Bitcoin

Spot Bitcoin And Ethereum ETFs Approved In Hong Kong

Published

2 weeks agoon

By

admin

The Hong Kong Securities and Futures Commission (SFC) has officially approved several spot Bitcoin and Ethereum exchange-traded funds (ETFs), a decision that marks a significant development in the region’s burgeoning crypto market. These approvals were granted to prominent asset managers including China Asset Management, Bosera Capital, and HashKey Capital Limited, alongside an in-principle approval for Harvest Global Investments.

Hong Kong’s SFC Approves Bitcoin And ETH ETFs

China Asset Management’s Hong Kong unit, as detailed in their press release, has received SFC approval to launch spot Bitcoin and Ethereum ETFs. This initiative is part of a collaboration with OSL Digital Securities Limited and BOCI International, aiming to provide retail asset management services with direct cryptocurrency subscriptions.

Similarly, Bosera Asset Management and HashKey Capital have announced that they have received conditional approval from the SFC for their own spot crypto ETFs. These products, named the Bosera HashKey Bitcoin ETF and the Bosera HashKey Ether ETF, will allow investors to directly use Bitcoin and Ethereum to subscribe for ETF shares, as stated in their press release.

Harvest Global Investments has also been spotlighted with the SFC’s in-principle nod for two major digital asset spot ETFs. According to their press release, Mr. Tongli Han, CEO and CIO of Harvest Global Investments, remarked, “This in-principle approval for Harvest Global Investments’ products in two major digital asset spot ETFs not only underscores Hong Kong’s competitive edge in the digital asset space, but also demonstrates our unrelenting pursuit of promoting innovation in the industry and meeting diversified investor needs.”

These ETFs are set to be launched through a partnership with OSL Digital Securities, the first digital asset platform licensed and insured by the SFC, highlighting a significant stride in addressing common market challenges such as excessive margin requirements and price premiums.

The press release from Bosera and HashKey highlights that the introduction of these virtual asset spot ETFs will not only provide new asset allocation opportunities but also reinforce Hong Kong’s status as an international financial center and a hub for virtual assets. This move is aligned with the city’s strategic push to establish itself as a regional leader in financial innovation, particularly in the digital asset sector.

The approvals are indicative of Hong Kong’s progressive regulatory framework which aims to integrate digital assets within its financial ecosystem safely and securely. The establishment of these ETFs is expected to provide a regulated, innovative investment avenue for both retail and institutional investors in the region. While there is not as much hype as there is around US ETFs, some analysts believe the impact could be similar.

