Bitcoin Halving

Bitcoin Halving Successfully Completed, Fueling Expectations of Price Surge – Blockchain News, Opinion, TV and Jobs

Published

2 weeks agoon

By

admin

The so-called ‘bitcoin halving’ was completed in the night from Friday to Saturday. This halving takes place once every four years and aims to counteract bitcoin inflation by making the currency scarcer. During the halving, rewards for creating a new bitcoin (also known as mining) are reduced. This has a slowing effect on the rate at which new bitcoins enter the market. It makes the cryptocurrency scarcer, which drives up the price.

Miners play a crucial role in the Bitcoin network. They use powerful computers to solve complex mathematical problems, adding new transactions to the blockchain, which is like a global ledger for Bitcoin.

Miners are rewarded in two ways: through transaction fees paid by users for faster transactions and through mining rewards, which are newly created bitcoins. Currently, miners receive 6.25 bitcoins for their work, worth around $437,500. After the latest halving, which occurred between April 18 and April 21, this reward will reduce to 3.125 bitcoins.

This reduction in rewards slows down the rate at which new bitcoins are created, ultimately decreasing the total supply. This scarcity is important because it maintains Bitcoin’s value proposition as digital gold.

In the past, halvings have led to a significant increase in the currency’s value. Cryptocurrency investors were therefore looking forward to the fourth halving.

One bitcoin is now worth about $64.800. The value of the cryptocurrency has more than doubled in the past six months.

The current halving is not exprected to affect the price of bitcoin in the short term, but many investors are expecting big gains in the months ahead. These expectations are based on the cryptocurrency’s performance after previous halvings in 2012, 2016 and 2020.

Currently, 19.6 million bitcoins have been mined. Ultimately, there should be a total of 21 million bitcoins on the market. This sets the digital currency apart from fiat money like the euro, which can be printed in unlimited quantities.

Source link

You may like

US DOJ Indicts Manhattan Man on Fraud Charges Related to $43,000,000 Fake Crypto Ponzi Scheme

$120 Million Futures Liquidated As Price Takes A Beating

Dogecoin Mirroring Price Action That Preceded Massive Bull Runs in the Past, Says Trader – Here’s His Outlook

Is Ethereum Back? Record 267,000 New Users Spark Speculation

Economist Alex Krüger Goes ‘Max Long’ on Crypto Positions – Here Are His Altcoin Picks

Crypto Investors Bet Big On ETFSwap (ETFS) Presale To Leverage Spot Bitcoin ETFs Popularity – Blockchain News, Opinion, TV and Jobs

Bitcoin Halving

Bitcoin Halving Successfully Completed, Fueling Expectations of Price Surge – Blockchain News, Opinion, TV and Jobs

Published

1 week agoon

April 24, 2024By

admin

The so-called ‘bitcoin halving’ was completed in the night from Friday to Saturday. This halving takes place once every four years and aims to counteract bitcoin inflation by making the currency scarcer. During the halving, rewards for creating a new bitcoin (also known as mining) are reduced. This has a slowing effect on the rate at which new bitcoins enter the market. It makes the cryptocurrency scarcer, which drives up the price.

Miners play a crucial role in the Bitcoin network. They use powerful computers to solve complex mathematical problems, adding new transactions to the blockchain, which is like a global ledger for Bitcoin.

Miners are rewarded in two ways: through transaction fees paid by users for faster transactions and through mining rewards, which are newly created bitcoins. Currently, miners receive 6.25 bitcoins for their work, worth around $437,500. After the latest halving, which occurred between April 18 and April 21, this reward will reduce to 3.125 bitcoins.

This reduction in rewards slows down the rate at which new bitcoins are created, ultimately decreasing the total supply. This scarcity is important because it maintains Bitcoin’s value proposition as digital gold.

In the past, halvings have led to a significant increase in the currency’s value. Cryptocurrency investors were therefore looking forward to the fourth halving.

One bitcoin is now worth about $64.800. The value of the cryptocurrency has more than doubled in the past six months.

The current halving is not exprected to affect the price of bitcoin in the short term, but many investors are expecting big gains in the months ahead. These expectations are based on the cryptocurrency’s performance after previous halvings in 2012, 2016 and 2020.

