Ripple

XRP Price Scenarios Ahead Of Ripple-SEC Case Update: Analyst

Published

2 weeks agoon

By

admin

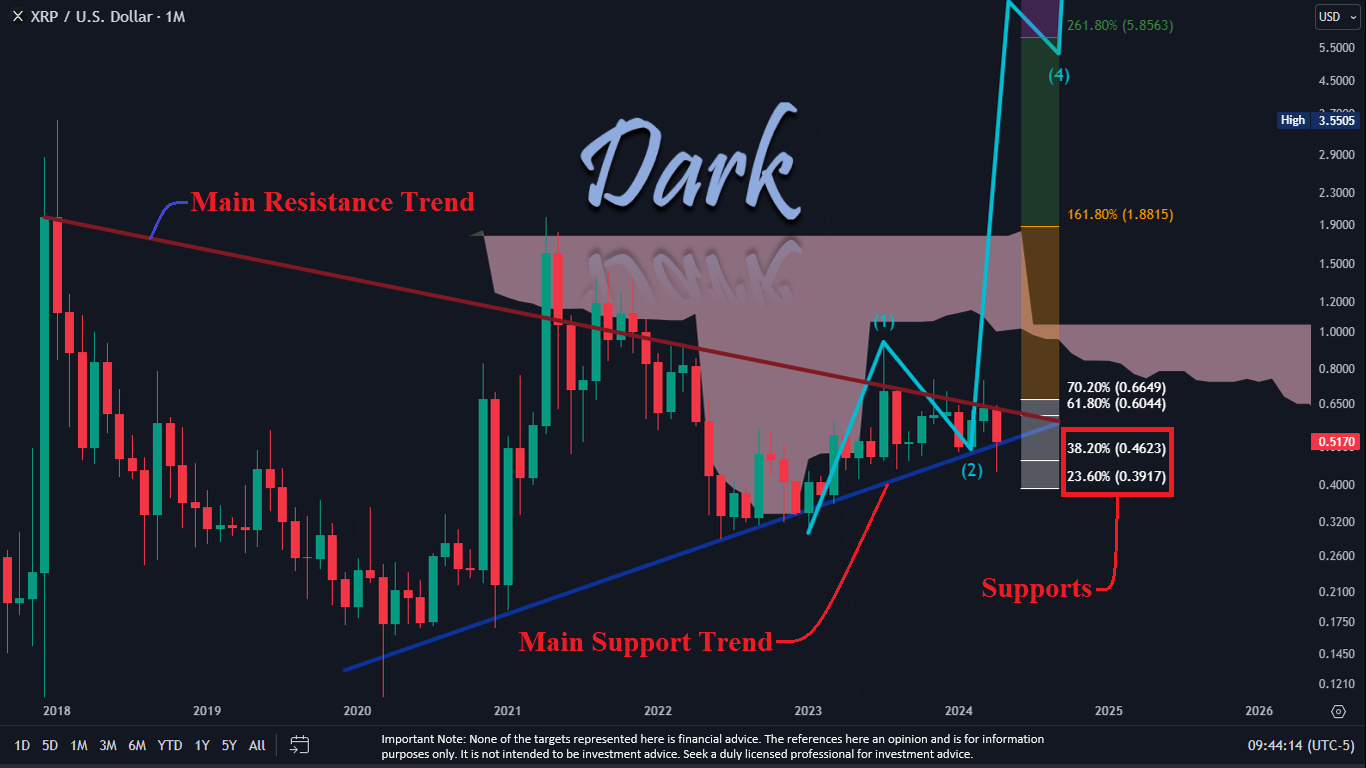

In a chart analysis shared via X, the crypto analyst Dark Defender provided insight into the potential price movements of XRP ahead of this week’s Ripple-SEC case update. The analysis, conducted on a monthly time frame, reveals that XRP has been holding above a critical support trend marked in blue. With the crypto community’s eyes set on the new Ripple filings expected next week, there’s a mix of anticipation and caution.

XRP Price Enters Potentially Crucial Week

Dark Defender notes that although market news does not typically have a direct correlation with price movements, the “last puzzle piece” pertaining to the Ripple case may add a layer of enthusiasm to the market sentiment surrounding XRP. The question posed is: What could happen if XRP fails to maintain its position above the blue support line?

According to the analysis, if XRP breaks below this blue support line, it will likely approach the two critical Fibonacci retracement levels at $0.4623 (38.2% retracement level) and $0.3917 (23.6% retracement level). These figures are derived from the swing high and low points on the chart, traditionally considered potential support levels where the price could stabilize or bounce back.

