz Audit” Has Officially Launched – Blockchain News, Opinion, TV and Jobs

Bitcoin Dropped Below 2017 All-Time-High but Could Sellers be Getting Exhausted? – Blockchain News, Opinion, TV and Jobs

What does the Coinbase Premium Gap Tell us about Investor Activity? – Blockchain News, Opinion, TV and Jobs

BNM DAO Token Airdrop

NFT Sector Keeps Developing – Number of Unique Ethereum NFT Traders Surged 276% in 2022 – Blockchain News, Opinion, TV and Jobs

New Minting Services

Block News Media Live Stream

A String of 200 ‘Sleeping Bitcoins’ From 2010 Worth $4.27 Million Moved on Friday

SEC’s Chairman Gensler Takes Aggressive Stance on Tokens – Blockchain News, Opinion, TV and Jobs

Friends or Enemies? – Blockchain News, Opinion, TV and Jobs

Enjoy frictionless crypto purchases with Apple Pay and Google Pay | by Jim | @blockchain | Jun, 2022

Block News Media Live Stream

Block News Media Live Stream

How Web3 can prevent Hollywood strikes

XRP Explodes With 1,300% Surge In Trading Volume As crypto Exchanges Jump On Board

Block News Media Live Stream

Trending

Altcoins2 years ago

Altcoins2 years agoBitcoin Dropped Below 2017 All-Time-High but Could Sellers be Getting Exhausted? – Blockchain News, Opinion, TV and Jobs

Binance2 years ago

Binance2 years agoWhat does the Coinbase Premium Gap Tell us about Investor Activity? – Blockchain News, Opinion, TV and Jobs

- Uncategorized2 years ago

BNM DAO Token Airdrop

BTC1 year ago

BTC1 year agoNFT Sector Keeps Developing – Number of Unique Ethereum NFT Traders Surged 276% in 2022 – Blockchain News, Opinion, TV and Jobs

- Uncategorized2 years ago

New Minting Services

Video1 year ago

Video1 year agoBlock News Media Live Stream

Bitcoin miners2 years ago

Bitcoin miners2 years agoA String of 200 ‘Sleeping Bitcoins’ From 2010 Worth $4.27 Million Moved on Friday

Bitcoin1 year ago

Bitcoin1 year agoSEC’s Chairman Gensler Takes Aggressive Stance on Tokens – Blockchain News, Opinion, TV and Jobs