Currently, 19.6 million bitcoins have been mined. Ultimately, there should be a total of 21 million bitcoins on the market. This sets the digital currency apart from fiat money like the euro, which can be printed in unlimited quantities.

Source link

Bitcoin

Conservative Projection Places Bitcoin At $245,000 In 5 Years

Published

2 weeks agoon

April 23, 2024By

admin

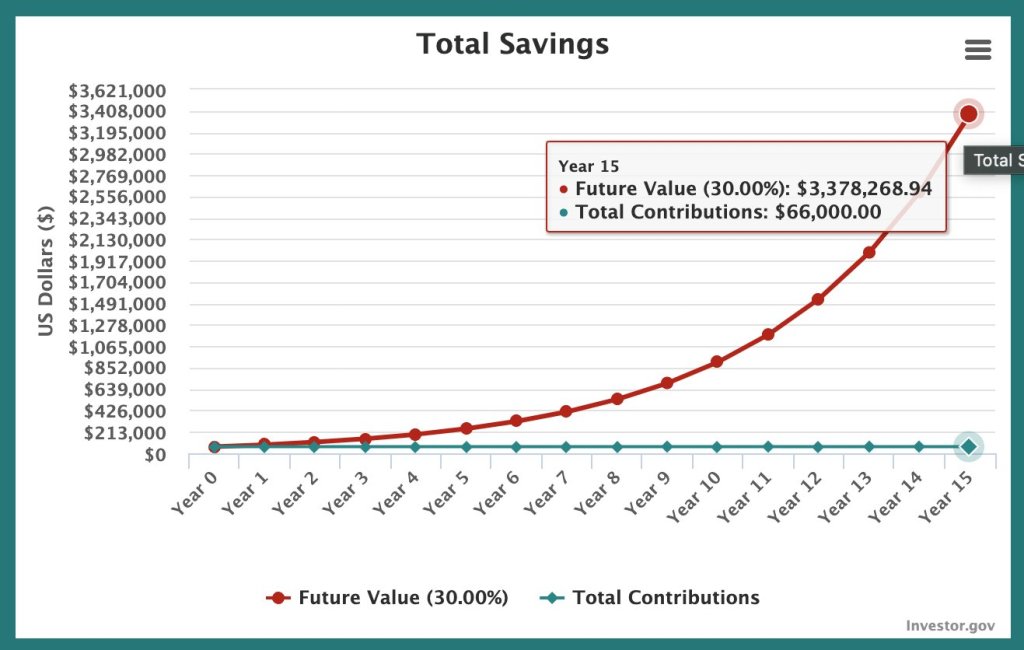

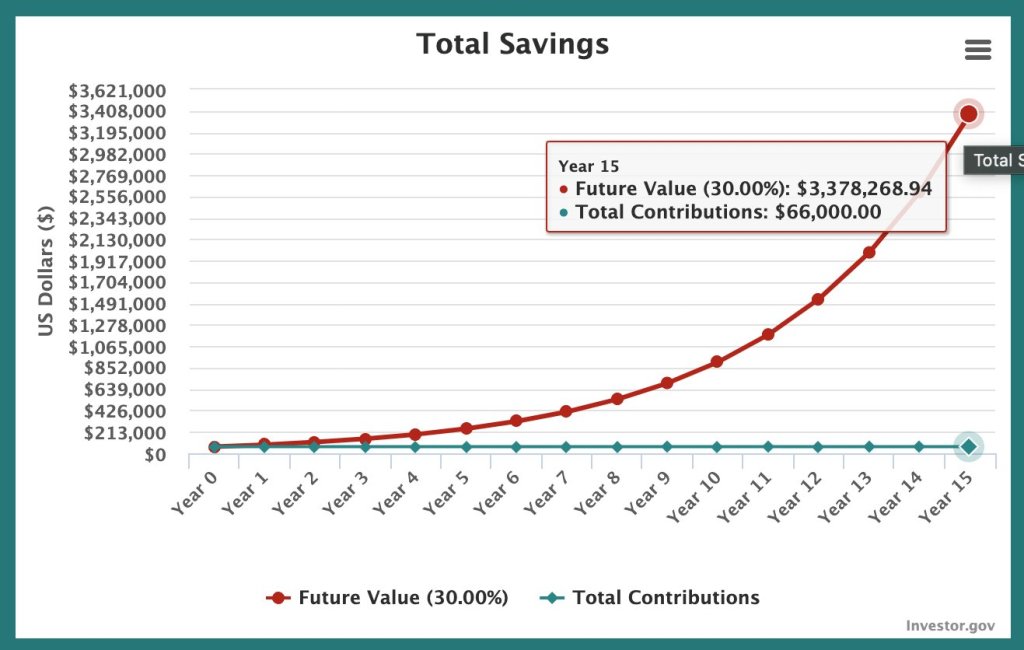

A recent analysis paints a rosy picture of Bitcoin’s future, even with a conservative growth projection. Taking to X, Michael Sullivan predicts that the world’s most valuable coin could reach a staggering $245,000 within just five years if it maintains a mere 30% compound annual growth rate (CAGR).

