Bitcoin

Will Bitcoin Break $74,000 Driven By TradFi FOMO?

Published

1 month agoon

By

admin

Willy Woo, an on-chain analyst, believes the Bitcoin upswing is far from over. Citing the development in the Bitcoin Macro Oscillator and the possibility of traditional finance jumping on the bandwagon (FOMO), the odds of BTC rallying in at least two strong legs up in the coming session could not be discounted.

On-Chain Data Signals More Upside For Bitcoin

In a post on X, Woo remains confident about what lies ahead for the world’s most valuable cryptocurrency. Based on on-chain development, there are indicators that the coin may firmly push higher, breaking above the current lull.

Bitcoin remains mostly range-bound when writing, trading within a tight zone capped by $73,800 on the upper end and $69,000 as immediate support. Even with analysts being confident of what lies ahead, the coin has failed to overcome strong selling momentum from sellers to breach all-time highs in a buy-trend continuation.

From how the coin is set up, the current sideways movement may be accumulation or distribution, depending on the breakout direction. For instance, any upswing above $72,400 might spur demand, lifting the coin towards $73,800. Conversely, losses below $69,000 and the middle BB might see BTC slump to March 5 lows or even lower.

Will TradFi FOMO And Short Squeeze Lift BTC?

Even with the slowdown in upside momentum, Woo says there is strong potential for “another solid leg up.” The analyst also added that there could be two surges if TradFi investors “FOMO” into Bitcoin. In the 2017 bull run, the rally to $20,000 was primarily due to retailers jumping in and FOMOing on the coin.

With spot Bitcoin exchange-traded funds (ETFs) available in the United States, speculation is that more institutions and high-net-worth individuals are buying the coin. If BTC rips higher, breaking $74,000, more inflow will likely be into the multiple spot Bitcoin ETFs, fueling demand.

This bullish outlook comes when other analysts expect Bitcoin to surge in the sessions ahead. In a post on X, one analyst says the incoming short squeeze will likely propel the coin above March highs. Whenever a short squeeze happens, prices rise, forcing sellers to buy back at higher prices, accelerating the uptrend.

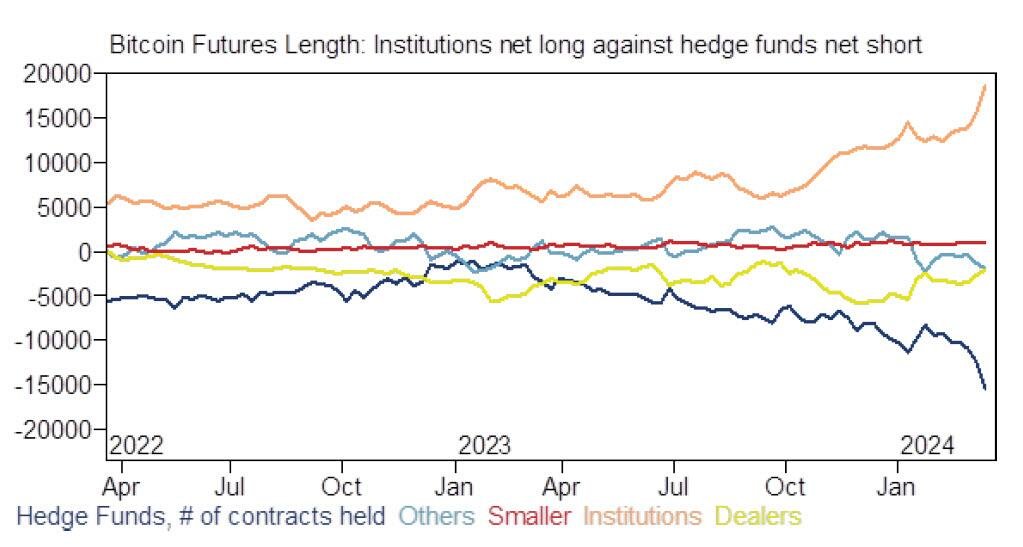

The assessment is behind a record-breaking gap between institutional investors betting on price increases and hedge funds selling the coin.