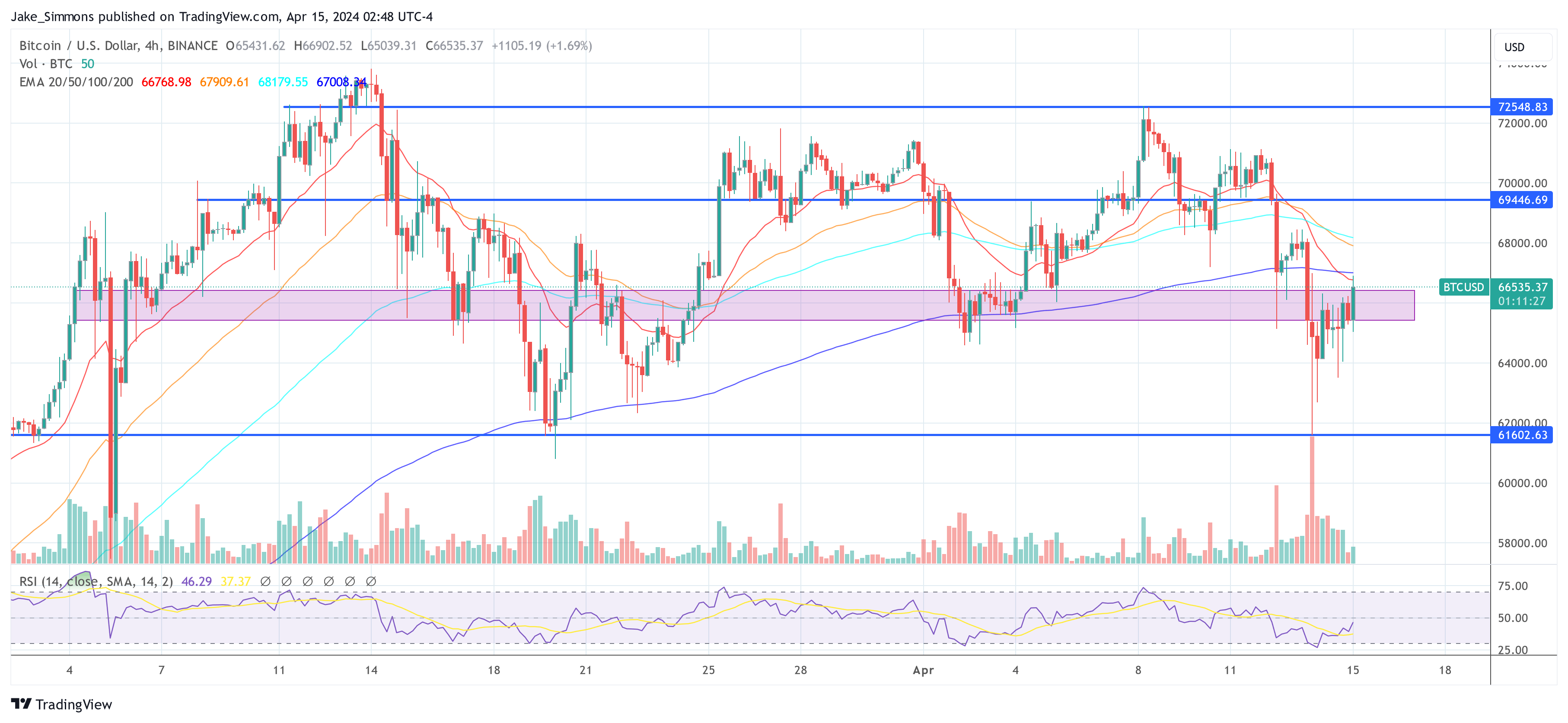

These approvals come on the heels of rumors last Friday about the potential approval of these ETFs. The market had been abuzz with speculations, and today’s confirmation has provided the Bitcoin and ETH prices with a much needed boost. BTC is up 2.2% since the announcement, surpassing the $66,000 mark. The approved ETFs are reportedly set to launch by the end of April.

At press time, BTC traded at $66,535.

Featured image created with DALL·E, chart from TradingView.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Source link

You may like

Billion-Dollar Bank Paying $700,000 Penalty for Illegally Freezing Accounts, Transferring Customers’ Cash to Debt Collectors

MetaWin Founder Launches $ROCKY Meme Coin on Base Network – Blockchain News, Opinion, TV and Jobs

Forget Meme Coins And NFTs, RWA And DePin Are The Next Big Things – Blockchain News, Opinion, TV and Jobs

Successful Beta Service launch of SOMESING, ‘My Hand-Carry Studio Karaoke App’

Legendary Trader Predicts When Bitcoin’s Bull Run Will End

JPMorgan Chase CEO Warns Multiple Headwinds Threaten US Economy, Urges Investors To Avoid ‘False Sense of Security’

Bitcoin

Legendary Trader Predicts When Bitcoin’s Bull Run Will End

Published

5 hours agoon

April 29, 2024By

admin

In a recent analysis, veteran trader Peter Brandt delved into the price behavior of Bitcoin, suggesting that the cryptocurrency might have reached its peak for the current cycle. According to Brandt, Bitcoin is exhibiting signs of “Exponential Decay,” indicating a weakening in the momentum of its bull market cycles over the years.

