Altcoins

Analyst Keeps Faith In XRP, Targets $288 Despite Price Retreat

Published

2 weeks agoon

By

admin

In the tumultuous world of cryptocurrency, where prices can soar to unprecedented heights one day and plummet to new lows the next, XRP, the digital asset associated with Ripple, finds itself at the center of attention once again. Despite recent dips in its value, XRP enthusiasts remain steadfast in their optimism, fueled by the unwavering confidence of cryptocurrency analyst Javon Marks.

Analyst’s Bold Prediction

Marks, known for his bullish outlook on XRP, has boldly predicted a jaw-dropping 400x surge in the price of XRP, envisioning the digital asset reaching the remarkable territory of $288. This audacious forecast comes in the face of recent challenges for XRP, including a notable dip in value and ongoing market turbulence.

With a Full Logarithmic Follow through, prices of $XRP (Ripple) may be more than poised for $200+.

Prices of Ripple went on an over +108,000% run in the 2017-2018 run and has since setup and broke out of its largest resisting structure EVER!

A mind-boggling, +33,030% run from… https://t.co/RWklG3ALh0 pic.twitter.com/r1Jie98X9s

— JAVON⚡️MARKS (@JavonTM1) April 5, 2024

Resilience Amidst Challenges

XRP has weathered its fair share of storms in recent weeks, experiencing a 24% decline from April 11 to 13, sending it to its lowest value since May 2023. Despite this setback, the digital asset showed resilience, bouncing back with a 5% rise on April 14. However, this recovery was short-lived as bearish sentiments regained control.

Chart: TradingView

At the time of writing, XRP was trading at $0.50, up a measly 0.7% in the last 24 hours, but sustained an 18.2% loss in the weekly timeframe, data from Coingecko shows.

Source: Coingecko

A psychological support, the $0.5 level tends to keep people comfortable if the price stays above it; a decline below it can alarm them. A breakdown below this level is significant because it may encourage traders to sell more because they think the price will drop even further.

XRP market cap currently atis now trading at $63,454. Chart: TradingView

Analyzing The Trends

Marks’ analysis hinges on XRP’s historical performance, particularly its ability to break out of downward trendlines. He points to a significant breakout in July 2023 following a pivotal ruling in the SEC vs. Ripple case.

Despite subsequent corrections and occasional bearish pressure, XRP has managed to remain above these trendlines, signaling a strong bullish trend that Marks believes will pave the way for a monumental price surge.

Short-Term Challenges

Despite the long-term optimism, XRP faces immediate challenges in the form of resistance and bearish sentiments. Trading below the 50-day Exponential Moving Average (EMA) and struggling to surpass the $0.50 mark, XRP must navigate through short-term obstacles before realizing its full potential.

As XRP enthusiasts eagerly await the fulfillment of Marks’ bold prediction, it’s essential to acknowledge the inherent volatility and uncertainty that characterizes the cryptocurrency market. Factors such as regulatory developments, market dynamics, and broader trends within the cryptocurrency space can all influence XRP’s price trajectory.

Featured image from Pexels, chart from TradingView

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Source link

You may like

Fantasy Metaverse Darklume – Presale is LIVE – Blockchain News, Opinion, TV and Jobs

XRP Can This 23 Million Token Purchase Spark A Rally?

Legendary Trader Peter Brandt Says Bitcoin Has 25% Chance of Hitting $160,000 – Here’s His Timeline

Ethereum Price Topside Bias Vulnerable If It Continues To Struggle Below $3.5K

Ethereum Showing Serious Strength as One Low-Cap Altcoin Flashes Bullish Signal for First Time Since 2022: Analyst

Ethereum Flashes Bullish Signals, Can It Rally 50% From Here?

Altcoins

XRP Can This 23 Million Token Purchase Spark A Rally?

Published

1 hour agoon

April 30, 2024By

admin

The cryptocurrency market continues to navigate a period of sluggishness. Yet, a recent whale activity has injected a flicker of hope for XRP, the native token of Ripple. On Tuesday, a significant investor, commonly referred to as a whale, acquired a hefty 23 million XRP, sparking renewed interest in the embattled token.

Whale Movement: A Sign Of Shifting Tides?

The purchase was identified by Whale Alert, a platform that tracks large cryptocurrency transactions. The tokens originated from a Binance exchange wallet, with the recipient address remaining undisclosed. However, the fact that the recipient was a Binance user suggests potential for further trading activity.