Bitcoin Projections: From Conservative To Exponential Growth

The analysis explores various growth possibilities for Bitcoin. Assuming the coin’s growth rate significantly contracts in the coming years, growing at just 30% CAGR, Sullivan projects the coin to reach $245,000 by 2029.

A decade later, it will be at $909,000; by 2039, each coin in circulation will be trading at a whopping $3.37 million. If, however, the CAGR rises to 40%, Bitcoin would be worth $10.3 million in 15 years and $1.9 million in 10 years.

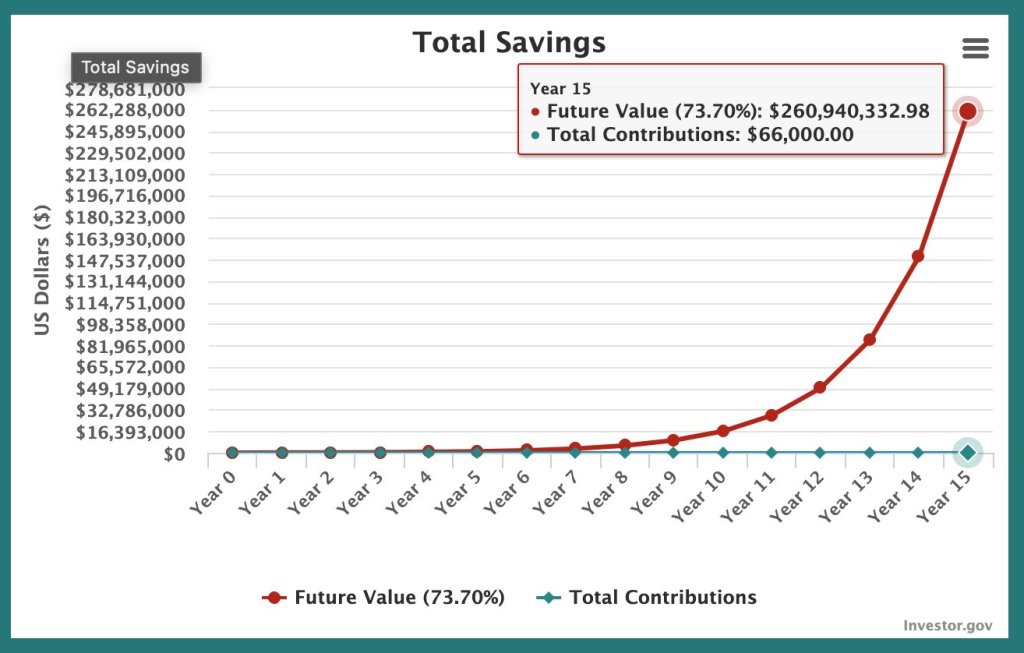

Still, even at these mega valuations, Bitcoin has been soaring at unprecedented rates, outperforming all traditional finance assets since launching. To demonstrate, Bitcoin registered a CAGR of 73.7% over the past four years.