“Does history make a case that Bitcoin has topped? It’s called Exponential Decay — and it describes Bitcoin,” Brandt wrote. He further explained, “The fact is that the bull market cycles in Bitcoin have lost a tremendous amount of thrust over the years… I don’t like the Exponential Decay occurring in Bitcoin — Bitcoin is one of my personal largest investment positions.”

Brandt provided a historical breakdown of Bitcoin’s bull cycles, noting a consistent decrease in the magnitude of gains:

- The bull cycle from December 21, 2009, to June 6, 2011, demonstrated a staggering 3,191X advance.

- The subsequent cycle from November 14, 2011, to November 25, 2013, showed a reduced yet impressive 572X advance.

- The period from August 17, 2015, to December 18, 2017, recorded a further diminished 122X advance.

- More recently, the cycle from December 10, 2018, to November 8, 2021, saw just a 22X advance.

Bitcoin Reached Its Cycle Peak With A Probability Of 25%

Drawing on these historical patterns, Brandt extrapolated that the current cycle, which began on November 21, 2022, would likely see an approximate 4.5X gain from its low of $15,473, predicting a potential high near $72,723. Notably, this peak has already been nearly met with a price of $73,835 recorded on March 14, 2024. Brandt underscores this observation with a caution, “The magnitude of each bull cycle has been roughly 20% of its predecessor, indicating significant energy loss.”

In his analysis, Brandt does not shy away from addressing the implications of Bitcoin’s halving events, which have historically been catalysts for substantial price increases. Despite this, he emphasizes the undeniable presence of the decay pattern: “But for now, we need to deal with the fact of Exponential Decay. It has happened. It is real. You may not want to believe it, but I place a 25% chance that Bitcoin has already topped for this cycle.”

In a communication on X, Brandt responded to a counter analysis by fellow analyst @Giovann35084111, who argued that Bitcoin follows a power law over time, suggesting the potential for ongoing growth despite the observed decay. Brandt acknowledged the validity. “Quite a thorough analysis,” Brand commented.

Quite a thorough analysis https://t.co/hiSogUtEkt

— Peter Brandt (@PeterLBrandt) April 29, 2024

@Giovann35084111’s analysis extends beyond cyclical trends by illustrating how deviations from the power law at specific intervals, particularly around halving events, provide a structured prediction model. This approach projects systematic patterns in Bitcoin’s price movements, reinforcing a bullish outlook. The analyst predicts a significant rise in Bitcoin’s price, estimating the next top at the end of 2025 to reach between $210,000 and $250,000.

In a later post, Brandt emphasized that his main prediction is an ongoing bull market into September/October 2025. He explained, “I give more credence to a report I issued in February. Here is a chart from that analysis — projecting a bull market until Sep/Oct 2025,” indicating that his views are influenced by evolving market data and theoretical models.