This whale movement is seen by some analysts as a potential turning point for XRP. Historically, large-scale purchases by whales have often preceded price surges. However, some experts caution against overinterpretation. Whale activity can be driven by various factors, and a single purchase doesn’t guarantee a sustained upward trend for XRP.

🚨 23,037,429 #XRP (11,550,284 USD) transferred from #Binance to unknown wallethttps://t.co/K00G3Ry7ab

— Whale Alert (@whale_alert) April 29, 2024

Open Interest: A Mixed Signal

Adding a layer of complexity is the recent decline in XRP Open Interest (OI). As per data from Coinalyze, XRP OI has dipped by 2.12% over the past 24 hours. Open Interest reflects the total value of outstanding futures contracts for a particular cryptocurrency. A decrease suggests a potential reduction in leveraged positions, which could indicate short-term selling pressure.

However, analysts point out that the perpetual contracts, which constitute the majority of XRP OI, still hold significant weight at over $374 million. A renewed buying spree could trigger a reversal in the Open Interest trend, potentially propelling the price upwards.

Total crypto market cap currently at $2.19 trillion. Chart: TradingView

The Lingering Shadow Of The SEC Lawsuit

It’s impossible to discuss XRP’s future without acknowledging the ongoing legal battle with the US Securities and Exchange Commission (SEC). The lawsuit, which alleges XRP is an unregistered security, has undoubtedly cast a long shadow over the token’s performance.

While the recent “remedies phase” of the lawsuit hints at a potential settlement, investors remain cautious. The final outcome and its timeline are still uncertain, leaving a cloud of ambiguity over XRP’s regulatory status.

XRP Price Outlook: A Glimmer Of Optimism?

Currently, XRP is trading at around $0.50, a significant drop from its all-time high of over $3. The price reflects the broader market slump and the ongoing legal battle.

The recent whale purchase, coupled with ongoing negotiations in the SEC lawsuit, offers a glimmer of hope for XRP bulls. However, a sustained price increase hinges on several factors. A favorable resolution to the lawsuit and a broader market recovery are crucial for XRP to regain its lost ground.

Featured image from Pexels, chart from TradingView

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Source link

Altcoins

Ethereum Showing Serious Strength as One Low-Cap Altcoin Flashes Bullish Signal for First Time Since 2022: Analyst

Published

13 hours agoon

April 30, 2024By

admin

A widely followed crypto strategist says that Ethereum (ETH) is likely gearing up for a big upside move as the leading smart contract platform shows “serious strength” in the charts.

Pseudonymous analyst and trader Bluntz tells his 257,000 followers on the social media platform X that ETH is looking strong both in its USD and Bitcoin (ETH/BTC) pairs.

“ETH and even ETH/BTC showing some serious strength today.”

Bluntz is a known practitioner of Elliot Wave Theory, an approach to technical analysis that states corrections often happen in three parts, or “A-B-C” waves. According to his chart, Bluntz is suggesting that Ethereum completed its three-wave correction when it hit $2,800 and is likely beginning a new leg of its bull run.

The trader’s chart also suggests that there is now a bullish divergence between ETH/BTC’s price action and its relative strength index (RSI), a momentum indicator. A bullish divergence signals the possibility of a trend reversal as it indicates that an asset’s momentum is on the up and up while price continues to move down or sideways.

At time of writing, Ethereum is trading at $3,183, down over 3% in the last 24 hours.

Bluntz also has his eye on an under-the-radar, lower market-cap altcoin that he says just flashed a rare bullish signal.

The trader says Helium (HNT), a Solana-based Internet of things-focused blockchain project, has likely bottomed out while showing a bullish divergence with its RSI.

“Very nice bullish divergence on HNT here after sweeping both a major range high and now range low, in fact the first one it’s had since 2022.

There’s some charts out there looking nice and bottomed out.”

At time of writing, HNT is trading at $5.14, up over 13% in the last 24 hours.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney

Source link

Altcoins

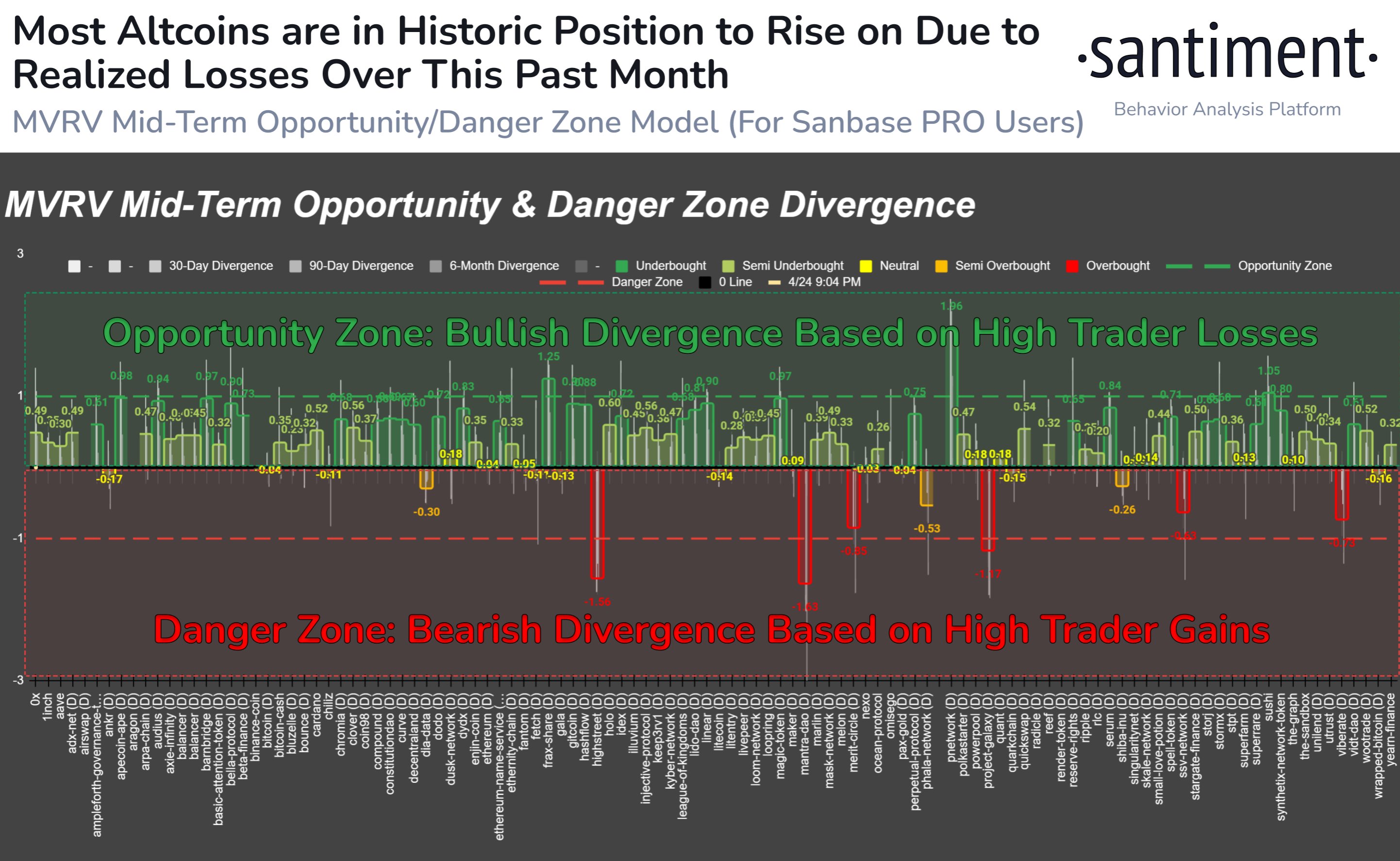

Most Altcoins in ‘Historic Position’ to Rally As Traders Realize Heavy Losses Over the Past Month: Santiment

Published

2 days agoon

April 29, 2024By

admin

Analytics firm Santiment says the majority of altcoins look set to ignite rallies after a month-long crypto correction.

Santiment says that the ongoing marketwide pullback has driven many altcoin traders to unload their stacks and incur heavy losses.

“According to our model, the mid-term gains and losses by average wallets indicate heavy realized losses across most altcoins. Over 85% of assets we track are in a historic opportunity zone when calculating the market value to realized value (MVRV) of wallets’ collective returns over one-month, three-month and six-month cycles.”

The MVRV is an on-chain indicator used to assess whether a crypto asset is undervalued or overvalued.

With the MVRV hovering at prime opportunity zones across multiple time frames for most altcoins, the analytics firm says that alts may be in a “historic position” to witness rallies.

“It may be justified to buy while there is growing fear seeping in from the crowd after all of these market cap dips.”

Amid the setup for a potential rally, Santiment notes that traders are starting to ignore volatile altcoins like Dogecoin (DOGE) in favor of crypto assets that have held up well amid choppy conditions.

