Altcoin

Polkadot Shines – Is Now The Time To Buy DOT Before $10?

Published

3 weeks agoon

By

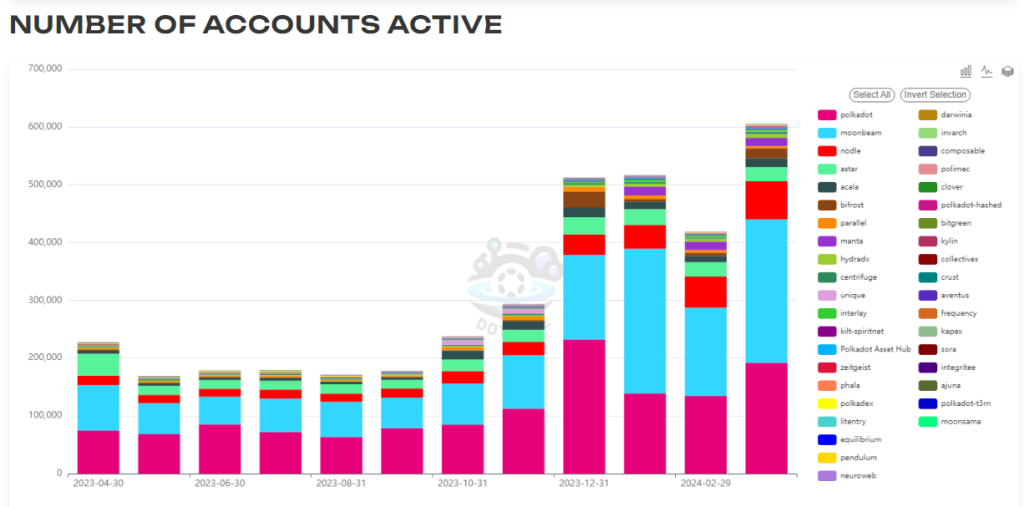

adminPolkadot, a blockchain platform designed for interoperability between different blockchains, is experiencing a surge in new users, but a disconnect between user growth and network activity is raising questions about its long-term viability.

Based on the latest figures, DOT tallied an all-time high in active wallets and unique accounts in March, surpassing 600,000 and 5.59 million, respectively. This suggests a growing interest in the platform, potentially driven by the thriving developer ecosystem on Polkadot’s parachains, specialized blockchains that connect to the main Polkadot chain. Moonbeam, a prominent parachain, played a particularly significant role, contributing the highest number of active addresses with nearly 250,000.

Source: Data

Polkadot Transactions Dip Despite Active User Growth

However, despite the influx of new users, the number of transactions on the Polkadot network hasn’t kept pace. While there was a modest increase in transactions compared to February, the current volume remains significantly lower than the peak recorded in December.

This inconsistency raises concerns about how actively users are engaging with the network. The possibility exists that users are holding or staking their DOT tokens instead of utilizing them for transactions on the platform.

Total crypto market cap is currently at $2.5 trillion. Chart: TradingView

Polkadot Price Seeks Stability After Recent Decline

The price of Polkadot’s native token, DOT, seems to be finding support around $9. This could indicate a period of consolidation after a decline from its previous highs above $11. While a price increase is typically seen as a positive sign, it’s important to consider it alongside actual network usage.

Source: Data

Is Polkadot Building Without Using?

The current situation with Polkadot presents a paradox. The platform is attracting new users, but they aren’t necessarily translating into active network participants. This could be due to several factors. Perhaps users are waiting for a specific application or service to be built on Polkadot before actively engaging. It’s also possible that technical limitations are hindering user activity.

Further analysis is needed to understand the reasons behind the lagging transactions. Examining the types of transactions occurring on the network could provide valuable insights. For instance, an increase in governance-related transactions might suggest a more engaged user base, even if overall transaction volume remains low.

Polkadot’s Future Hinges On Active Network Use

While the growth in active wallets and accounts is a positive sign for Polkadot, it’s crucial to convert this interest into actual network usage. The success of Moonbeam demonstrates the potential for a vibrant developer ecosystem on Polkadot. However, broader adoption across various use cases is necessary for the platform to reach its full potential.