Therefore, if this trend continues, Sullivan says BTC will smash above the $1 million level a year after halving in 2028. However, half a decade later, each coin will change hands at over $16.5 million.

A look back at Bitcoin’s history makes it clear that the coin has been on a tear. Following this historical trend and making projections for the future, BTC could be far more valuable in the next five or ten years.

There Are No Guarantees, Crypto Is Dynamic

While these projections are undoubtedly exciting for Bitcoin holders, it’s crucial to remember that they are just projections. The crypto market, just like any other tradable asset, doesn’t move in straight lines.

As an illustration, after peaking at nearly $70,000 in 2021, prices crashed to as low as $15,600 the following year. In 2017, BTC rose to around $20,000 before tanking to below $4,000 a year later in 2018. This volatility and the dynamic market, influenced by new circumstances, don’t guarantee these lofty projections.

Nonetheless, analysts remain optimistic of what lies ahead, especially after the historic Halving event on April 20. As traditional finance players join in, finding exposure in BTC through spot exchange-traded funds (ETFs), prices might rise, even breaking above the all-time highs of around $74,000.

Feature image from DALLE, chart from TradingView

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Source link

Bitcoin

Bitcoin Users Spend Record $2.4 Million On Block 840,000

Published

2 weeks agoon

April 21, 2024By

admin

With Bitcoin finally completing its fourth-year halving cycle, many users are aggressively competing for halving blocks, paying exorbitant amounts of fees to mine a single block.

Bitcoin Mining Pool Pays Over $2.4 Million In Block Fees

Earlier today, the 840,000th block was added to the Bitcoin blockchain, triggering the onslaught of the highly anticipated halving event. While the price of BTC did not witness a dramatic change following the halving, transaction fees spiked to unprecedented highs.

Amidst the massive competition, a mining pool identified as ViaBTC had successfully mined the 840,000th Bitcoin block. Cumulatively, BTC users had spent a staggering $37.7 BTC in mining fees, equivalent to $2.4 million, recording the highest fee ever paid for a Bitcoin block.

According to reports from mempool, after ViaBTC had produced the 840,000th block, the protocol had initiated an automated reduction of miners’ reward by half, from 6.25 BTC to 3.125 BTC per block. In addition to the fees, ViaBTC had received a total payout of 40.7 BTC, valued at approximately $2.6 million, for mining the historic block.

While it may seem that Bitcoin miners had thrown caution to the wind by spending over $2.4 million on a single block, the 840,000th block had a major significance within the cryptocurrency space. The historic Bitcoin block is said to hold the first Satoshis, ‘sats,’ the smallest units of BTC following the halving.

There are several of these “epic sats,” that appear after the halving event, coveted as a rare collector’s item among cryptocurrency enthusiasts. Some even speculate that these Bitcoin fragments could be potentially worth millions of dollars.

Including the hype surrounding these fragmented BTC, much of the competition for the Bitcoin blocks, following the halving has been attributed to the new Runes Protocol which launched at the same time as the Bitcoin halving.

Degens Rush To Secure Infamous Rune Tokens

The Runes Protocol, created by Casey Rodamor, a Bitcoin developer, has sent shockwaves through the cryptocurrency community, as degens are avidly competing to etch and mint tokens directly on the Bitcoin network.

While mining pools were mining new Bitcoin blocks, degens had paid over 78.6 BTC valued at $4.95 million to mint the rarest Runes. This exponential surge in fees has been an unprecedented event, highlighting the increased adoption and participation of the Bitcoin network.

According to reports from Ord.io, a Rune labeled as ‘Decentralized’ was acquired for a fee of 7.99 BTC, equivalent to $510,760. While another titled ‘Dog-Go-To-The-Moon’ was obtained for a fee of 6.73 BTC, worth approximately $429,831.

Leonidas, protocol developer and host of the groundbreaking Ordinals, a system for numbering “epic sats,” has declared the Runes Protocol a remarkable success as degens have “single-handedly offset the drop in miner rewards from the halving.” He concluded that Runes have significantly impacted Bitcoin’s security budget, potentially playing a major role in ensuring the network’s sustainability.