Feature image from DALLE, chart from TradingView

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Source link

You may like

Bitcoin Just Entered a ‘Second Danger Zone,’ Warns Crypto Analyst – Here Are His Targets

Forbes Unveils 20 Crypto ‘Zombies,’ Declares Ripple And XRP Among The Undead

Crypto Trader Issues Bitcoin Warning, Says Ethereum Liquid Staking Project Flashing Short-Term Bullish Signal

Crypto Analyst Predicts Massive Move For Bitcoin, What’s The Target?

Analyst Warns One Crypto Asset Category About To Face a Reckoning, Maps Path Forward for Bitcoin and Hedera

DOGE Price Prediction – Dogecoin Below $0.14 Could Spark Larger Degree Drop

Bitcoin

Bitcoin Just Entered a ‘Second Danger Zone,’ Warns Crypto Analyst – Here Are His Targets

Published

31 mins agoon

April 27, 2024By

admin

A cryptocurrency analyst and trader is warning that Bitcoin (BTC) may see another move to the downside in the next two weeks.

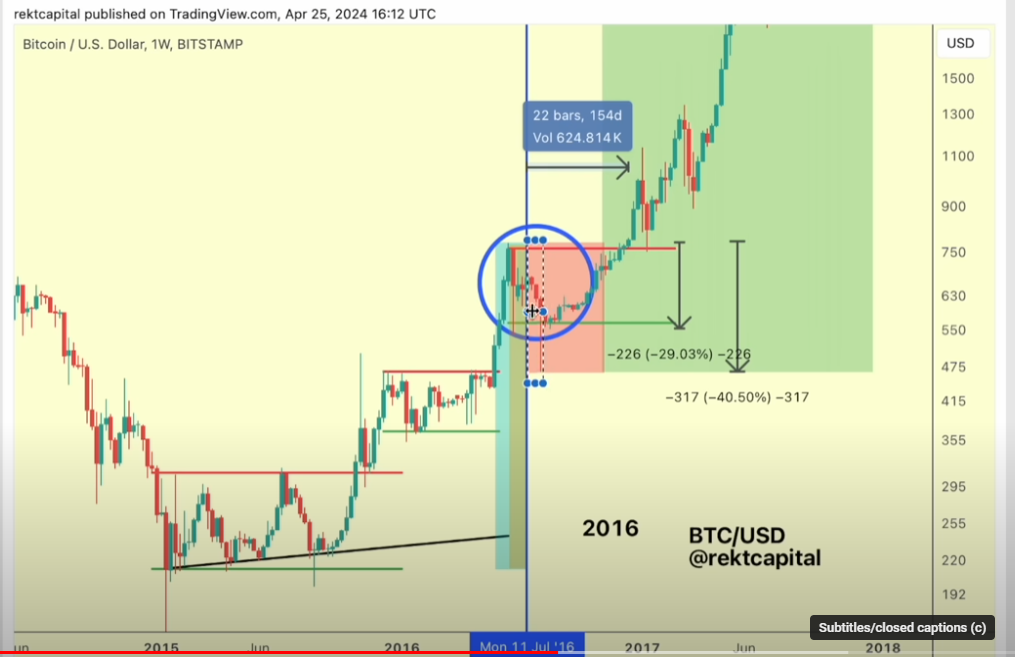

The analyst pseudonymously known as Rekt Capital tells his 74,300 YouTube subscribers that the current Bitcoin correction may be mirroring its 2016 halving price action when BTC witnessed two corrective waves: one before the halving and another after the halving.

According to the analyst, the historical precedent suggests that it is within the realm of possibility for BTC to witness another pullback within weeks after the most recent halving.

“If you look at these halving retraces, a small portion of them occur before the halving. But the majority of these pullbacks and consolidation periods occur after the halving…

In 2016, we had a slightly different scenario where 28 days before the halving, we saw this pre-halving retrace kick start… Pre-halving we already saw that initial downside wick that crashed. But after the halving, we saw additional downside so in effect, this danger zone did not just end before the halving. It extended a few more weeks after the halving…

If we think about the pre-halving danger zone 1714206893, we need to also potentially factor in or at least consider a potential danger zone after the halving – so, a second danger zone.”