Featured image from Pexels, chart from TradingView

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Source link

You may like

Altcoin

85% Of Altcoins In “Opportunity Zone,” Santiment Reveals

Published

4 days agoon

April 26, 2024By

admin

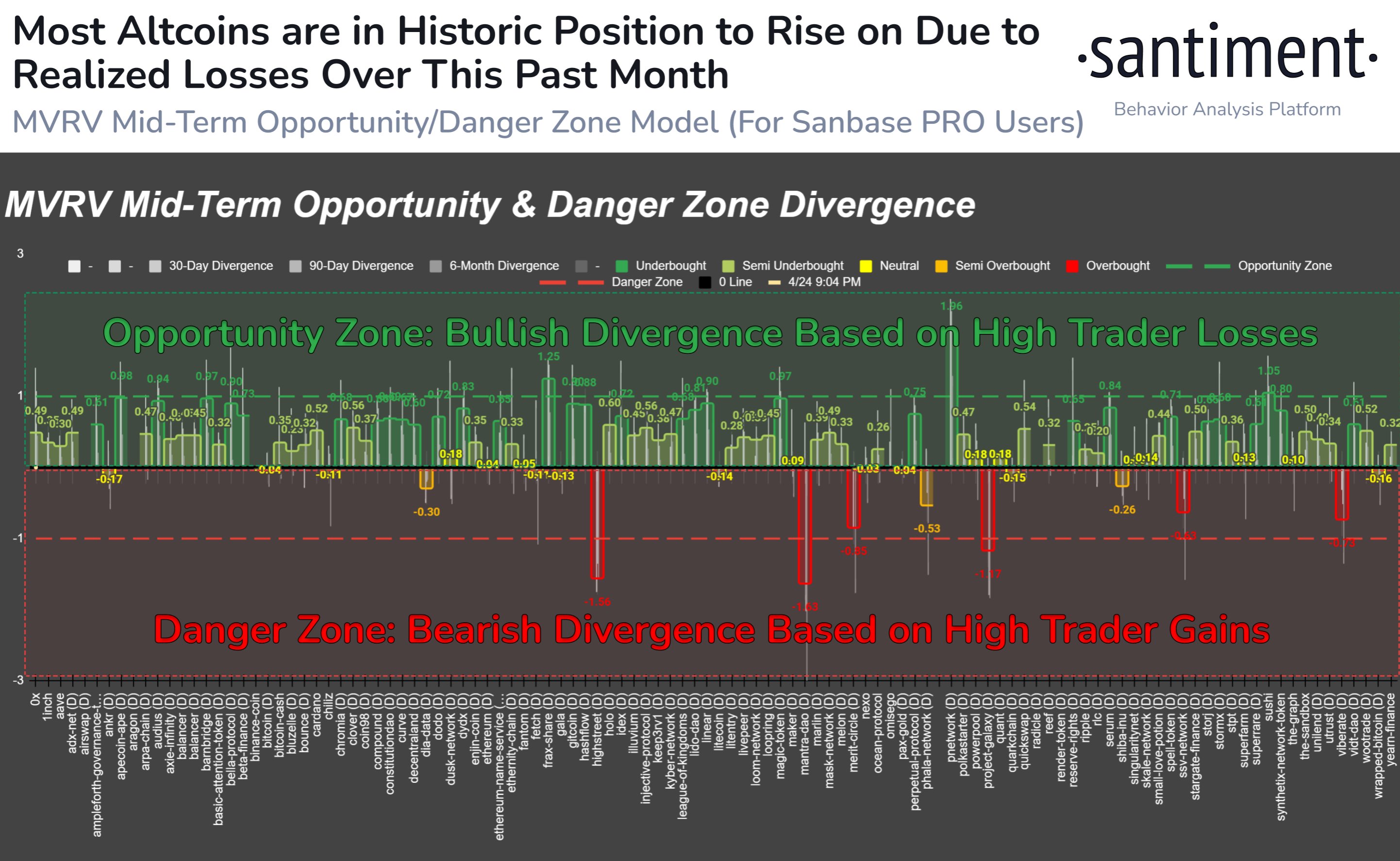

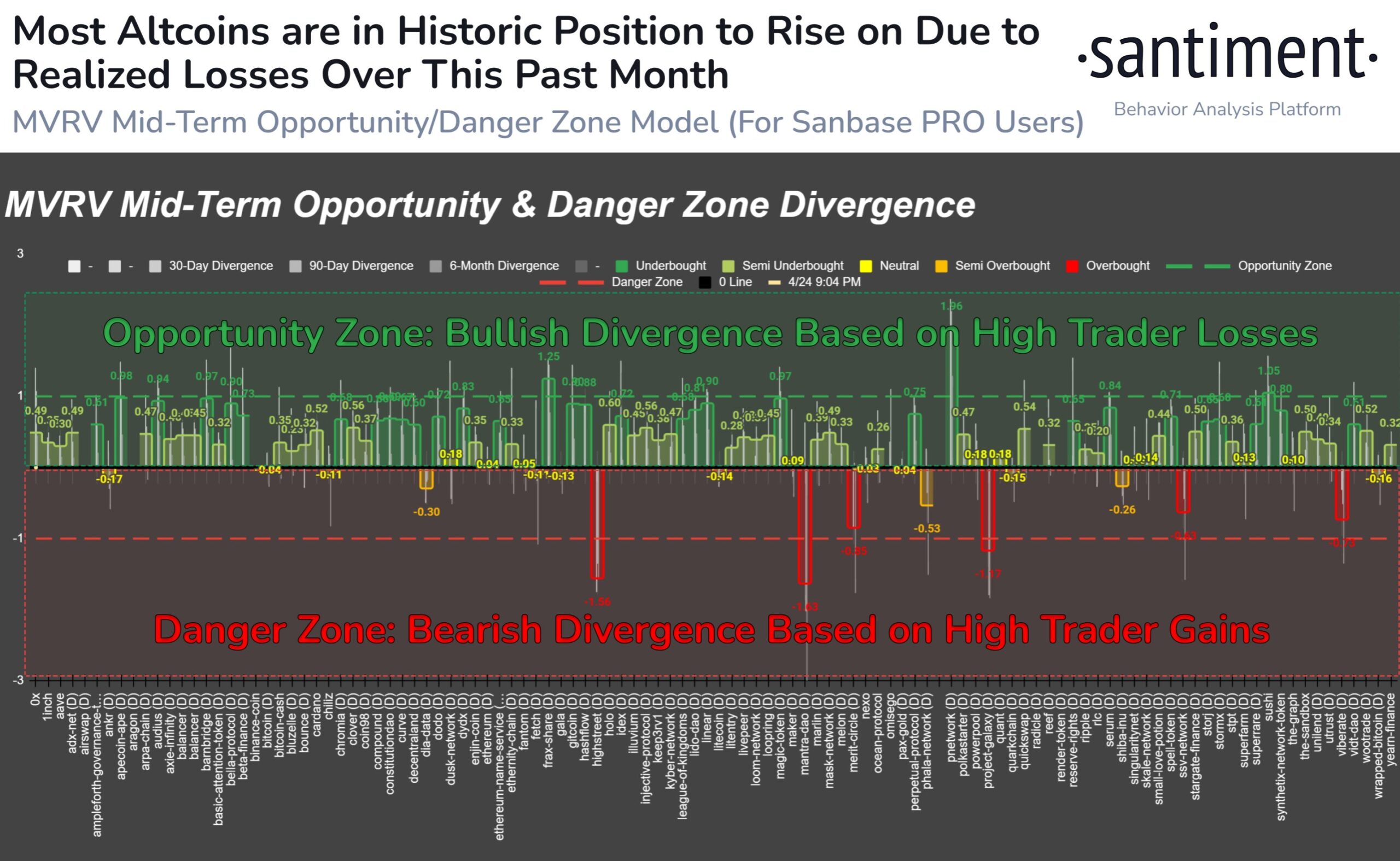

The on-chain analytics firm Santiment has revealed that over 85% of all altcoins in the sector are currently in the historical “opportunity zone.”