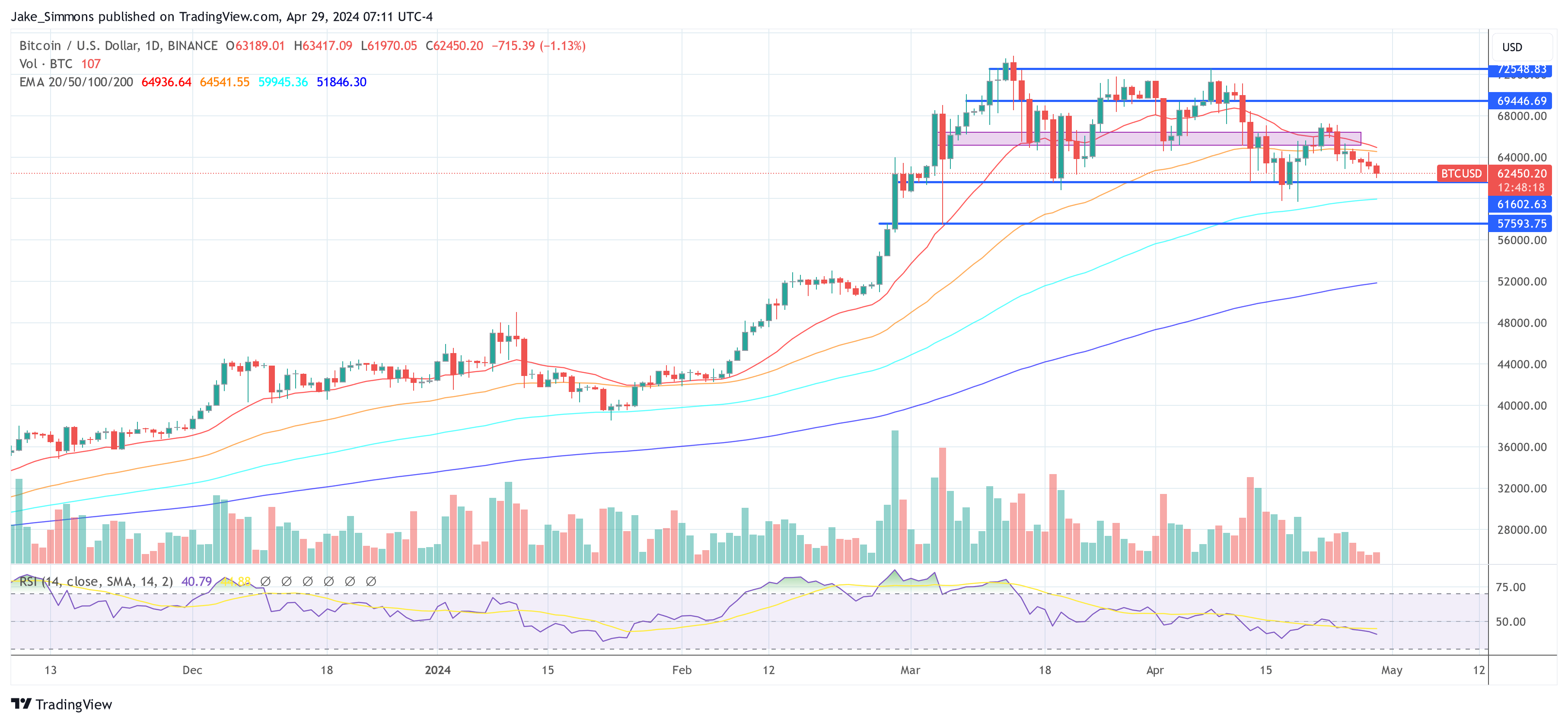

At press time, BTC traded at $62,450.

Featured image created with DALL·E, chart from TradingView.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Source link

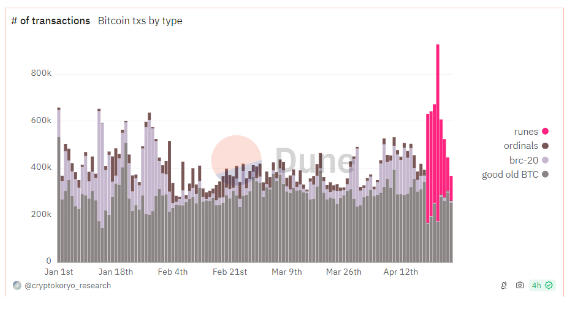

The Bitcoin network has witnessed a surge in trading activity in the days after the halving, as shown by on-chain data. Although the just concluded halving brought a lot of attention to Bitcoin, the recent surge in trading activity can be attributed to something else.

According to data from on-chain analytics platform IntoTheBlock, the number of daily BTC transactions has grown rapidly in the past few days to reach a new high of 927,000 thanks to a new token standard called Runes.

Bitcoin Daily Transactions Reach New All-Time High

Bitcoin’s price has been skyrocketing since the beginning of the year with interest in the top cryptocurrency exploding. All that new interest means more people buying, selling, and trading BTC, which has led to a huge increase in the number of daily transactions.

Despite the increase in activity, the number of daily transactions failed to break above the 724,000 record for the past four months, until recently this week.