The pseudonymous analyst says that based on historical price action, Bitcoin could trade within the post-halving danger zone until next month.

“So if the halving was last week then technically we have a three-week window of 21 days… Maybe even less than that right now because it’s the [27th] of April…

So just over two weeks left for this post-halving danger zone based on historical tendencies in 2016 for this post-halving danger zone to come to full fruition.”

According to Rekt Capital, Bitcoin’s current support zone at around the $60,000 price could prove to be enduring if it holds over the next couple of weeks.

“It’s about these next two weeks, these two pivotal weeks. Can we continue to hold on at the range low here [around $60,000]? And if we do within the next two weeks, then that gives us a fair degree of confidence that maybe, just maybe, this re-accumulation range low is going to continue to hold.”

At time of writing, Bitcoin is trading for $62,871, down over 3% in the past day.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: DALLE3

Source link

Bitcoin

Forbes Unveils 20 Crypto ‘Zombies,’ Declares Ripple And XRP Among The Undead

Published

5 hours agoon

April 27, 2024By

admin

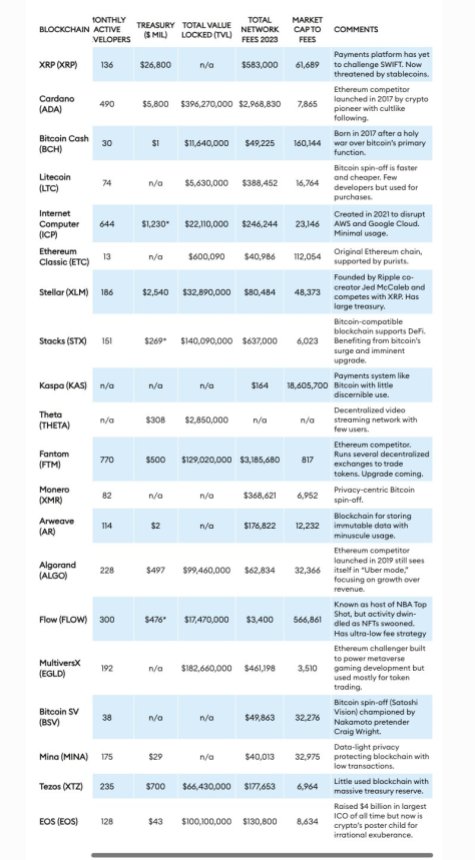

In a controversial report, Forbes unveiled a list of 20 “crypto billion-dollar zombies,” Layer 1 (L1) tokens, which the news outlet defines as crypto assets with substantial valuations but “limited utility beyond speculative trading.”

These cryptocurrencies and projects include Ripple, XRP, Ethereum Classic (ETC), Tezos (XTZ), Algorand (ALGO), and Cardano (ADA), among others.

XRP And Ethereum Classic In The Spotlight

Ripple Labs, the company behind XRP, was highlighted as a prominent crypto zombie. Despite XRP’s active trading volume of around $2 billion daily, Forbes asserts that the token’s primary purpose remains “speculative” and “lacking meaningful utility.”

However, Ripple Labs and XRP are not alone in this regard. Forbes reveals that 50 blockchains, excluding Bitcoin (BTC) and Ethereum (ETH), currently trade at values surpassing $1 billion, with at least 20 of them classified as “functional zombies.” Collectively, these 20 blockchains hold a market value of $116 billion, despite having “limited user bases.”

According to Forbes, an example of a “functional zombie” is Ethereum Classic, which maintains the distinction of being the original Ethereum chain.

While ETC has a market value of $4.6 billion, its fee generation in 2023 was less than $41,000, raising questions about the blockchain’s viability for the news organization.

Another crypto project in Forbes’ report is Tezos, which raised $230 million through an initial coin offering (ICO) in 2017.