In the context of the current chart, a drop below these levels, particularly if the price closes under $0.3917 for two to three days consecutively, would invalidate the bullish five-wave structure that Dark Defender suggests could propel XRP to a high of $5.85. On the flip side, should XRP reclaim the 61.8% Fibonacci level at $0.6044, it could signify a first step towards a strong upward move.

Between the price range of $0.6649 and $0.3917, any price movement is considered a sideways trend. A breakout above the 70.2% level at $0.6649 would likely confirm a bullish trend, with the analyst highlighting this as a significant threshold for a positive price trajectory. Above this level, XRP would then eye the next Fibonacci extension levels of $1.8815 (161.8% extension) and potentially $5.8563 (261.8% extension), which are ambitiously projected targets.

The chart also highlights a “Main Resistance Trend” line that has capped the price since the peak of early 2018, and the current price action is pinched between this descending resistance and the ascending support trend lines, forming a converging pattern that traders often interpret as a potential breakout signal.

A breakout could be the first bullish indication of a larger rally, with at least one monthly close above the line required. In the past, several attempts at a breakout have failed, and even one monthly close was followed by a fall back below the trendline the following month.

Ripple Vs. SEC: What To Expect This Week

Ripple Labs is gearing up to file its response to the US Securities and Exchange Commission’s (SEC) remedies briefing on April 22, a pivotal moment in their protracted legal battle. This response from Ripple is in reaction to the SEC’s briefing that put forth potential remedies including disgorgement of profits derived from XRP sales and civil penalties. The financial stakes are high, with the SEC calculating fines that could reach around $2 billion, claiming that Ripple engaged in an unregistered securities offering with its XRP sales.

The legal and financial communities expect Ripple to mount a formidable defense against the SEC’s claims. Key to this counter-argument will be undermining the SEC’s assertion of the necessity for disgorgement, given the alleged lack of demonstrable financial harm to XRP purchasers. Furthermore, Ripple is likely to leverage favorable recent legal decisions and regulatory developments, aiming to weaken the SEC’s position.

According to the schedule, Ripple is expected to submit a public redacted version of its opposition brief along with associated declarations and exhibits today, if these materials are devoid of any SEC-designated confidential information. If confidentiality is a concern, Ripple will file the documents under seal and submit a redacted public version by April 24. Following this, the SEC will have the opportunity to reply, with their response anticipated to be filed under seal by May 6.

At press time, XRP traded at $0.53.

Featured image from NameCoinNews, chart from TradingView.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Source link

You may like

JPMorgan Chase, Bank of America and Citibank Holding $7,427,000,000,000 Off-Balance Sheet in Potentially Dangerous Cocktail of Unknown Assets: Report

Crypto Expert Turns Bullish On Bitcoin, Predicts Quantitative Easing Will Begin Soon

US DOJ Indicts Manhattan Man on Fraud Charges Related to $43,000,000 Fake Crypto Ponzi Scheme

$120 Million Futures Liquidated As Price Takes A Beating

Dogecoin Mirroring Price Action That Preceded Massive Bull Runs in the Past, Says Trader – Here’s His Outlook

Is Ethereum Back? Record 267,000 New Users Spark Speculation

haskkey group

Ripple Forms Partnership With Tokyo Unit of $1,200,000,000 Firm To Push for XRPL-Powered Solutions in Japan

Published

2 days agoon

May 1, 2024By

admin

Payments firm Ripple has inked a new partnership with the Tokyo-based arm of HashKey Group in an effort to bring XRP Ledger-based supply chain finance solutions to Japan.

Ripple and HashKey DX, a Japanese consulting company of the HashKey Group, will also work with Japanese financial services giant SBI Holdings, which has been partnered with the San Francisco payments firm on remittances in Japan since 2016.

HashKey Group is a Hong Kong-based Web3 infrastructure developer that reported a valuation of more than $1.2 billion in January, according to a Bloomberg report.

Ripple notes in a new partnership announcement that HashKey has launched blockchain-powered supply chain finance solutions across mainland China, registering 23 banks and 4,300 suppliers.

Now, the payments firm and HashKey DX aim to offer the same solutions in Japan.

Explains Ripple,

“As part of this partnership, SBI Group companies will become the first Japanese corporations to utilize this supply chain finance solution. Looking ahead, the three companies will explore further collaboration on various enterprise blockchain use cases that will leverage the robust capabilities of the XRPL.”

XRP is trading at $0.4975 at time of writing. The eighth-ranked crypto asset by market cap is down nearly 4% in the past 24 hours.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney

Source link

Altcoins

XRP Can This 23 Million Token Purchase Spark A Rally?

Published

4 days agoon

April 30, 2024By

admin

The cryptocurrency market continues to navigate a period of sluggishness. Yet, a recent whale activity has injected a flicker of hope for XRP, the native token of Ripple. On Tuesday, a significant investor, commonly referred to as a whale, acquired a hefty 23 million XRP, sparking renewed interest in the embattled token.