The main catalyst for this activity surge is the recent launch of the Runes token standard on the Bitcoin blockchain. The Runes Protocol is a new token standard on BTC that gives users a more efficient way of creating fungible tokens.

The additional functionality provided by Runes opens up new possibilities for Bitcoin, allowing users to create non-fungible tokens more efficiently than the existing BRC-20 token system.

Bitcoin is now trading at $63.711. Chart: TradingView

The Runes token standard surged immediately among developers and users after launch, constituting over 68% of Bitcoin transactions recorded. According to Dune’s analytics dashboard, the number of Runes transactions surged to 753,000 on Tuesday, April 23. As a result, the total number of transactions on the day crossed over 927,000 to break the 724,000 record set in December 2023.

Bitcoin hit a new all-time high in daily transactions!

Following the launch of Runes, The number of Bitcoin transactions has increased rapidly, hitting 927,000 on Tuesday. This breaks the previous high of 724k set in December of 2023 pic.twitter.com/30JXbrLmdR

— IntoTheBlock (@intotheblock) April 26, 2024

On the other hand, the hype surrounding the Runes token standard seems to have faded so quickly. The number of transactions on Runes has now fallen to 104,800 in the past 24 hours, constituting 26% of the total number of transactions.

Bitcoin Price Prediction

At the time of writing, Bitcoin is trading at $63,711 with a price resistance now around $64,500. Bitcoin’s price trajectory can be very tough to predict. Many Bitcoin analysts and traders are still looking forward to a bullish effect of the just concluded halving on the price of the cryptocurrency. A Bitcoin bull flag has just been formed which suggests the possibility of an uptrend very soon.

However, crypto expert Peter Brandt believes Bitcoin might have already reached its top in the current market cycle. His theory is based on the exponential decay thesis which shows that the percentage gain of Bitcoin price has reduced in succeeding market cycles.

Featured image from Pexels, chart from TradingView

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Source link

Bitcoin

Bitcoin Could Witness Repeat of November 2020 Parabolic Rally Amid Max Price Compression, Says Analyst

Published

1 day agoon

April 28, 2024By

admin

A widely followed analyst believes that Bitcoin (BTC) is gearing up for a parabolic surge despite its recent price doldrums.