Tezos’ XTZ token currently holds a market capitalization of $1.2 billion. However, the blockchain’s fee earnings were meager, with $5,640 in February 2024 and a total of $177,653 for all of 2023.

Algorand, once hailed as an “Ethereum killer” due to its capability of processing 7,500 transactions per second, faces similar challenges.

Despite a market cap of $2 billion and a treasury holding of $500 million, Algorand earned $63,000 in blockchain transaction fees throughout 2023. For Forbes, this casts doubt on its actual adoption and utility.

Crypto ‘Zombie’ Blockchains

The zombie blockchains are categorized into two groups by Forbes: spin-offs and direct competitors to established blockchains like Bitcoin and Ethereum.

Spin-off zombies include Bitcoin Cash (BCH), Litecoin (LTC), Monero (XMR), Bitcoin SV (BSV), and Ethereum Classic.

These blockchains, collectively valued at $23 billion, reportedly emerged from “disagreements” among programmers regarding the governance and direction of the original chains.

Forbes notes that when such conflicts arise, hard forks occur, resulting in new networks that share the same transaction history as their predecessors. The agency claims that their market value “often exceeds” their real-world usage.

Overall, The report highlights a growing disparity between the valuations of certain projects in the cryptocurrency industry and their actual utility and usage. Consequently, Forbes refers to these projects as “zombies.”

Featured image from Shutterstock, chart from TradingView.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Source link

Analyst

Crypto Analyst Predicts Massive Move For Bitcoin, What’s The Target?

Published

13 hours agoon

April 26, 2024By

admin

Despite BTC’s recent unimpressive price action, crypto analyst Doctor Profit has shared his bullish sentiment for Bitcoin and the broader crypto market. The analyst further suggested that a parabolic move was imminent and that crypto investors should position themselves accordingly.

Crypto Market Preparing For A “Third Industrial Revolution”

Doctor Profit mentioned in an X (formerly Twitter) post that the crypto market “is preparing itself for the third Industrial Revolution,” thereby hinting at a trend reversal for Bitcoin and altcoins soon enough. “Be part of it, or regret for [a] lifetime,” the crypto analyst added as he warned crypto investors of missing this market rally.

Related Reading: HBAR Prices Crashes 35% As BlackRock Denies Any Ties To Hedera

In a previous X post, Doctor Profit gave an idea of what to expect from the crypto market (Bitcoin in particular) when it makes its next leg up. He stated that the flagship crypto will rise to $84,000 after it is done trading the sideway range between $60,000 and $72,000. In another X post, he claimed that the super cycle will start after Bitcoin hits $72,000.

Meanwhile, Doctor Profit suggested that the price corrections experienced were normal and usually occur in each crypto cycle. He further remarked that the 10 to 20% price fluctuations weren’t big moves. His statement echoes the sentiment of Alex Thorn, Head of Research at Galaxy Digital, who previously warned that bull markets weren’t “straight lines up.”

Bitcoin Is In The Re-Accumulation Period

In a recent X (formerly Twitter) post, crypto analyst Rekt Capital confirmed that Bitcoin is currently in the Re-Accumulation phase, which occurs after the Bitcoin Halving. He further noted that the goal now “is for Bitcoin to move sideways to catch a breather, for the market to cool off after [a] fantastic Pre-Halving price performance.

According to Rekt Capital, this Re-Accumulation period can last for multiple weeks “and even up to 150 days.” The analyst revealed that once this period is over, Bitcoin will experience a breakout from this sideways range, followed by a parabolic uptrend.

This uptrend phase is said to last for over a year. However, with the probability of this being an accelerated market cycle, Rekt Capital remarked that the duration for this uptrend could be cut in half. Crypto analysts like Tom Dunleavy, Partner and Chief Investment Officer (CIO) at MV Capital, predict that the flagship crypto will rise as high as $100,000 when that time comes.

At the time of writing, Bitcoin is trading at around $64,360, up in the last 24 hours according to data from CoinMarketCap.