“The total amount of non-empty Bitcoin wallets is rapidly growing despite choppy prices. Altcoin wallets for assets like Dogecoin have flattened after enormous rises earlier this year. Cardano is one of the few networks to see active wallets drop.”

At time of writing, DOGE is trading for $0.149, down over 34% from its 2024 high of $0.228. Meanwhile, Bitcoin is worth $64,000, a 13% decrease from its 2024 high of $73,650.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/Doremi/Sensvector

Source link

Fantasy Metaverse Darklume – Presale is LIVE – Blockchain News, Opinion, TV and Jobs

XRP Can This 23 Million Token Purchase Spark A Rally?

Legendary Trader Peter Brandt Says Bitcoin Has 25% Chance of Hitting $160,000 – Here’s His Timeline

Ethereum Price Topside Bias Vulnerable If It Continues To Struggle Below $3.5K

Ethereum Showing Serious Strength as One Low-Cap Altcoin Flashes Bullish Signal for First Time Since 2022: Analyst

Ethereum Flashes Bullish Signals, Can It Rally 50% From Here?

Consensys Takes Legal Action Against SEC to Safeguard U.S. Ethereum Community – Blockchain News, Opinion, TV and Jobs

Billion-Dollar Bank Paying $700,000 Penalty for Illegally Freezing Accounts, Transferring Customers’ Cash to Debt Collectors

MetaWin Founder Launches $ROCKY Meme Coin on Base Network – Blockchain News, Opinion, TV and Jobs

Forget Meme Coins And NFTs, RWA And DePin Are The Next Big Things – Blockchain News, Opinion, TV and Jobs

Successful Beta Service launch of SOMESING, ‘My Hand-Carry Studio Karaoke App’

Legendary Trader Predicts When Bitcoin’s Bull Run Will End

JPMorgan Chase CEO Warns Multiple Headwinds Threaten US Economy, Urges Investors To Avoid ‘False Sense of Security’

Ethereum Price Reverse Gains, Can ETH Bulls Save The Day?

Most Altcoins in ‘Historic Position’ to Rally As Traders Realize Heavy Losses Over the Past Month: Santiment

Bitcoin Dropped Below 2017 All-Time-High but Could Sellers be Getting Exhausted? – Blockchain News, Opinion, TV and Jobs

What does the Coinbase Premium Gap Tell us about Investor Activity? – Blockchain News, Opinion, TV and Jobs

BNM DAO Token Airdrop

NFT Sector Keeps Developing – Number of Unique Ethereum NFT Traders Surged 276% in 2022 – Blockchain News, Opinion, TV and Jobs

New Minting Services

Block News Media Live Stream

A String of 200 ‘Sleeping Bitcoins’ From 2010 Worth $4.27 Million Moved on Friday

SEC’s Chairman Gensler Takes Aggressive Stance on Tokens – Blockchain News, Opinion, TV and Jobs

Friends or Enemies? – Blockchain News, Opinion, TV and Jobs

Enjoy frictionless crypto purchases with Apple Pay and Google Pay | by Jim | @blockchain | Jun, 2022

Block News Media Live Stream

Block News Media Live Stream

How Web3 can prevent Hollywood strikes

XRP Explodes With 1,300% Surge In Trading Volume As crypto Exchanges Jump On Board

Block News Media Live Stream

Trending

Altcoins2 years ago

Altcoins2 years agoBitcoin Dropped Below 2017 All-Time-High but Could Sellers be Getting Exhausted? – Blockchain News, Opinion, TV and Jobs

Binance2 years ago

Binance2 years agoWhat does the Coinbase Premium Gap Tell us about Investor Activity? – Blockchain News, Opinion, TV and Jobs

- Uncategorized2 years ago

BNM DAO Token Airdrop

BTC1 year ago

BTC1 year agoNFT Sector Keeps Developing – Number of Unique Ethereum NFT Traders Surged 276% in 2022 – Blockchain News, Opinion, TV and Jobs

- Uncategorized2 years ago

New Minting Services

Video2 years ago

Video2 years agoBlock News Media Live Stream

Bitcoin miners2 years ago

Bitcoin miners2 years agoA String of 200 ‘Sleeping Bitcoins’ From 2010 Worth $4.27 Million Moved on Friday

Bitcoin1 year ago

Bitcoin1 year agoSEC’s Chairman Gensler Takes Aggressive Stance on Tokens – Blockchain News, Opinion, TV and Jobs