Whale Movement: A Sign Of Shifting Tides?

The purchase was identified by Whale Alert, a platform that tracks large cryptocurrency transactions. The tokens originated from a Binance exchange wallet, with the recipient address remaining undisclosed. However, the fact that the recipient was a Binance user suggests potential for further trading activity.

This whale movement is seen by some analysts as a potential turning point for XRP. Historically, large-scale purchases by whales have often preceded price surges. However, some experts caution against overinterpretation. Whale activity can be driven by various factors, and a single purchase doesn’t guarantee a sustained upward trend for XRP.

🚨 23,037,429 #XRP (11,550,284 USD) transferred from #Binance to unknown wallethttps://t.co/K00G3Ry7ab

— Whale Alert (@whale_alert) April 29, 2024

Open Interest: A Mixed Signal

Adding a layer of complexity is the recent decline in XRP Open Interest (OI). As per data from Coinalyze, XRP OI has dipped by 2.12% over the past 24 hours. Open Interest reflects the total value of outstanding futures contracts for a particular cryptocurrency. A decrease suggests a potential reduction in leveraged positions, which could indicate short-term selling pressure.

However, analysts point out that the perpetual contracts, which constitute the majority of XRP OI, still hold significant weight at over $374 million. A renewed buying spree could trigger a reversal in the Open Interest trend, potentially propelling the price upwards.

Total crypto market cap currently at $2.19 trillion. Chart: TradingView

The Lingering Shadow Of The SEC Lawsuit

It’s impossible to discuss XRP’s future without acknowledging the ongoing legal battle with the US Securities and Exchange Commission (SEC). The lawsuit, which alleges XRP is an unregistered security, has undoubtedly cast a long shadow over the token’s performance.

While the recent “remedies phase” of the lawsuit hints at a potential settlement, investors remain cautious. The final outcome and its timeline are still uncertain, leaving a cloud of ambiguity over XRP’s regulatory status.

XRP Price Outlook: A Glimmer Of Optimism?

Currently, XRP is trading at around $0.50, a significant drop from its all-time high of over $3. The price reflects the broader market slump and the ongoing legal battle.

The recent whale purchase, coupled with ongoing negotiations in the SEC lawsuit, offers a glimmer of hope for XRP bulls. However, a sustained price increase hinges on several factors. A favorable resolution to the lawsuit and a broader market recovery are crucial for XRP to regain its lost ground.

Featured image from Pexels, chart from TradingView

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Source link

Analyst

Analyst Says Prepare For 700% Jump To $4, Here’s When

Published

6 days agoon

April 28, 2024By

admin

The bullish predictions for the XRP price are back, even with the bulls struggling to push the crypto on a price surge. EGRAG, a cryptocurrency expert, has made one of these positive forecasts, which is that there will be a price spike of tremendous magnitude. According to the analyst’s recent post on social media, XRP could reach the $4 price level over the long term.

Crypto Analyst Predicts 700% Bullish XRP Price Action

XRP has experienced a small decline in value over the past few days as the entire crypto market consolidates in price action. XRP’s price movement this year has largely left many of its fervent enthusiasts feeling disappointed, particularly considering the fact that it is yet to reach the $1 mark as predicted by many analysts.

Data from Coinmarketcap shows XRP now finds itself bouncing around at the $0.51 price mark after retesting the $0.435 on April 13. However, according to EGRAG, this is poised to change soon.

EGRAG, known for this very bullish stance on XRP, recently noted in his analysis that the current XRP price movement mimics the 2021 move which saw it breaking as high as $1.8. According to his analysis, EGRAG divided the price outlook into two sections blue and yellow, each depicting mirror images of 2021 price movement.

#XRP Imitating 2021 – Move:

🔵 Blue Section: The current trajectory suggests a possible reach of $1.4 by June-July, a key target. The price range between ($1.2 – $1.8) is a plausible target.

🟡 Yellow Section: Aiming for $4 is feasible if we follow a similar path to 2021.… pic.twitter.com/BMUJSbb5GQ

— EGRAG CRYPTO (@egragcrypto) April 25, 2024

The blue section is more of a narrow price trajectory which suggests that XRP could reach $1.4 by June or July, with a price range between $1.2 to $1.8. Meanwhile, the yellow section is a more bullish price trajectory. According to the analyst, XRP could reach the $4 price level by June or July if it follows the yellow section of 2021’s movement. Interestingly, a surge to the $4 price level would put the price of XRP at a new all-time high.

What’s Next For XRP?

EGRAG is one of the many crypto analysts who are still bullish on XRP’s price trajectory. His long-term price projection for XRP is $27, which he believes is still viable. At the time of writing, XRP is trading at $0.5148, down by 16.8% in the past 30 days.