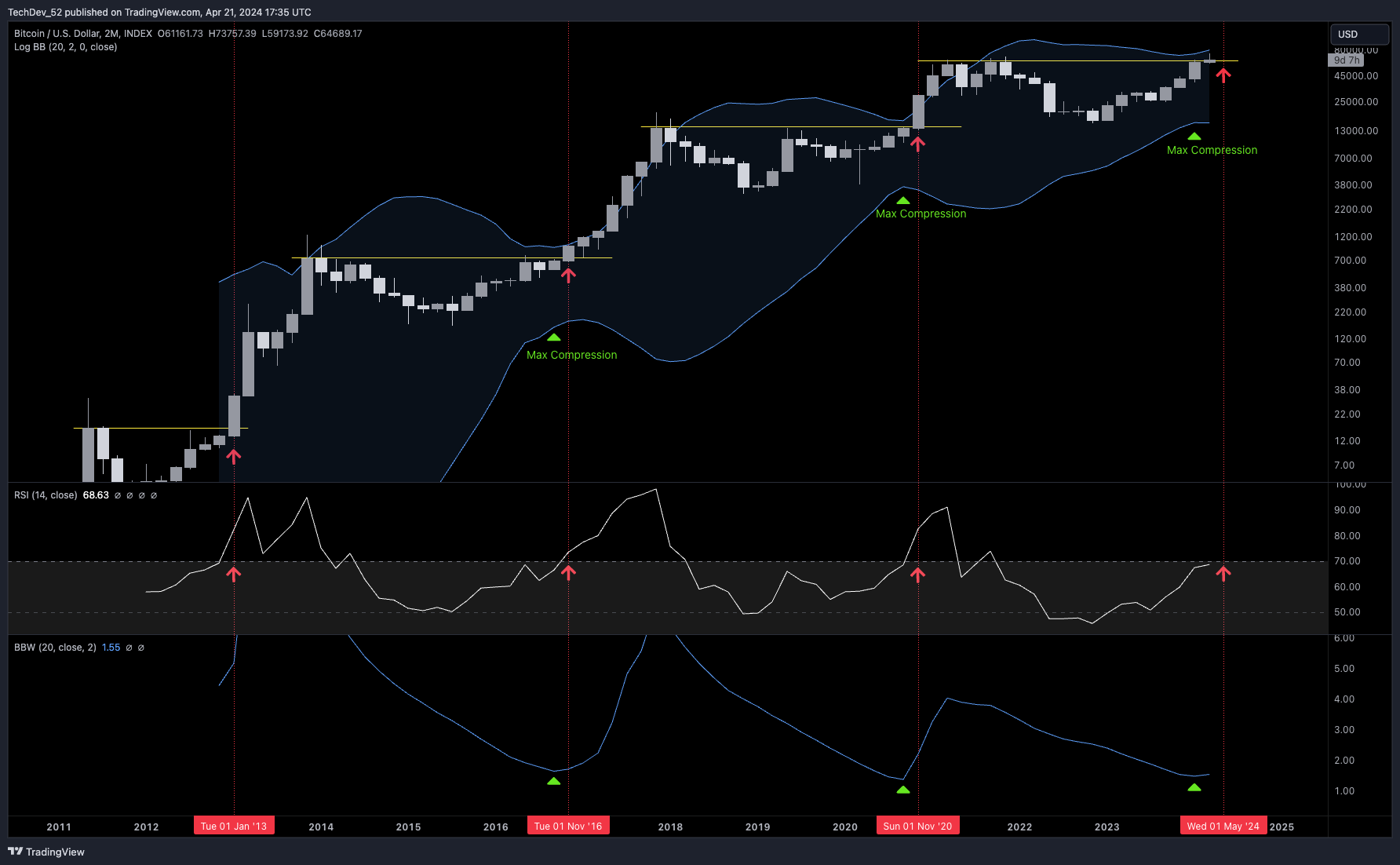

Pseudonymous crypto strategist TechDev tells his 447,600 followers on the social media platform X that conditions on Bitcoin’s two-month chart suggest that BTC is almost ready to witness a price explosion.

The analyst predicts that BTC will rally by over 120%, similar to what happened in late 2020 when Bitcoin surged from around $13,000 to over $29,000 in just two months.

“Bitcoin’s two-month candle is right on the candle body high, soon after max compression.

As RSI (relative strength index) is about to break 70.

These have been the conditions which led to the last three parabolic accelerations.

I suspect this next two-month candle will be as tall as Nov 2020.”

Looking at the trader’s chart, he appears to point out that Bitcoin saw parabolic surges in 2013, 2016 and 2020 when its momentum indicator, the relative strength index (RSI), went above the bullish 70 level.

He also says that Bitcoin’s volatility indicator – the Bollinger Bands Width (BBW) – bottomed out during the same three instances, indicating that BTC was preparing for a big price explosion.

As Bitcoin replicates the exact conditions, TechDev says it is unlikely for BTC to go through a price collapse.

“Please also point out the ‘pullbacks/crashes/dumps’ many have freaked about over the last eight months.”

Although TechDev is optimistic about the prospect of another parabolic run for Bitcoin, fellow crypto analyst DonAlt does not share the same sentiment.

The analyst who nailed the 2022 Bitcoin bottom warns that support at $60,000 looks vulnerable after getting tested multiple times.

“Back to the same old level. The more often it’s tested the more likely it is to break.

I think even bulls would want to get a washout below it at this point.

Complacency until proven otherwise (as in until $68,000 is reclaimed or range is lost and then reclaimed again).”