MVRV Would Suggest Most Altcoins Are Ready For A Bounce

In a new post on X, Santiment discussed how the altcoin market looks based on their MVRV ratio model. The “Market Value to Realized Value (MVRV) ratio” is a popular on-chain indicator that compares the market cap of Bitcoin against its realized cap.

The market cap here is the usual total valuation of the asset’s circulating supply based on the current spot price. At the same time, the latter is an on-chain capitalization model that calculates the asset’s value by assuming the “true” value of any coin in circulation is the last price at which it is transferred on the blockchain.

Given that the last transaction of any coin would have likely been the last time it changed hands, the price at its time would act as its current cost basis. As such, the realized cap essentially sums up the cost basis of every token in the circulating supply.

Therefore, one way to view the model is as a measure of the total amount of capital the investors have put into the asset. In contrast, the market cap measures the value holders are carrying.

Since the MVRV ratio compares these two models, its value can tell whether Bitcoin investors hold more or less than their total initial investment.

Historically, when investors have been in high profits, tops have become probable to form, as the risk of profit-taking can spike in such periods. On the other hand, a dominance of losses could lead to bottom formations as selling pressure runs out in the market.

Based on these facts, Santiment has defined an “opportunity” and “danger” zone model for altcoins. The chart below shows how the market currently looks from the perspective of this MVRV model.

The data for the MVRV divergence for the various altcoins | Source: Santiment on X

Under this model, when the MVRV divergence for any asset on some timeframe is higher than 1, the coin is considered to be inside the bullish opportunity zone. Similarly, if it is less than -1, it suggests it’s in the bearish danger zone.

The chart shows that MVRV divergence for a large part of the market is in the opportunity zone right now. As the analytics firm explains,

Over 85% of assets we track are in a historic opportunity zone when calculating the market value to realized value (MVRV) of wallets’ collective returns over 1-month, 3-month, and 6-month cycles.

Thus, if the model is to go by, now may be the time to go around altcoin shopping.

ETH Price

Ethereum, the largest among the altcoins, has observed a 3% surge over the past week, which has taken its price to $3,150.

Looks like the price of the asset has gone up over the last few days | Source: ETHUSD on TradingView

Featured image from Shutterstock.com, Santiment.net, chart from TradingView.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Source link

Stellar (XLM), a prominent player in the digital asset landscape, is experiencing a surge in optimism as analysts forecast a significant price increase in the near future. The cryptocurrency, currently priced at $0.1126, has demonstrated stability amidst market fluctuations, attracting investor interest and propelling a potential bullish trend.

Source: Coingecko

Stellar Breaks Out Of Technical Pattern

This newfound optimism stems from a recent technical breakout. XLM successfully emerged from an Ascending Triangle pattern, a bullish indicator that often precedes price surges. This breakout was further bolstered by a retest of the breakout level, solidifying the potential for an upward trajectory.

Technical analysts are leveraging the measured move technique to predict XLM’s future price movement. This analysis suggests a target range spanning from 0.38 to 0.47 cents, aligning with Fibonacci levels 0.70 to 0.78. This range signifies substantial growth potential, enticing investors seeking profitable opportunities.

Total crypto market cap currently at $2.2 trillion. Chart: TradingView

Investor Confidence On The Rise

Beyond technical indicators, investor confidence is playing a significant role in Stellar’s projected rise. The recent 2.50% price increase over the last 24 hours underscores this growing momentum. This shift in market sentiment indicates a bullish trend, potentially leading to a notable price appreciation in the coming months.

Analyst Projects Stellar To Reach $0.47

Adding fuel to the fire, crypto analyst EGRAG CRYPTO recently shared a bullish forecast for XLM’s price trajectory. The analyst predicts a surge towards a promising target of $0.47, highlighting the potential for substantial growth. This bullish sentiment resonates with investors and enthusiasts, further bolstering confidence in Stellar’s future.

#XLM Rockets Towards 0.47c!

🔥 #XLM has successfully broken out of the Ascending Triangle and is currently retesting the breakout level. This sets the stage for a potential bullish move.

📈 The measured move suggests a target range between Fib 0.702-0.786 (0.38-0.47c),… pic.twitter.com/bmezGMnrTI

— EGRAG CRYPTO (@egragcrypto) April 23, 2024

The analysis digs deeper, identifying key Fibonacci retracement levels as crucial milestones for XLM. These levels not only serve as potential profit-taking targets for investors but also signify the strength of the upward momentum.