This means in order to reach $4 in July, the bulls will have to push the crypto on a 677% increase in less than three months. Although the volatile nature of cryptocurrencies suggests this price run is possible, current market dynamics point to modest XRP price gains at best.

On the other hand, on-chain metrics have revealed that a bullish sentiment might be returning to XRP. Notably, the amount of XRP wallets holding at least 1 million coins has been surging recently, which could be a signal of a coming price surge.

XRP at $0.51 | Source: XRPUSDT on Tradingview.com

Featured image from Coinpedia, chart from Tradingview.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Source link

JPMorgan Chase, Bank of America and Citibank Holding $7,427,000,000,000 Off-Balance Sheet in Potentially Dangerous Cocktail of Unknown Assets: Report

Crypto Expert Turns Bullish On Bitcoin, Predicts Quantitative Easing Will Begin Soon

US DOJ Indicts Manhattan Man on Fraud Charges Related to $43,000,000 Fake Crypto Ponzi Scheme

$120 Million Futures Liquidated As Price Takes A Beating

Dogecoin Mirroring Price Action That Preceded Massive Bull Runs in the Past, Says Trader – Here’s His Outlook

Is Ethereum Back? Record 267,000 New Users Spark Speculation

Economist Alex Krüger Goes ‘Max Long’ on Crypto Positions – Here Are His Altcoin Picks

Crypto Investors Bet Big On ETFSwap (ETFS) Presale To Leverage Spot Bitcoin ETFs Popularity – Blockchain News, Opinion, TV and Jobs

Bitbot’s Presale Passes $3M After AI Development Update – Blockchain News, Opinion, TV and Jobs

Dogecoin Breaks Out Of Descending Triangle Like It Did In 2021, Analyst Sets $6 Target

Bitcoin Cash (BCH) Backer Roger Ver Arrested and Charged With Evading Nearly $50,000,000 in Taxes

AppLayer Unveils Fastest EVM Network and $1.5M Network Incentive Program – Blockchain News, Opinion, TV and Jobs

Whales Dive In, But Dogecoin Price Sinks 20%: What’s Going On?

Humanode, a blockchain built with Polkadot SDK, becomes the most decentralized by Nakamoto Coefficient – Blockchain News, Opinion, TV and Jobs

Here’s When Bitcoin Could Halt the ‘Slide’ and Start To Pump, According to On-Chain Analytics Firm Santiment

Bitcoin Dropped Below 2017 All-Time-High but Could Sellers be Getting Exhausted? – Blockchain News, Opinion, TV and Jobs

What does the Coinbase Premium Gap Tell us about Investor Activity? – Blockchain News, Opinion, TV and Jobs

BNM DAO Token Airdrop

NFT Sector Keeps Developing – Number of Unique Ethereum NFT Traders Surged 276% in 2022 – Blockchain News, Opinion, TV and Jobs

New Minting Services

Block News Media Live Stream

A String of 200 ‘Sleeping Bitcoins’ From 2010 Worth $4.27 Million Moved on Friday

SEC’s Chairman Gensler Takes Aggressive Stance on Tokens – Blockchain News, Opinion, TV and Jobs

Friends or Enemies? – Blockchain News, Opinion, TV and Jobs

Enjoy frictionless crypto purchases with Apple Pay and Google Pay | by Jim | @blockchain | Jun, 2022

Block News Media Live Stream

How Web3 can prevent Hollywood strikes

Block News Media Live Stream

XRP Explodes With 1,300% Surge In Trading Volume As crypto Exchanges Jump On Board

Block News Media Live Stream

Trending

Altcoins2 years ago

Altcoins2 years agoBitcoin Dropped Below 2017 All-Time-High but Could Sellers be Getting Exhausted? – Blockchain News, Opinion, TV and Jobs

Binance2 years ago

Binance2 years agoWhat does the Coinbase Premium Gap Tell us about Investor Activity? – Blockchain News, Opinion, TV and Jobs

- Uncategorized2 years ago

BNM DAO Token Airdrop

BTC1 year ago

BTC1 year agoNFT Sector Keeps Developing – Number of Unique Ethereum NFT Traders Surged 276% in 2022 – Blockchain News, Opinion, TV and Jobs

- Uncategorized2 years ago

New Minting Services

Video2 years ago

Video2 years agoBlock News Media Live Stream

Bitcoin miners2 years ago

Bitcoin miners2 years agoA String of 200 ‘Sleeping Bitcoins’ From 2010 Worth $4.27 Million Moved on Friday

Bitcoin1 year ago

Bitcoin1 year agoSEC’s Chairman Gensler Takes Aggressive Stance on Tokens – Blockchain News, Opinion, TV and Jobs