At time of writing, Bitcoin is worth $63,524.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/andrey_l/Panuwatccn

Source link

Billion-Dollar Bank Paying $700,000 Penalty for Illegally Freezing Accounts, Transferring Customers’ Cash to Debt Collectors

MetaWin Founder Launches $ROCKY Meme Coin on Base Network – Blockchain News, Opinion, TV and Jobs

Forget Meme Coins And NFTs, RWA And DePin Are The Next Big Things – Blockchain News, Opinion, TV and Jobs

Successful Beta Service launch of SOMESING, ‘My Hand-Carry Studio Karaoke App’

Legendary Trader Predicts When Bitcoin’s Bull Run Will End

JPMorgan Chase CEO Warns Multiple Headwinds Threaten US Economy, Urges Investors To Avoid ‘False Sense of Security’

Ethereum Price Reverse Gains, Can ETH Bulls Save The Day?

Most Altcoins in ‘Historic Position’ to Rally As Traders Realize Heavy Losses Over the Past Month: Santiment

Analyst Predicts Potential Climb to $16

US National Debt Surges $273,859,000,000 in Two Months As Billionaire Leon Cooperman Warns Nation Heading Toward Financial Crisis

Bitcoin Daily Transactions Just Hit A New ATH

Bitcoin Could Witness Repeat of November 2020 Parabolic Rally Amid Max Price Compression, Says Analyst

Analyst Says Prepare For 700% Jump To $4, Here’s When

Solana Witnessing ‘Dramatic Increase’ in Investor Allocations This Year, According to New CoinShares Survey

Expert Says Bitcoin Price Has Topped And Is In Exponential Decay, Why This Is Not A Bad Thing

Bitcoin Dropped Below 2017 All-Time-High but Could Sellers be Getting Exhausted? – Blockchain News, Opinion, TV and Jobs

What does the Coinbase Premium Gap Tell us about Investor Activity? – Blockchain News, Opinion, TV and Jobs

BNM DAO Token Airdrop

NFT Sector Keeps Developing – Number of Unique Ethereum NFT Traders Surged 276% in 2022 – Blockchain News, Opinion, TV and Jobs

New Minting Services

Block News Media Live Stream

A String of 200 ‘Sleeping Bitcoins’ From 2010 Worth $4.27 Million Moved on Friday

SEC’s Chairman Gensler Takes Aggressive Stance on Tokens – Blockchain News, Opinion, TV and Jobs

Friends or Enemies? – Blockchain News, Opinion, TV and Jobs

Enjoy frictionless crypto purchases with Apple Pay and Google Pay | by Jim | @blockchain | Jun, 2022

Block News Media Live Stream

Block News Media Live Stream

How Web3 can prevent Hollywood strikes

XRP Explodes With 1,300% Surge In Trading Volume As crypto Exchanges Jump On Board

Block News Media Live Stream

Trending

Altcoins2 years ago

Altcoins2 years agoBitcoin Dropped Below 2017 All-Time-High but Could Sellers be Getting Exhausted? – Blockchain News, Opinion, TV and Jobs

Binance2 years ago

Binance2 years agoWhat does the Coinbase Premium Gap Tell us about Investor Activity? – Blockchain News, Opinion, TV and Jobs

- Uncategorized2 years ago

BNM DAO Token Airdrop

BTC1 year ago

BTC1 year agoNFT Sector Keeps Developing – Number of Unique Ethereum NFT Traders Surged 276% in 2022 – Blockchain News, Opinion, TV and Jobs

- Uncategorized2 years ago

New Minting Services

Video1 year ago

Video1 year agoBlock News Media Live Stream

Bitcoin miners2 years ago

Bitcoin miners2 years agoA String of 200 ‘Sleeping Bitcoins’ From 2010 Worth $4.27 Million Moved on Friday

Bitcoin1 year ago

Bitcoin1 year agoSEC’s Chairman Gensler Takes Aggressive Stance on Tokens – Blockchain News, Opinion, TV and Jobs