XLM seven-day price action. Source: Coingecko

Interestingly, the analysis suggests that XLM has the potential to surpass traditional technical indicators. Should the cryptocurrency surpass the formidable Fib 1.618 level, it could embark on a remarkable ascent, exceeding expectations and venturing into uncharted territory.

Market Volatility Warns For Caution

While the outlook for Stellar appears promising, it’s crucial to remember the inherent volatility of the cryptocurrency market. Unforeseen events and market fluctuations can significantly impact prices.

Despite the inherent risks, the technical indicators and growing investor confidence paint a compelling picture for Stellar’s future. As the digital asset landscape continues to evolve, Stellar’s potential for significant growth is undeniable.

Featured image from Pexels, chart from TradingView

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Source link

Altcoin

The Next Dogecoin? Top Trader Points To This Memecoin

Published

1 week agoon

April 19, 2024By

admin

Crypto trading sensation Ansem, known on X (formerly Twitter) as @blknoiz06, has directed the market’s gaze towards the Bitcoin Runes ecosystem, labeling it as the nascent grounds for the next 100x crypto opportunity, as NewsBTC reported yesterday. Ansem, whose prowess is well-documented through his previous astronomical gains of 170x on Solana (SOL), 520x on dogwifhat (WIF), and 80x on Bonk (BONK), stirred the crypto community with his recent Dogecoin comparison.

On the cusp of Bitcoin’s highly anticipated halving today, Ansem doubled down on his initial assessment, particularly highlighting two tokens within the Bitcoin Runes ecosystem: Bitcoin Wizards (WZRD) and PUPS. He equates WZRD with Dogecoin, suggesting it has the potential to mirror Dogecoin’s viral success. In contrast, he compares PUPS to the lesser-known but highly profitable dogwifhat (WIF).

Related Reading: Elon Musk Latest Tweet: How Much Did Dogecoin Gain From It Today?

In a tweet that caught the eye of both investors and enthusiasts, Ansem elaborated on his reasoning behind the picks, stating:

Great thread, been saying, I believe Runes are next asymmetric 100x opp in crypto. The meme that got DOGE founder interested in Bitcoin & the phrase magic internet money is still used today – representative of bitcoin culture. DOGE equivalent = WZRD, WIF equivalent = PUPS.

Ansem references a thread on X by Immutable Edge (@ImmutableSOL), who delved into the historical and cultural significance of the “Magic Internet Money” meme, originally sparked by mavensbot’s viral Reddit ad.

The “Magic Internet Money” meme dates back to February 18, 2013, when mavensbot, a digital artist, submitted a hand-drawn depiction of a blue wizard to promote Bitcoin on Reddit. This ad, created during Bitcoin’s early adoption phase, was crucial in cultivating a cultural ethos around Bitcoin.

It resonated deeply within the community, encapsulating the whimsical yet revolutionary nature of Bitcoin’s rise. The ad’s simplicity and authenticity resonated with the Reddit community, propelling Bitcoin from a niche internet experiment to a major financial phenomenon. Within weeks of the ad’s debut, Bitcoin’s value surged from $27 to a record high of $1,132 by November 2013.

Bitcoin Wizards, one of the highlighted tokens, aims to rekindle this original spirit. The token leverages the iconic imagery and cultural narrative of the “Magic Internet Money” meme to foster a new wave of interest and adoption. The creators of WZRD are not only paying homage to Bitcoin’s roots but are also embedding this storied meme within the mechanics of a modern cryptocurrency, aiming to capture both nostalgia and innovation.

The Bitcoin Wizards project is part of the broader Bitcoin Runes ecosystem, which reached a lot of hype prior to its launch. According to Ansem, WZRD’s history and deep roots in memes give it the perfect ingredients to become the next Dogecoin, just on Bitcoin Runes.

Moreover, the analyst assessment comes at a critical time for the crypto market, which is often influenced by the narratives that capture the community’s imagination. As the Bitcoin halving event unfolds, many eyes will be on the Bitcoin Runes ecosystem to see if it can indeed replicate the meteoric rises seen in BRC-20 tokens and Ordinals.