BTC price sitting at $63,700 after halving | Source: BTCUSD on Tradingview.com

Featured image from Watcher Guru, chart from Tradingview.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Source link

US DOJ Indicts Manhattan Man on Fraud Charges Related to $43,000,000 Fake Crypto Ponzi Scheme

$120 Million Futures Liquidated As Price Takes A Beating

Dogecoin Mirroring Price Action That Preceded Massive Bull Runs in the Past, Says Trader – Here’s His Outlook

Is Ethereum Back? Record 267,000 New Users Spark Speculation

Economist Alex Krüger Goes ‘Max Long’ on Crypto Positions – Here Are His Altcoin Picks

Crypto Investors Bet Big On ETFSwap (ETFS) Presale To Leverage Spot Bitcoin ETFs Popularity – Blockchain News, Opinion, TV and Jobs

Bitbot’s Presale Passes $3M After AI Development Update – Blockchain News, Opinion, TV and Jobs

Dogecoin Breaks Out Of Descending Triangle Like It Did In 2021, Analyst Sets $6 Target

Bitcoin Cash (BCH) Backer Roger Ver Arrested and Charged With Evading Nearly $50,000,000 in Taxes

AppLayer Unveils Fastest EVM Network and $1.5M Network Incentive Program – Blockchain News, Opinion, TV and Jobs

Whales Dive In, But Dogecoin Price Sinks 20%: What’s Going On?

Humanode, a blockchain built with Polkadot SDK, becomes the most decentralized by Nakamoto Coefficient – Blockchain News, Opinion, TV and Jobs

Here’s When Bitcoin Could Halt the ‘Slide’ and Start To Pump, According to On-Chain Analytics Firm Santiment

Ethereum Price Revisits Key Support, Can Bears Take Over?

Solana Co-Founder Says Cosmos and One SOL Rival Are Clear Winners in Building Sovereign Blockchains

Bitcoin Dropped Below 2017 All-Time-High but Could Sellers be Getting Exhausted? – Blockchain News, Opinion, TV and Jobs

What does the Coinbase Premium Gap Tell us about Investor Activity? – Blockchain News, Opinion, TV and Jobs

BNM DAO Token Airdrop

NFT Sector Keeps Developing – Number of Unique Ethereum NFT Traders Surged 276% in 2022 – Blockchain News, Opinion, TV and Jobs

New Minting Services

Block News Media Live Stream

A String of 200 ‘Sleeping Bitcoins’ From 2010 Worth $4.27 Million Moved on Friday

SEC’s Chairman Gensler Takes Aggressive Stance on Tokens – Blockchain News, Opinion, TV and Jobs

Friends or Enemies? – Blockchain News, Opinion, TV and Jobs

Enjoy frictionless crypto purchases with Apple Pay and Google Pay | by Jim | @blockchain | Jun, 2022

Block News Media Live Stream

How Web3 can prevent Hollywood strikes

Block News Media Live Stream

XRP Explodes With 1,300% Surge In Trading Volume As crypto Exchanges Jump On Board

Block News Media Live Stream

Trending

Altcoins2 years ago

Altcoins2 years agoBitcoin Dropped Below 2017 All-Time-High but Could Sellers be Getting Exhausted? – Blockchain News, Opinion, TV and Jobs

Binance2 years ago

Binance2 years agoWhat does the Coinbase Premium Gap Tell us about Investor Activity? – Blockchain News, Opinion, TV and Jobs

- Uncategorized2 years ago

BNM DAO Token Airdrop

BTC1 year ago

BTC1 year agoNFT Sector Keeps Developing – Number of Unique Ethereum NFT Traders Surged 276% in 2022 – Blockchain News, Opinion, TV and Jobs

- Uncategorized2 years ago

New Minting Services

Video2 years ago

Video2 years agoBlock News Media Live Stream

Bitcoin miners2 years ago

Bitcoin miners2 years agoA String of 200 ‘Sleeping Bitcoins’ From 2010 Worth $4.27 Million Moved on Friday

Bitcoin1 year ago

Bitcoin1 year agoSEC’s Chairman Gensler Takes Aggressive Stance on Tokens – Blockchain News, Opinion, TV and Jobs