BTC bears pull down price | Source: BTCUSD on Tradingview.com

Featured image from Kapersky, chart from Tradingview.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Source link

Bitcoin Just Entered a ‘Second Danger Zone,’ Warns Crypto Analyst – Here Are His Targets

Forbes Unveils 20 Crypto ‘Zombies,’ Declares Ripple And XRP Among The Undead

Crypto Trader Issues Bitcoin Warning, Says Ethereum Liquid Staking Project Flashing Short-Term Bullish Signal

Crypto Analyst Predicts Massive Move For Bitcoin, What’s The Target?

Analyst Warns One Crypto Asset Category About To Face a Reckoning, Maps Path Forward for Bitcoin and Hedera

DOGE Price Prediction – Dogecoin Below $0.14 Could Spark Larger Degree Drop

WhalesNight AfterParty 2024 – Blockchain News, Opinion, TV and Jobs

‘Violent to the Upside’: This Catalyst Could See Bitcoin Explode by up to 1,486%, Says Strike CEO Jack Mallers

85% Of Altcoins In “Opportunity Zone,” Santiment Reveals

Ethereum, Solana and Altcoins Approaching ‘Banana Zone,’ According to Macro Guru Raoul Pal – Here’s His Outlook

Bullish March Marks Record for Bitcoin – Blockchain News, Opinion, TV and Jobs

Why Is The Dogecoin Price Down Today?

The AI-Based Smart Contract Audit Firm “Bunzz Audit” Has Officially Launched – Blockchain News, Opinion, TV and Jobs

Successful Beta Service launch of SOMESING, ‘My Hand-Carry Studio Karaoke App’

dWallet Network brings multi-chain DeFi to Sui, featuring native Bitcoin and Ethereum – Blockchain News, Opinion, TV and Jobs

Bitcoin Dropped Below 2017 All-Time-High but Could Sellers be Getting Exhausted? – Blockchain News, Opinion, TV and Jobs

What does the Coinbase Premium Gap Tell us about Investor Activity? – Blockchain News, Opinion, TV and Jobs

BNM DAO Token Airdrop

NFT Sector Keeps Developing – Number of Unique Ethereum NFT Traders Surged 276% in 2022 – Blockchain News, Opinion, TV and Jobs

New Minting Services

Block News Media Live Stream

A String of 200 ‘Sleeping Bitcoins’ From 2010 Worth $4.27 Million Moved on Friday

SEC’s Chairman Gensler Takes Aggressive Stance on Tokens – Blockchain News, Opinion, TV and Jobs

Friends or Enemies? – Blockchain News, Opinion, TV and Jobs

Enjoy frictionless crypto purchases with Apple Pay and Google Pay | by Jim | @blockchain | Jun, 2022

Block News Media Live Stream

Block News Media Live Stream

How Web3 can prevent Hollywood strikes

XRP Explodes With 1,300% Surge In Trading Volume As crypto Exchanges Jump On Board

Block News Media Live Stream

Trending

Altcoins2 years ago

Altcoins2 years agoBitcoin Dropped Below 2017 All-Time-High but Could Sellers be Getting Exhausted? – Blockchain News, Opinion, TV and Jobs

Binance2 years ago

Binance2 years agoWhat does the Coinbase Premium Gap Tell us about Investor Activity? – Blockchain News, Opinion, TV and Jobs

- Uncategorized2 years ago

BNM DAO Token Airdrop

BTC1 year ago

BTC1 year agoNFT Sector Keeps Developing – Number of Unique Ethereum NFT Traders Surged 276% in 2022 – Blockchain News, Opinion, TV and Jobs

- Uncategorized2 years ago

New Minting Services

Video1 year ago

Video1 year agoBlock News Media Live Stream

Bitcoin miners2 years ago

Bitcoin miners2 years agoA String of 200 ‘Sleeping Bitcoins’ From 2010 Worth $4.27 Million Moved on Friday

Bitcoin1 year ago

Bitcoin1 year agoSEC’s Chairman Gensler Takes Aggressive Stance on Tokens – Blockchain News, Opinion, TV and Jobs