At press time, WZRD traded at $12.15, up 70% in the last 24 hours.

Featured image created with DALL·E, chart from TradingView.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Source link

Consensys Takes Legal Action Against SEC to Safeguard U.S. Ethereum Community – Blockchain News, Opinion, TV and Jobs

Billion-Dollar Bank Paying $700,000 Penalty for Illegally Freezing Accounts, Transferring Customers’ Cash to Debt Collectors

MetaWin Founder Launches $ROCKY Meme Coin on Base Network – Blockchain News, Opinion, TV and Jobs

Forget Meme Coins And NFTs, RWA And DePin Are The Next Big Things – Blockchain News, Opinion, TV and Jobs

Successful Beta Service launch of SOMESING, ‘My Hand-Carry Studio Karaoke App’

Legendary Trader Predicts When Bitcoin’s Bull Run Will End

JPMorgan Chase CEO Warns Multiple Headwinds Threaten US Economy, Urges Investors To Avoid ‘False Sense of Security’

Ethereum Price Reverse Gains, Can ETH Bulls Save The Day?

Most Altcoins in ‘Historic Position’ to Rally As Traders Realize Heavy Losses Over the Past Month: Santiment

Analyst Predicts Potential Climb to $16

US National Debt Surges $273,859,000,000 in Two Months As Billionaire Leon Cooperman Warns Nation Heading Toward Financial Crisis

Bitcoin Daily Transactions Just Hit A New ATH

Bitcoin Could Witness Repeat of November 2020 Parabolic Rally Amid Max Price Compression, Says Analyst

Analyst Says Prepare For 700% Jump To $4, Here’s When

Solana Witnessing ‘Dramatic Increase’ in Investor Allocations This Year, According to New CoinShares Survey

Bitcoin Dropped Below 2017 All-Time-High but Could Sellers be Getting Exhausted? – Blockchain News, Opinion, TV and Jobs

What does the Coinbase Premium Gap Tell us about Investor Activity? – Blockchain News, Opinion, TV and Jobs

BNM DAO Token Airdrop

NFT Sector Keeps Developing – Number of Unique Ethereum NFT Traders Surged 276% in 2022 – Blockchain News, Opinion, TV and Jobs

New Minting Services

Block News Media Live Stream

A String of 200 ‘Sleeping Bitcoins’ From 2010 Worth $4.27 Million Moved on Friday

SEC’s Chairman Gensler Takes Aggressive Stance on Tokens – Blockchain News, Opinion, TV and Jobs

Friends or Enemies? – Blockchain News, Opinion, TV and Jobs

Enjoy frictionless crypto purchases with Apple Pay and Google Pay | by Jim | @blockchain | Jun, 2022

Block News Media Live Stream

Block News Media Live Stream

How Web3 can prevent Hollywood strikes

XRP Explodes With 1,300% Surge In Trading Volume As crypto Exchanges Jump On Board

Block News Media Live Stream

Trending

Altcoins2 years ago

Altcoins2 years agoBitcoin Dropped Below 2017 All-Time-High but Could Sellers be Getting Exhausted? – Blockchain News, Opinion, TV and Jobs

Binance2 years ago

Binance2 years agoWhat does the Coinbase Premium Gap Tell us about Investor Activity? – Blockchain News, Opinion, TV and Jobs

- Uncategorized2 years ago

BNM DAO Token Airdrop

BTC1 year ago

BTC1 year agoNFT Sector Keeps Developing – Number of Unique Ethereum NFT Traders Surged 276% in 2022 – Blockchain News, Opinion, TV and Jobs

- Uncategorized2 years ago

New Minting Services

Video1 year ago

Video1 year agoBlock News Media Live Stream

Bitcoin miners2 years ago

Bitcoin miners2 years agoA String of 200 ‘Sleeping Bitcoins’ From 2010 Worth $4.27 Million Moved on Friday

Bitcoin1 year ago

Bitcoin1 year agoSEC’s Chairman Gensler Takes Aggressive Stance on Tokens – Blockchain News, Opinion, TV and Jobs